Template Letter for Requesting Money Owed

When a financial obligation remains unpaid, it can be uncomfortable and frustrating. Crafting a clear and polite request for the amount due is essential in maintaining professional relationships while ensuring you receive what is rightfully yours. Knowing how to structure your request increases the chances of a swift and positive response.

Effective communication is key when dealing with overdue payments. A well-written message can convey your expectations without sounding confrontational, allowing you to resolve the situation amicably. It is important to remain firm, yet courteous, ensuring that the recipient understands the urgency of the matter without feeling attacked.

In this guide, we will walk through how to create a professional and respectful approach to retrieving the funds owed to you. By following these steps, you can reduce misunderstandings and expedite the resolution of outstanding debts, helping to maintain both your financial stability and professional rapport.

Why You Need a Payment Request Letter

When financial commitments are not met on time, it is crucial to communicate your expectations clearly. An official request can help both parties understand the situation, avoid misunderstandings, and facilitate a resolution. Having a structured approach when reaching out is vital to ensuring prompt action without damaging professional relationships.

There are several reasons why a formal written request is necessary:

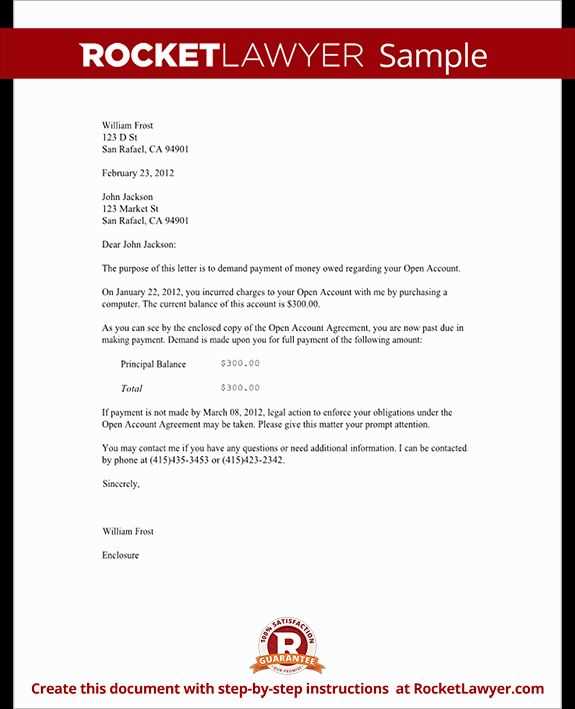

- Clarity: A written request removes ambiguity, clearly outlining the amount due, deadlines, and the consequences of non-payment.

- Professionalism: Using a formal approach helps maintain respect and professionalism, preventing the situation from becoming personal or confrontational.

- Documentation: A written record serves as proof of your request and can be referenced if further action is needed.

- Accountability: The recipient is more likely to take the matter seriously when it’s presented in writing, knowing it has been formally documented.

- Time-saving: A well-crafted request can eliminate unnecessary back-and-forth, speeding up the payment process.

In the following sections, we will explore how to write an effective request that ensures the best possible outcome for all parties involved.

