Template for Trust Distribution Letter of Instructions

Clear and precise communication is essential when conveying how assets should be managed and distributed among recipients. This document serves as an important tool to ensure all parties involved are informed of their roles and responsibilities, as well as the specific terms of asset distribution. Without proper documentation, misunderstandings and disputes may arise, making it crucial to set clear guidelines.

By outlining specific procedures and conditions, this communication ensures that the individual’s wishes are properly executed. When creating such a document, it is important to address all necessary details, ensuring that it is legally binding and recognized by relevant authorities. Understanding how to craft this type of formal communication will help avoid potential issues and provide clarity for all involved.

Importance of Trust Distribution Letters

Clear documentation is essential to ensure that the distribution of assets occurs smoothly and according to the individual’s wishes. Without proper guidance, there is a risk of confusion or even legal disputes between beneficiaries. A well-crafted document serves as a roadmap for asset allocation, providing clarity to all involved parties. It outlines the expectations and responsibilities, ensuring that everything is carried out as intended.

Ensuring Legal Clarity

One of the primary reasons for creating such a document is to ensure that legal obligations are met. It acts as an official record that can be referenced in case of disagreements or challenges. By specifying how assets should be handled, it protects both the recipient and the person assigning the distribution, helping to avoid potential complications.

Facilitating Smooth Execution

In the absence of clear instructions, there may be delays or errors in carrying out the allocation. This document ensures that every step is outlined, allowing for an efficient and orderly process. By laying out specific terms, it eliminates uncertainty and helps guide the executor in making decisions that are in line with the individual’s wishes.

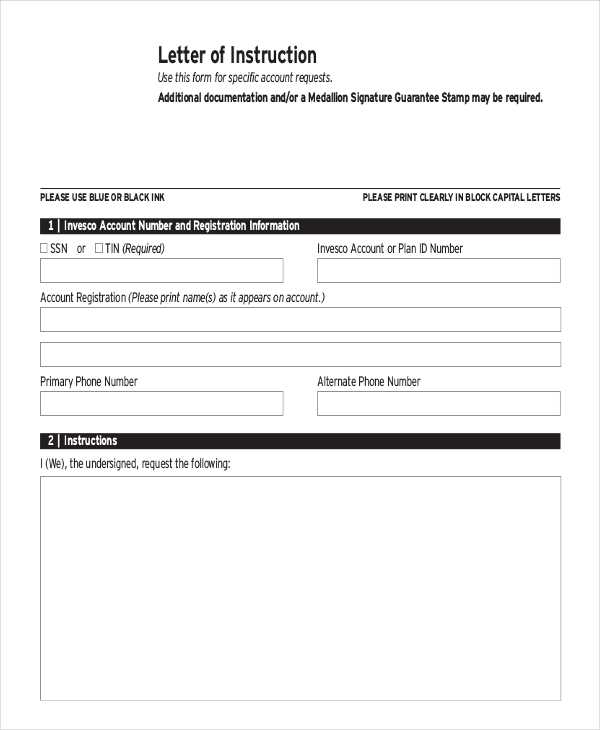

Key Elements in a Distribution Template

To ensure that the process of allocating assets is handled effectively, specific elements must be included in the document. Each section should serve a clear purpose, guiding both the executor and the beneficiaries. Below are the fundamental components that must be carefully outlined to avoid ambiguity and ensure the successful execution of the plan.

| Element | Description |

|---|---|

| Introduction | Establishes the purpose of the document and outlines the individual’s intent regarding asset allocation. |

| List of Beneficiaries | Clearly identifies all recipients, including their full names and relationship to the individual. |

| Asset Allocation | Details the specific assets to be distributed, including values, items, and quantities where applicable. |

| Conditions or Restrictions | Any limitations or requirements that must be met before the assets can be distributed are explained here. |

| Executor’s Responsibilities | Outlines the duties and authority of the individual responsible for carrying out the instructions. |

| Signatures | Signatures of the individual creating the document and witnesses, ensuring legal validity. |

