Year End Tax Letter Template for Smooth Tax Filing

At the conclusion of each fiscal period, it’s crucial to ensure all necessary documentation is properly prepared and organized. This can greatly streamline the process of reporting income and expenses to the appropriate authorities. Having a well-structured form can significantly reduce stress and potential errors, ensuring all required information is included in a clear and concise manner.

Why a Well-Structured Form Matters

A properly crafted form allows for easy tracking of all financial activities that occurred over the past year. With the right structure, it becomes simpler to communicate important financial details to accountants or regulatory bodies. This ensures compliance with regulations while optimizing potential returns or reducing liabilities.

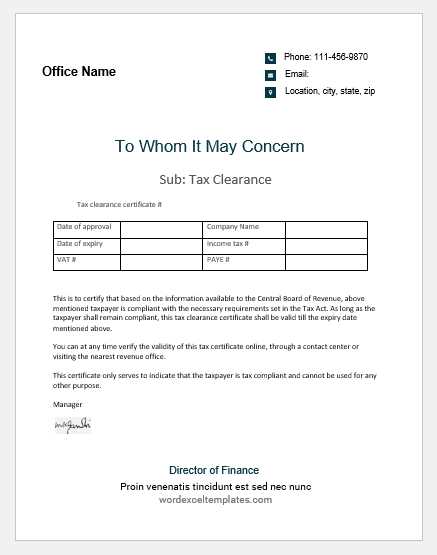

Essential Information to Include

- Personal Information: Full name, address, and contact details of the individual or business.

- Income Summary: A clear breakdown of earnings for the period, including wages, freelance work, or investment returns.

- Deduction Details: Any allowable deductions, such as business expenses or charitable contributions.

- Important Dates: Relevant filing dates and deadlines that should be met.

How to Organize Your Document

The document should begin with personal details and then move on to financial summaries in a structured format. Ensure each section is labeled clearly to avoid confusion. By following a logical flow, the person reviewing it will easily understand the information provided.

How to Avoid Common Mistakes

One of the most frequent errors is failing to include all required information. Double-check for any missing details or inconsistencies. Additionally, it’s important to avoid vague descriptions–be specific about income, deductions, and other financial items. This will help ensure that no information is overlooked during the review process.

Using a Standardized Approach

Utilizing a consistent format each year can help in building a more streamlined process for both preparation and review. With templates available, it’s possible to save time while ensuring all necessary sections are covered. This reduces the chance of missing key components and provides a professional presentation of your financial information.

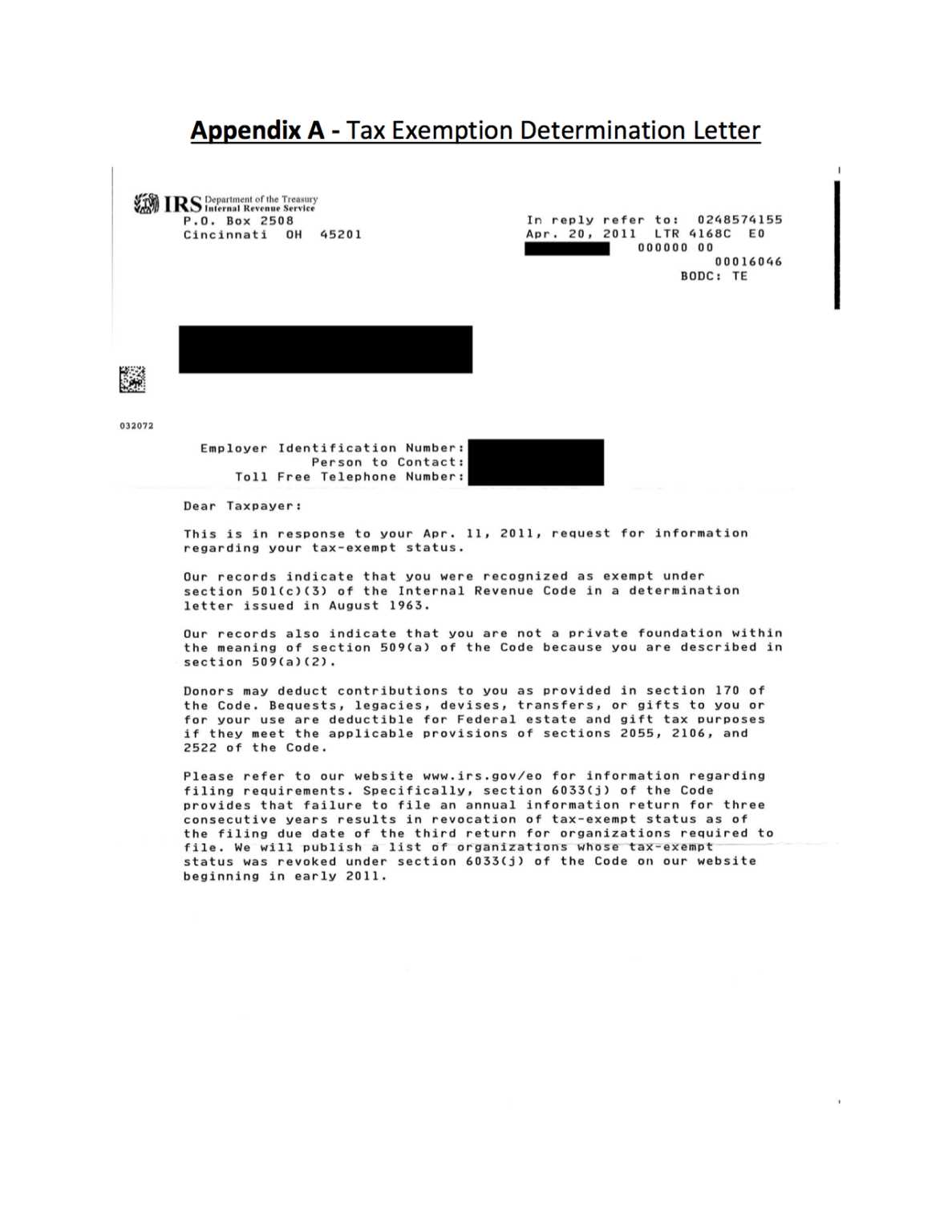

Why Proper Documentation Is Crucial for Financial Reporting

At the conclusion of any financial period, preparing the necessary documents is a vital task. These materials help ensure a smooth and accurate process when submitting important financial information to relevant authorities. A well-organized and detailed document can minimize errors, maximize potential returns, and ensure compliance with all applicable laws.

Creating a Clear and Effective Document

Designing a precise and professional document requires careful attention to detail. Start by structuring the content logically, ensuring all necessary sections are included and labeled correctly. A clear layout will help prevent confusion during review, making it easier for both the individual preparing the material and the person reviewing it.

Critical Information to Include

It’s important to include specific details such as personal identification information, a summary of financial earnings, allowable deductions, and other relevant data. Each piece of information should be presented in a manner that’s easy to read and comprehend, reducing the chance of misunderstandings.

Additionally, ensure that key dates and deadlines are outlined, as this helps prevent delays in submission and potential penalties. Taking the time to verify all entries for accuracy can save both time and effort in the long run.

Avoiding Common Pitfalls

While preparing this document, it’s crucial to avoid common mistakes such as leaving out critical details or being vague in descriptions. Specificity is key to ensuring that all relevant financial information is captured, and that there’s no room for error or misinterpretation.

Achieving Accuracy in Submission

To guarantee precision, take extra care when reviewing the document before submission. Double-check all figures and details to ensure everything is correct. Using a consistent format each year can help streamline this process, ensuring that no information is overlooked and that your filing remains consistent and professional.