Time barred debt template letter

If a debt is time-barred, you are no longer legally obligated to repay it. In many cases, this is because the statute of limitations has expired. A time-barred debt template letter can help you communicate this to creditors or debt collectors, asserting your rights and preventing them from attempting to collect the debt further.

Use this template to clearly state that the debt in question is past the statute of limitations. By referencing the specific dates and relevant legal provisions, you assert that the creditor or collector can no longer pursue any action regarding this debt. Make sure to avoid making any payments or acknowledging the debt in writing to preserve your defense.

This letter should include the necessary details, such as the date when the debt became due, the last payment made, and any legal time limits associated with the debt. It’s crucial to keep a copy for your records and send the letter via certified mail for documentation purposes. By sending this letter, you protect yourself from any further collection attempts on a debt that no longer requires repayment.

Here is the corrected version:

If you’re dealing with time-barred debt, you should be clear and concise in your response. Acknowledge the debt and its status under the law. Mention the specific time limits for debt recovery in your jurisdiction. Explain that the statute of limitations has expired, making the debt unenforceable. State that any further attempts to collect on the debt will not be entertained, as it’s no longer legally valid. Keep the tone firm, but respectful.

Key Points to Include

Start by stating that the debt in question is time-barred. Specify the date when the statute of limitations began and the period after which the debt can no longer be pursued. Mention the specific law or statute that applies to your case, ensuring the creditor knows you are aware of your rights. Reaffirm that, due to the expiration of the statute of limitations, any further communication regarding this debt is unwelcome.

Template Suggestion

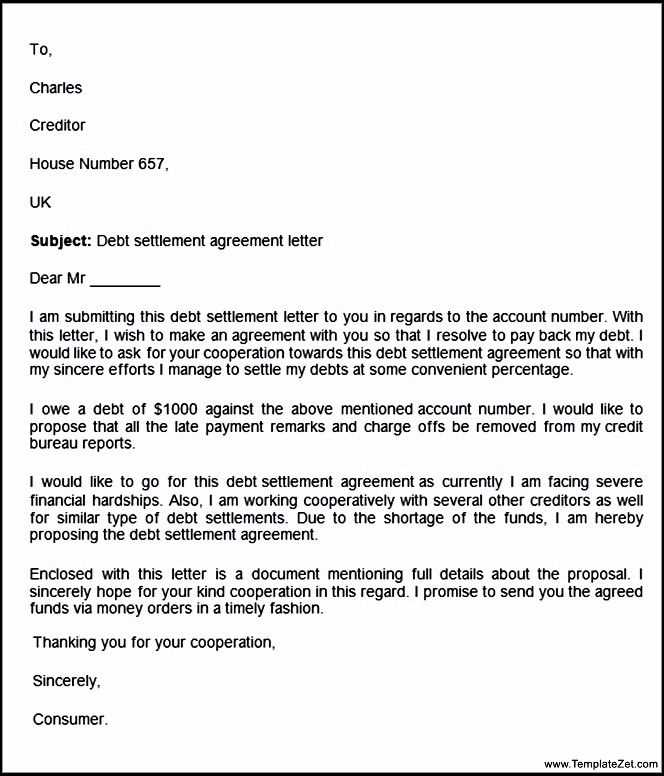

Subject: Debt Collection Response – Time-Barred Debt

Dear [Creditor’s Name],

I am writing in response to your recent communication regarding the debt referenced in your letter dated [Date]. Please be advised that the statute of limitations has expired on this debt. According to [relevant statute], the period for legal action to collect this debt has lapsed, making it unenforceable.

As such, I kindly ask that you cease any further attempts to collect this debt. Should you continue to pursue this matter, I will be forced to take appropriate action to protect my rights.

Thank you for your understanding.

Sincerely,

[Your Name]

Time Barred Debt Template Letter Guide

Understanding Time Barred Debts and Their Legal Impact

Time barred debts are debts that can no longer be legally enforced because the statute of limitations has expired. The time limit varies depending on the jurisdiction, but once the period is over, creditors cannot take legal action to collect the debt. A time barred debt letter can help you assert your rights and prevent further attempts to collect the debt.

