Debt Validation Letter Template for Disputing Debt Claims

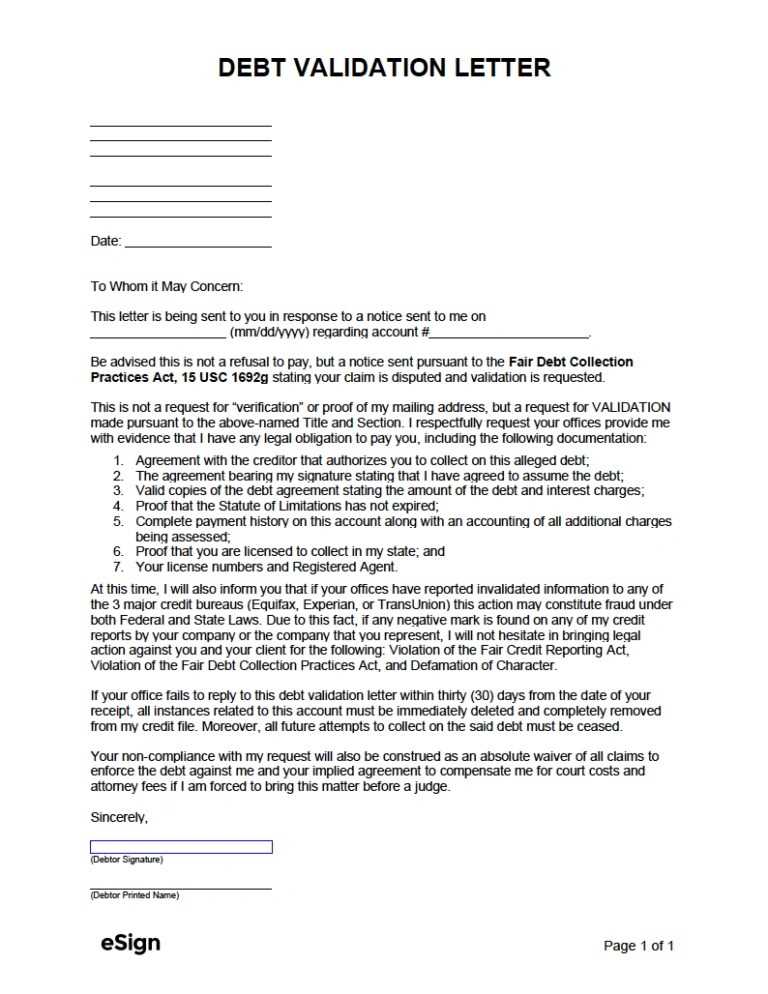

When you are confronted with an incorrect claim regarding an outstanding balance, it is crucial to take the necessary steps to dispute it effectively. A well-crafted response can help you protect your financial reputation and ensure that no wrongful charges affect your credit. This section will guide you on how to create an appropriate response to any unwarranted claims from creditors or collectors.

Key Information to Include

To create a clear and effective response, ensure you provide the following details:

- Personal information: Include your full name, address, and account number if applicable.

- Claim specifics: Address the particular charge or claim you are disputing.

- Request for clarification: Politely ask for documentation that supports the charge.

- Legal references: Mention relevant laws that support your position.

Structuring Your Response

Make sure the communication is polite and professional. Avoid confrontational language and focus on asking for clarity. Use formal language, and organize your thoughts logically:

- Start with a formal greeting and introduction of the issue at hand.

- State your request clearly, specifying the need for supporting documentation.

- Provide any necessary context, such as previous interactions or known issues with the account.

- Conclude by requesting a timely response or action.

Common Mistakes to Avoid

Be mindful of these errors when crafting your response:

- Failure to provide sufficient details: Be thorough in your explanation to avoid confusion.

- Using vague or unclear language: Your request should be specific and easy to understand.

- Being aggressive or disrespectful: Keep your tone respectful to increase the chances of a favorable outcome.

