Wage Verification Letter Template for Simple Use

When it comes to verifying someone’s professional background and income details, having the right document can simplify the process. These forms are essential for confirming employment status and financial standing in various scenarios, such as loan applications, renting agreements, or visa processing.

Creating an accurate and professional document requires attention to detail and structure. The right format ensures that the necessary information is clear, concise, and appropriately organized for the intended purpose. It can be tailored for both employers and employees to reflect specific requirements.

Employers often use these documents to provide an official statement regarding an individual’s role, salary, and other work-related facts. On the other hand, employees may need this confirmation for personal or financial matters, so understanding how to structure and present this information is crucial.

Purpose of a Wage Verification Letter

Such documents serve a crucial role in confirming a person’s employment and financial situation. They are commonly requested in situations where official proof of income and employment is necessary. The primary aim is to provide a reliable source of information that can support various personal and professional needs.

These confirmations are typically used in the following scenarios:

- Loan or mortgage applications, where proof of income is required for approval.

- Rental agreements, to confirm a tenant’s ability to meet financial obligations.

- Immigration processes, where financial stability is often a consideration for visa or residency applications.

- Employee benefits, such as insurance or retirement plans, where employers need to validate work-related details.

In each case, the document ensures that the information being provided is accurate, professional, and verified by the employer. It helps to build trust between parties, whether it’s a financial institution, a landlord, or a government body, all of whom rely on accurate employment and income data.

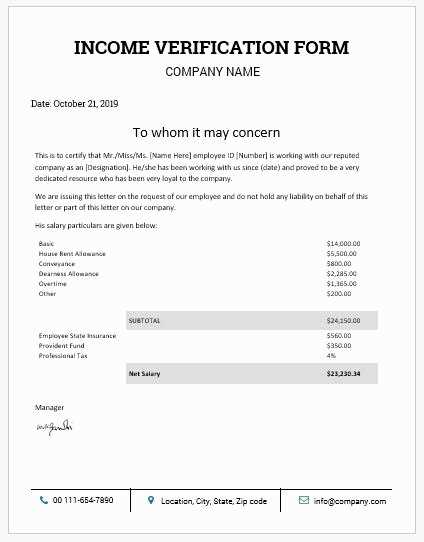

Essential Information to Include

To ensure that the document serves its purpose effectively, it is important to include the necessary details that provide clear and accurate proof of employment and financial standing. Omitting critical information could lead to confusion or rejection of the request. The details should be precise and structured, making the content easy to understand for any reviewing party.

Key Details to Include

- Employee’s Full Name – Clearly state the person’s legal name to avoid any confusion.

- Job Title – Specify the current role held by the employee within the company.

- Employment Start Date – Include the date the individual began working for the company.

- Salary Information – Provide the individual’s salary, either annual or monthly, depending on the request.

- Employer’s Contact Information – Ensure the employer’s details, such as name, phone number, and address, are included for verification purposes.

Additional Information to Consider

- Employment Status – Note whether the employee is full-time, part-time, or contractual.

- Job Responsibilities – Briefly outline the main duties or responsibilities held by the employee.

- Duration of Employment – Indicate how long the employee has been with the company if different from the start date.

Including this comprehensive set of information will make the document clear and professional, ensuring it meets the requirements of the requesting entity.

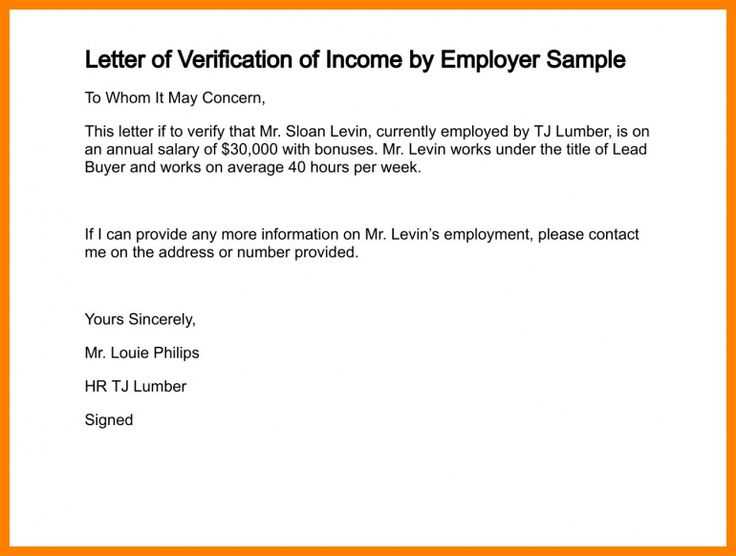

Steps to Customize a Template

Personalizing a document for confirming employment and income details involves several steps to ensure that it fits the specific needs of the situation. The structure should be adapted based on the particular requirements of the request and the information to be conveyed. Each section should be adjusted to reflect the unique details of the individual and the employer.

