Verification of funds letter template

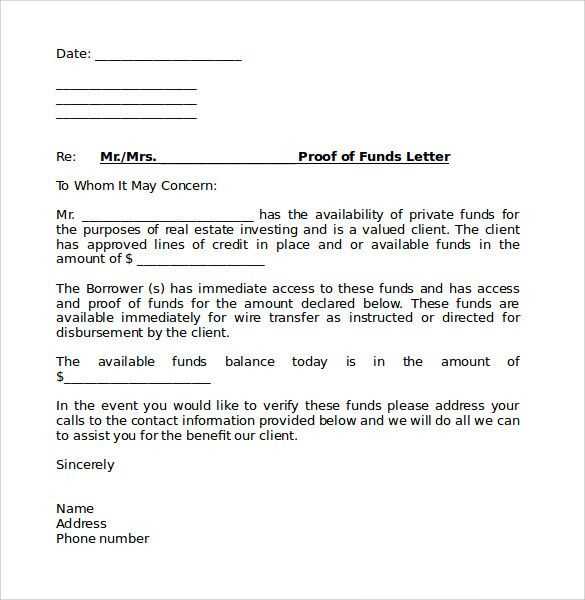

To confirm the availability of funds, a verification of funds letter serves as an official document from a financial institution or an individual providing proof of the funds required for a transaction or process. This letter is crucial for various situations, including visa applications, loan requests, or real estate transactions. A well-structured letter eliminates confusion and provides all necessary information to ensure transparency.

When drafting this letter, it should include specific details such as the account holder’s name, the type of account, and the exact balance or amount available. The letter must also be signed by an authorized representative of the financial institution or the individual verifying the funds. Make sure to use clear and precise language to avoid misinterpretations. Below is a basic template you can follow to create your verification of funds letter.

Here is the corrected version:

Make sure the letter includes the date and is addressed to the relevant party. Begin with a clear statement confirming the availability of funds, specifying the exact amount and the type of account. The letter should specify that the funds are readily accessible for the intended purpose and include details of the financial institution’s verification, such as the bank’s name and contact information.

The letter must be signed by an authorized representative of the financial institution, with their title and contact details provided. This ensures the authenticity of the document. Avoid unnecessary jargon or ambiguous phrases. Keep the language clear and professional to ensure that the recipient understands the status of the funds without confusion.

Finally, include any specific instructions for contacting the bank or the representative for further verification if required. The document should be printed on official letterhead for credibility.

- Verification of Funds Letter Template

A verification of funds letter confirms the availability of sufficient financial resources for a specific purpose. This letter is typically issued by a financial institution, such as a bank, and provides evidence that an individual or organization has the necessary funds. It is commonly required in real estate transactions, visa applications, or other financial agreements. Below is a template that can be used for this purpose.

Verification of Funds Letter Template

Bank Name:

[Bank Name]

[Bank Address]

[City, State, ZIP Code]

[Phone Number]

[Email Address]

Date:

[Date]

To Whom It May Concern,

This letter serves as confirmation that [Account Holder’s Name], a client of [Bank Name], currently holds an account with our institution. The account has been active since [Account Opening Date]. As of [Date], the available balance in the account is [Amount in USD] ([Currency]).

We confirm that the funds mentioned are available and may be used for [specific purpose, e.g., a real estate transaction, travel expenses, etc.]. This letter is issued at the request of the account holder and is intended for the purpose of verifying financial capability for [specify the purpose].

Should you require further information, please do not hesitate to contact us at the details above.

Sincerely,

[Bank Representative Name]

[Bank Representative Title]

[Signature (if required)]

