VAT Exemption Letter Template for Easy Use

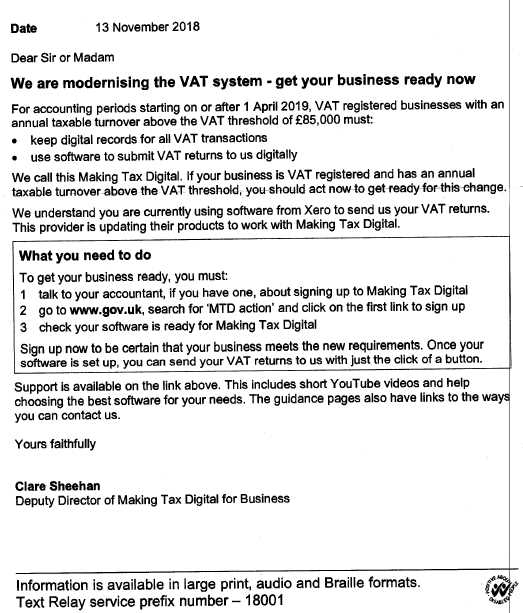

In business and taxation, there are various circumstances where specific goods or services can be granted relief from standard tax rates. Such benefits are typically provided to organizations or individuals who meet certain conditions set by tax authorities. Knowing how to effectively communicate the request for such relief can streamline the process and ensure compliance with the rules.

To properly request these allowances, it’s essential to create a formal document that adheres to the required structure and includes all necessary details. This ensures that your request is clear, valid, and more likely to be approved. A well-crafted form can save time and prevent unnecessary complications during the approval process.

Having the right format for such communications is critical. Utilizing a ready-made structure not only saves time but also reduces the chances of making errors that could delay or invalidate the application. Whether you are a business owner, accountant, or legal professional, understanding how to fill out this important paperwork correctly can make a significant difference in your financial dealings.

Understanding Tax Relief Documentation

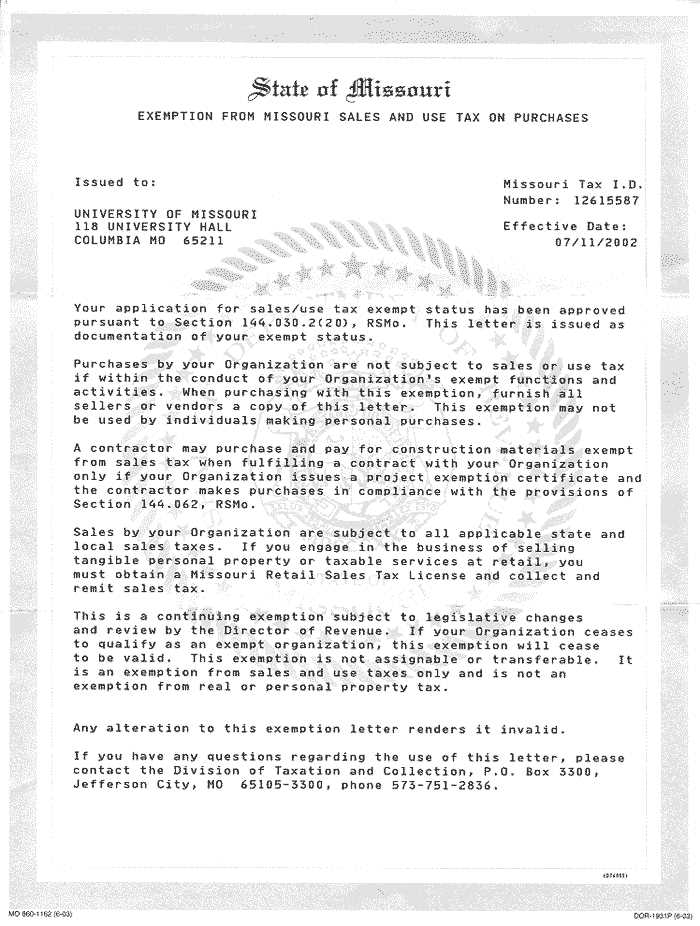

When seeking certain tax reductions or benefits, it’s necessary to submit a formal document that requests such advantages. This process is vital for both individuals and businesses looking to ensure they pay only the applicable tax rates. Such documents help verify eligibility and provide a clear request to the tax authorities.

Understanding the structure and purpose of this type of documentation is essential for those who need it. The document should clearly outline why the applicant qualifies for the reduction and include all supporting details to validate the request. A correctly completed submission reduces the risk of delays or misunderstandings during the approval process.