Understanding the Importance of Disputing Unwarranted Claims

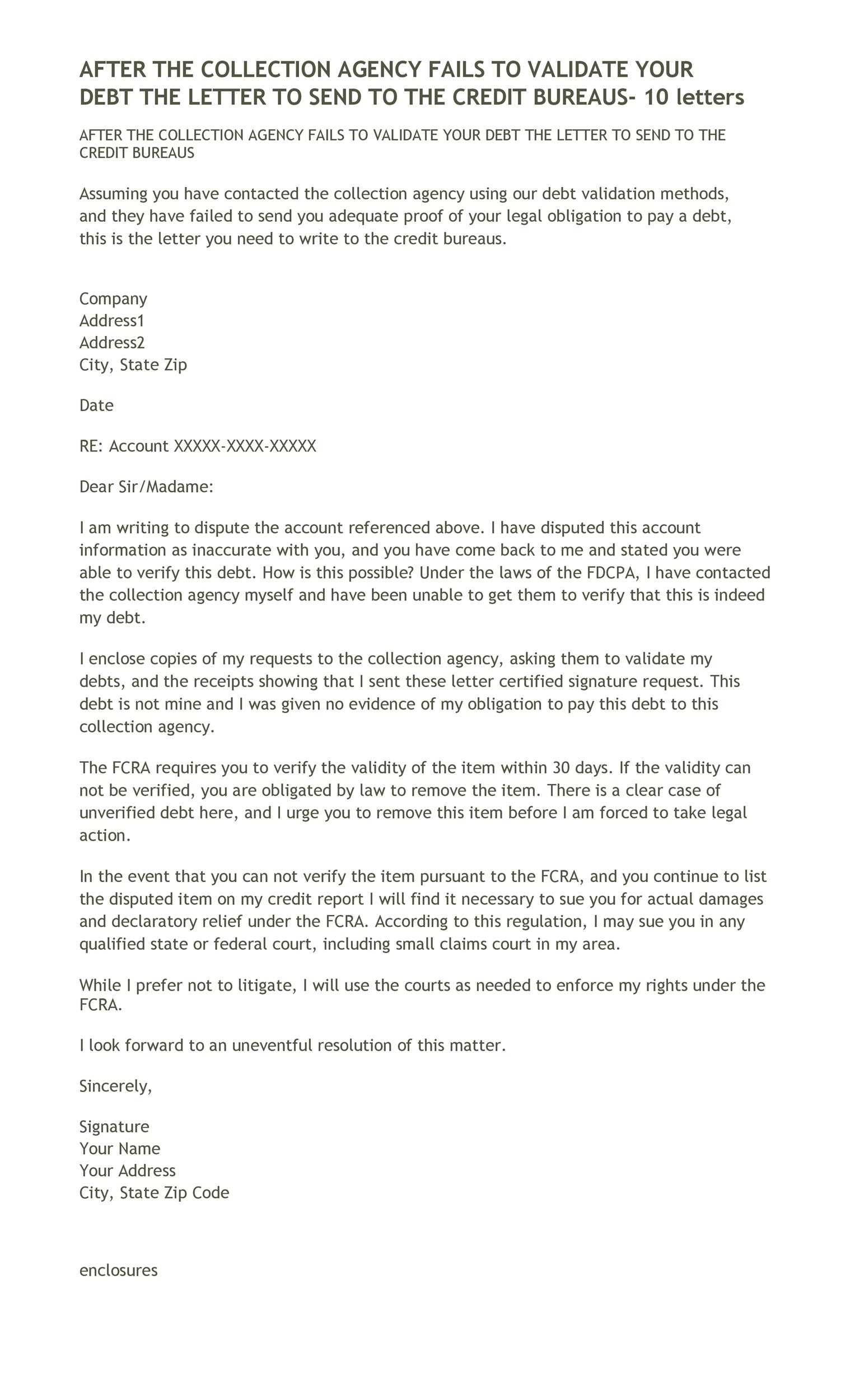

When you are contacted about an inaccurate financial obligation, it is essential to address the situation promptly and clearly. Taking action to request proof and clarify the legitimacy of the claim can safeguard your financial health and prevent further complications. This section outlines why it’s crucial to request verification, how to effectively draft a response, and when the best time to send such a request is.

Why Sending a Verification Request Matters

Requesting proof of a claim is a critical step in protecting yourself from false charges or mistakes. By formally asking for supporting documents, you ensure that the party making the claim has the proper evidence to back it up. This request serves as a legal safeguard, preventing erroneous entries from damaging your credit or leading to unnecessary actions.