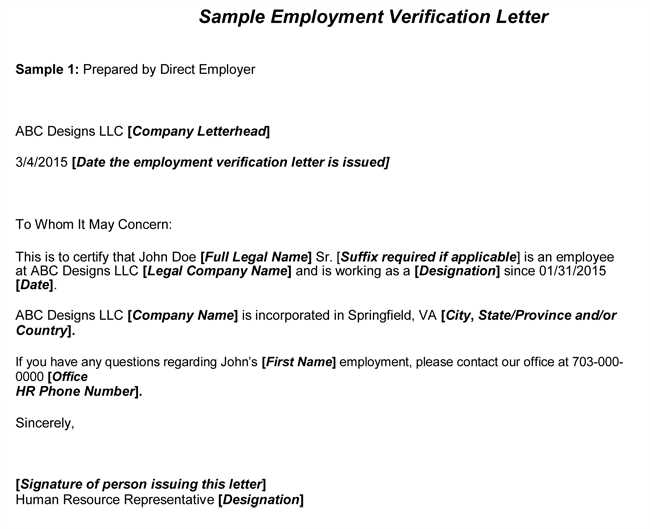

Follow these steps to properly format a funds verification letter:

1. Include a Clear Heading

At the top of the letter, use a professional heading with the title “Funds Verification Letter” or a similar variation. Include the date and your contact information, such as name, address, phone number, and email. This ensures clarity and helps the reader identify the purpose of the letter immediately.

2. Address the Recipient

Begin the letter with a formal greeting to the recipient, such as “Dear [Recipient’s Name or Title],”. If you are unsure of the specific name, “To Whom It May Concern” is acceptable.

3. Provide Account Details

State the account holder’s name and account number. Specify that this letter is intended to verify the available funds in the account. It’s important to include relevant details, such as the account type (checking, savings, etc.), to avoid any confusion.

4. State the Balance and Currency

Clearly state the current balance of the account in question. Include the specific currency for accuracy. Mention if any restrictions apply to the funds, such as temporary holds or pending transactions.

5. Confirm the Verification Details

Provide a statement verifying the authenticity of the funds. Example: “We confirm that the account listed above has a balance of [amount] in [currency] as of [date].”

6. Add Authorization Information

If necessary, include a section confirming that the letter is authorized by the account holder. This might involve a statement such as, “This letter is issued at the request of [account holder’s name].”

7. Closing and Signature

End the letter with a formal closing, such as “Sincerely” or “Best Regards,” followed by the name and title of the person issuing the letter. Make sure to leave space for the signature and include the organization’s name if applicable.

8. Optional Attachments

If required, attach supporting documents, such as recent bank statements or account verification forms. These can help substantiate the claims in the letter.

Ensure the letter includes the exact amount of funds available in the account. This value should be clear and verifiable, including the currency type. Specify the account holder’s full name, address, and account number for identification purposes. Also, state the account type, whether personal or business, to clarify the source of funds. Provide details about the financial institution, such as its name, address, and contact information, to support authenticity. Include the date of the letter and the name of the person who issued it along with their position and signature to validate the document.

Account Balance and Currency

Clearly state the available balance in the account. Use precise figures and mention the specific currency to avoid any confusion about the financial value being verified. Double-check these details to ensure accuracy and legitimacy.

Institution Information

List the financial institution’s full details, including its official name and contact details, to verify the origin of the funds. This establishes credibility and assures the recipient that the letter is legitimate. Make sure this information is up-to-date and accurate.

One of the most frequent mistakes in writing a verification of funds letter is failing to include the necessary details about the source of the funds. Always specify whether the funds are in a checking or savings account, and clarify whether they are liquid or tied to investments. This ensures clarity and credibility for the recipient.

Inaccurate or Vague Language

Avoid using vague terms like “large amount” or “sufficient funds.” Be specific about the exact amount and the type of assets being verified. Providing concrete numbers and clear descriptions helps the recipient to verify the funds more effectively.

Missing Authorization or Signature

Another mistake is neglecting to include proper authorization or the necessary signatures. A verification of funds letter should always be signed by an authorized representative from the financial institution or a bank officer. Without this signature, the letter may not be considered valid.