Here are some key elements to consider when creating this kind of document:

| Key Element | Description |

|---|---|

| Eligibility Information | Provide clear details on why you qualify for the reduction, including any specific criteria or documentation needed to prove eligibility. |

| Supporting Documents | Attach any necessary paperwork that supports the claim, such as business licenses or proof of charitable status. |

| Clear Request | State the exact nature of the request, detailing which benefits or reductions are being sought and why. |

| Contact Information | Ensure the correct contact details are provided for follow-up or additional inquiries by the relevant tax body. |

By understanding the key components of such documentation and following the appropriate format, applicants increase the likelihood of receiving approval for their request. A well-organized and complete submission reflects professionalism and adherence to legal standards, which is crucial for a smooth process.

What They Are and Why They’re Important

In business, there are specific documents designed to request tax relief for eligible parties, whether they are companies or individuals. These documents are crucial for formally stating the intent to claim a reduction in tax obligations under the law. Without such paperwork, the request for relief cannot be processed, leaving the applicant liable for full tax payments.

The Role of Formal Requests

These formal requests help organizations reduce their tax burdens by proving they meet the criteria for certain benefits. They are typically required when an entity qualifies for special tax status, such as for non-profit organizations or those involved in specific sectors like education or healthcare. The importance of these requests lies in their ability to provide clear evidence and reasoning, enabling tax authorities to evaluate and grant the relief.

Why Proper Documentation is Crucial

Submitting the correct paperwork ensures that the process is handled efficiently and without unnecessary delays. Tax authorities rely on accurate and well-documented submissions to process claims quickly. A clear, structured request can expedite the approval process and avoid potential complications that might arise from incomplete or ambiguous submissions.

Creating a Tax Relief Request

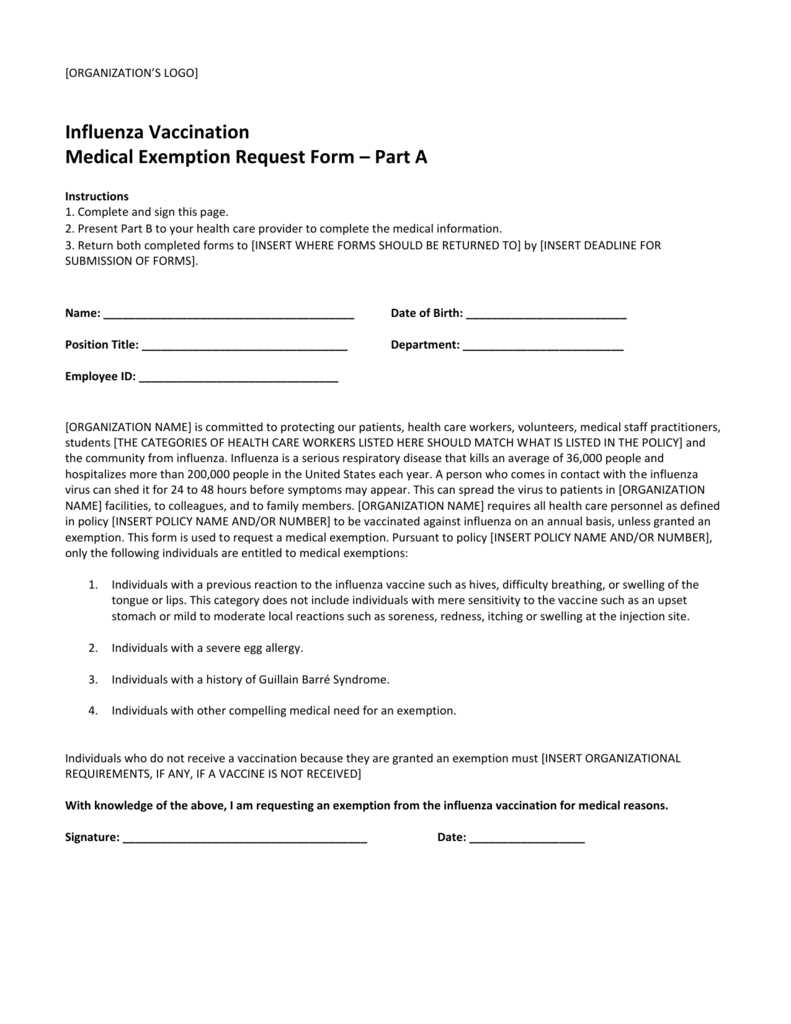

When requesting a reduction in tax obligations, it’s essential to create a formal document that clearly outlines the basis for the request. This document serves as a detailed explanation of why the applicant qualifies for the tax benefit and includes all necessary information to support the claim. A well-structured submission ensures that tax authorities can process the request efficiently and without confusion.

To begin, it’s important to include basic details such as the applicant’s name, business information, and the specific tax benefit being requested. Additionally, supporting documents or evidence proving eligibility should be attached. A clear and concise explanation of why the applicant qualifies for the relief will strengthen the case and improve the chances of approval.

Lastly, be sure to include contact details for follow-up or clarification. Providing accurate and accessible information will help expedite the review process and address any potential questions that may arise. Ensuring all sections are complete and accurate is the key to creating an effective and successful submission.

