Statute Barred Template Letter Guide

When dealing with overdue debts, there are situations where a claim can no longer be legally enforced due to the passage of a specific time period. This concept plays a crucial role in protecting individuals from unwarranted legal actions related to old financial obligations. Knowing when and how to respond can help in managing such claims effectively and ensuring that your rights are protected.

Understanding the Legal Time Limit

Each jurisdiction has its own time limits, beyond which creditors cannot take legal action to recover a debt. This period is usually referred to as the limitation period. Once this timeframe expires, the debt is considered “time-barred,” meaning that even if the creditor tries to pursue the debt, they will be unable to take it to court.

What Happens When the Time Limit Passes?

Once the time limit has passed, the debt becomes unenforceable. This means that the creditor cannot initiate a legal process to claim the outstanding amount. However, the debt may still exist, and the creditor may try to contact the debtor. It’s essential to recognize that while they can’t legally pursue the debt, the obligation technically remains unless formally written off or settled.

How to Respond to Such Claims

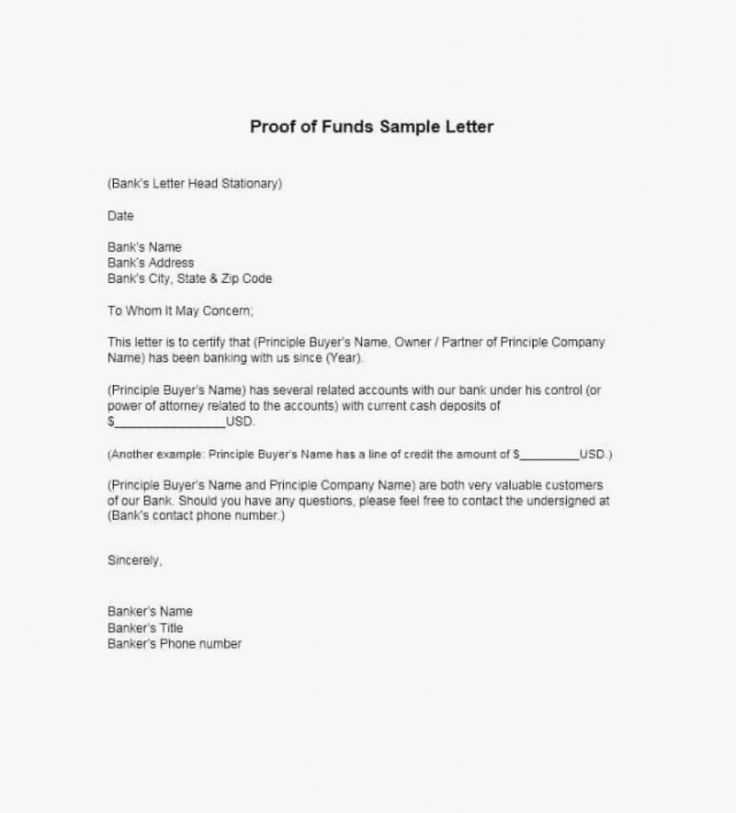

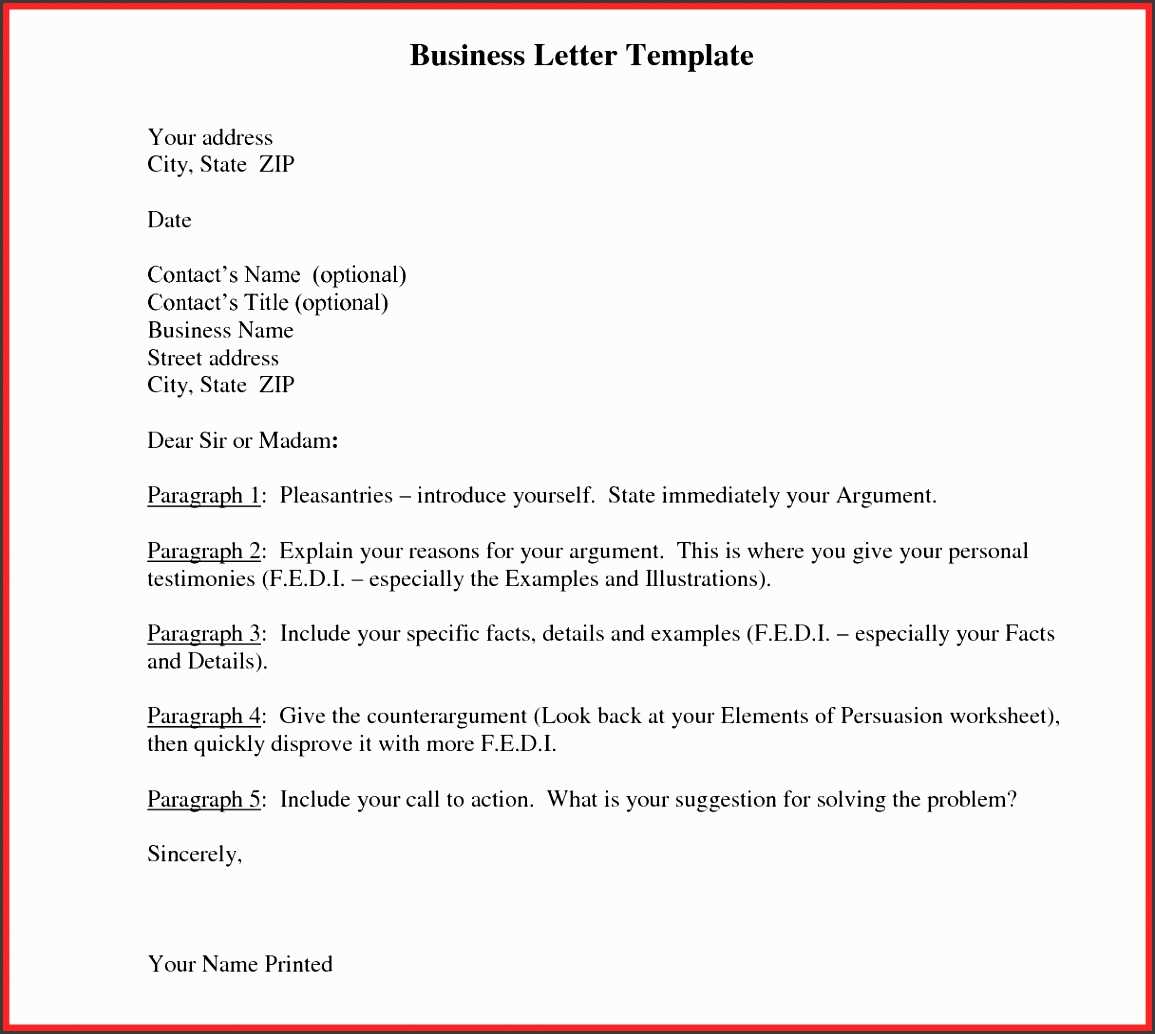

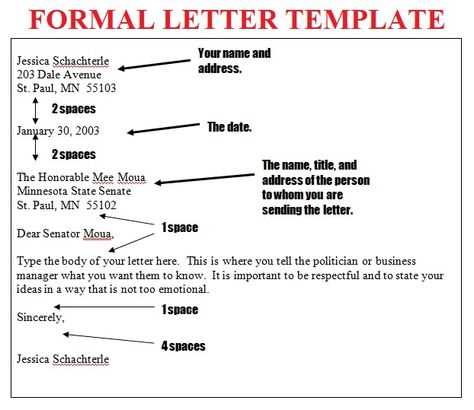

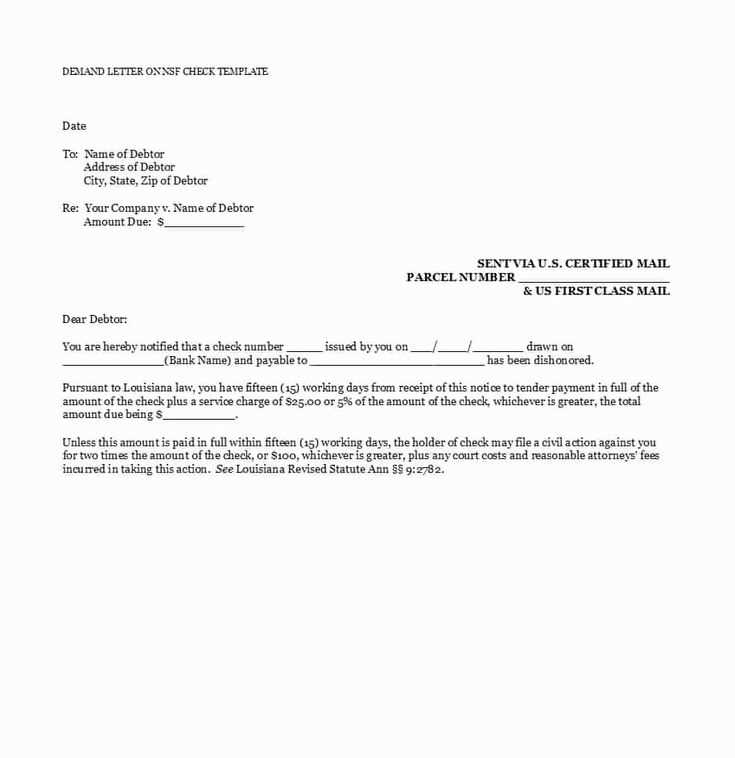

If a creditor contacts you regarding an old debt that you believe is no longer enforceable, it’s important to respond appropriately. A formal communication may be necessary to inform the creditor that the claim is beyond the legal time limit. In doing so, it’s important to ensure that all relevant information is included to avoid further attempts to collect the debt.

What Should Be Included in Your Response?

- Clear statement: Assert that the debt is time-limited and outline the relevant dates.