Here are the steps to follow when customizing the document:

- Choose the Appropriate Format – Select a format that aligns with the purpose of the document, whether it’s for a financial institution, a landlord, or another official entity.

- Enter Personal Information – Start by inputting the employee’s full name, job title, and other personal details to ensure proper identification.

- Update Employment Details – Adjust the employment start date, job responsibilities, and work status to reflect the employee’s current situation.

- Include Salary and Income Information – Be sure to input the correct income details, whether it’s annual, monthly, or per-hour earnings, based on the recipient’s needs.

- Add Employer’s Contact Information – Update the employer’s contact details so the recipient can reach out for further clarification or confirmation.

- Proofread and Finalize – Once all sections are updated, carefully review the document for accuracy and completeness before sending it out.

By following these steps, you can create a well-tailored document that meets the specific requirements of both the individual and the requesting party.

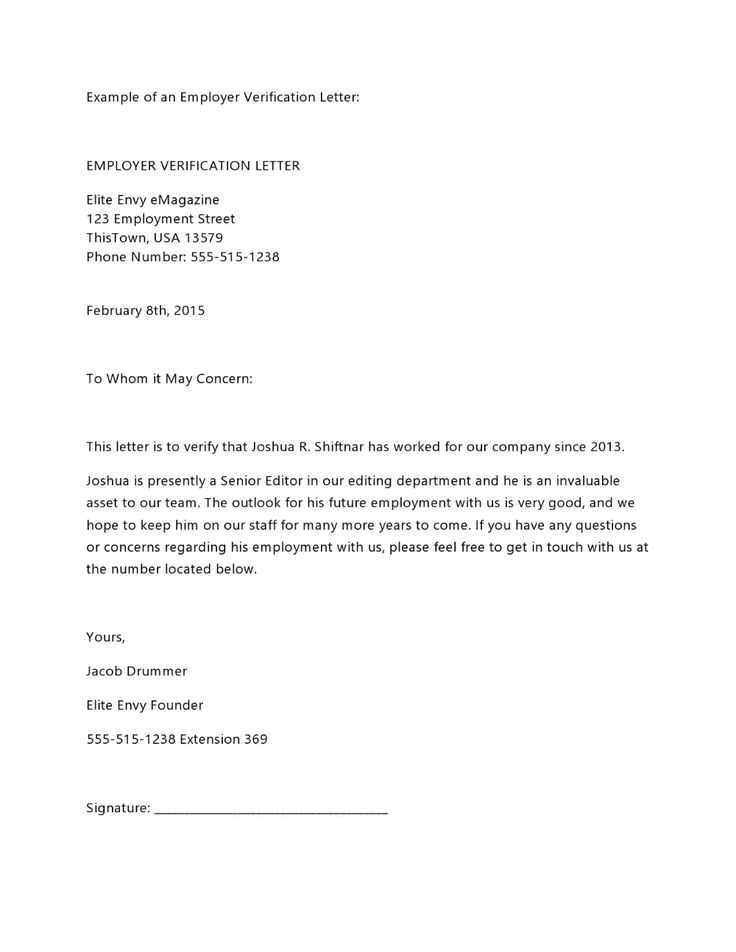

Why You Might Need This Letter

There are various situations in which an official document confirming a person’s employment status and income may be required. These instances generally arise when a third party needs reliable proof of someone’s financial stability or job position for various processes such as loans, rental applications, or immigration procedures.

Below are some common scenarios where such a document may be requested:

| Situation | Reason for Request |

|---|---|

| Loan Application | To prove income and ensure repayment ability for personal, car, or home loans. |

| Rental Agreement | Landlords may request it to confirm the tenant’s ability to pay rent on time. |

| Visa or Immigration | Government authorities may require proof of employment and income as part of visa approval processes. |

| Insurance Purposes | For verifying eligibility and securing the correct coverage based on employment status. |

These examples show how important it is to have an official statement of employment details readily available for various official and personal purposes.

