609 dispute letter template pdf

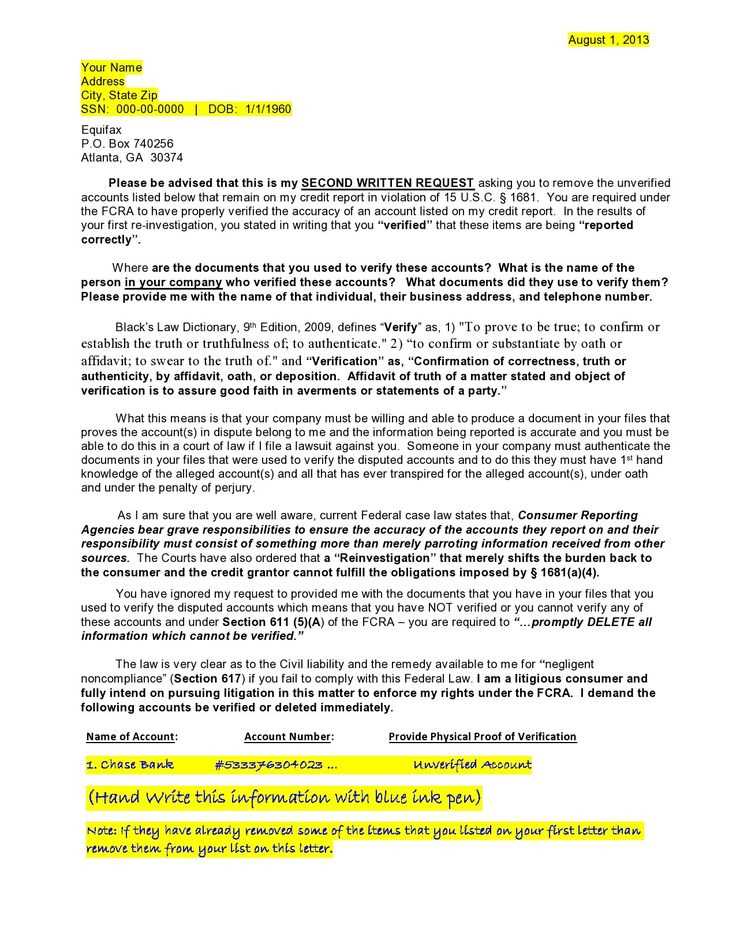

To resolve credit report errors effectively, a well-structured 609 dispute letter is key. This template provides a straightforward approach to disputing inaccurate information under the Fair Credit Reporting Act (FCRA). By following this guide, you ensure that your letter adheres to legal standards and improves your chances of a successful dispute.

