Surety letter template

Key Elements of a Surety Letter

A well-crafted surety letter clearly defines the responsibilities of the parties involved. The following components should be included:

- Introduction: Identify the parties involved–the principal, the surety, and the beneficiary.

- Guarantee: Clearly state the scope of the guarantee, outlining the terms and conditions under which the surety will be responsible.

- Duration: Mention the period during which the surety’s obligations will be valid.

- Conditions for Claim: Describe the specific conditions under which a claim can be made against the surety.

- Signatures: Ensure the letter is signed by all relevant parties for validity.

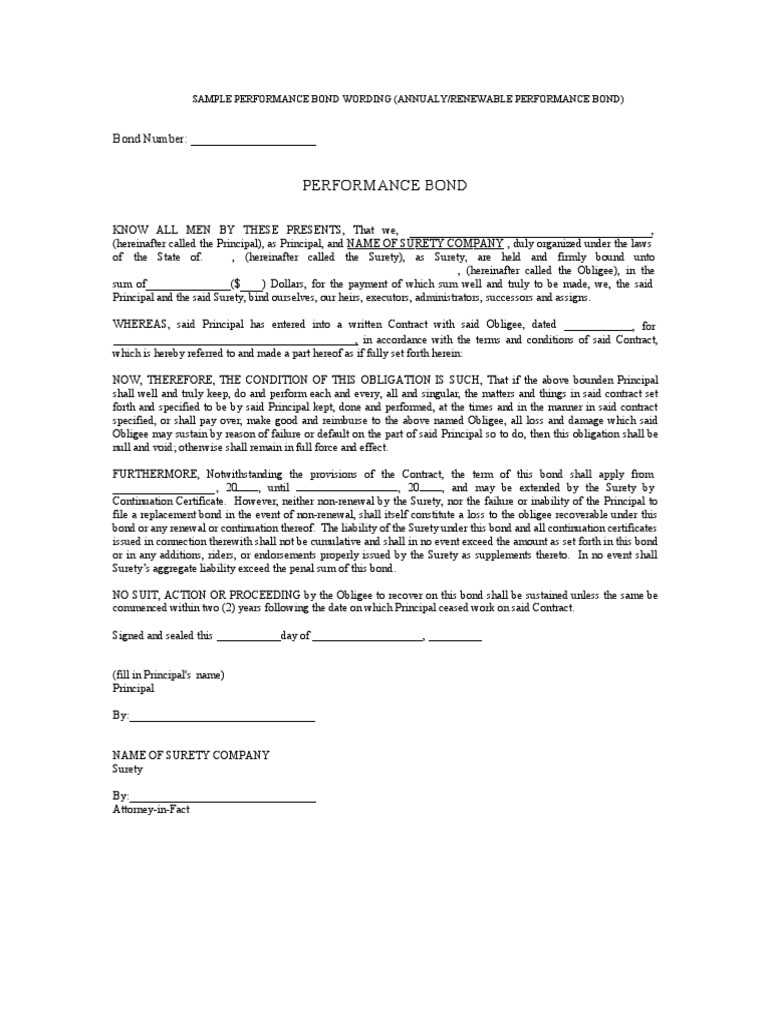

Sample Surety Letter

The following is a basic template for a surety letter:

[Date] [Surety Company Name] [Surety Address] [City, State, ZIP] Subject: Surety Letter for [Name of the Principal] Dear [Recipient's Name], This letter serves as a guarantee on behalf of [Principal's Full Name/Company Name], in connection with [specific agreement or contract]. As the surety, we agree to be responsible for [detailed explanation of responsibility], should the principal fail to fulfill their obligations as stated in [specific contract, agreement, or obligation]. This surety guarantee is effective from [start date] to [end date] and will remain valid unless a claim is made within [duration for claim]. Should the principal default or fail to meet the terms of the agreement, we, as the surety, agree to fulfill the obligations up to a maximum amount of [specify dollar value or obligation]. For any inquiries, please contact [surety contact details]. Sincerely, [Surety Company Name] [Authorized Representative Name] [Title] [Signature]

Final Notes

Ensure that the terms are clear and unambiguous to avoid potential disputes. Always include the necessary details to cover all eventualities related to the agreement or obligation. A properly written surety letter serves as a strong legal tool to protect both the principal and the beneficiary in case of non-performance.

