Overdue Payment Letter Template for Effective Reminders

When clients fail to meet the agreed-upon financial deadlines, it’s essential to address the issue promptly and professionally. Communicating effectively can help recover funds while maintaining a positive business relationship. A well-crafted communication can encourage timely resolution without causing tension.

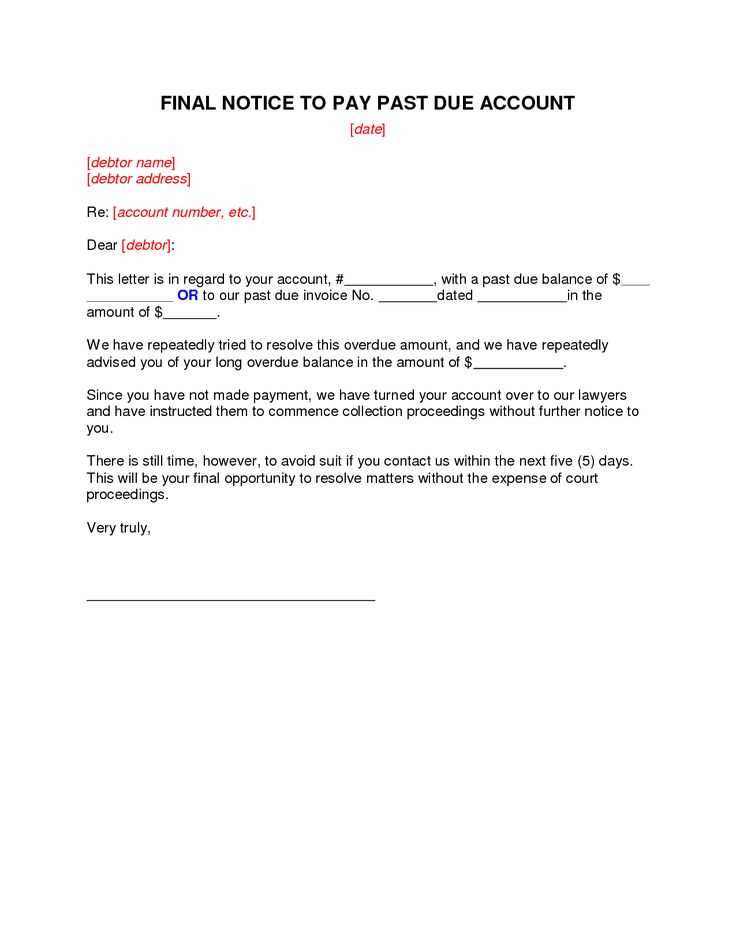

Key Elements to Include in Your Message

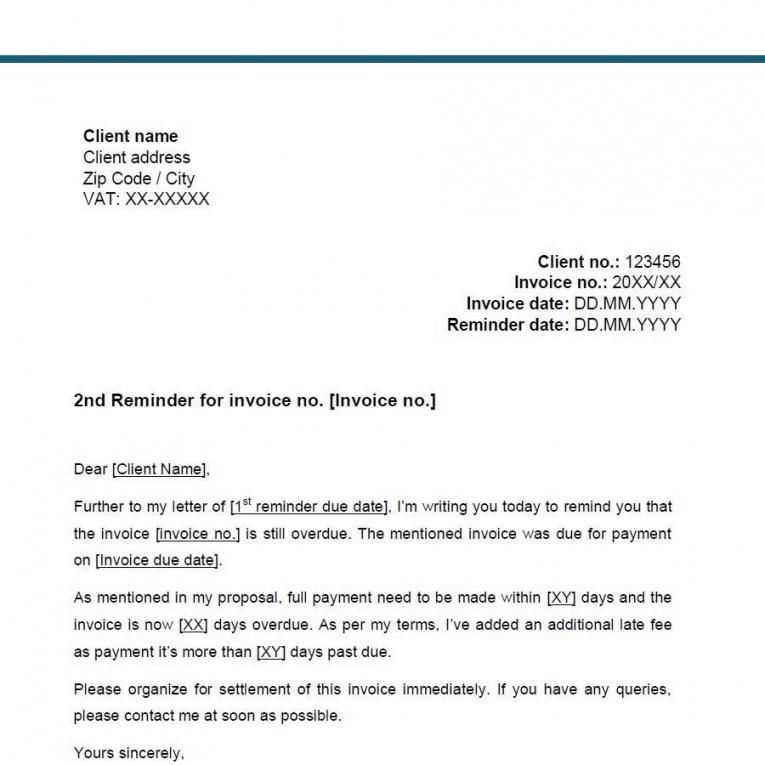

In every communication, ensure that the message is clear, polite, and specific. Begin by addressing the recipient respectfully, stating the amount due, and mentioning any prior discussions or agreements. It’s also crucial to maintain a professional tone while emphasizing the importance of resolving the matter quickly.