When to Use a Time Barred Debt Letter Template

You should use a time barred debt letter template if a debt collector attempts to collect a debt that is past the statute of limitations. By using this template, you formally inform the collector that the debt is time barred and cannot be pursued legally. This letter can also prevent the collector from continuing to contact you regarding the debt.

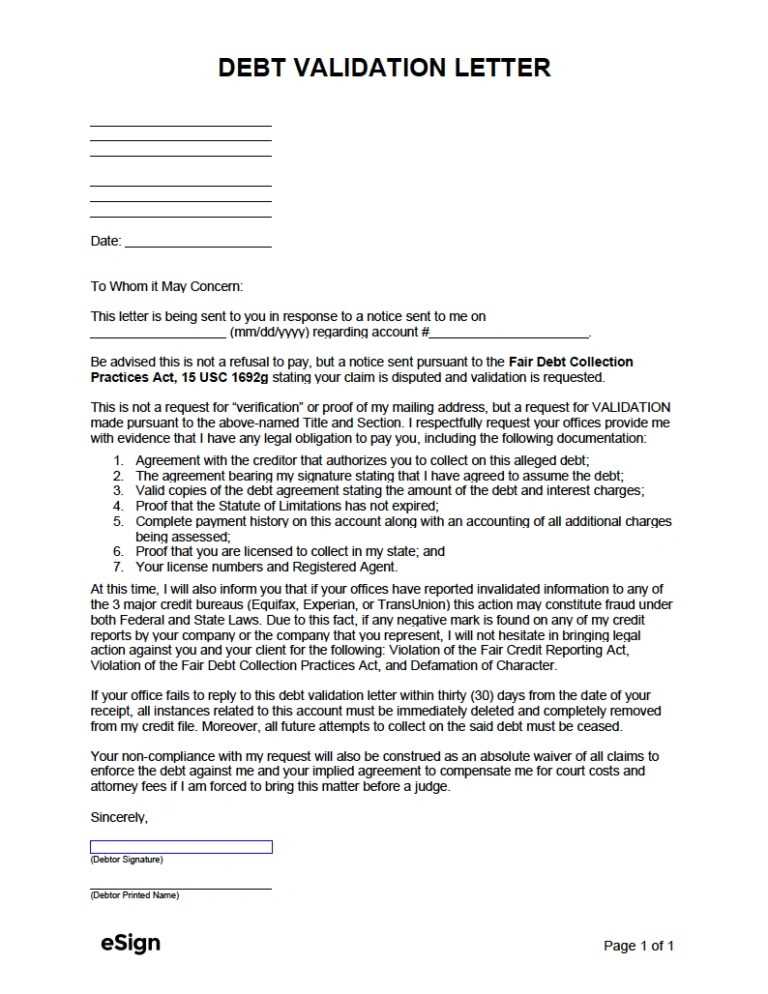

Key Information to Include in Your Debt Letter

The debt letter should clearly state the following:

- Your full name and address.

- The creditor’s or debt collector’s name and contact information.

- The account number or reference number of the debt in question.

- The date the debt was incurred.

- Confirmation of the date the statute of limitations expired for your jurisdiction.

- A statement that the debt is time barred and cannot be legally collected.

Be concise, and avoid unnecessary details that don’t directly address the statute of limitations issue.

How to Confirm Your Debt is Time Barred Before Sending the Letter

To confirm your debt is time barred, review your records and check the original agreement, the last payment made, or any communication received from the creditor or debt collector. Different types of debt have different limitation periods, and these periods can be interrupted under certain circumstances. If you’re unsure, you may want to consult with a legal professional to ensure that your debt is indeed time barred before proceeding.

Common Mistakes to Avoid When Writing a Time Barred Debt Letter

Avoid the following errors when writing your letter:

- Including incorrect or incomplete details about the debt.

- Falsely stating that the debt is time barred if you are unsure.

- Sending the letter to the wrong address or without proper identification.

- Not providing sufficient proof of the statute of limitations for your jurisdiction.

Make sure all information is accurate, and be clear about your legal rights.

What Happens After Sending the Time Barred Debt Letter?

Once you send the time barred debt letter, the collector is legally obligated to stop attempting to collect the debt. If they continue to contact you or try to take legal action, you may have grounds for further legal action against them. Keep a copy of the letter and any responses for your records, as they can be important if the situation escalates.