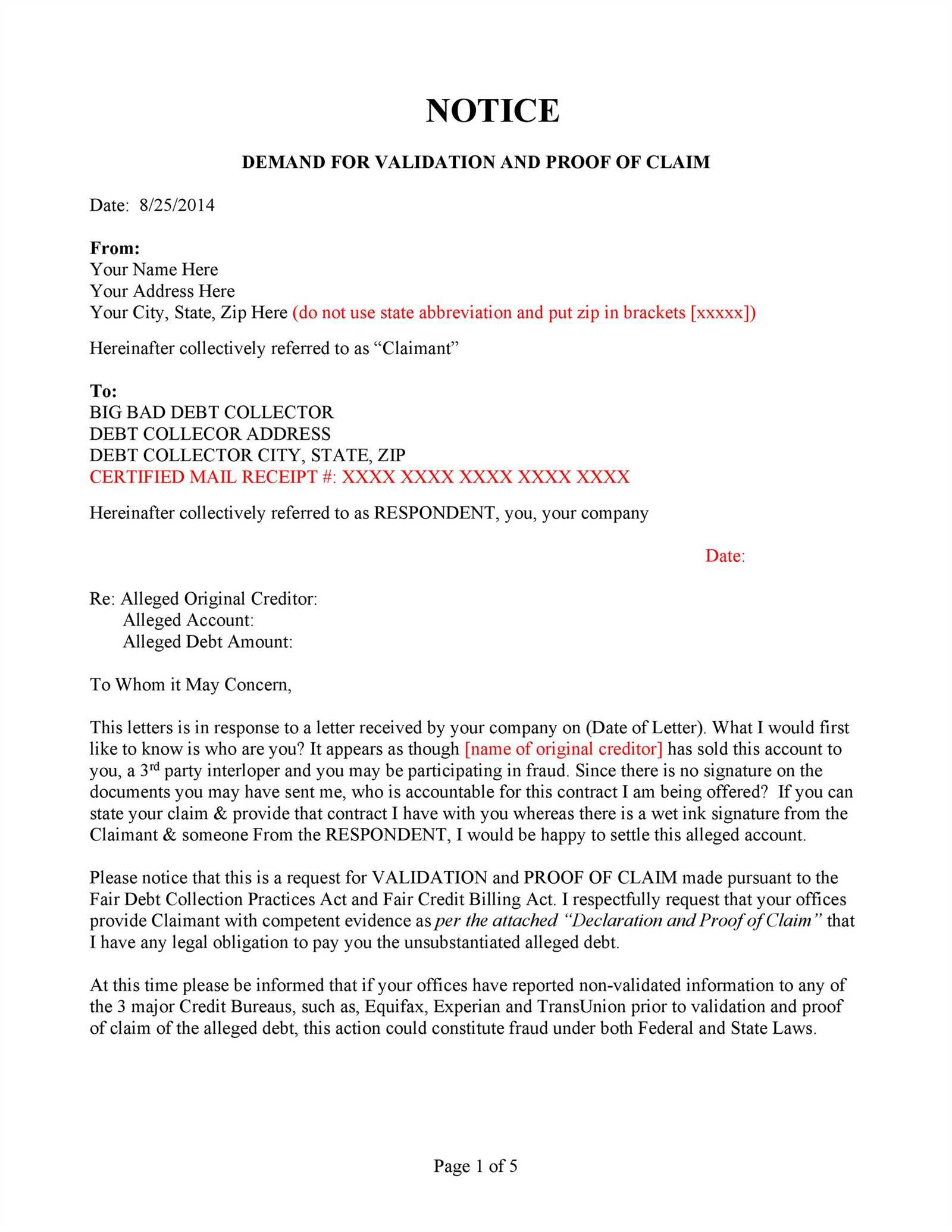

Step-by-Step Guide to Crafting a Response

Writing an effective response involves several clear steps:

- Step 1: Begin with a formal greeting and state your intent to dispute the claim.

- Step 2: Provide the details of the claim you are questioning and ask for specific evidence supporting it.

- Step 3: Reference any relevant laws or regulations that protect your rights in this situation.

- Step 4: Conclude by requesting a response within a reasonable timeframe.

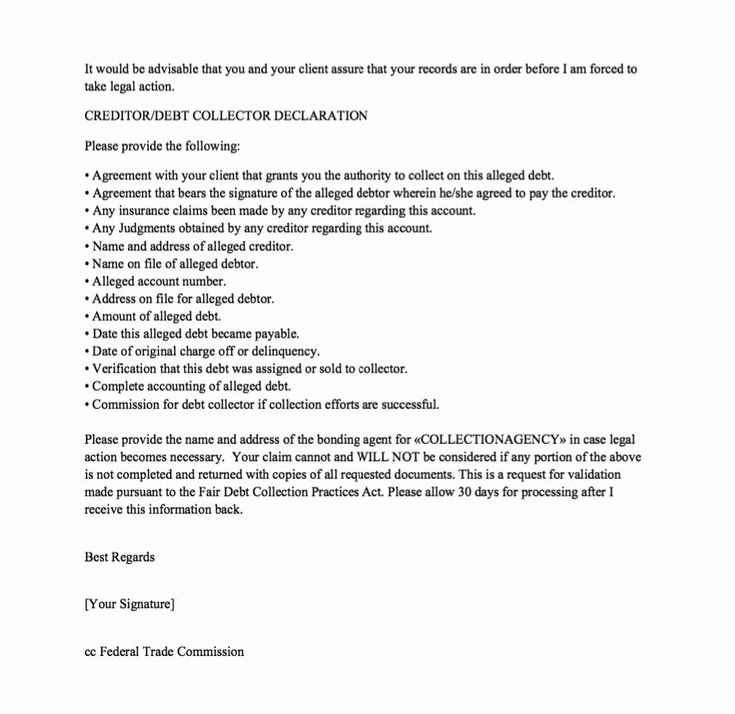

Key Information to Include in Your Response

Your response should contain key elements that make it clear and persuasive:

- Personal information: Your full name, address, and account number, if applicable.

- Details of the claim: The specific charge or balance in question.

- Request for documentation: Ask for supporting evidence, such as contracts or account statements.

- Legal references: Cite relevant consumer protection laws that back your request.

Avoiding Common Mistakes in Disputing Claims

When disputing a claim, avoid these common pitfalls:

- Being too vague: Make sure your request is specific and includes all necessary details.

- Using aggressive language: Keep your tone respectful and professional to increase the chances of a positive outcome.

- Failing to follow up: If you do not receive a response within a reasonable period, send a reminder or escalation.

When is the Ideal Time to Send a Request?

Sending your request at the right time can make a significant difference in the outcome. The best time to send such a request is as soon as you receive notice of the claim. Acting quickly helps you avoid unnecessary interest charges or other penalties. Additionally, if you are dealing with a collection agency, sending the request within the legally designated time frame can strengthen your position.