Wells fargo gift letter template

To ensure smooth processing of a gift as part of a home loan application with Wells Fargo, it’s important to submit a properly structured gift letter. This letter verifies that the funds you’ve received are a gift, not a loan, and will not require repayment. It is a key document for the lender’s due diligence in confirming that the gift funds won’t impact your ability to repay the mortgage.

Below is a straightforward Wells Fargo gift letter template that outlines the key components needed for approval. The letter should include the donor’s full name, address, phone number, and relationship to the recipient. It should clearly state the gift amount and affirm that no repayment is expected. A brief statement about how the funds will be used, like for a down payment or closing costs, is also helpful.

Ensure that both the donor and the recipient sign the letter. Wells Fargo may also request the donor’s bank statement or other proof of funds to verify the source of the gift. Following these guidelines closely will streamline the approval process and help avoid unnecessary delays.

Here’s the revised text with minimal repetition:

When drafting a Wells Fargo gift letter, it’s important to follow their specific format to ensure it meets all requirements. The gift letter should clearly state the donor’s intent, the amount of the gift, and confirm that the money is a gift, not a loan. Additionally, include the donor’s relationship to the recipient and their contact information. Make sure to sign and date the letter to validate the transaction.

Ensure the letter reflects that the funds are not expected to be repaid under any circumstances. This detail is crucial for the lender to process the loan smoothly. Wells Fargo also requires that the donor’s statement be clear about their financial situation and that they have the ability to give the gift without any undue financial hardship.

For best results, use the template provided by Wells Fargo to avoid missing any necessary details. Review the document thoroughly before submission to ensure all fields are completed accurately and truthfully.

- Wells Fargo Gift Letter Template

To create a Wells Fargo gift letter, include the following information to ensure the gift is properly documented for the mortgage process:

Required Information for the Gift Letter

| Field | Description |

|---|---|

| Donor’s Full Name | Provide the full name of the person giving the gift. |

| Donor’s Address | Include the full address of the donor, including city, state, and ZIP code. |

| Recipient’s Full Name | State the name of the person receiving the gift. |

| Gift Amount | Specify the exact dollar amount being gifted. |

| Relationship to Recipient | Clarify the relationship between the donor and the recipient (e.g., parent, grandparent, friend). |

| Gift Purpose | Explain that the gift is for purchasing a home and is not a loan, meaning repayment is not expected. |

| Donor’s Signature | The donor must sign the letter to confirm the authenticity of the gift. |

Example of a Gift Letter

Here is a simple template you can use:

[Donor's Name] [Donor's Address] [City, State, ZIP Code] [Date] [Recipient's Name] [Recipient's Address] [City, State, ZIP Code] Dear [Lender's Name], I, [Donor's Full Name], hereby confirm that I am gifting the sum of [$X,XXX] to [Recipient's Full Name]. This gift is intended to assist with the purchase of a home and is given with no expectation of repayment. Sincerely, [Donor's Signature]

Ensure that the gift letter is signed by the donor and includes all requested details. The letter must clearly indicate that no repayment is expected for the gift.

A Wells Fargo Gift Letter is a document required by the bank to confirm that a monetary gift you receive, typically for a home down payment, is a true gift and not a loan. This letter verifies that the money won’t need to be repaid, which is crucial for the underwriting process of your mortgage application.

Why You Need It

Wells Fargo and other lenders need to ensure that the funds used for your down payment are not borrowed. A Gift Letter helps the bank distinguish between gifts and loans, ensuring you meet the necessary criteria for a mortgage approval. Without it, your loan may be delayed or denied.

Key Elements of a Wells Fargo Gift Letter

- The donor’s name, address, and relationship to you.

- The exact dollar amount of the gift.

- A statement confirming that the money is a gift and doesn’t need to be repaid.

- The donor’s signature and date.

Submitting this letter along with your other documentation streamlines your application process, ensuring everything is in order for the mortgage approval.

Ensure your gift letter is clear and includes all required details. Wells Fargo typically asks for certain specifics to verify the legitimacy of the gift. Start by addressing the letter to “Wells Fargo Home Mortgage” and include your full name, address, and phone number at the top. Make it clear that the funds are a gift and not a loan. Specify the amount of the gift, the relationship between the giver and the recipient, and confirm that there is no expectation of repayment.

Key Elements to Include

Your gift letter should contain the following information:

- The donor’s name, address, and relationship to the recipient.

- The exact amount of the gift.

- A statement that no repayment is required.

- The donor’s signature and the date the gift was given.

Ensure Accuracy

Check that all the information is consistent with any supporting documents, such as bank statements. Wells Fargo may request these documents to verify the transfer of the gift funds. Provide a copy of the donor’s bank statement showing the withdrawal of the gifted amount for additional verification.

By following these guidelines, you’ll ensure your gift letter meets Wells Fargo’s requirements and helps avoid any delays in the mortgage process.