Essential Steps to Drafting It

Creating a formal document requesting a reduction in tax liability involves several key steps. These steps ensure that the submission is clear, complete, and meets all requirements set by tax authorities. By following a structured approach, applicants can minimize errors and increase the likelihood of a successful request.

1. Gather Required Information

The first step is to collect all necessary details and documentation to support the claim. This includes:

- Personal or business information

- Specific tax benefit being requested

- Proof of eligibility (e.g., business licenses, nonprofit status)

2. Draft the Request Clearly

The next step is to write the actual request. It should clearly state the purpose, provide relevant details, and explain why the applicant qualifies for the benefit. Focus on the following:

- Start with a formal greeting and introduce the purpose of the request.

- Provide the required documentation and details about eligibility.

- Make a direct request for the reduction and explain its importance.

By following these steps, the document will be well-structured and ready for submission, ensuring a smooth process from start to finish.

Template Benefits for Tax Relief Requests

Using a ready-made structure for drafting tax relief requests offers several advantages. It streamlines the process, reduces the likelihood of mistakes, and ensures consistency in every submission. By utilizing a predefined format, businesses and individuals can save time while ensuring their requests meet all necessary legal and procedural requirements.

Efficiency is one of the key benefits of using a structured format. With a clear, organized outline, the process of creating the document becomes quicker and more efficient. There’s no need to start from scratch, and essential elements are already included, allowing you to focus on the specifics of your request.

Consistency is another major advantage. Using a set format ensures that every request follows the same structure and includes all required components. This consistency helps prevent errors and ensures that no important detail is left out, making it easier for tax authorities to review and process the submission.

In summary, using a predefined structure for tax relief requests provides clarity, reduces stress, and increases the chances of approval, making the entire process smoother and more reliable.

Why Use a Template for Efficiency

Utilizing a pre-designed structure for creating tax reduction requests offers significant benefits in terms of speed and accuracy. Instead of starting from scratch, a ready-made format helps ensure that all necessary components are included and organized correctly. This approach minimizes the risk of errors and allows the process to move quickly, saving both time and effort.

Streamlining the Process

One of the primary advantages of using a structured format is how it simplifies the entire process. Key details are already outlined, so you can focus on filling in the specific information for your situation. This removes the uncertainty of whether important elements are missing, ensuring a complete and professional submission. Key benefits include:

- Clear structure with all necessary sections

- Faster completion due to predefined sections

- Less room for errors or omissions

Ensuring Consistency and Accuracy

Consistency is critical when dealing with formal requests, and using a standard format ensures that all submissions follow the same approach. This consistency leads to greater accuracy, as there is a clear order in which to present the necessary information. The structure helps you maintain professionalism and ensures that all critical data is accurately represented in the request.

Key Information to Include

When submitting a formal request for tax relief, it’s essential to include all relevant details to ensure the claim is processed smoothly. The document must present a clear and complete picture of why the applicant qualifies for the benefit. Missing or incomplete information could delay the review process or even result in rejection.

Basic Details of the Applicant

The first section should clearly identify the applicant. This includes providing:

- Name or business name

- Contact information

- Tax identification number or business registration number

Eligibility and Supporting Evidence

Next, it’s crucial to provide a clear explanation of why the applicant qualifies for the tax reduction. This section should include:

- A description of the qualifying criteria

- Relevant supporting documents (e.g., proof of non-profit status, business licenses)

- Any legal or regulatory references that back the claim

Ensuring these details are included helps tax authorities understand the applicant’s eligibility and process the request effectively.

