Stop payment letter template

To stop a payment on a check, you must act quickly and communicate directly with your bank. Provide a formal letter to ensure your request is processed smoothly. Include clear details such as the check number, date, and amount, along with the reason for stopping the payment. Be specific about your instructions to avoid any confusion or delays.

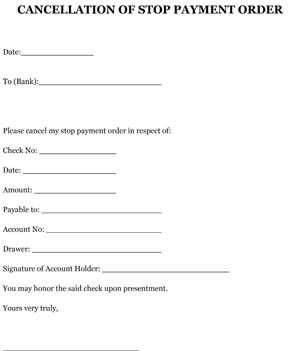

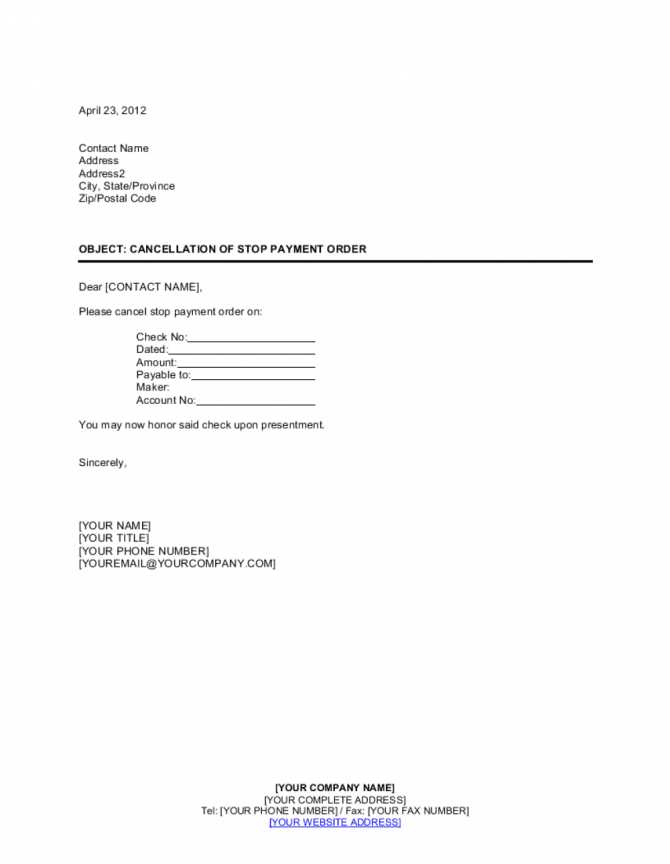

A well-written stop payment letter should start with your contact information and the bank’s address. Clearly identify your account details, including the account number and the check in question. Specify the stop payment request with the necessary information–this may include the recipient’s name and the payment amount. Include any supporting details that justify the stop request, such as a lost or stolen check.

It’s also a good idea to ask for written confirmation from the bank once the request is processed. This ensures that the payment will not go through and protects you from any potential issues. Keep a copy of the letter and the bank’s confirmation for your records.

Here’s a revised version of the HTML outline with minimal repetition while retaining the meaning and structure:htmlEdit

To initiate a stop payment request, clearly state your intent in the letter. Include details like the account number, check number, and date, along with the reason for the request. This provides clarity and ensures the request is processed promptly.

Key Information to Include

| Information | Description |

|---|---|

| Bank Information | Include the name of the bank, your account number, and any other relevant banking details. |

| Check Number | Provide the check number that needs to be stopped to ensure accuracy. |

| Amount | State the exact amount written on the check. |

| Date | List the date on the check to help identify it easily. |

| Reason for Request | Clearly mention the reason you wish to stop the payment (e.g., lost check, fraud, dispute). |