To ensure your gift letter meets Wells Fargo’s requirements for mortgage approval, include the following key details:

1. Donor’s Information

Clearly state the donor’s full name, address, and relationship to the borrower. This confirms the source of the gift and validates its authenticity. Wells Fargo requires this information to confirm that the gift is from a legitimate source, not a loan.

2. Gift Amount and Purpose

Specify the exact dollar amount of the gift and state that it is a gift, not a loan. Include a brief statement confirming that the funds are given freely with no expectation of repayment. Wells Fargo will reject any indication that the gift is a loan or has conditions attached.

3. Date of Transfer

Indicate the date the gift will be transferred to the borrower. This helps Wells Fargo track the timing of the gift and confirm it aligns with the borrower’s closing timeline.

4. No Repayment Statement

Clearly state that the gift is not a loan and does not need to be repaid. Wells Fargo requires this to ensure the funds will not increase the borrower’s debt obligations, which could affect the loan approval.

5. Donor’s Signature

The donor must sign the letter, confirming all information provided is accurate. This signature adds a layer of verification and credibility to the gift letter.

By ensuring these key details are present, you help streamline the mortgage approval process with Wells Fargo and avoid any delays or complications.

Ensure the gift letter clearly states that the funds are a gift, not a loan. Wells Fargo requires explicit confirmation that the donor does not expect repayment. Use phrases like “This is a gift with no expectation of repayment” to avoid any ambiguity.

Provide complete information about both the donor and the recipient. Include full names, addresses, and relationship details. Wells Fargo may reject letters that don’t include these details.

Do not overlook the amount of the gift. The letter must specify the exact dollar amount of the gift being provided to the recipient, ensuring clarity and transparency.

Avoid leaving out the donor’s signature. Wells Fargo requires the gift letter to be signed by the donor to validate the authenticity of the gift.

Don’t forget to include the date of the gift. The letter should state the exact date when the funds were given to the recipient, as this is a critical piece of information for verification.

Do not submit a vague or generic letter. It is important that the language used is clear, specific, and adheres to Wells Fargo’s guidelines. A generic letter may delay or derail the mortgage approval process.

Wells Fargo guidelines specify that a gift letter should be written by the person providing the gift–this is typically a family member. The letter must clearly state that the funds are a gift and not a loan, with no expectation of repayment.

Eligible Gift Givers

According to Wells Fargo, acceptable gift givers include parents, siblings, children, grandparents, and even domestic partners. In some cases, extended family members, such as aunts, uncles, and cousins, may also be considered, but this may require additional documentation to confirm the relationship.

What the Gift Letter Should Include

The gift letter must specify the amount of the gift, the donor’s name, the recipient’s name, the relationship between the two parties, and a statement that the gift is not a loan. It should also include the donor’s contact information, and sometimes the source of the funds.

To submit your gift letter to Wells Fargo for mortgage approval, follow these steps:

1. Prepare the Gift Letter

The gift letter should clearly state the amount of the gift, the donor’s relationship to you, and that the funds are a gift and not a loan. Include the donor’s contact information, the source of the funds, and a statement confirming there is no expectation of repayment.

