Template letter for debt repayment

Writing a letter for debt repayment can be a straightforward way to communicate your intent to settle a debt. This letter serves as a formal document, outlining your commitment and plan to repay the owed amount. It’s important to be clear, concise, and respectful when crafting such a letter, ensuring that both parties understand the terms and expectations.

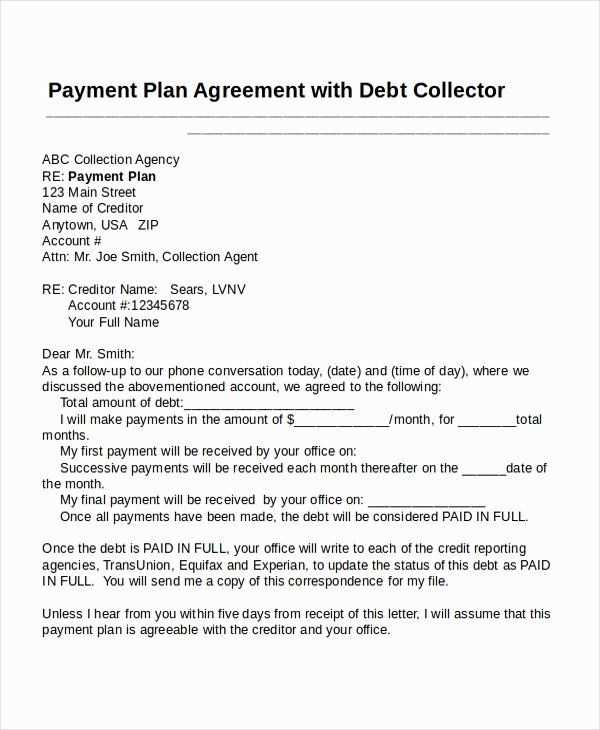

Start by including your personal information, the creditor’s details, and the reference to the debt being addressed. Be direct in stating the amount owed and the payment terms you are proposing. Offering a timeline for repayment shows your dedication to resolving the issue in an organized manner.

Conclude the letter with a polite yet firm closing, expressing your willingness to discuss further arrangements if necessary. Including your contact details allows for easy communication should any issues arise during the repayment process.

Here are the revised lines with minimized repetitions:

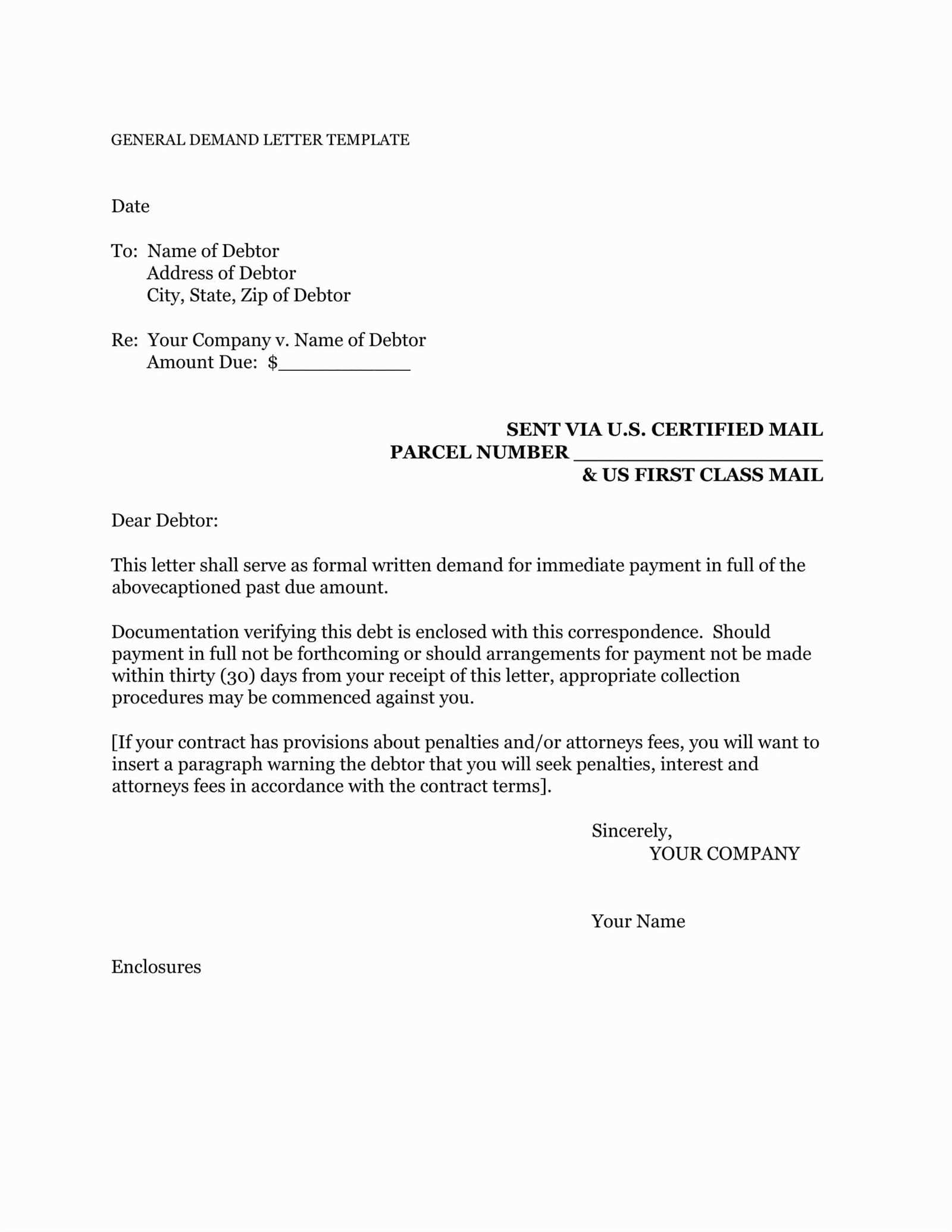

To ensure clarity and avoid redundancy, start with a direct request for payment while keeping a polite yet firm tone. This sets a clear expectation for the recipient.

Example of Revised Request

- “I kindly request that you settle the outstanding balance of $XXX by [date].”

- “Please arrange the payment within the next 15 days to avoid any additional fees.”

- “We appreciate your prompt attention to this matter and look forward to resolving the balance soon.”

These changes ensure that the message remains respectful, but also directly communicates the urgency of the situation. Avoid excessive repetition of phrases like “please,” “kindly,” or “as soon as possible,” and instead, focus on clear deadlines and expectations.

Additional Adjustments

- “If you have already processed the payment, kindly disregard this notice.”

- “We are happy to discuss any issues related to this invoice if you need assistance.”

By removing redundant phrases, you can keep the tone professional while maintaining clarity in your communication.

- Template Letter for Debt Repayment

When drafting a letter for debt repayment, clarity and professionalism are key. Use a direct and respectful tone, outlining the specifics of your payment proposal. Here’s an example of a debt repayment template that you can adapt to your situation:

Debt Repayment Letter Template

Your Name

Your Address

City, State, ZIP Code

Email Address

Phone Number

Date

Creditor’s Name

Creditor’s Address

City, State, ZIP Code

Dear [Creditor’s Name],

I am writing to discuss the outstanding balance on my account [Account Number]. Due to [briefly explain your financial situation], I have encountered difficulty in paying the full amount at this time. I am committed to repaying the debt and would like to propose the following payment arrangement:

- Total amount owed: $[Amount]

- Proposed monthly payment: $[Amount]

- First payment due on: [Date]

- Last payment due by: [Date]

Please let me know if this payment plan works for you or if any adjustments are necessary. I am open to discussing other options and am eager to resolve this matter. Your cooperation and understanding in this situation are greatly appreciated.

Thank you for your time and consideration. I look forward to hearing from you soon.

Sincerely,

[Your Name]

Final Notes

Ensure that you provide accurate details and communicate openly. If you are unsure about any aspects of the repayment plan, seek advice before sending the letter. Maintaining transparency will help build trust with your creditor and may lead to more favorable terms for both parties.

