Free Zero Balance Letter Template for Debt Settlement

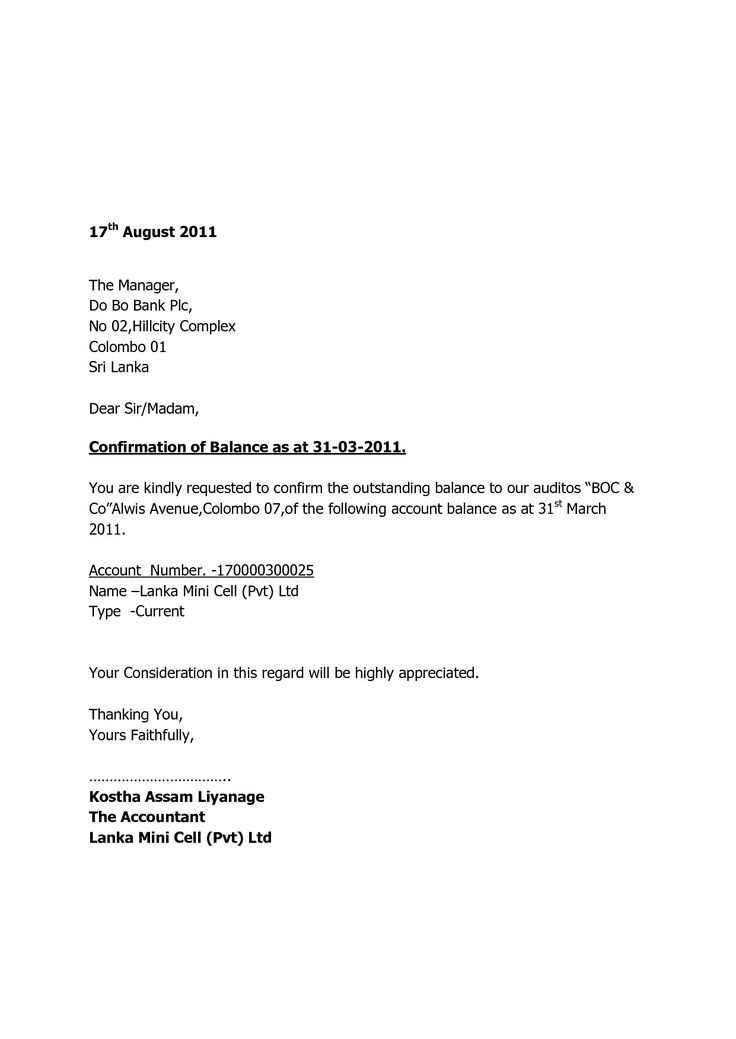

In financial transactions, it’s important to ensure that both parties acknowledge when an obligation has been fully settled. This acknowledgment is often done through a formal written communication confirming the outstanding amount has been paid in full. Such documentation is essential for record-keeping and can help avoid future disputes over payment statuses.

Purpose of a Settlement Confirmation

When a debt is cleared, it’s critical to have a formal document that states the payment has been completed and no further amounts are owed. This serves as proof for the debtor, the creditor, and any third parties that may need verification of the settlement. Additionally, such documentation provides peace of mind for both parties, ensuring that the transaction is officially closed.

Why It’s Important

- Prevents future misunderstandings: Having proof that a debt is settled can help avoid disagreements or claims that money is still owed.

- Maintains clear financial records: This document serves as a record that can be referred to in the future if questions arise.

- Protects both parties: It safeguards the interests of both the debtor and creditor by confirming that the terms of the agreement have been met.

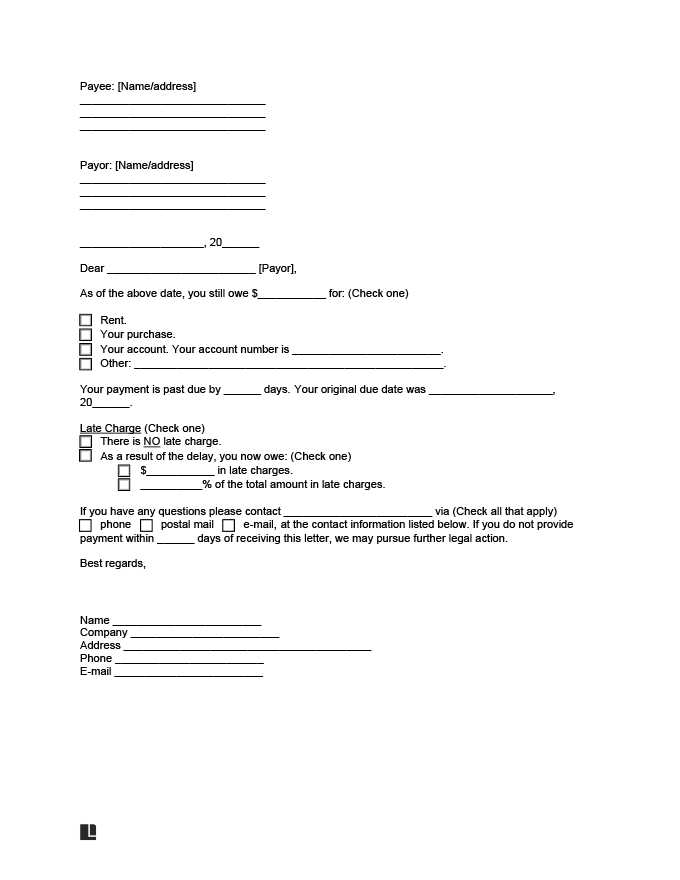

How to Draft the Document

Creating such a statement involves clearly stating the details of the transaction. The most important elements to include are the payment amount, date, and the fact that the debt is now fully satisfied. The document should be signed by both parties to ensure mutual agreement on the closure of the account.

