Template for late payment letter

Key Elements of a Late Payment Letter

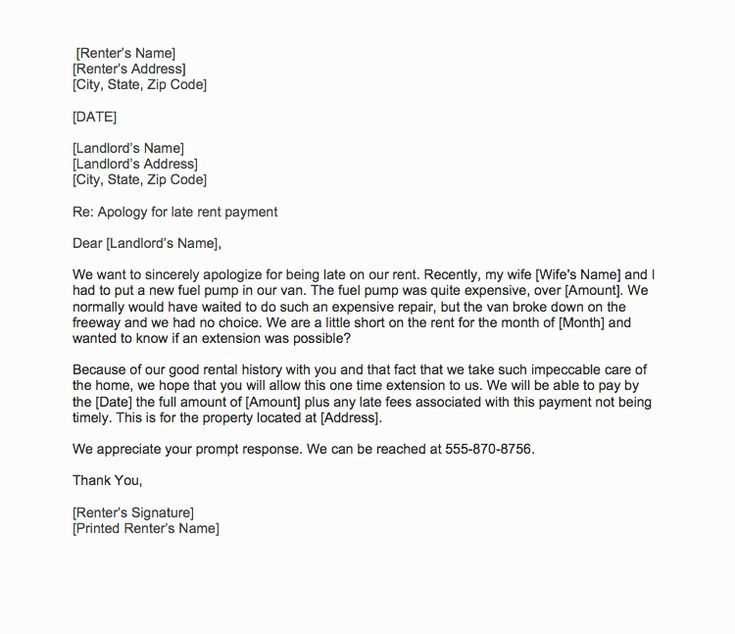

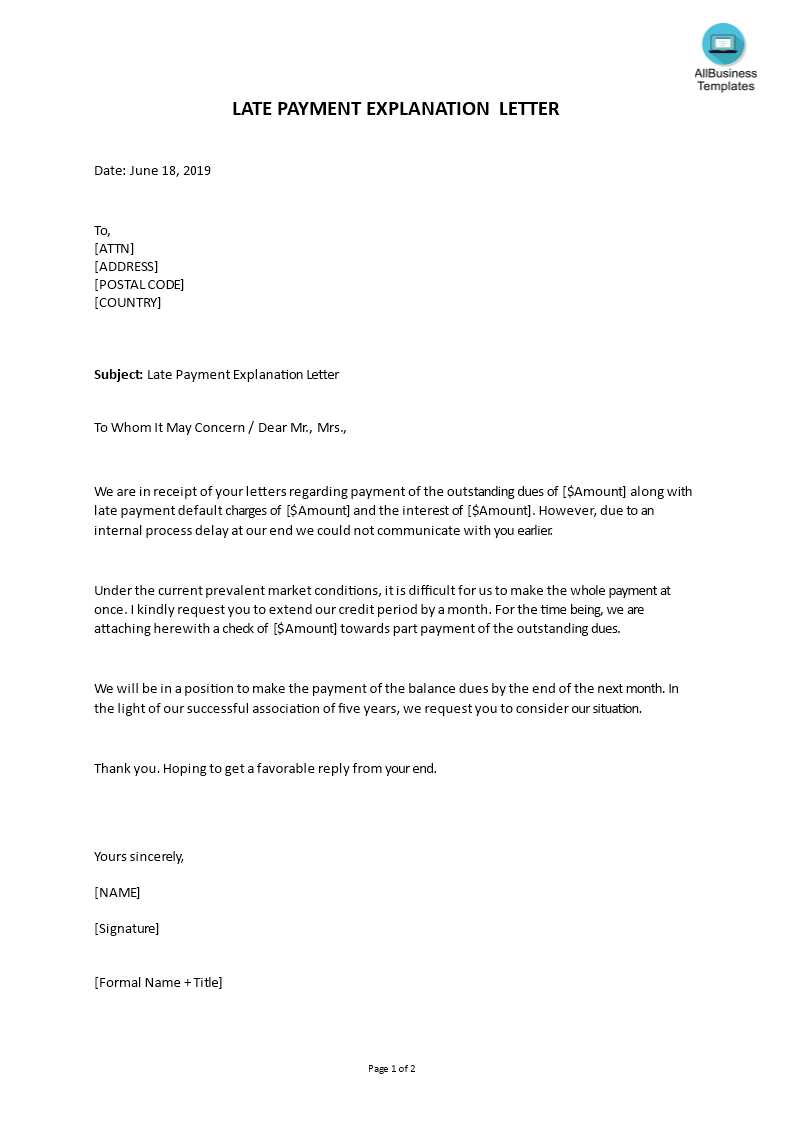

Writing a late payment letter requires clear communication and a professional tone. The letter should include essential details such as the amount due, the original payment terms, and the actions required from the recipient. Below is a simple yet effective template you can use:

Late Payment Letter Template

Date: [Insert Date]

Recipient Name: [Insert Recipient Name]

Recipient Address: [Insert Address]

Dear [Recipient Name],

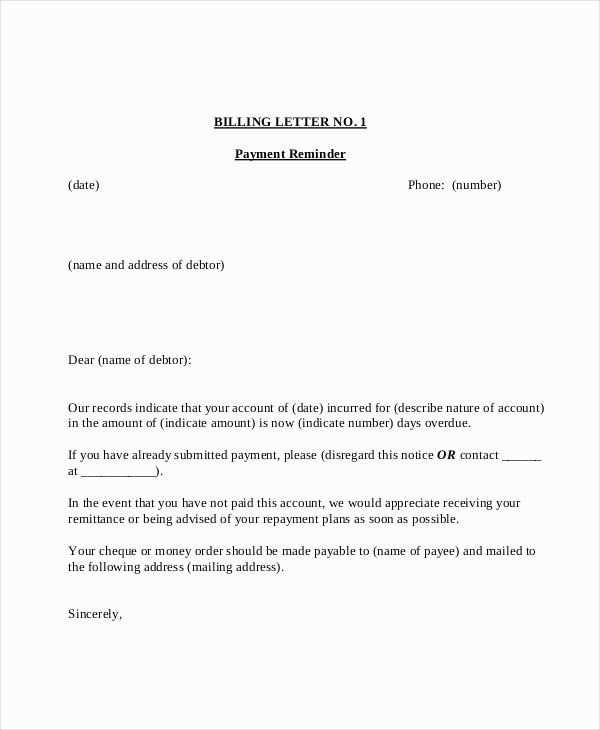

This letter is a reminder regarding the outstanding payment of [Amount Due], which was due on [Original Due Date]. As of today, the payment is [Number of Days Late] days past due.

Please find the details of the outstanding payment below:

- Invoice Number: [Invoice Number]

- Amount Due: [Amount Due]

- Original Due Date: [Original Due Date]

We kindly request that you settle the amount within [Number of Days, e.g., 7 days] to avoid any late fees or further action. Please find the payment instructions below:

- Payment Method: [Insert Payment Method]

- Bank Details: [Insert Bank Details or Payment Information]

If you have already made the payment, please disregard this letter and accept our thanks. If you have any questions or concerns, feel free to contact us at [Phone Number] or [Email Address].

We appreciate your prompt attention to this matter.

Sincerely,

[Your Name]

[Your Job Title]

[Company Name]

[Phone Number]

[Email Address]

Tips for Sending a Late Payment Letter

- Be Polite: Always maintain professionalism in your language, even if the payment is overdue.

- Stay Clear and Direct: Avoid unnecessary details and get straight to the point with the payment information.

- Follow Up: If the payment isn’t made within the specified time, send a follow-up letter or call the recipient.