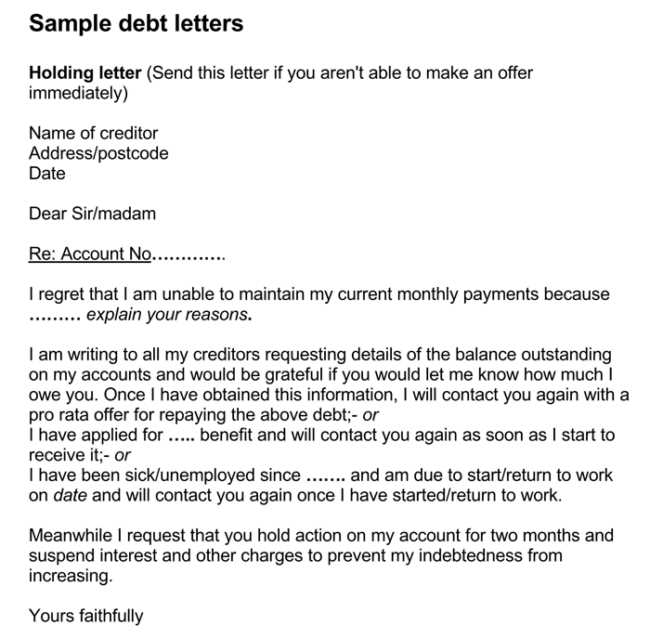

Begin by clearly stating the purpose of your letter. Indicate that you are requesting repayment for the outstanding debt. Be direct, using a polite and professional tone. Specify the exact amount owed and the date when the payment was due.

Debt Details

Include a breakdown of the debt, mentioning any interest or late fees if applicable. Provide clear information about the original loan or agreement that led to the debt. Reference any previous communications or agreements regarding repayment, such as installment plans or promises to pay.

Repayment Proposal

Offer a realistic repayment plan. If you can make partial payments, specify how much you will pay and the frequency of the payments. If you intend to pay the full amount at once, include the date when the payment will be made. Be clear and specific to avoid misunderstandings.

Conclude with a polite request for confirmation of the repayment plan and express your intention to resolve the matter promptly. Reaffirm your commitment to meeting the repayment terms. Include your contact information for any follow-up.

Clearly outline the following details in your repayment letter to ensure clarity and prevent misunderstandings:

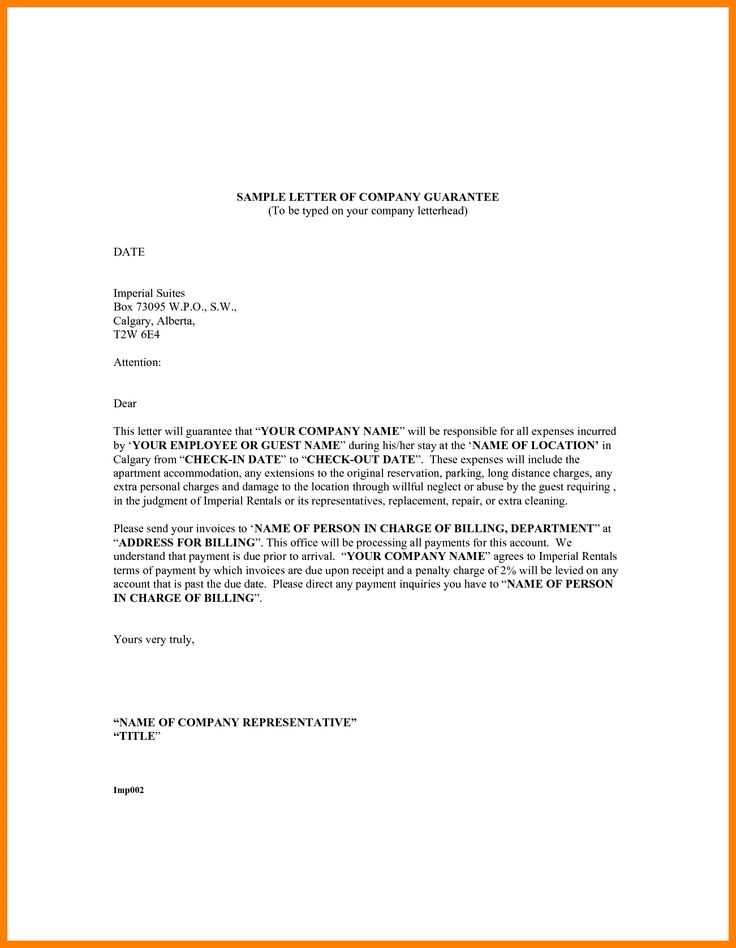

1. Your Contact Information

Provide your full name, address, and phone number at the top of the letter. This ensures the recipient can easily reach you for any follow-up or further discussion.