Template Example

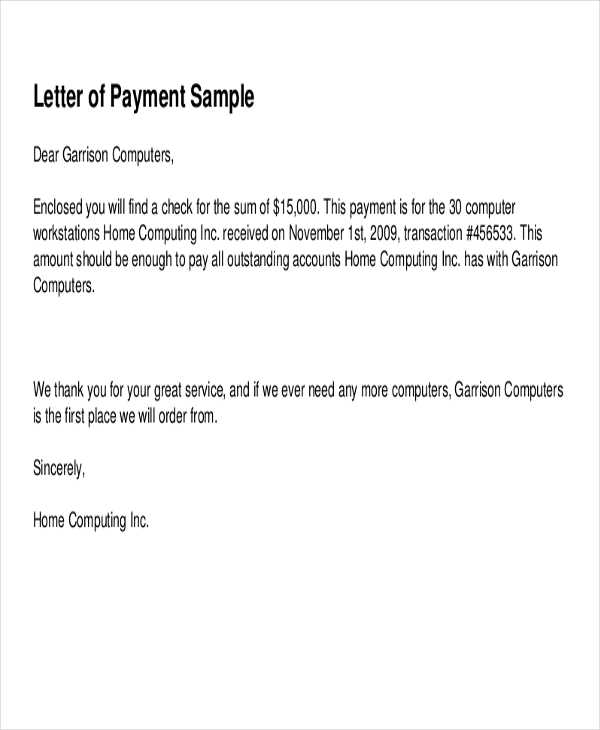

Here’s a simple format for your stop payment letter:

[Your Name] [Your Address] [City, State, ZIP Code] [Date] [Bank Name] [Bank Address] [City, State, ZIP Code] Subject: Stop Payment Request Dear Sir/Madam, I am writing to request a stop payment on check number [Check Number], dated [Date], for the amount of [Amount]. The reason for this request is [Reason]. Please ensure that no further action is taken on this check. Thank you for your prompt attention to this matter. Sincerely, [Your Name]

This format ensures all necessary information is included for processing the request without delay.

How to Structure a Stop Payment Letter

Begin with your full name and address at the top of the letter. This ensures the recipient can easily identify you. Below that, include the date of writing the letter. Then, list the recipient’s name and address, usually the bank or financial institution where the payment was made. Be sure to address the letter to the correct department or person.

In the body of the letter, clearly state your request to stop the payment. Include the payment details such as the check number, amount, date, and the payee’s name. This information helps avoid any confusion and allows the recipient to act swiftly on your request.

It is important to explain why you are requesting the stop payment. Whether it’s due to a dispute, lost check, or unauthorized transaction, specify the reason briefly but directly.

Finish the letter with a polite request for confirmation. Ask the recipient to inform you once the payment has been stopped and to provide any necessary follow-up actions. End with a courteous closing, such as “Sincerely,” followed by your signature and printed name.

Make sure to keep a copy of the letter for your records and send it via a traceable method to ensure delivery and receipt confirmation. If possible, contact the bank by phone to verify the stop payment request has been processed successfully.

Essential Information to Include

Clearly state the payment details, including the amount, date, and recipient. Ensure all identifying information about the payment is accurate to avoid confusion.

Bank Account Details

Include the bank account number and any relevant routing information if applicable. This ensures there is no ambiguity regarding the transaction that is being stopped.

Reason for Stop Payment

Specify the reason for requesting the stop payment, such as an error in the payment amount, a canceled transaction, or fraudulent activity. Provide concise, factual details to support your request.

Sign and date the letter, confirming that the information provided is correct. This adds a layer of authenticity and accountability to the request.

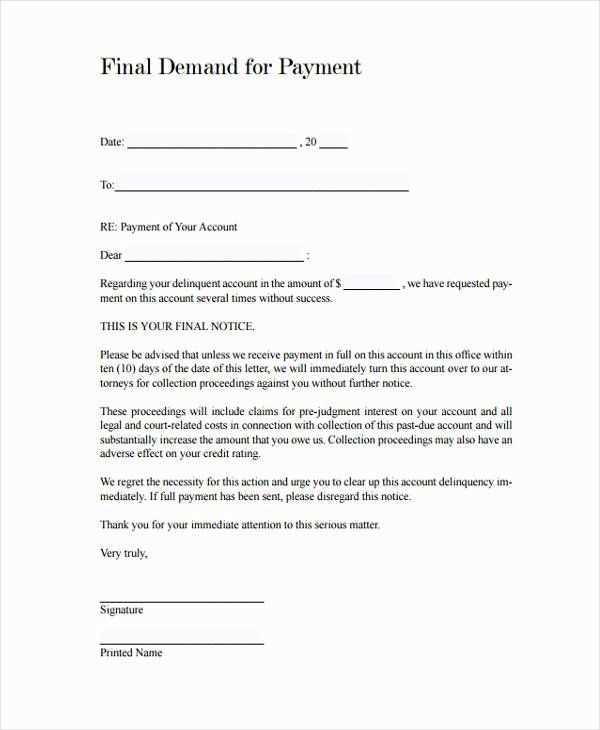

When to Use a Stop Payment Request

If you notice an error with a check or a payment, a stop payment request can help prevent funds from being withdrawn. It’s useful if you suspect fraud or have authorized a payment in error. You should request a stop payment promptly to maximize the chance of success, especially if the check hasn’t been processed yet.

