Tax refund letter template

When requesting a tax refund, it’s crucial to craft a letter that is clear, concise, and includes all necessary details. Below is a simple template to guide you through writing a tax refund request letter.

Template for Tax Refund Request

Here’s a basic outline to follow:

[Your Name] [Your Address] [City, State, ZIP Code] [Email Address] [Phone Number] [Date] [Tax Department Name] [Tax Department Address] [City, State, ZIP Code] Subject: Request for Tax Refund Dear [Tax Department Representative's Name], I am writing to request a refund for the overpayment of my taxes for the tax year [Year]. My tax return, filed on [Date], indicates that I paid more than my required amount. Below are the details of my filing: - Taxpayer Name: [Your Full Name] - Social Security Number (or Tax ID): [Your SSN or Tax ID] - Tax Year: [Year] - Refund Amount Requested: [Amount] - Reason for Refund: [Brief explanation of the reason for the overpayment] I have attached the necessary documentation, including a copy of my filed tax return and proof of payment. Please process my refund as soon as possible. Thank you for your attention to this matter. I look forward to your response. Sincerely, [Your Full Name]

Key Tips for Your Tax Refund Request

- Provide Accurate Information: Double-check your tax details to ensure all information is correct, including your taxpayer ID, filing year, and refund amount.

- Include Supporting Documents: Attach copies of your tax return and payment records. This helps the tax department process your request more efficiently.

- Be Clear and Direct: Keep your request short and to the point. Avoid unnecessary details that don’t pertain to the refund request.

Additional Information

If you’ve filed a tax return and believe a refund is due, but haven’t received it, make sure to follow up after 6-8 weeks. The tax department may require additional time to process your claim, especially if the volume of requests is high.

