What is a 609 Letter Template

When reviewing personal financial records, individuals often encounter incorrect information that may negatively impact their scores. There is a formal method available to challenge and remove such inaccuracies. This process can help restore accuracy and fairness to credit reports, providing a clear and structured approach for addressing discrepancies.

How to Begin the Dispute Process

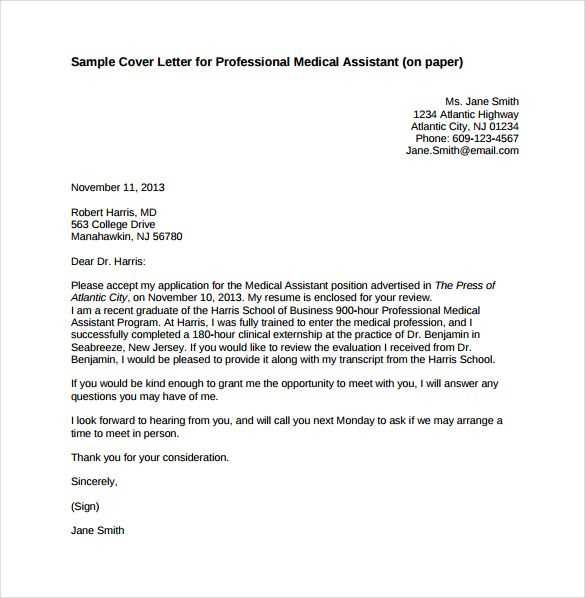

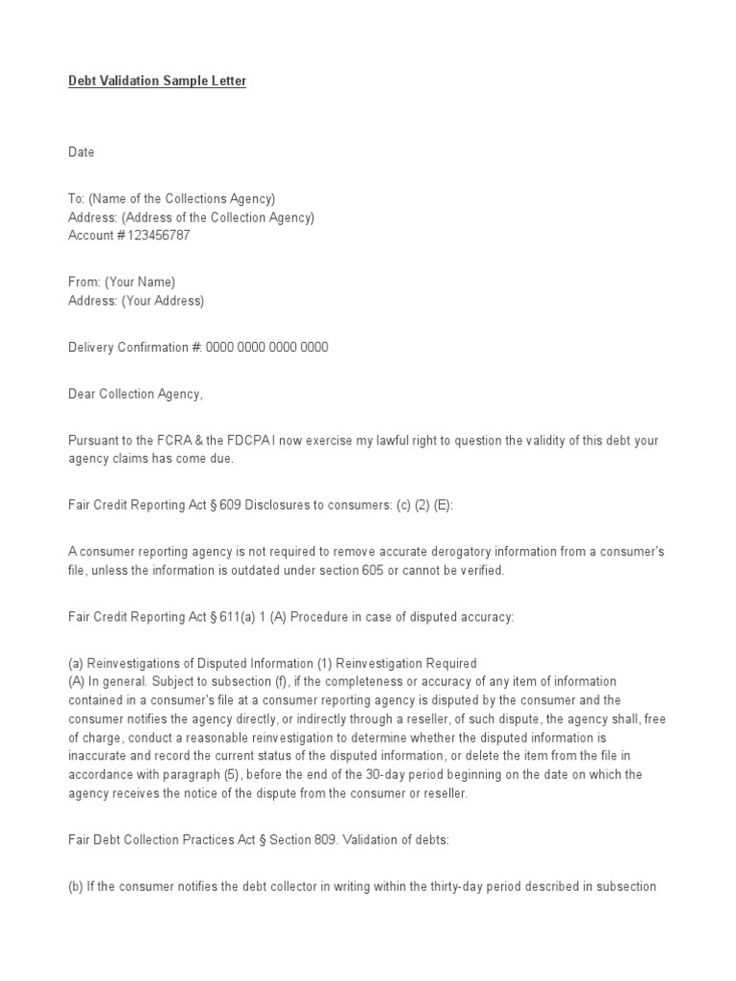

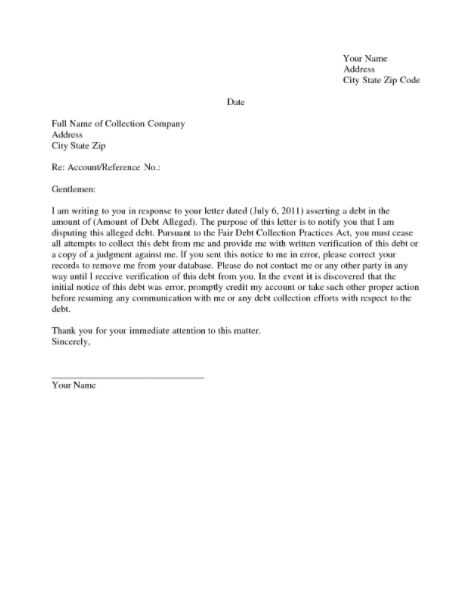

The first step involves gathering evidence that proves the information in question is incorrect. Once that is established, a formal written request is made to the reporting agency or company responsible for the error. This communication should clearly explain the issues, cite any supporting documents, and request a correction.

Key Components of an Effective Dispute Request

- Clear Identification – Include personal information such as your full name, address, and identification number.

- Specific Errors – Describe the specific inaccuracies you wish to dispute, providing details to help resolve the issue.

- Supporting Documents – Attach proof that demonstrates the errors, such as bank statements, receipts, or contracts.

Potential Impact on Credit Reports

Successfully correcting erroneous details on a financial record can lead to an improvement in an individual’s credit standing. It can help open opportunities for loans, better interest rates, and improved financial stability. However, it’s important to understand that not all requests are accepted, and some may take time for resolution.

When to Use This Method

This process is typically used when there is clear evidence that the information in a report is inaccurate and affects financial decisions. Individuals might consider this approach when there are discrepancies in personal details, transaction histories, or accounts that don’t belong to them.

Final Thoughts

Taking the time to dispute erroneous data can be an important step in ensuring that credit records accurately reflect an individual’s financial history. While this process may require patience, the long-term benefits of accurate credit information are well worth the effort.

Dispute Process for Inaccurate Financial Information