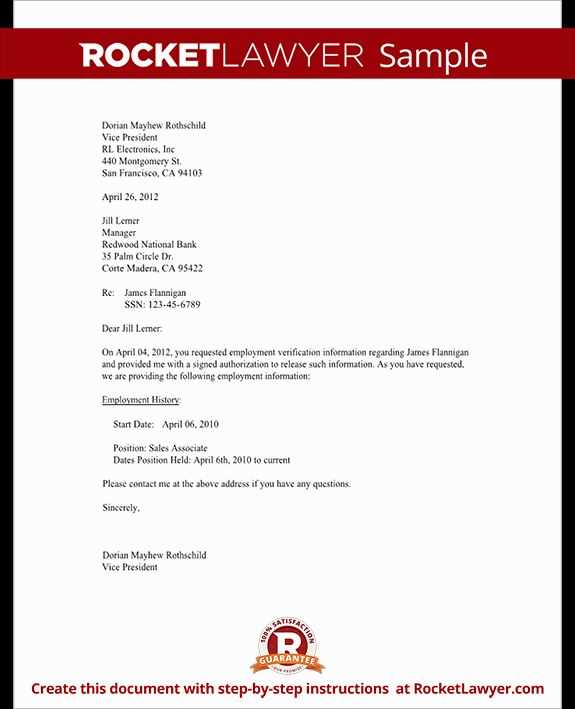

Steps to Create a Trust Letter

Creating a formal document to guide the allocation of assets is a crucial process. It ensures that the individual’s wishes are clearly communicated and legally binding. By following a structured approach, you can make sure all necessary details are covered and that there are no ambiguities. The following steps will help you craft a well-organized document.

Gather Relevant Information

Start by collecting all pertinent details regarding the individuals involved, including beneficiaries and their relationships to the person creating the document. List all assets that need to be distributed and any specific conditions or preferences. Organizing this information beforehand will help streamline the process and prevent overlooking any important aspect.

Draft Clear and Specific Terms

Be precise when outlining how each asset should be allocated. Include specific instructions about who will receive what, and ensure that no part is left to interpretation. Clarity is essential to avoid potential conflicts or confusion in the future. This section should leave little room for ambiguity, making the intentions of the individual obvious to all parties involved.

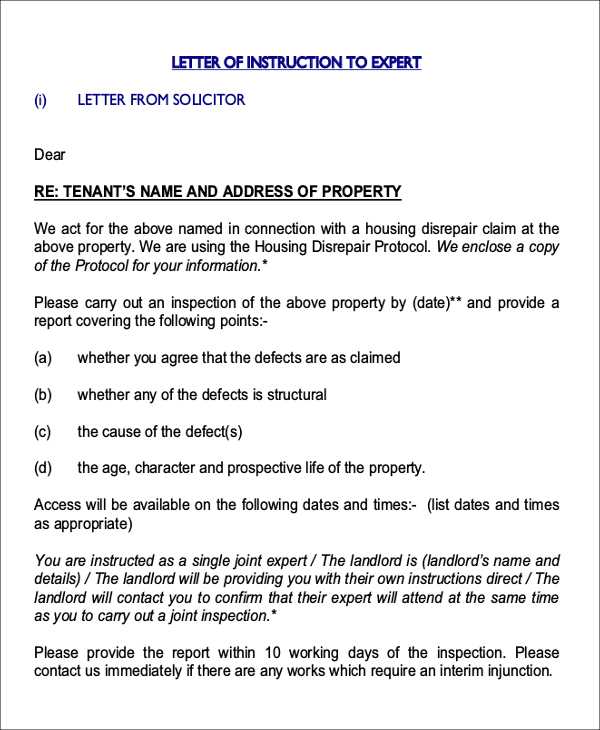

Common Mistakes to Avoid in Letters

When crafting a formal document to outline the allocation of assets, it’s easy to make mistakes that could lead to confusion, disputes, or even legal issues. To ensure that the process goes smoothly, it’s important to avoid common pitfalls that can undermine the effectiveness of the communication. Below are some of the most frequent errors that should be avoided during the creation of such documents.

Ambiguity in Asset Allocation

- Failing to specify exactly what assets are being distributed can lead to confusion.

- Using vague language such as “items of value” without further clarification.

- Not listing items individually, which could result in disagreements among beneficiaries.

Neglecting Legal Formalities

- Omitting necessary signatures or witnessing requirements, which can invalidate the document.