Surety Letter Template: A Detailed Guide

Understanding the Purpose of a Surety Letter

Key Elements to Include in a Surety Letter

How to Write a Surety Letter for Personal Guarantees

Legal Considerations When Drafting a Surety Letter

Common Mistakes to Avoid in Letter Drafting

How to Tailor a Surety Letter for Different Industries

A surety letter serves as a formal assurance from one party to another, guaranteeing the performance or payment of an obligation. It’s crucial for ensuring trust, especially in situations involving loans, contracts, or personal guarantees. The letter serves as a promise to step in should the primary party fail to meet their obligations.

Key elements to include in a surety letter are the names and details of the parties involved (the principal, the obligee, and the surety), a clear statement of the obligation, the specific terms of the guarantee, and the duration of the agreement. Make sure to state the conditions under which the surety will be responsible for the debt or obligation, and outline any limits to this responsibility.

When writing a surety letter for personal guarantees, begin with a declaration of the guarantor’s intention to be held accountable for the debtor’s obligations. Clearly outline the amount or terms of the guarantee and state the circumstances under which the guarantor will be liable. The letter should reflect a deep understanding of the terms agreed upon and include any legal or financial conditions agreed with the debtor.

Legal considerations include ensuring that the letter complies with local laws regarding liability, contract law, and the specific regulations governing surety agreements. Confirm that the agreement does not violate any statutes or create unintended obligations for the guarantor. Always ensure that the language used is unambiguous to avoid future disputes.

Common mistakes to avoid include vague language, unclear terms regarding the surety’s obligations, and failing to include the effective date or expiration of the guarantee. Always double-check for consistency between the terms in the letter and the underlying agreement to ensure the surety letter is enforceable.

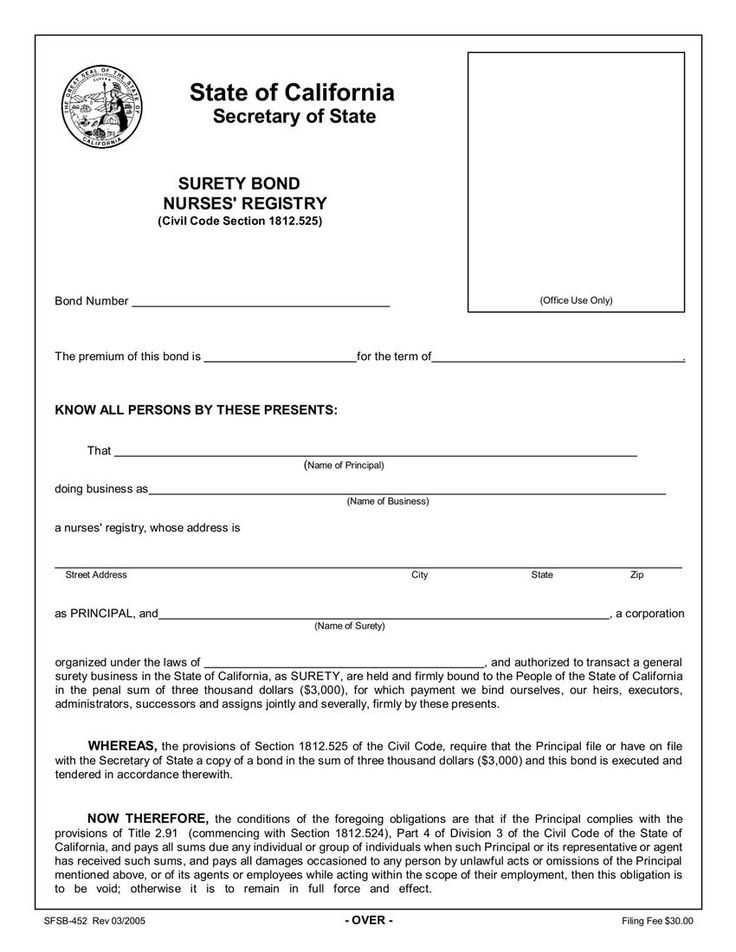

Tailoring a surety letter for different industries requires adjusting the language and terms based on the specific needs and risks of that industry. For example, in construction, surety letters often cover performance bonds, while in finance, they may focus on loan repayment guarantees. Understanding the unique demands of each industry will help you craft a more effective and targeted document.