- Supporting evidence: Provide any documentation or evidence that supports your claim that the debt is past the legal time frame.

- Polite and professional tone: Keep the communication formal and respectful to avoid unnecessary escalation.

Common Mistakes to Avoid

When addressing time-limited claims, it’s important not to make the following mistakes:

- Admitting liability: Never admit to owing the debt in your response, as this could reset the limitation period.

- Ignoring the claim: Failing to respond may allow the creditor to attempt further collection efforts.

- Providing incomplete details: Ensure that your response includes all the necessary information to avoid confusion or delay.

Legal Protection and Your Rights

Being aware of your rights in situations like this is crucial. The law is designed to protect you from the stress of dealing with unreasonably old debts. If you find yourself uncertain about the legal implications of your situation, it’s advisable to seek professional advice to ensure that you handle the matter correctly and protect yourself from any unwarranted claims.

Understanding Time-Limited Debt Claims

When a financial obligation becomes too old to be enforced legally, it enters a phase where creditors can no longer pursue it through court actions. This period is set by law to ensure fairness and protect individuals from outdated claims. Understanding how to deal with such situations is essential for safeguarding your rights.

In cases where an old debt is being pursued, using the right communication can help you effectively address the issue and prevent further actions. Crafting a proper response can clarify your position and protect you from unwarranted legal steps.

How to Respond to Expired Debt Claims

