Write Off Debt Letter Template for Clear Financial Solutions

Managing outstanding financial obligations can be challenging. Having a clear and concise approach to resolving these issues is essential, especially when formal communication is needed. This guide offers insights on how to properly structure a request for reducing or eliminating certain financial responsibilities, ensuring all necessary details are included for effective communication.

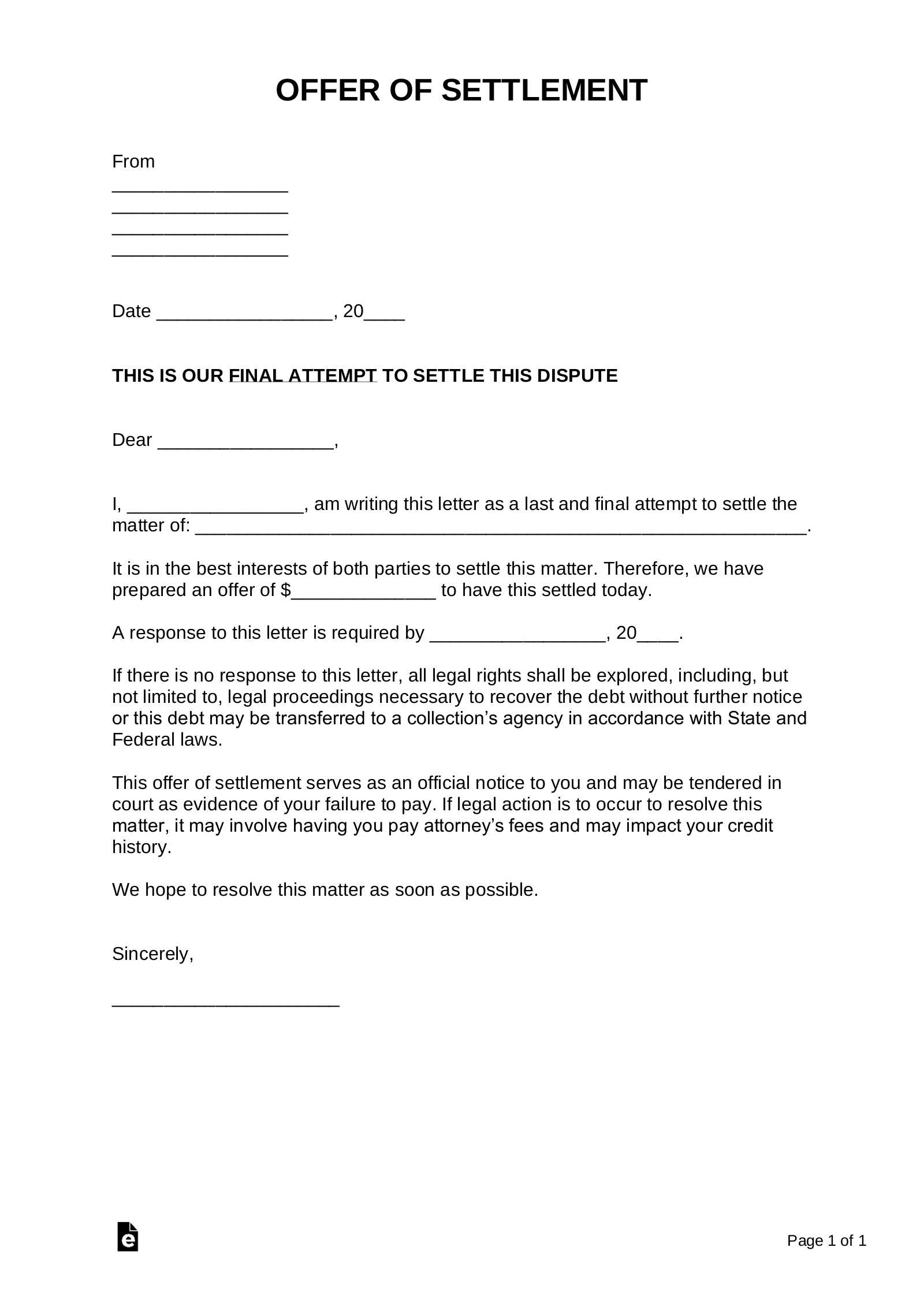

Steps to Craft a Successful Request

When composing such a formal request, the process involves several key elements that must be addressed. It is important to communicate clearly and professionally to increase the likelihood of a positive outcome. Below are the crucial steps to take:

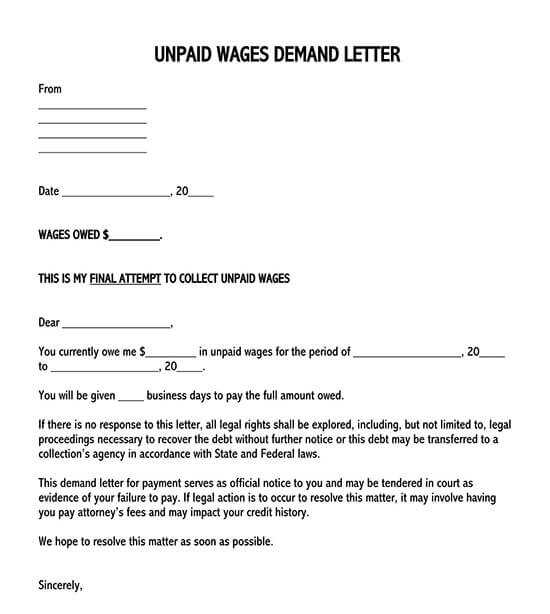

- Begin with a Clear Statement: Express the intent of the message right from the start, making it evident that you are seeking a reduction or cancellation of an amount.

- Provide Supporting Information: Include relevant account details or agreements that justify your request, such as payment history or circumstances.

- State the Desired Outcome: Be specific about the amount or condition you are seeking to resolve, ensuring there are no ambiguities.

Essential Elements to Include

For your message to be considered seriously, it must be thorough and accurate. The following components are essential:

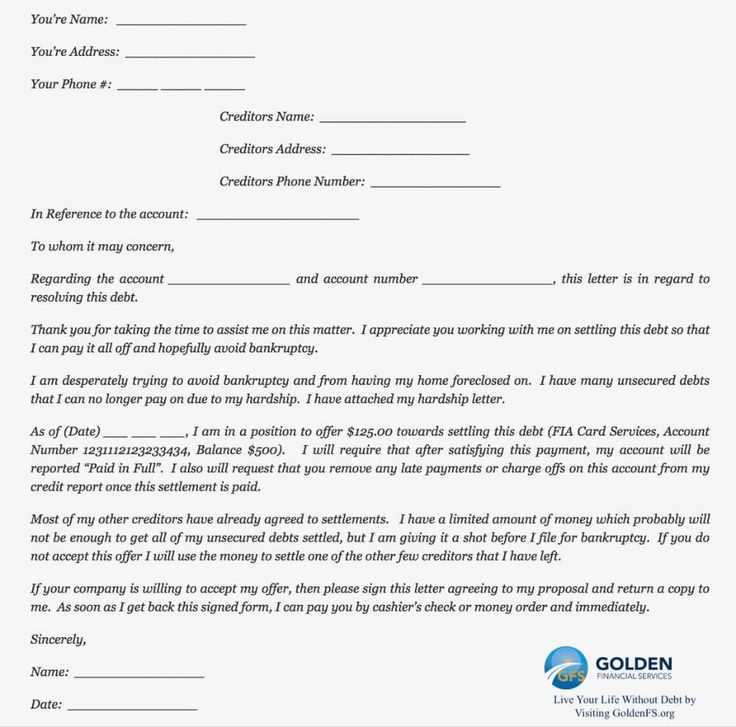

- Personal Details: Include your full name, contact information, and any relevant account numbers.

- Financial Situation: Briefly explain the circumstances that have led to the request, such as hardship or unforeseen challenges.

- Proposal for Resolution: Clearly outline the resolution you are seeking and how it benefits both parties.

Common Errors to Avoid

While drafting your request, it’s crucial to avoid common mistakes that could negatively impact your request. Here are a few to watch out for:

- Vague Language: Avoid unclear terms or statements that may confuse the reader.

- Overly Emotional Tone: Keep the message professional, without excessive emotional appeal.

- Failure to Include Key Information: Omitting important details could lead to delays or rejection of your request.