How to Customize the Template for Various Purposes

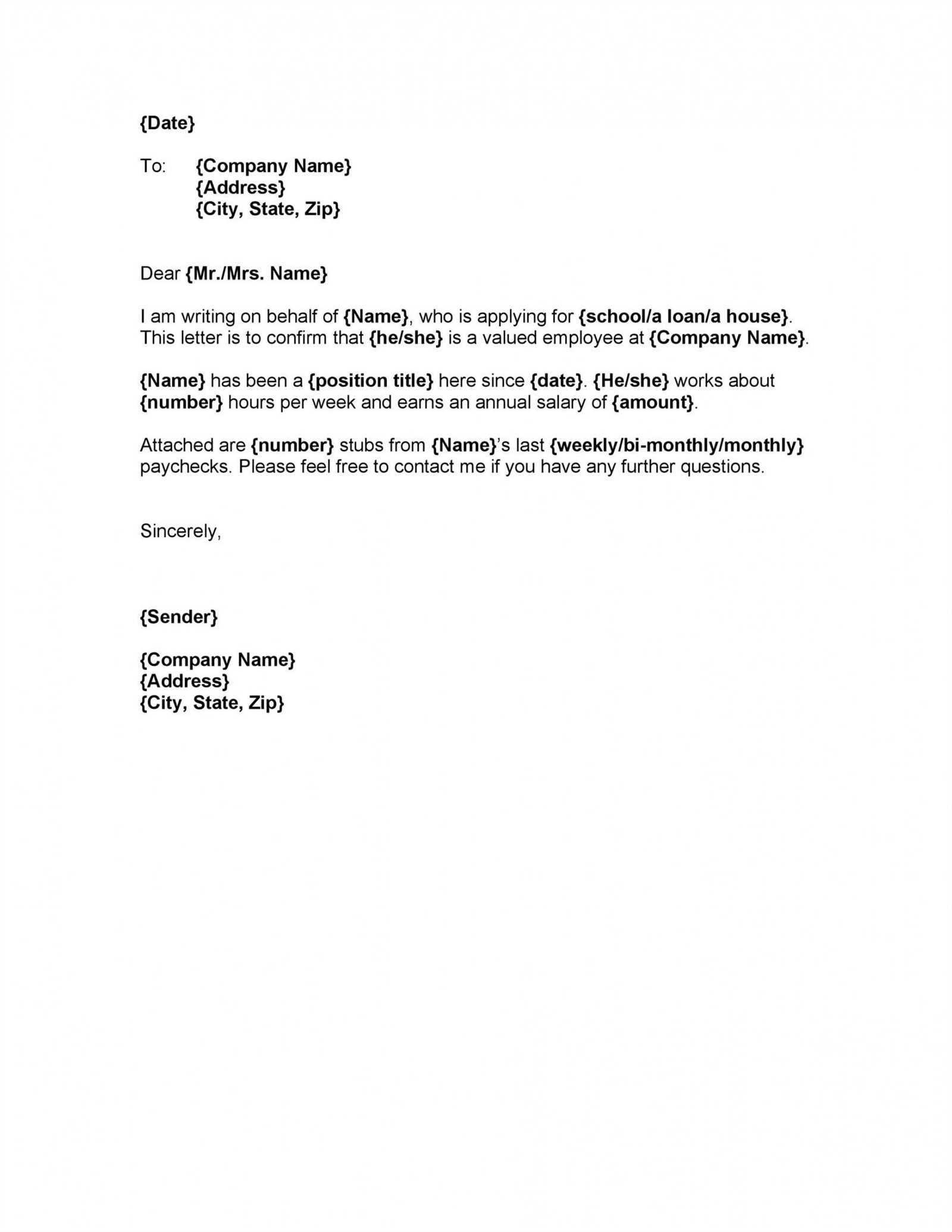

To tailor the verification of funds letter template for specific uses, focus on adjusting key elements to match the requirements of each situation. For instance, if the letter is intended for a real estate transaction, modify the content to include property-related details, such as the buyer’s name, purchase price, and escrow information.

1. Include Relevant Transaction Information

Begin by inserting transaction-specific details, like the amount of money being verified and the purpose of the funds. If you’re using the letter for a loan application, provide the loan amount, interest rate, and repayment terms. Always ensure these figures are accurate to avoid any miscommunication.

2. Adjust Language and Tone

For more formal contexts, such as business dealings or corporate loans, use a formal tone. On the other hand, for personal or less formal situations, a slightly more approachable style may be appropriate. Always ensure the language aligns with the expectations of the recipient, whether they are a financial institution, a real estate agent, or an individual.

Customize the letter by adding any necessary documentation or references to prove the funds’ legitimacy. This might include account statements, bank certifications, or other supporting documents. Tailoring these elements ensures the letter meets the specific needs of each recipient while maintaining its credibility and clarity.