When an individual finds discrepancies in their financial records, it’s possible to challenge these errors formally. A structured approach allows individuals to request corrections to improve the accuracy of their reports, which may lead to better financial opportunities. This method is essential for addressing mistakes that could negatively affect credit scores and financial decisions.

Purpose and Advantages of the Dispute Process

The goal of using this method is to correct inaccuracies in financial documents, such as mistaken account details or unrecognized transactions. By initiating the process, individuals can improve their creditworthiness, increase the chances of loan approval, and obtain better interest rates. It serves as a crucial tool for those seeking to maintain a fair and accurate credit report.

How Disputes Influence Credit Ratings

Successfully challenging and removing errors from a financial record can lead to a positive change in a credit score. As discrepancies are corrected, the individual’s financial standing improves, making it easier to secure favorable terms for loans or credit cards. However, not all disputes result in immediate changes, and some may take time to process.

Key Steps to Follow When Initiating the Dispute

- Gather Evidence – Collect any relevant documentation that proves the inaccuracies.

- Write the Request – Compose a formal request that clearly explains the errors, including supporting evidence.

- Submit the Request – Send the dispute to the appropriate agency or organization that handles the information in question.

Common Mistakes to Avoid

Inaccurate or unclear disputes can lead to delays or rejections. Common errors include failing to provide sufficient documentation, writing vague explanations, or neglecting to follow the correct format. Being thorough and precise is key to ensuring that the dispute is addressed effectively.

Understanding the Legal Framework

The process of challenging financial information is supported by various consumer protection laws. These laws ensure that individuals have the right to dispute incorrect entries and demand accurate records. Understanding these legal protections can make the dispute process more straightforward and effective.

Best Times to Initiate the Dispute Process

This method is typically used when there are clear errors that could impact financial decisions. Common situations for initiating a dispute include discrepancies in personal details, credit accounts that don’t belong to the individual, or transactions that have been incorrectly reported. It is most effective when there is strong evidence to support the claim.