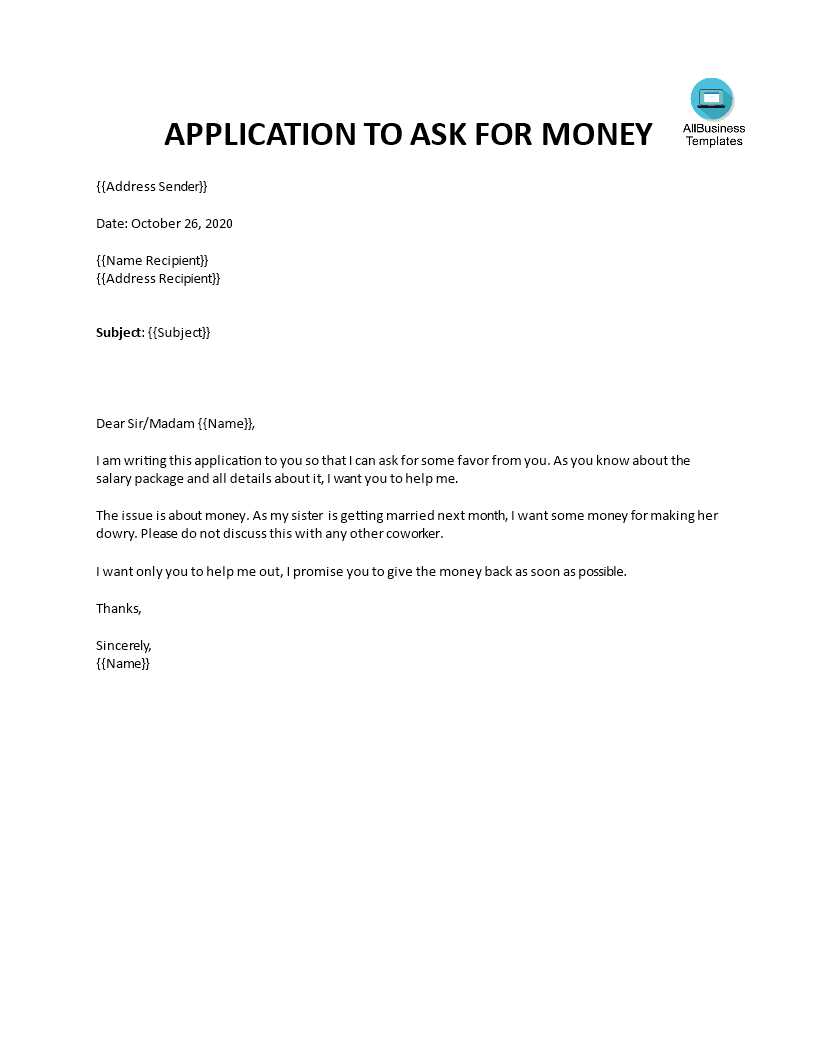

How to Write an Effective Payment Letter

When requesting payment for an outstanding balance, it’s important to communicate your message clearly, professionally, and with tact. A well-structured request can help you achieve a positive outcome and ensure that the issue is addressed promptly. To craft an effective message, there are several key elements to consider.

Key Elements to Include

- Clear Subject Line: Start by using a concise and informative subject that lets the recipient know exactly what the communication is about, such as “Request for Payment of Invoice #12345”.

- Polite Greeting: Begin with a respectful greeting, addressing the recipient by name if possible. Maintain a professional tone throughout.

- Details of the Balance: Provide specific details of the amount due, including any reference numbers, invoices, or agreements. This helps to eliminate confusion and reminds the recipient of their responsibility.

- Payment Terms: Clearly state the due date for payment and any late fees or consequences for not paying on time.

- Request for Action: Politely ask for the payment to be made, emphasizing any necessary steps the recipient needs to take to fulfill the obligation.

- Contact Information: Provide your contact details, ensuring the recipient can reach out easily if there are any questions or concerns.

Tone and Language Tips

- Be Professional: While it is essential to be firm, keep the tone professional and polite. Avoid sounding confrontational or accusatory.

- Be Clear and Direct: Clearly outline your expectations without unnecessary detail or ambiguity. Stick to the facts.

- Be Concise: Keep your communication brief and to the point. A long-winded message may cause the recipient to overlook the main issue.

By following these guidelines, you can ensure that your request is both effective and courteous, helping you to resolve the matter efficiently and professionally.