When it becomes clear that a debt is no longer enforceable, sending a formal response may be necessary to inform the creditor. This document should clearly outline the time constraints on the debt and provide a clear explanation of why the claim is no longer valid. It’s crucial to include all relevant dates and evidence supporting your statement.

When to Send the Response

It’s important to send this communication as soon as you are made aware of the claim. Delaying the response can result in the creditor continuing their collection efforts, despite the debt’s expiration. A prompt and clear response will help prevent any misunderstandings or further legal actions.

Essential Information for Your Response

Your formal communication should include several key elements: a clear statement that the debt is time-limited, the dates that mark the start and end of the limitation period, and any evidence that supports your claim. This information ensures that the creditor understands the situation and that your rights are protected.

Avoiding Common Mistakes in Debt Responses

It’s easy to make mistakes when dealing with expired debts. A few common errors to avoid include admitting liability for the debt, which could restart the time limit, or neglecting to include key details in your response. Always keep the communication professional and clear to avoid complicating the matter.

Understanding Your Legal Rights

In situations involving outdated debts, understanding your legal rights is crucial. Once the time limit has passed, creditors can no longer pursue the debt legally, and you are under no obligation to repay. Familiarizing yourself with these rights will help you make informed decisions when handling such claims.

Tips for Managing Debt Collection Efforts

Dealing with any type of debt collection can be stressful. To handle these situations effectively, it’s essential to remain calm and assertive. Know when to seek professional help, and always respond appropriately to any claims, ensuring that you protect your interests and avoid unnecessary complications.