Template for Late Payment Letter

How to Start Your Late Payment Letter: Key Information to Include

Structuring the Body: What to Address and How

Setting a Clear Payment Deadline in the Letter

Professional Language to Use in a Late Payment Letter

Adding Penalties or Interest Clauses: When and How to Mention

Best Practices for Sending the Letter to Ensure Receipt

Begin your late payment letter by clearly stating the purpose. Address the recipient by name and mention the invoice number, date of issue, and the amount due. Acknowledge the delay and provide context, such as the original payment terms or agreed-upon date.

Structuring the Body: What to Address and How

In the body, be direct and polite. First, reiterate the original agreement regarding payment terms. Clearly mention how many days past due the payment is, and outline any steps taken to resolve the matter. If necessary, include a summary of previous reminders or communications, showing your efforts to settle the debt amicably.

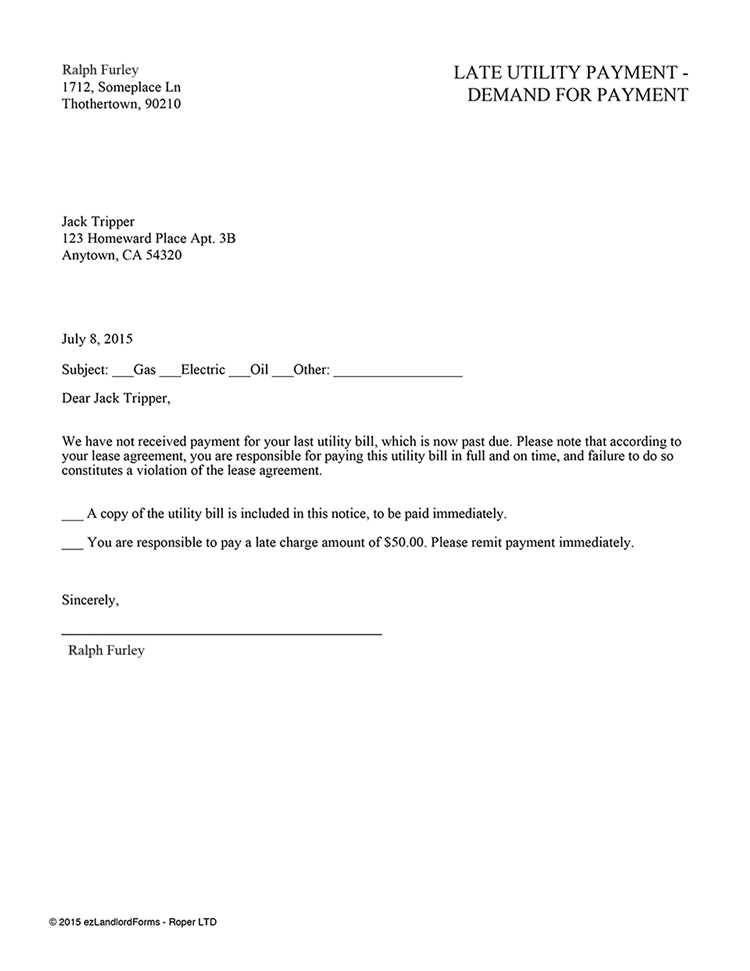

Setting a Clear Payment Deadline in the Letter

Specify a new, firm deadline for payment. State the exact date by which the payment should be made and emphasize the importance of meeting this deadline to avoid further action. If applicable, mention consequences for continued delay, such as penalties or interest fees.

Use professional, neutral language throughout the letter. Stay respectful and avoid sounding aggressive. Maintain a calm and cooperative tone to encourage resolution without escalating the situation.

If your terms include penalties or interest charges, state these clearly. For example, “A late fee of $X will apply after [date]” or “Interest will accrue at a rate of X% per month.” Ensure these clauses are in line with the agreement or legally enforceable.

Finally, ensure the letter is sent via a reliable method. Consider using certified mail or another service that confirms receipt. This ensures the recipient has received the communication and helps you track any responses or delays.