Key Elements to Include

- Identification of the parties involved: Clearly state the names of both the debtor and creditor.

- Details of the payment: Include the exact amount paid and the date on which the payment was completed.

- Confirmation of settlement: State explicitly that the full debt has been cleared and no further payments are due.

- Signatures: Both parties should sign the document to confirm agreement and finalize the process.

When to Use This Document

It’s advisable to issue this statement immediately after the last payment has been made. It’s important to use it whenever the outstanding balance has been fully paid, whether it’s a loan, service, or any other form of financial agreement. Issuing this document as soon as possible helps in preventing any future confusion or discrepancies regarding the settlement.

What is a Debt Clearance Document?

Why You Need a Payment Confirmation Notice

How to Draft a Settlement Acknowledgment

Essential Details to Include in the Statement

When to Submit a Final Payment Notice

How Pre-made Formats Simplify the Process

When a financial obligation has been fully paid, it is essential to create a formal document that officially acknowledges the settlement. This ensures both parties are in agreement about the payment status and provides proof that no further amounts are due. Such a statement is crucial for maintaining clear financial records and protecting both the debtor and creditor from future disputes.

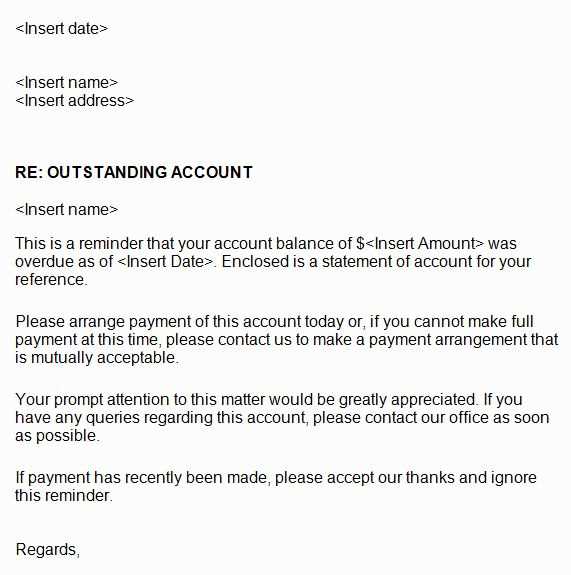

Why You Need a Payment Confirmation Notice

After settling any outstanding dues, confirming the closure of the agreement with a written notice is necessary. This confirmation serves as a protective measure, making it clear that the terms of the financial arrangement have been fulfilled. Without this written acknowledgment, there is potential for misunderstandings or false claims of outstanding debt.

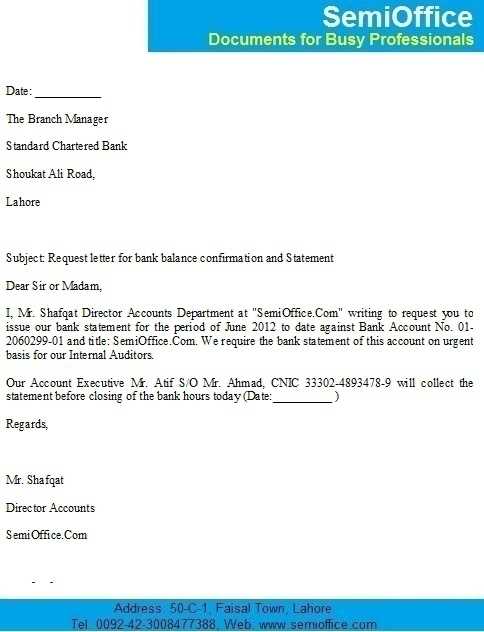

How to Draft a Settlement Acknowledgment

Creating this document involves clearly stating the key details of the transaction, including the total amount paid, the payment date, and the acknowledgment that the debt is fully satisfied. Be sure to include the names of the parties involved and ensure both parties sign the document to validate the transaction.

Essential Details to Include in the Statement

The document should contain specific details such as the names of the debtor and creditor, the exact payment amount, the date of payment, and a declaration that the debt has been fully paid. It’s important to include both parties’ signatures to confirm mutual consent and avoid future disputes.

When to Submit a Final Payment Notice

It’s recommended to issue this confirmation immediately after the last payment is made. The earlier it’s issued, the better, as it protects both the debtor and creditor from any future confusion or claims regarding the outstanding debt.

How Pre-made Formats Simplify the Process

Using a pre-designed format can significantly reduce the time and effort needed to create this acknowledgment. With key sections already outlined, a template streamlines the process and ensures all necessary details are included, helping both parties avoid errors and finalize the agreement efficiently.