Tax Refund Letter Template

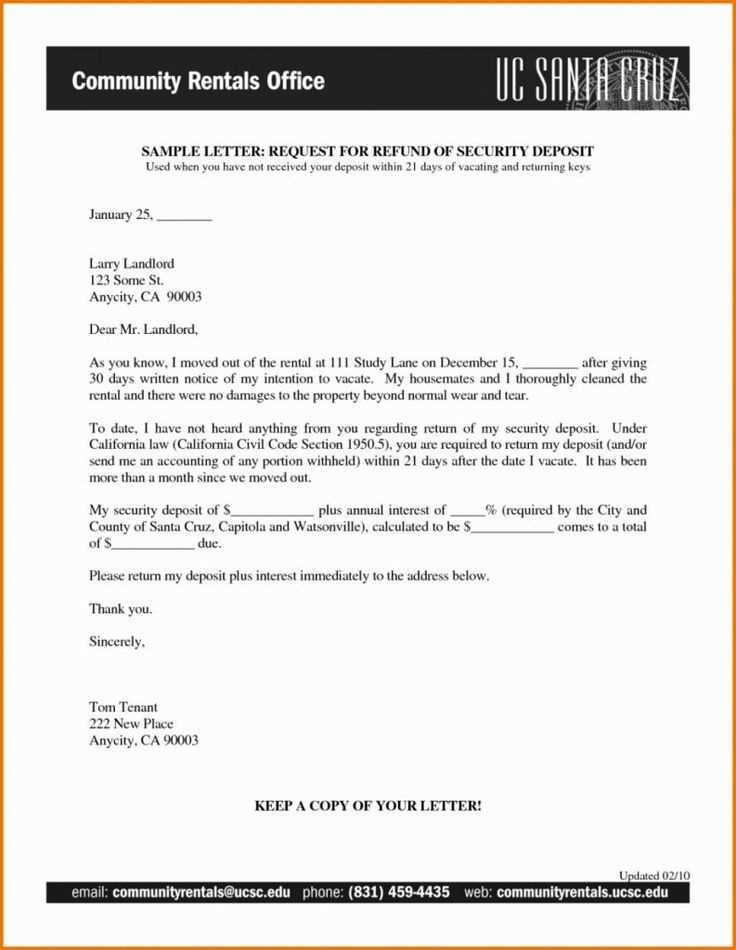

How to Address the Refund Letter to the Appropriate Department

Key Elements to Include in a Refund Letter

Formatting Your Request for Clarity and Professionalism

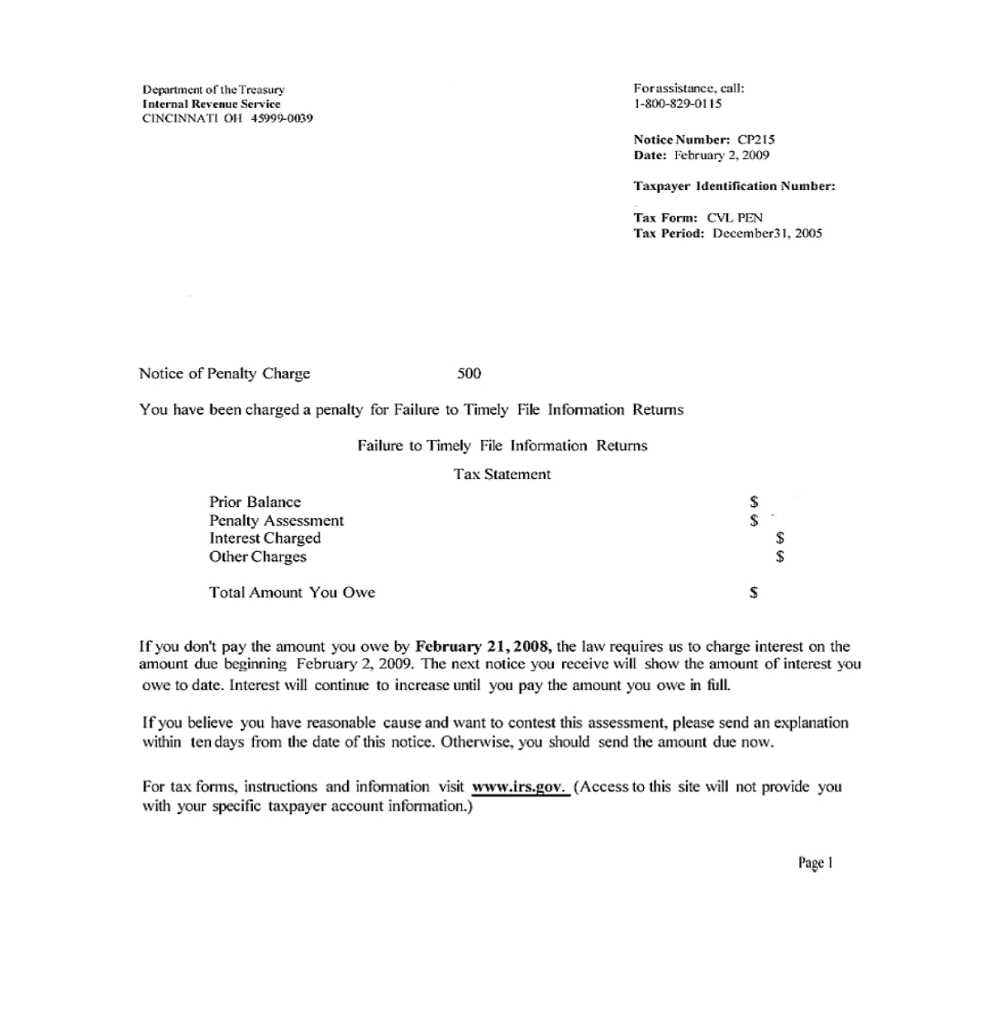

Steps to Ensure Accuracy When Mentioning Amounts

Common Mistakes to Avoid When Writing a Refund Letter

How to Follow Up After Sending the Letter

Start by addressing the refund letter to the correct department or office. Identify the right contact information through the tax authority’s website or your previous correspondence. If possible, use a specific person’s name, including their title and the department they represent, to ensure your request reaches the right hands.

Make sure your letter includes the following key elements: your full name, address, and tax identification number, along with the exact amount you are requesting to be refunded. Provide a detailed explanation for the refund, referencing relevant tax forms, receipts, or any other supporting documentation. This ensures that the reader understands your case quickly.

Format the letter clearly. Use paragraphs to separate each piece of information, and employ bullet points where appropriate to list documents or actions. A professional tone is important–keep the language formal, but approachable. Ensure the letter looks clean and is easy to read by using a standard font like Arial or Times New Roman with appropriate spacing.

Double-check the accuracy of the refund amount. Review your tax documents carefully to ensure you mention the correct figures. Misstating the refund amount can cause unnecessary delays, so take the time to verify each number. If there are any discrepancies, mention them briefly, providing clear explanations for any differences.

Avoid common mistakes, such as failing to include necessary details like your tax identification number or submitting incomplete documentation. Be clear in your request and make sure all supporting documents are attached in an organized manner. Double-check your spelling and grammar to present a professional letter that conveys your attention to detail.

After sending the letter, follow up if you haven’t received a response within the expected time frame. Contact the department by phone or email to confirm receipt of your letter and inquire about the status of your refund. Keeping track of your communication will help prevent unnecessary delays and ensure that your request is being processed.