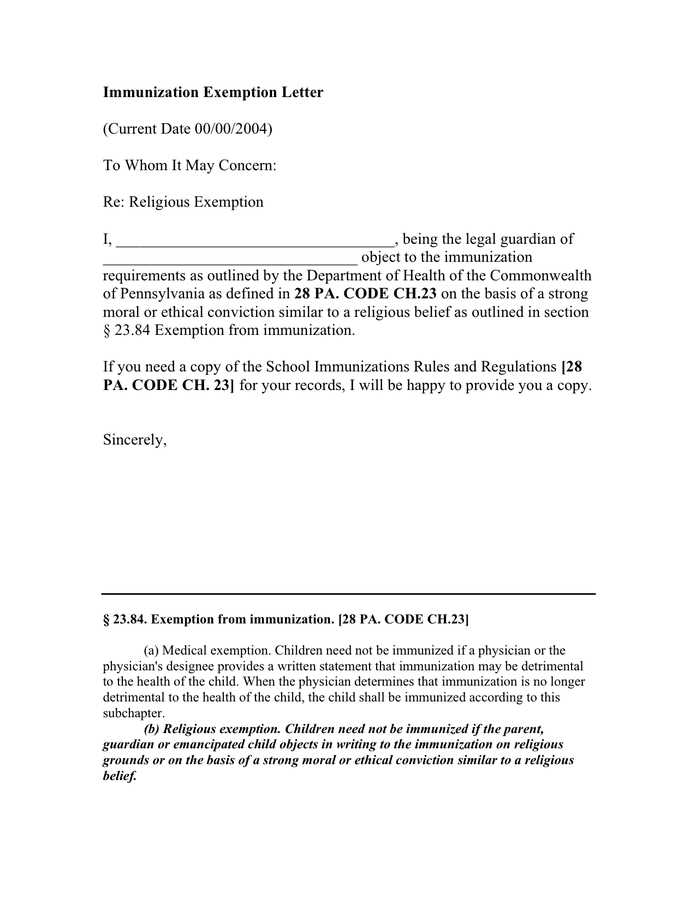

Important Details to Mention in the Letter

When drafting a formal request for a tax benefit, it is crucial to include specific information that clearly outlines the applicant’s eligibility. Each detail included should be precise and support the claim for relief. Omitting important points can lead to confusion or delay in processing the request.

Clarify the Purpose of the Request

Begin by clearly stating the purpose of the document. This includes:

- The type of tax benefit being requested

- The reason why the applicant qualifies for the relief

Be specific and direct in this section to avoid ambiguity and ensure the tax authorities understand the request immediately.

Provide Supporting Evidence

Supporting documentation is a key element of a successful submission. Make sure to include:

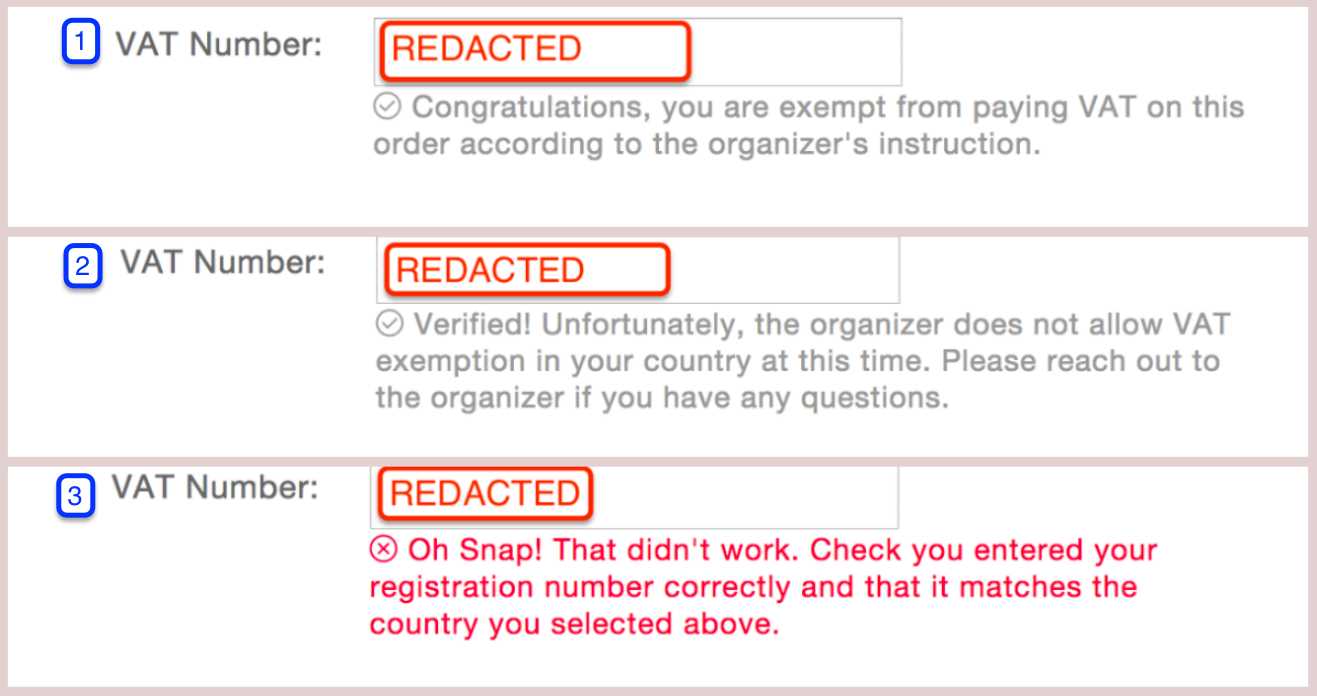

- Proof of eligibility, such as tax registration numbers or non-profit status

- References to applicable laws or regulations that justify the request

- Any other relevant documents that back the claim

Including clear evidence will help strengthen the case and facilitate a faster approval process. Providing comprehensive details gives the tax authorities the information they need to assess and approve the request efficiently.