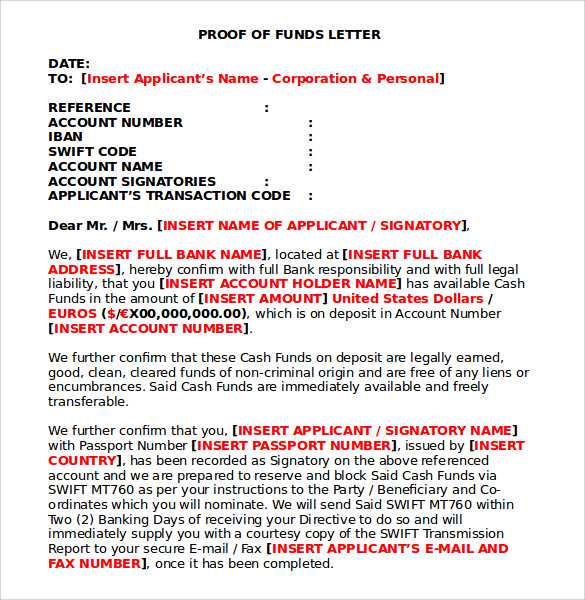

A Verification of Funds (VOF) letter is a critical document often required in financial transactions, especially in real estate or large investments. Understanding its legal implications can prevent potential complications. This letter serves as proof of a person’s or company’s financial capability, but it must adhere to certain legal standards to be valid.

Accuracy and Truthfulness

The primary legal aspect of a VOF letter is ensuring its content is truthful and accurate. Misrepresentation of funds, whether intentional or not, could lead to legal consequences such as fraud charges or breach of contract claims. It’s crucial for the issuing bank or financial institution to verify that the funds mentioned in the letter are available and legally accessible to the person requesting the verification.

Liability of the Issuing Institution

The institution providing the VOF letter is legally responsible for the accuracy of the information contained within it. Banks or financial institutions that issue these letters must confirm the client’s financial standing, which includes verifying account balances and ensuring that the funds are not encumbered. In some cases, financial institutions may face liability if the verification is later proven to be inaccurate or misleading.

- Ensure that the letter includes accurate account details and balances.

- Confirm that the funds are legally available and not restricted in any way.

- Include a disclaimer clarifying the institution’s limited liability for future financial actions.

By adhering to these legal requirements, both parties involved in the transaction can mitigate risks associated with financial misrepresentation.

To submit the verification of funds letter, follow these steps carefully. First, ensure the document is complete and accurate. Double-check the financial details and official signatures before sending. Many institutions accept scanned copies or digital formats like PDFs, but confirm the preferred format beforehand. If they require physical copies, print the letter on official letterhead and include any supporting documents requested.

Submitting Electronically

If you’re submitting electronically, use the official email address or portal provided by the institution. Attach the document in the correct format (usually PDF). Some authorities might request a specific subject line or additional information, so follow any instructions carefully to avoid delays.

Mailing a Physical Copy

If mailing a physical copy, use a reliable courier service to ensure the document arrives on time. Keep a copy of the tracking number for reference. When sending, ensure that all documents are securely packaged to prevent damage during transit.

Always include a cover letter or any required reference numbers, and follow any specific guidelines given by the institution or authority. This ensures smooth processing of your request.

Verification of Funds Letter Template

Ensure the letter includes the name of the individual or entity verifying the funds, along with their position and contact information for verification purposes. Clearly state the amount available, along with the type of account or assets being referenced. Avoid ambiguity; provide specific details about the financial resources, whether they are liquid assets or otherwise. Mention the date the verification was conducted to confirm its validity.

| Element | Recommendation |

|---|---|

| Verifier Information | Include name, title, and contact details. |

| Amount | State the exact amount available for verification. |

| Type of Funds | Clarify whether the funds are liquid or tied to other assets. |

| Date of Verification | Indicate the exact date the verification took place. |

Avoid unnecessary jargon or vague terms that could cause confusion. The letter should be direct and to the point, providing only the required information for the recipient to confirm the validity of the funds. Also, ensure the letter is signed by the appropriate authority to validate its authenticity.