Fraud or Unauthorized Transactions

If you believe a payment was made without your consent, immediately contact your bank to initiate a stop payment. This action helps protect your account from unauthorized withdrawals and potential fraud.

Incorrect Payment Details

If the payment details, such as the amount or payee information, are incorrect, a stop payment can prevent the transaction from clearing. Make sure to provide accurate details to your bank to ensure the request is processed quickly.

Common Errors to Avoid

Ensure you include the correct account details in the stop payment letter. An incorrect account number or check information can result in a failed stop payment request.

1. Inaccurate Payment Information

- Double-check the check number, date, and amount to avoid mistakes.

- Verify the recipient’s name and account information if applicable.

2. Late Submission

- Submit the stop payment letter before the transaction is processed, as banks may not be able to stop payments after they’ve been completed.

- Check the bank’s processing times to ensure your request is made promptly.

3. Using Generic Language

- Avoid vague terms. Be specific about which payment you are referring to in your letter.

- Clearly state the payment details to prevent confusion and ensure accuracy.

4. Not Following Bank Requirements

- Each bank may have specific requirements for stop payment requests, including forms or additional documentation.

- Review your bank’s stop payment policy before sending the letter.

Understanding Bank Requirements for Requests

When requesting a stop payment, banks typically require specific information. Ensure you have all the details about the transaction, including the check number, account number, date of the payment, and the amount. This information helps the bank locate the payment quickly and verify the details. Some banks also ask for a written statement or form to process your request.

Key Information Banks Need

In addition to basic transaction details, banks may require a signature for verification. Depending on the institution, there might be a deadline for submitting your stop payment request, typically 24 to 48 hours after the transaction is initiated. Always double-check with your bank about their specific time frame and requirements.

Fees and Processing Time

Most banks charge a fee for processing stop payments. The cost varies by bank, so it’s important to inquire beforehand. Processing time for stop payments can take several business days, depending on the bank’s policies and the type of payment involved. Make sure to ask about any potential delays or additional steps required.

Template Example for Stop Payment

If you need to request a stop payment for a check or payment, here’s a clear template to guide you. Adjust the details accordingly to ensure the accuracy of your request:

Stop Payment Request Letter

Date: [Insert Date]

Bank Name: [Insert Bank Name]

Bank Address: [Insert Bank Address]

City, State, Zip Code: [Insert City, State, Zip]

Subject: Stop Payment Request

Dear [Bank Name] Team,

I am writing to formally request a stop payment on the following check:

- Check Number: [Insert Check Number]

- Amount: [Insert Check Amount]

- Payee Name: [Insert Payee’s Name]

- Date of Issue: [Insert Issue Date]

I understand that there may be fees associated with this request, and I am prepared to cover those charges as necessary. Please confirm the stop payment has been placed as soon as possible. I would appreciate it if you could send a written confirmation of this action.

If you need any further information to process this request, please feel free to contact me directly at [Insert Phone Number] or via email at [Insert Email Address].

Thank you for your attention to this matter.

Sincerely,

[Your Full Name]

[Your Address]

[City, State, Zip Code]

This version reduces repetitive wording while keeping the context and meaning intact.

To ensure clarity and precision, streamline the language without sacrificing the core message. Start with clear, direct statements that focus on action and intent.

- Remove unnecessary modifiers that do not add specific meaning or context.

- Opt for simple sentence structures that avoid redundancy while preserving key details.

- Substitute phrases with shorter alternatives that maintain the intended message without over-explanation.

- Use the active voice to make the letter more direct and engaging.

For instance, instead of saying “Please ensure that you stop the payment immediately,” simply state “Stop the payment immediately.” This keeps the focus on the necessary action without excess wording.

By making these adjustments, the letter becomes more concise and to the point, improving readability and maintaining professionalism.