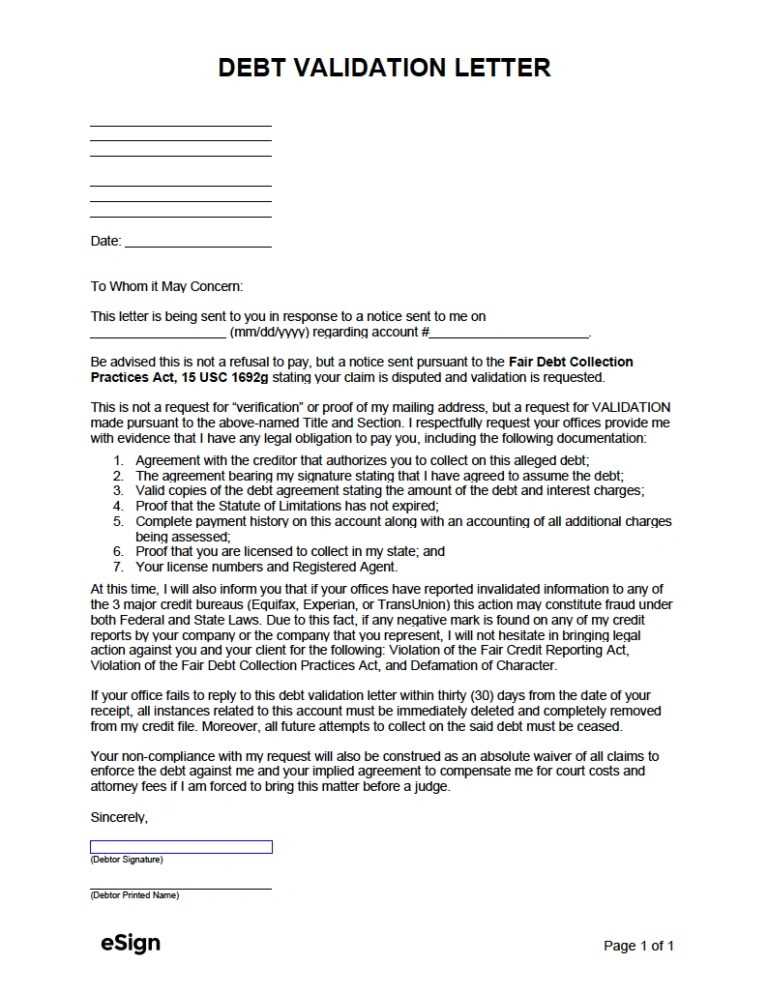

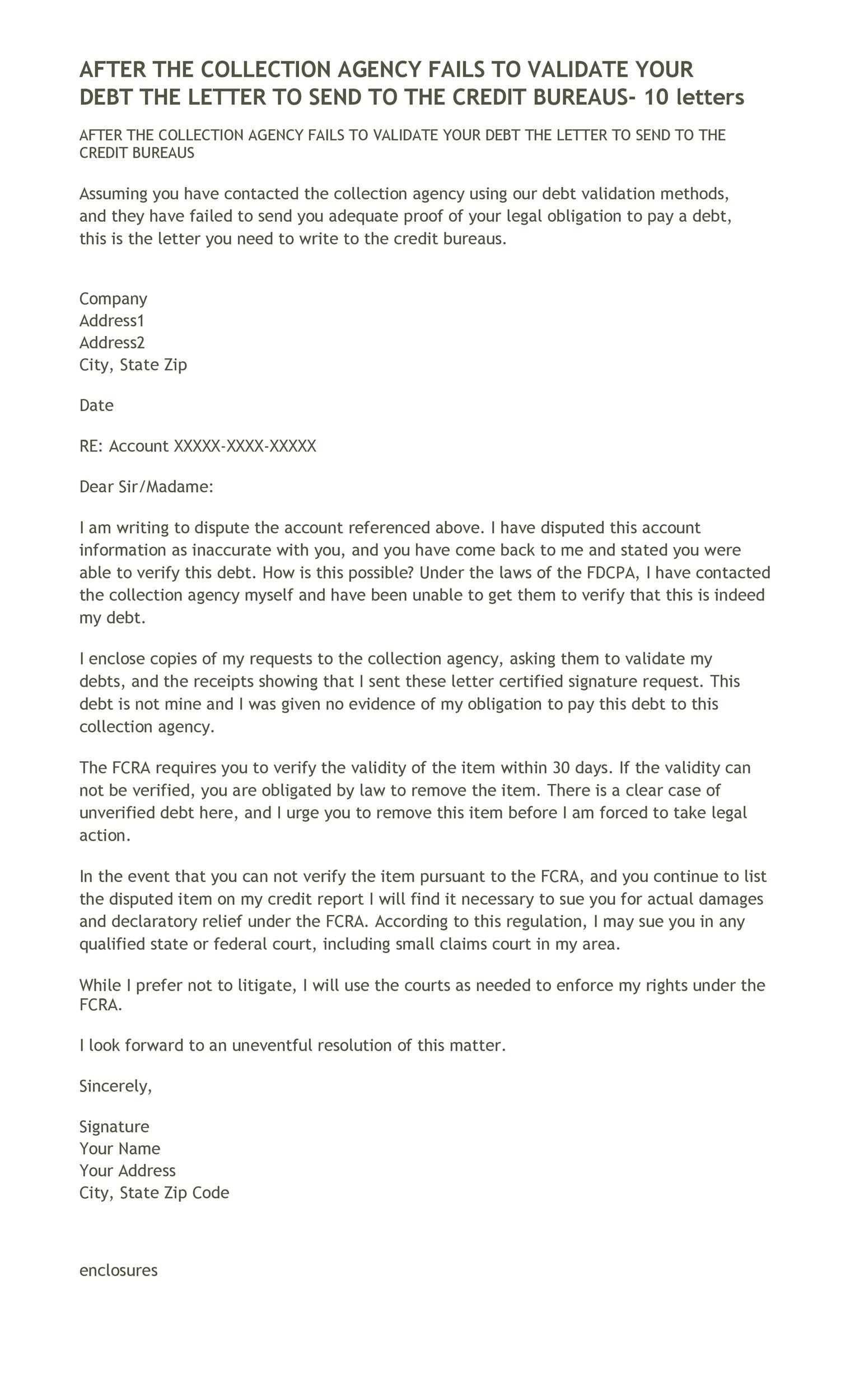

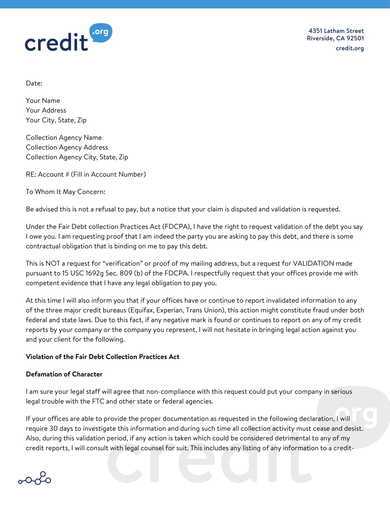

Understanding the Legal Framework

Before submitting a request, it is essential to understand the legal implications of such actions. In many cases, there are specific laws governing how and when financial obligations can be adjusted. Be sure to consult relevant regulations and guidelines to ensure your request is in line with these standards.

Understanding Financial Obligation Reduction Requests

When seeking to resolve financial responsibilities, it is essential to follow a clear and structured process. Proper communication helps ensure that your proposal is understood and considered. In this section, we will explore the necessary steps, key information to include, and common challenges you may face when attempting to reduce or settle balances.

Key Steps in Crafting Your Proposal: To begin, it’s crucial to identify the specific amount or terms you are seeking to change. Your request should be precise, outlining the desired outcome clearly, without any ambiguity. Providing supporting information such as payment history or financial constraints will strengthen your case.

What to Include in Your Document: A well-crafted request should contain vital details. These include your personal information, the account number associated with the obligation, and a concise explanation of your circumstances. Presenting a reasonable proposal that benefits both parties is essential for a favorable resolution.

Tips for Successful Negotiation: When discussing possible adjustments, it’s important to maintain professionalism and be open to compromise. Be realistic in your expectations, and demonstrate how a reduction would be beneficial for both sides. Keep the tone calm and factual to foster a productive discussion.

Common Issues in Financial Reductions: There are several common challenges in this process, including delayed responses, miscommunication, or a lack of understanding from the other party. Ensure that all necessary information is clear and complete, and follow up promptly if needed.

When Adjustments Are Legally Valid: Legal considerations are vital when proposing changes to financial terms. Different regulations govern when and how adjustments can be made. It’s important to understand these laws before proceeding, ensuring that your request complies with all applicable rules.