2. Include Necessary Documents

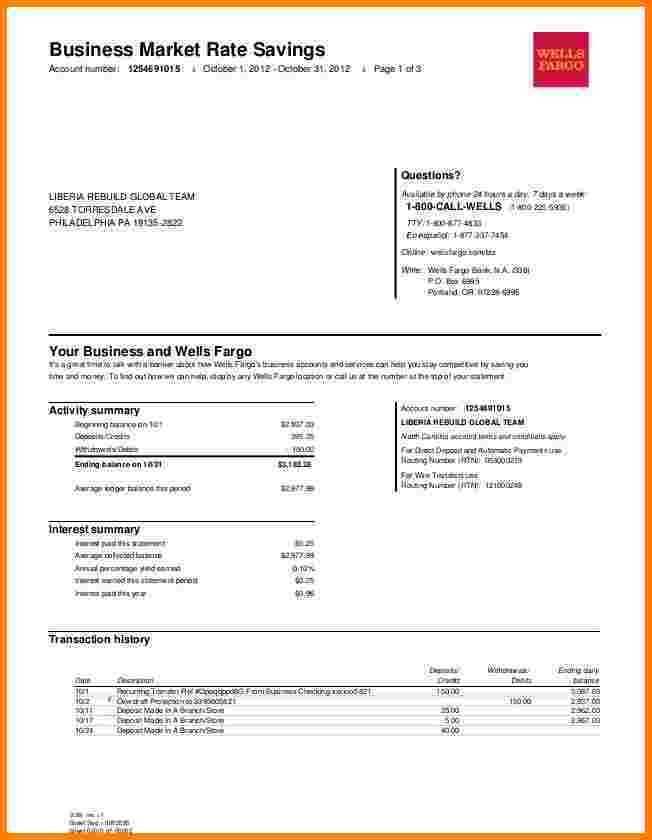

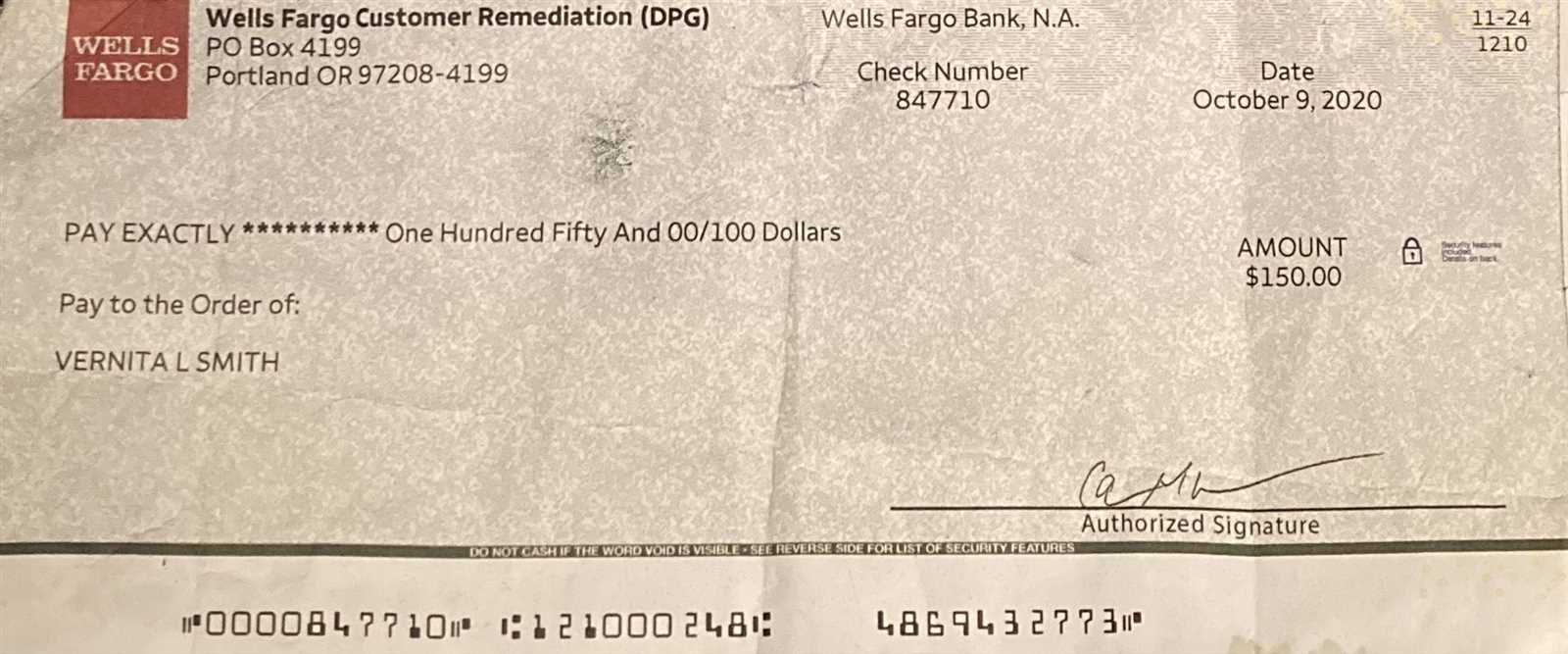

Along with the gift letter, you’ll need to provide supporting documents, such as the donor’s bank statement showing the transfer of funds or a copy of the check used for the gift.

3. Review Wells Fargo’s Requirements

Ensure your gift letter meets Wells Fargo’s specific requirements, which may include signing the letter and providing additional documentation, such as a copy of the donor’s ID or proof of their financial ability to give the gift.

4. Submit Your Gift Letter

Submit the letter and supporting documents through Wells Fargo’s preferred method, either online through their secure portal or by mailing the materials to the designated address.

5. Confirm Receipt and Follow Up

Once submitted, confirm that Wells Fargo has received your gift letter and documents. Stay in touch with the mortgage officer to ensure everything is in order for your approval process.

Wells Fargo Gift Letter Template

To streamline your home loan application, you must submit a gift letter when receiving funds from a relative or friend. Wells Fargo requires this letter to confirm that the money is a gift, not a loan, and will not be expected to be repaid. Here’s how to structure it:

- Sender’s Information: Include the full name, address, phone number, and relationship to the borrower.

- Recipient’s Information: The borrower’s full name and the property address should be clearly stated.

- Gift Amount: Clearly specify the dollar amount being gifted. The letter should detail this amount with no ambiguity.

- Statement of Gift: Clearly state that the gift is given with no expectation of repayment. Wells Fargo requires this explicit language.

- Signature: The letter must be signed by the person gifting the money, verifying the truthfulness of the information provided.

- Source of Funds: If requested, mention where the funds are coming from (e.g., savings, investment account). This ensures there is no source of repayment tied to the gift.

Keep the letter clear, formal, and concise. Wells Fargo may request documentation verifying the source of the gift funds, so make sure to have it ready if needed.