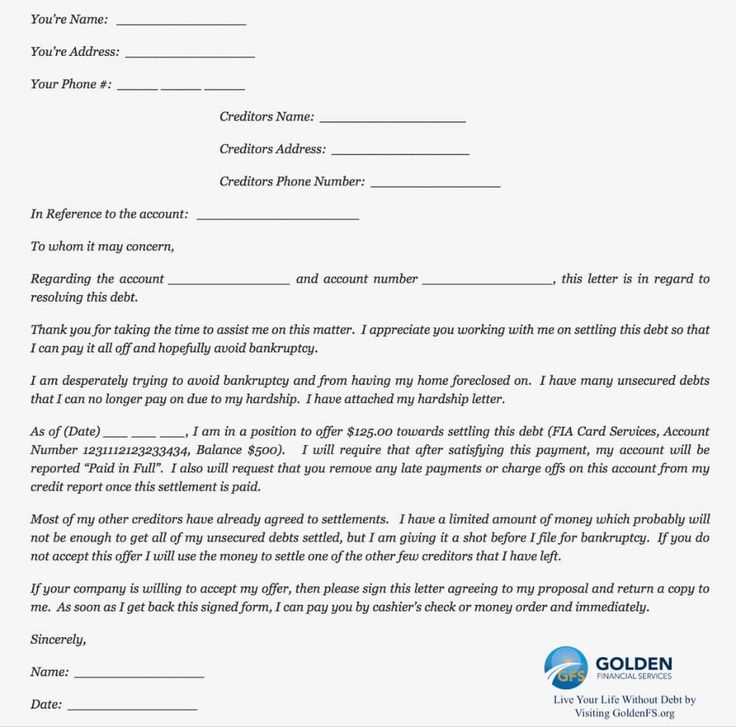

Common Mistakes in Debt Collection Letters

When requesting overdue payments, it’s important to avoid certain errors that could undermine your efforts. While it’s easy to become frustrated or emotional, a poorly crafted message can damage your professional reputation or result in delayed payments. Understanding the common pitfalls can help ensure that your communication is effective and respectful.

- Being Too Aggressive: One of the most common mistakes is using an overly harsh or threatening tone. While it’s important to be firm, an aggressive approach can backfire, alienating the recipient and making them less likely to cooperate.

- Vague Language: Using unclear or non-specific language can confuse the recipient, leading to delays. Always specify the amount due, the due date, and any consequences for non-payment.

- Failure to Document: Leaving out critical details, such as invoice numbers or past communication, can make it difficult for the recipient to track the debt. Ensure that all relevant information is included to avoid confusion.

- Overly Lengthy Messages: A long-winded request can cause the recipient to lose focus on the important details. Keep your message concise, ensuring all necessary information is communicated effectively.

- Lack of a Clear Deadline: Without a clear timeframe for payment, the recipient may not feel any urgency. Always state the exact due date and any late fees or consequences for missing it.

- Ignoring the Recipient’s Perspective: Failing to show empathy or considering the recipient’s situation can make your message seem impersonal or insensitive. Acknowledge the possibility of genuine issues, such as financial difficulties, to foster a more cooperative approach.

Avoiding these mistakes can greatly improve your chances of receiving prompt payment and maintaining a positive relationship with your clients or partners.

Tips for Ensuring Prompt Payment

Getting paid on time is crucial for maintaining smooth cash flow and business operations. However, many individuals and businesses face delays when it comes to settling outstanding balances. To increase the chances of prompt payment, it’s essential to employ strategies that encourage timely action while maintaining professional and positive relationships.

Strategies to Encourage Timely Payment

- Set Clear Terms: From the outset, establish clear payment terms that both parties understand. Specify due dates, payment methods, and any late fees for overdue payments.

- Send Reminders: A friendly reminder before the due date can prevent missed payments. Follow up shortly after the due date if the payment hasn’t been made, maintaining a polite tone throughout.

- Offer Multiple Payment Methods: Providing various ways for the recipient to make payment–such as credit card, bank transfer, or online payment systems–makes it easier for them to pay promptly.

- Incentivize Early Payments: Offering a small discount for early settlement can motivate clients to pay ahead of the deadline.

- Maintain Professionalism: While it’s important to be firm about your expectations, always keep communication polite and professional. This helps maintain a positive working relationship, even when dealing with sensitive financial matters.

Building Long-Term Payment Discipline

- Establish Regular Billing Cycles: Sending regular invoices at consistent intervals can help set expectations and prevent delays, as clients will know when to expect payment reminders.

- Communicate Early About Issues: If a payment is delayed, reach out promptly to understand the reasons behind it. Open communication can prevent misunderstandings and find a solution before the situation worsens.

By incorporating these strategies into your business practices, you can encourage prompt payments while fostering trust and reliability with clients or partners.