Essential Components

- Recipient’s name and contact details

- Invoice number and due date

- Outstanding balance

- A request for payment or resolution date

- Consequences of continued delay, if applicable

Crafting the Message: Tone and Style

The tone of your message should remain courteous yet firm. Express understanding of potential issues while reinforcing the need for prompt action. Avoid being overly harsh, but make it clear that further delays are not acceptable.

Following Up on Delayed Payments

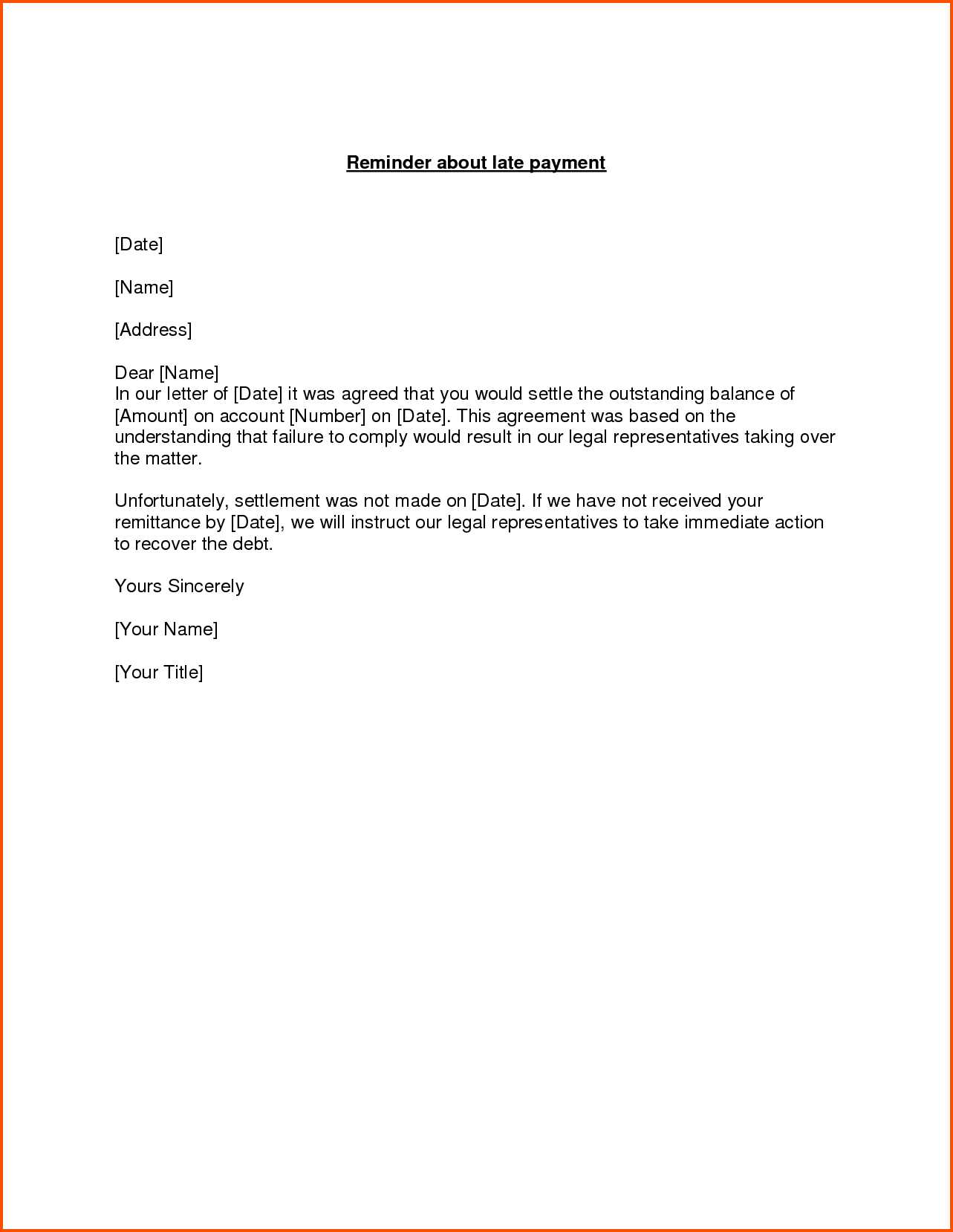

In cases where no response is received after the initial notice, a follow-up is necessary. A polite reminder can help nudge the client into action, ensuring that the matter is resolved efficiently. However, make sure to give enough time between communications to avoid overwhelming the recipient.