2. The Creditor’s Information

Include the creditor’s name, address, and any specific department (if applicable) to direct the letter appropriately. This eliminates the possibility of the letter being misplaced or delayed.

3. Debt Details

Specify the amount owed, including principal, interest, and any other fees. Reference any account numbers or invoices associated with the debt for easy identification.

4. Repayment Plan

Describe the terms of repayment clearly. Include the payment amount, frequency (e.g., monthly), and the start date. If you plan to make a lump sum payment, mention this as well.

5. Acknowledgment of the Debt

Express your understanding of the debt and your commitment to repaying it. This shows accountability and helps build trust between you and the creditor.

6. Confirmation of Agreement

Offer the creditor the opportunity to confirm the repayment plan. This is often done through a signed agreement, but ensure you request their acknowledgment in writing.

7. Closing Remarks

Thank the creditor for their understanding and cooperation. End the letter on a positive note to maintain a good relationship moving forward.

Sample Table: Repayment Plan Breakdown

| Payment Date | Payment Amount | Remaining Balance |

|---|---|---|

| February 15, 2025 | $200 | $800 |

| March 15, 2025 | $200 | $600 |

| April 15, 2025 | $200 | $400 |

| May 15, 2025 | $200 | $200 |

| June 15, 2025 | $200 | $0 |

Maintain a respectful and professional tone throughout the letter. A polite approach increases the likelihood of a positive response. Keep the language straightforward and avoid sounding confrontational. The goal is to express a genuine intent to resolve the matter while acknowledging the outstanding debt.

Avoid using overly formal or aggressive language, as it can create tension. Instead, use clear and concise statements, emphasizing your willingness to work together toward a solution. For instance, you can say, “I am committed to settling this matter promptly and would appreciate your cooperation in arranging a payment plan.”

Stay calm and composed even if the situation is stressful. Expressing understanding of the creditor’s position can also help. For example, “I understand the importance of settling this debt and am doing my best to meet my obligations.”

Finally, use positive reinforcement to encourage collaboration. Offer constructive suggestions, such as a reasonable timeline for repayment, while leaving room for flexibility. This shows you are approachable and willing to find common ground.

Begin by clearly stating your intention to pay the debt in installments. Be specific about the amount you can pay, the frequency of payments, and the expected duration of the plan. For example, “I propose to pay $100 monthly until the total debt of $1,000 is settled.” This helps the creditor understand your commitment and gives them a clear framework to evaluate.

Next, ensure your proposed payment schedule is realistic based on your current financial situation. If you can pay bi-weekly, monthly, or quarterly, state it explicitly, and explain any flexibility you might need. A transparent approach will demonstrate your willingness to work together towards resolution.

It’s important to outline how you plan to manage payments. If you’re paying by bank transfer, check, or another method, specify it. This reduces any confusion later on. Include details like the exact dates of your payments and the preferred mode of transaction, so everything is clear from the start.

If applicable, include any considerations for potential changes in your financial situation. For example, “If my circumstances change, I will notify you and suggest a revised payment plan.” This shows you are proactive and responsible, and it keeps communication open in case adjustments are needed.

Lastly, express your commitment to honoring the payment plan. Assure the creditor that you will make every effort to stick to the schedule. A sentence like, “I am fully committed to this plan and will notify you if any issues arise” emphasizes your dedication to resolving the debt responsibly.

Clarity is key. Avoid using vague language that could confuse the recipient. Be specific about the amount owed, the repayment schedule, and the proposed method of payment. Any ambiguity can delay the process or lead to misunderstandings.