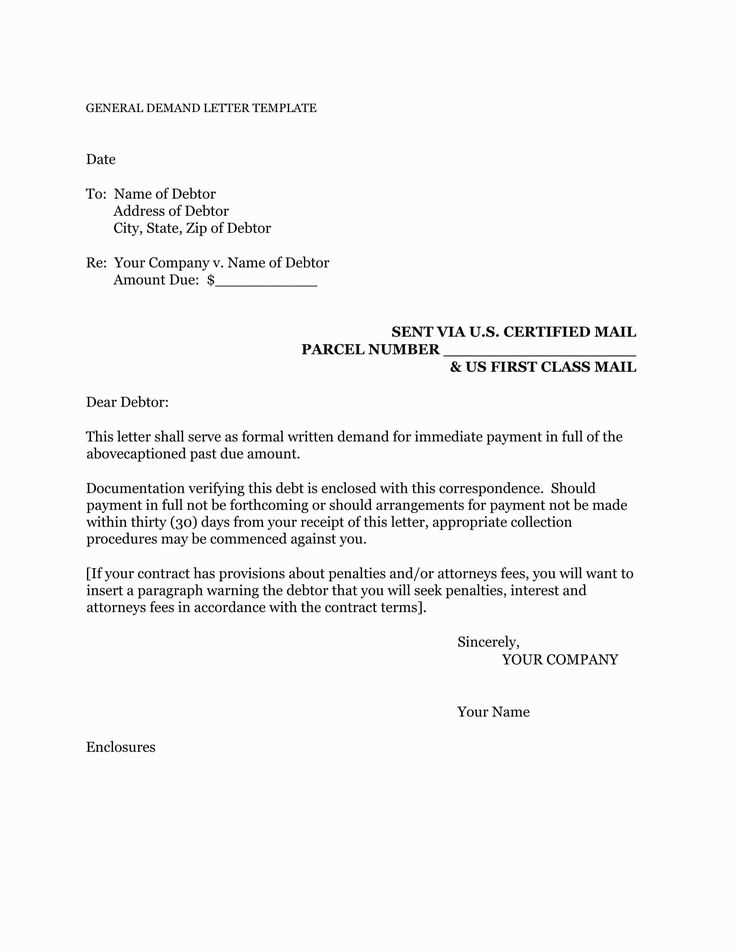

Legal Considerations When Requesting Payment

When pursuing overdue payments, it’s crucial to be aware of the legal implications involved. While it’s important to communicate your expectations clearly, you must also respect the legal rights of both parties to avoid potential disputes or escalation. Understanding the rules and regulations governing financial transactions can help you navigate this sensitive process effectively and avoid costly mistakes.

Key Legal Aspects to Keep in Mind

- Contractual Obligations: Ensure that all agreements, whether written or verbal, are clearly documented. Reference these terms in your communications to remind the recipient of their legal obligations to settle the balance.

- Limitations on Debt Collection: Be aware of any statutes of limitations on pursuing unpaid balances in your jurisdiction. There are often time restrictions that limit how long you can legally pursue outstanding debts.

- Harassment Laws: Always avoid aggressive or harassing language. There are strict laws in place to prevent unfair treatment, and violating these can lead to legal action against you.

- Late Fees and Interest: Ensure that any penalties or interest for late payment are clearly defined in your agreement. Charging excessive fees or interest can result in legal complications if they are deemed unfair or not previously agreed upon.

When to Seek Legal Help

- Non-Response or Disputes: If the recipient refuses to pay or disputes the balance, it may be time to consult with a legal professional to explore your options.

- Debt Collection Agencies: In some cases, it may be necessary to hire a debt collection agency. Before proceeding, ensure you understand their practices and the legal framework surrounding their operations.

By keeping these legal considerations in mind, you can reduce the risk of complications while ensuring that you follow the proper procedures to collect what is owed to you.

When to Follow Up on Outstanding Debts

It’s essential to know the right time to follow up on overdue balances. A delay in payment can affect your business operations, but too frequent or untimely reminders can harm your relationship with clients. Understanding when and how to follow up can help you stay professional while encouraging prompt resolution of the issue.

Below is a table outlining suggested follow-up timelines based on the length of time the payment has been overdue:

| Time Elapsed | Action | Suggested Tone |

|---|---|---|

| 0-7 Days | Send a friendly reminder | Polite and cordial |

| 8-14 Days | Send a formal follow-up | Firm but respectful |

| 15-30 Days | Send a final notice | Serious and professional |

| 30+ Days | Consider escalation or legal action | Firm and urgent |

By following these guidelines, you can ensure that you maintain professionalism and increase the chances of receiving payment in a timely manner. Always tailor your approach to the situation to maintain a positive business relationship while addressing the overdue balance effectively.