- Not complying with local legal standards and regulations, leading to the document being challenged.

- Overlooking the need for a clear date, which could cause doubts about the timing of the instructions.

Legal Requirements for Trust Documents

Creating a document that outlines the allocation of assets is not only about personal preferences but also about meeting specific legal requirements. To ensure that the document is legally enforceable, it must comply with local regulations and formalities. This includes following the correct procedure for signing, witnessing, and other legal considerations that guarantee the document’s validity.

Each jurisdiction has its own set of rules for such documents, and failing to meet these requirements can result in the document being challenged or disregarded. It is important to understand what needs to be included, from the necessary signatures to the appropriate legal language, to ensure that the distribution is carried out smoothly and without complications.

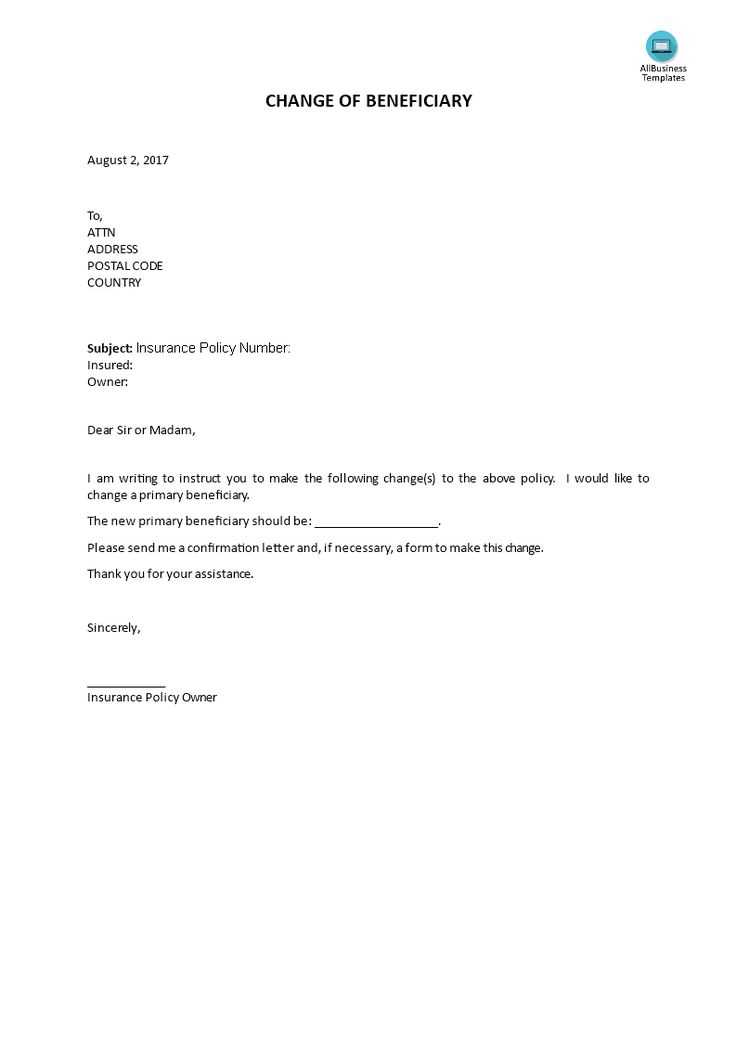

How to Customize Your Template

Personalizing a formal document that outlines the allocation of assets is essential to make sure it meets your specific needs and intentions. While generic formats can provide a helpful starting point, customization ensures that the content is tailored to reflect your wishes clearly and comprehensively. By adjusting the details and language, you can create a document that fits your unique situation.

Adjusting Specific Terms

It’s important to review each section and modify it to suit the exact nature of the assets and the beneficiaries. Make sure to update the allocation of items, include any special conditions, and ensure that the responsibilities of the executor are detailed accurately. Customizing these details will provide clarity and prevent confusion.

Ensuring Legal Compliance

Before finalizing the document, check that all legal requirements are met. Depending on the jurisdiction, there may be specific clauses or formalities that must be included. Customizing the legal language to reflect the correct terms will help ensure that the document is enforceable and recognized by relevant authorities.