1. Ignoring Proper Formatting

Formatting your repayment letter properly ensures that it looks professional and is easy to read. Avoid cluttering the letter with unnecessary details or making it difficult for the reader to follow your points. Use clear paragraphs, bullet points where appropriate, and a logical flow of information.

2. Not Acknowledging the Debt Amount

Always state the exact amount owed. Failing to do this might leave the recipient unsure about how much is due or whether there are any discrepancies. Clearly outline the total amount, along with any interest, fees, or late charges if applicable.

3. Offering Unclear Payment Terms

Be specific about how you plan to make the repayment. If you are offering a payment plan, include the exact amounts and due dates for each installment. A vague promise like “I will pay when I can” doesn’t create the structure needed for both parties to be confident in the agreement.

4. Failing to Follow Up

Don’t assume that sending one letter is enough. Be proactive in following up. Mention your intention to send further communication to ensure that your repayment schedule is being adhered to. This helps in keeping both parties accountable.

5. Not Expressing Accountability

It’s important to show that you take responsibility for the debt. Don’t deflect blame or make excuses. Acknowledge your financial obligations and the inconvenience they might have caused the recipient.

6. Overpromising Without a Plan

Avoid making promises you can’t keep. Overcommitting to unrealistic repayment amounts or timelines can break trust. Ensure that the terms you set are achievable based on your current financial situation.

7. Missing the Tone

Tone plays an important role. Maintain a respectful and cooperative tone in the letter. Avoid sounding defensive, accusatory, or overly apologetic. This can help maintain a positive relationship with the recipient.

8. Not Including Relevant Details

Make sure to provide all necessary details, such as account numbers or reference codes, to avoid any confusion. Missing details can delay the repayment process and cause unnecessary back-and-forth.

9. Not Keeping a Copy

Always keep a copy of the repayment letter for your own records. This will serve as proof of your communication in case of future disputes or misunderstandings.

Table of Key Points to Include in a Repayment Letter

| Point | Details |

|---|---|

| Amount Owed | Clearly state the exact amount of the debt. |

| Payment Terms | Be specific about the payment schedule and method. |

| Acknowledgment | Acknowledge your responsibility for the debt. |

| Follow-Up | Mention your intention to follow up with further communication. |

| Relevant Information | Provide any necessary account numbers or reference codes. |

Once you’ve sent your repayment letter, it’s time to follow up and stay proactive. Here’s what to do next:

- Monitor for Acknowledgement – Keep an eye on your email or postal mail for a response. A creditor may confirm receipt of your letter or request further documentation.

- Track Your Payments – Stay organized and document all payments made under the terms of the agreement. Make sure to keep records of transaction dates, amounts, and methods.

- Stay in Touch – If you haven’t received a reply within a reasonable time frame, reach out again. Ensure they are processing your repayment plan as agreed.

- Evaluate Progress – Regularly assess whether your payment schedule is on track. If any issues arise, contact the creditor early to prevent delays.

- Address Issues Quickly – If you receive any communication regarding late payments or misunderstandings, respond immediately. Clear up any confusion as soon as possible to avoid penalties or further complications.

Debt Repayment Template Letter

When crafting a letter for repayment, focus on clarity and formality without overusing terms like “debt” or “repayment.” This will help maintain the tone professional while conveying your message effectively. Here’s how to structure it:

Key Points to Include

- Start with a polite salutation and clearly state the purpose of the letter.

- Provide details of the amount owed and the agreed-upon payment terms.

- Offer specific dates for payment or installments, if applicable.

- Express your willingness to cooperate and discuss flexible options, if necessary.

- Close the letter with a polite acknowledgment of the creditor’s understanding and your intention to honor the arrangement.

Example Template

Dear [Creditor’s Name],

I am writing to confirm the details of the amount outstanding on my account. I acknowledge the amount of [insert amount] and am committed to fulfilling the obligations as agreed. I propose the following payment schedule: [insert payment dates and amounts].

If there are any questions regarding this arrangement, please do not hesitate to contact me. I appreciate your understanding and cooperation as we finalize these terms.

Sincerely,

[Your Name]