Tax Return Engagement Letter Template for Tax Professionals

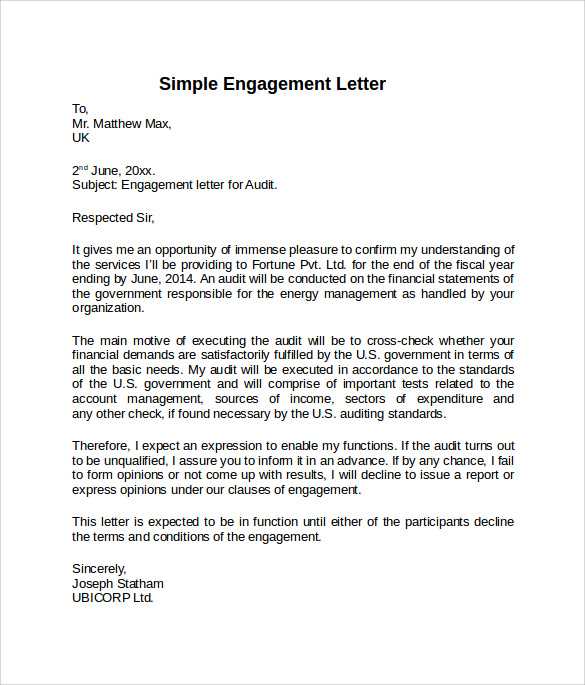

When providing financial services, it’s crucial to establish a solid understanding between you and your clients. A well-structured agreement helps define the scope of your work, ensuring that both parties are aligned and expectations are clear. This type of document protects your interests and reduces the risk of misunderstandings, setting a professional tone from the start.

Such agreements typically include key details about the work to be performed, timelines, payment terms, and responsibilities. By having these points clearly outlined, you can foster trust and transparency with clients while ensuring compliance with relevant regulations. The purpose of these agreements goes beyond just formalities; they lay the foundation for a smooth working relationship.

Additionally, providing a tailored contract helps prevent potential disputes by offering a reference point if questions arise during the service period. Having a formalized agreement can save both time and effort, allowing you to focus on delivering quality outcomes for your clients.

Why Use a Professional Service Agreement

Establishing clear terms before starting any professional project is essential to ensure smooth collaboration and protect both parties. A well-drafted document outlining the scope of services, expectations, and responsibilities serves as a foundation for a transparent and effective working relationship. It reduces ambiguity and provides a reference point in case of any disputes or misunderstandings.

Clarity and Protection for Both Parties

Having a structured agreement ensures that both the service provider and the client are on the same page regarding deliverables, timelines, and payment. This clarity helps to set realistic expectations, prevent potential issues, and avoid confusion over what is included in the work. It also protects both parties by clearly outlining the terms of the agreement, making sure each party understands their obligations.

Legal Compliance and Risk Management

From a legal standpoint, formalizing the agreement helps ensure that all actions taken during the course of the service are compliant with relevant laws and regulations. Such documents can be valuable in the event of a legal dispute, providing proof of the agreed-upon terms. This risk management tool reduces the chances of legal complications, offering peace of mind for both professionals and clients.

Essential Elements of the Agreement

To ensure the clarity and effectiveness of any professional arrangement, certain components must be included in the agreement. These elements serve to define the relationship, establish clear expectations, and provide the framework for services to be rendered. By incorporating these key sections, both parties can be confident that all necessary details are accounted for.

Scope of Services and Deliverables

One of the most important aspects of an agreement is clearly outlining the scope of work. This includes specifying the tasks, services, and responsibilities to be completed. Defining these details avoids confusion later and helps both parties understand what is expected. Including deliverables with specific deadlines also ensures that timelines are met and expectations are aligned.

Terms and Conditions of the Agreement

The terms and conditions section defines the legal obligations of both parties, including payment schedules, cancellation policies, and confidentiality clauses. It is essential to establish these aspects upfront to avoid potential misunderstandings. Additionally, including these details protects both the service provider and the client from unexpected issues and provides legal security in case of disputes.

Benefits of Clear Agreements

Establishing a well-defined agreement brings numerous advantages to both professionals and their clients. When both parties have a mutual understanding of the terms, the entire process becomes smoother, more predictable, and free from misunderstandings. Clear documentation serves as a foundation for a strong and trustworthy relationship.

Enhanced Communication and Trust

By outlining the scope and responsibilities in writing, communication becomes more transparent. Both parties know what to expect and can avoid potential issues that arise from assumptions or unclear expectations. This fosters trust, as clients feel more confident in the process, and professionals can work with greater assurance.

Prevention of Disputes

Having a comprehensive agreement helps prevent conflicts. With all terms clearly laid out, there is less room for ambiguity, which reduces the likelihood of disagreements. If any concerns arise during the course of the project, the agreement acts as a reference to resolve them quickly, ensuring smooth progress.

How to Customize Your Agreement

Customizing a service agreement allows you to tailor the document to meet the unique needs of each client. By adjusting the details to reflect specific services, timelines, and expectations, you ensure that the agreement accurately represents the work being performed and protects both parties involved. Here are some key elements to focus on when personalizing your document.

| Section | What to Customize |

|---|---|

| Scope of Work | Describe the exact tasks, services, and deliverables, ensuring they align with the client’s needs. |

| Timeline | Set specific deadlines for milestones and final completion to ensure clear expectations. |

| Payment Terms | Define the amount, method, and schedule for payments to avoid any financial misunderstandings. |

| Confidentiality | Include clauses related to privacy, ensuring that sensitive information remains secure. |

By addressing these areas, you create a document that is both practical and legally sound, giving both you and your client peace of mind throughout the project.

Common Mistakes to Avoid in Service Agreements

When creating a formal agreement, it’s crucial to avoid certain pitfalls that can lead to confusion or legal issues later. Failing to include important details or being too vague can cause misunderstandings between both parties. Here are some common mistakes to watch out for when drafting these documents:

- Not Defining the Scope Clearly – Leaving the tasks or deliverables vague can create ambiguity. Always ensure that the work is described in precise terms.

- Skipping Payment Details – Omitting payment schedules, rates, and methods can result in disputes over financial matters. Make sure the terms are clearly laid out.

- Failing to Address Termination Conditions – Not including clauses for termination or exit conditions can lead to complications if the agreement needs to be ended prematurely.

- Overlooking Legal and Confidentiality Clauses – Important clauses regarding confidentiality or legal protections should never be ignored, as they protect both parties in case of disputes.

By avoiding these mistakes, you can ensure that your agreement is clear, comprehensive, and legally sound, minimizing the risk of complications down the line.

Legal Considerations for Financial Professionals

For professionals providing financial services, understanding the legal framework surrounding their agreements is essential to avoid potential liabilities and ensure compliance with regulations. A comprehensive understanding of these legal aspects can help in maintaining a professional reputation and minimizing risks.

- Compliance with Regulations – Ensure that all terms within the agreement adhere to relevant laws and industry standards. Compliance with local, state, and federal regulations is crucial for protecting your practice.

- Client Privacy and Confidentiality – It’s essential to include clear provisions regarding the confidentiality of client information. Clients trust you with sensitive data, and safeguarding this information is both an ethical and legal obligation.

- Liability and Limitations – Clearly outline the extent of your responsibility and any limitations to avoid overextending your obligations. Defining what is and isn’t covered in your agreement can prevent legal disputes.

- Dispute Resolution – Include provisions on how disputes will be handled, whether through arbitration, mediation, or litigation. Establishing this process upfront can prevent costly legal battles.

By addressing these legal considerations, financial professionals can protect themselves, maintain a transparent relationship with clients, and avoid future complications in their work.