Final Steps

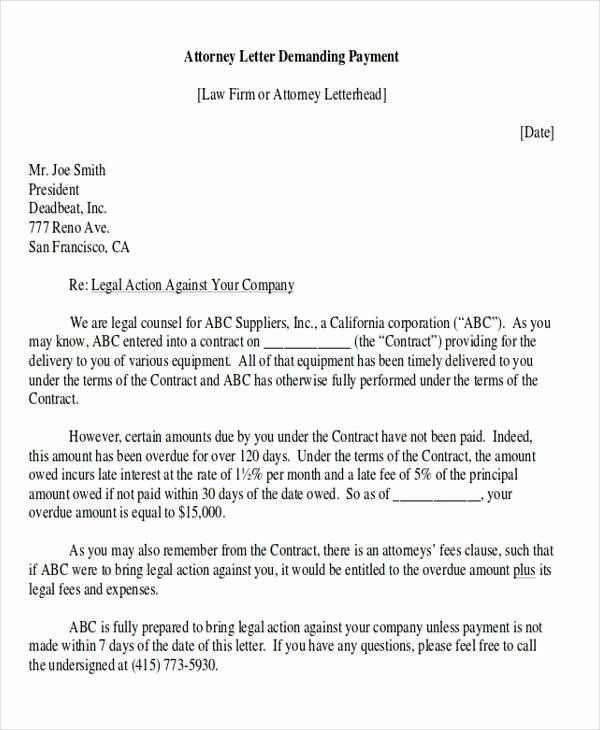

If no resolution occurs after multiple attempts, you may need to consider legal action or third-party intervention. Always try to maintain a professional approach, as long-term business relationships can sometimes be salvaged through respectful and clear communication.

How to Create an Effective Reminder Notice

Effective communication is crucial when addressing an unpaid balance. A clear, professional approach helps maintain positive relationships while encouraging prompt resolution of financial issues. Understanding key elements can make a significant difference in ensuring that the message is received and acted upon in a timely manner.

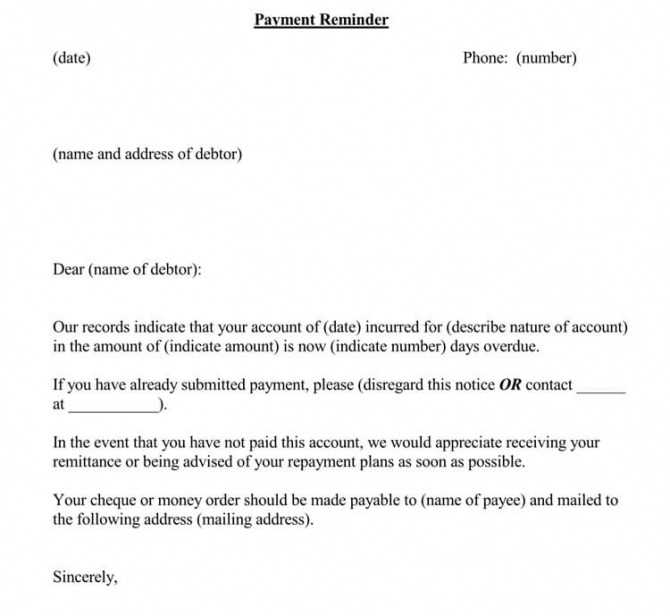

Essential Elements of a Reminder

When drafting a message regarding an outstanding balance, several components are essential. Start by identifying the recipient and including all relevant details such as invoice number, due date, and the amount due. Clearly state the purpose of the message without being overly confrontational. Offering a solution, such as a revised payment date, can also show willingness to collaborate.

Best Practices for Writing Requests

It is important to maintain a tone that is firm yet courteous. Avoid sounding too aggressive, but be clear that timely payment is necessary. A good practice is to use polite language while still conveying the urgency of the situation. Providing multiple payment options or offering assistance can increase the likelihood of a swift response.

How to Set Terms Effectively: Clearly defined terms are key to preventing future misunderstandings. When possible, outline payment deadlines upfront and consider setting late fees for delayed payments. This sets expectations for your clients and can help you avoid future delays.

Polite yet Firm Messaging: Striking the right balance in tone is important. While it’s necessary to remain polite, you should not shy away from stating that the matter requires resolution. A respectful approach will keep the client engaged without damaging the professional relationship.

Legal Aspects: Always be mindful of the legal framework when sending such notices. In certain situations, formal warnings or involvement from a collections agency may be necessary. Ensure that your communications comply with relevant laws, as non-compliance can have serious repercussions.