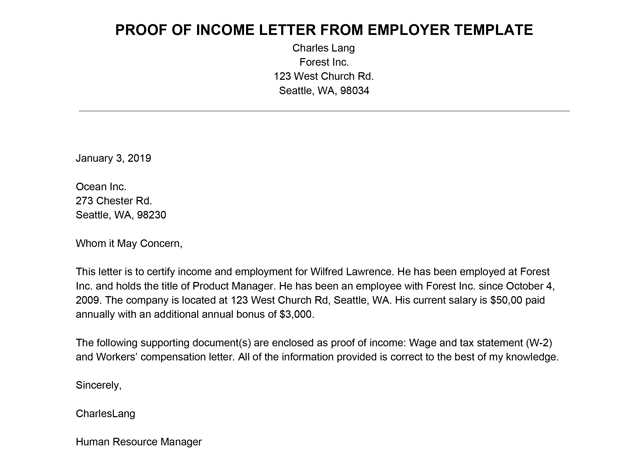

Guidelines for Writing a Professional Letter

When creating a formal document to confirm employment or income details, it is essential to ensure that it maintains a professional tone and structure. A well-crafted document reflects both the individual’s and the company’s credibility. To achieve this, certain key elements should be followed to ensure clarity, accuracy, and a positive impression.

Here are some important guidelines to consider when drafting such a document:

- Be Clear and Concise – Avoid unnecessary jargon and ensure that the content is easy to understand. Stick to the essential details without over-explaining.

- Maintain a Formal Tone – Use formal language and avoid casual phrasing. The document should reflect professionalism at all times.

- Provide Accurate Information – Double-check the details, such as the employee’s job title, income, and employer’s contact information, to ensure no errors.

- Structure the Content Properly – Organize the document logically, starting with the employee’s information, followed by the job-related details, and ending with the employer’s information.

- Proofread Before Sending – Carefully review the document for grammatical or factual errors to maintain professionalism.

By following these guidelines, you can create a document that effectively serves its purpose while maintaining a professional standard that is suitable for any official request.

Legal Implications of Wage Verification

When providing a formal statement regarding someone’s employment and earnings, it is essential to understand the potential legal consequences that may arise. These documents are not only used to confirm income but can also serve as evidence in legal matters. Therefore, ensuring accuracy and compliance with relevant laws is crucial when drafting such records.

Responsibility for Providing Accurate Information

Employers and individuals drafting these statements must be aware that any inaccuracies or false information could lead to legal disputes or claims of fraud. It is vital to verify the facts before issuing the document to avoid any liability. Misrepresentations, whether intentional or accidental, can result in legal consequences for both the issuer and the recipient.

Privacy and Confidentiality Considerations

These documents contain sensitive personal and financial information, which must be handled with care. Employers must ensure that any disclosure of such information complies with data protection laws and regulations. Unauthorized sharing of an individual’s financial details can lead to breaches of confidentiality and legal action. Always seek consent before sharing employment details with third parties.

Understanding these legal considerations helps mitigate potential risks and ensures that the information shared remains accurate, secure, and within the bounds of the law.

How to Safely Share Verification Documents

Sharing sensitive documents that confirm employment details and income requires caution to ensure both security and privacy. These records often contain personal information, and improper handling can lead to data breaches or unauthorized access. Following the right procedures is essential to protect both the individual’s privacy and the integrity of the document.

Use Secure Channels

Always ensure that the method of sharing is secure. For digital documents, use encrypted email services or secure file-sharing platforms that offer password protection. Avoid using unencrypted or public channels like regular email, as they can be vulnerable to interception. If sharing physically, ensure that the documents are delivered securely, such as through registered mail or hand delivery.

Limit Access to Authorized Parties

Before sharing any documents, confirm the identity of the recipient and ensure they have the necessary authorization to view the information. Restrict the distribution of sensitive data to only those who absolutely need it. When possible, share the minimum amount of information required to meet the request.

By adhering to these practices, you can reduce the risk of exposing sensitive information and ensure that the process of sharing employment details remains secure and compliant with privacy regulations.