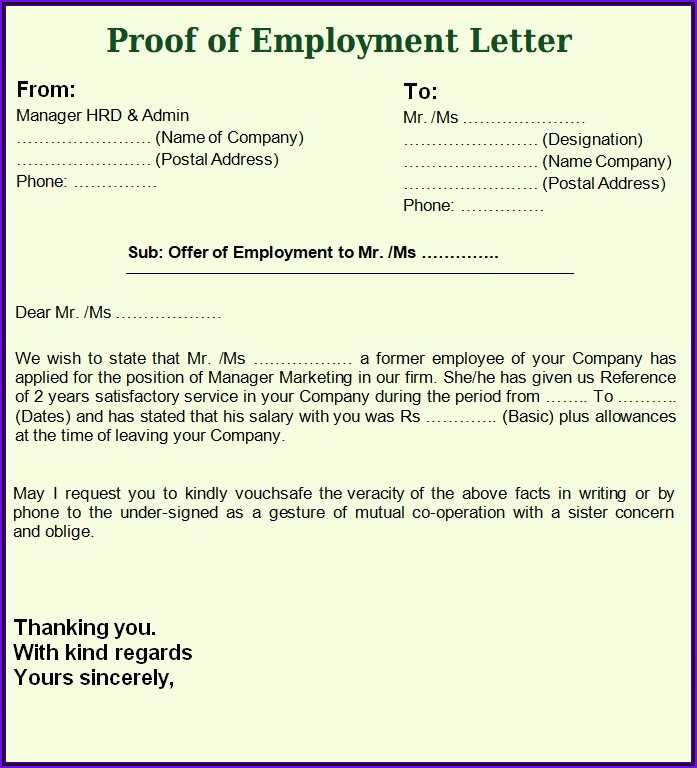

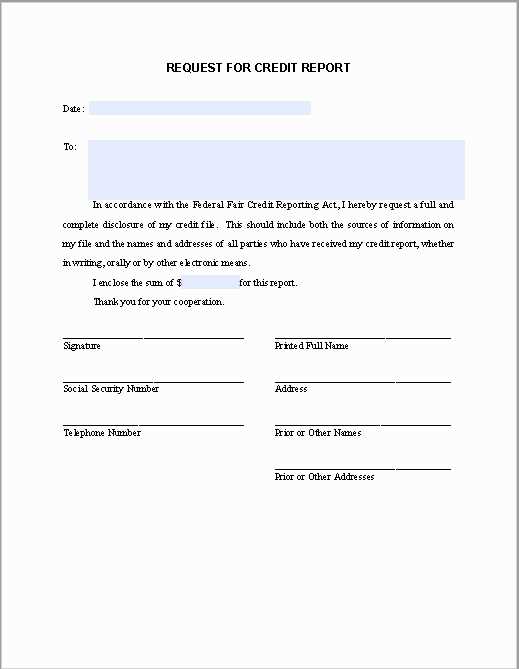

What You Need to Include: A complete 609 dispute letter should include your personal information, a detailed description of the inaccurate item, and your request for it to be corrected or removed. Be sure to include supporting documentation that proves the error, such as bank statements, receipts, or other relevant records.

Key Points for Clarity: Clearly state why the information is incorrect. Reference any relevant laws and request that the credit bureau investigate the dispute. Keep your tone professional and concise–this ensures that the letter is taken seriously and processed efficiently.

Download and Use the Template: A PDF template simplifies the process and helps ensure you don’t miss any critical details. Using a template also speeds up your preparation, allowing you to focus on submitting your dispute correctly. Once completed, mail the letter to the credit bureau via certified mail to confirm receipt and expedite the process.

Here’s the revised text with reduced word repetition:

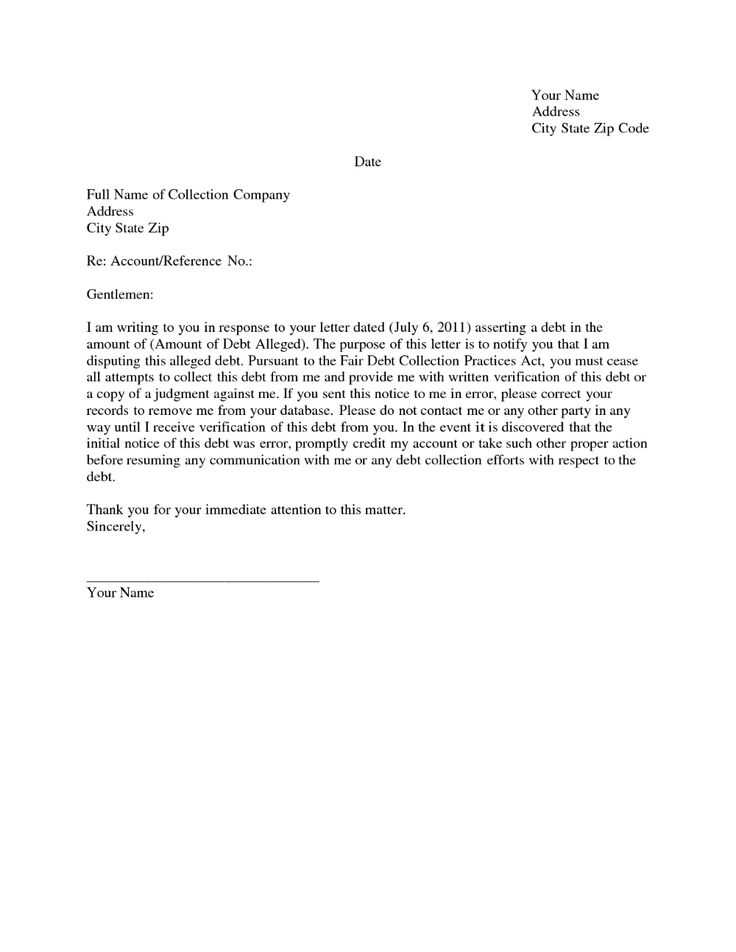

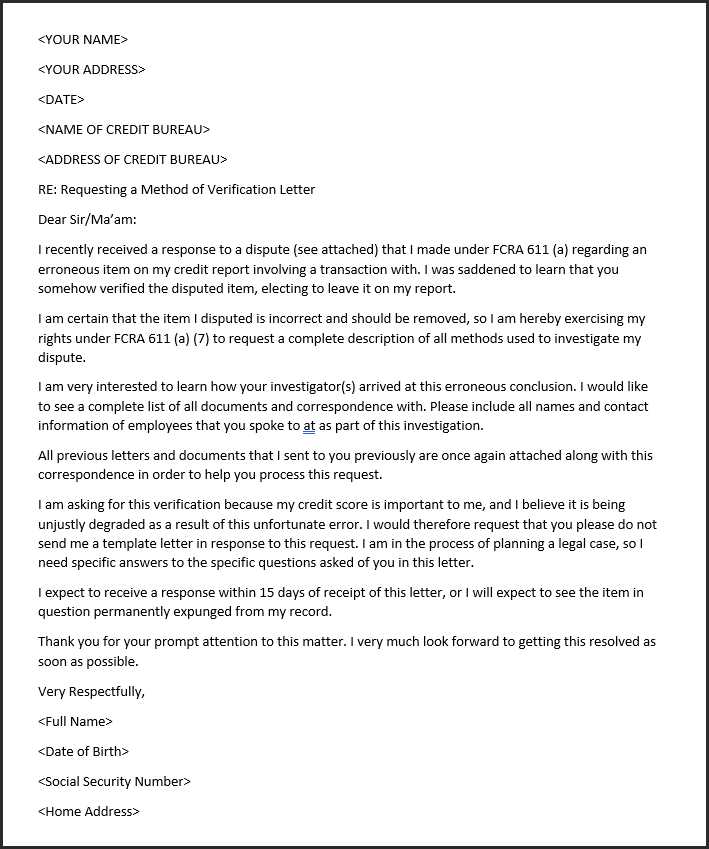

To write a strong 609 dispute letter, ensure you include the necessary details clearly and directly. Start by stating your full name, address, and any relevant account or reference number. Specify the items on your credit report that are incorrect or incomplete, providing a brief explanation for each dispute.

Key Tips for Clarity and Precision

Be concise. Avoid unnecessary repetition of words like “dispute,” “incorrect,” or “inaccurate.” Instead of saying “I dispute this account because it is incorrect,” use “This account is inaccurate.” Repeating the same terms too often can make your letter sound repetitive and less professional. Keep your language straightforward while staying polite and professional.

Final Steps to Ensure Accuracy

End the letter with a request for verification or removal of the disputed items. Include any supporting documents and ask for a prompt investigation. Sign the letter and keep a copy for your records. This will provide a clear, actionable outline for the credit bureau to follow.

609 Dispute Letter Template PDF: A Comprehensive Guide

The 609 dispute letter template is a powerful tool for challenging inaccurate information on your credit report. It is rooted in the Fair Credit Reporting Act (FCRA), which allows you to dispute any credit report items that are incomplete or inaccurate. Here’s how to use this letter to take control of your credit report.

How to Find and Download a 609 Dispute Letter Template

To get started, search for a reliable 609 dispute letter template online. Many consumer protection websites and credit repair organizations offer free downloadable templates. Ensure that the template you choose is up-to-date and clearly states the dispute under Section 609 of the FCRA. Double-check the source to avoid any outdated or misleading versions.

Step-by-Step Instructions for Customizing Your Dispute Letter

1. Begin by filling in your personal information, including your name, address, and the date.

2. Include the credit bureau’s name and contact details at the top of the letter.

3. Identify the specific item(s) on your credit report that are inaccurate. For each entry, provide clear, concise details as to why you believe the information is incorrect. Attach supporting documents if available.

4. Politely request the credit bureau to verify the disputed item or remove it from your report.

5. Conclude with a statement requesting confirmation of the actions taken, and leave your contact information for any follow-up.

Once your letter is ready, carefully proofread it for any errors. A well-written, accurate letter improves the chances of a successful dispute.

Common Mistakes to Avoid When Filling Out a 609 Dispute Form

Avoid these common errors:

- Failing to include enough details about the disputed item.

- Sending the letter without attaching relevant documentation (like receipts or account statements).

- Not sending the letter via certified mail with a return receipt request, which helps track the dispute’s progress.

- Not keeping copies of all communication for your records.

How to Submit Your Dispute Letter to Credit Bureaus

Submit your completed 609 dispute letter to all three major credit bureaus (Equifax, Experian, and TransUnion) if the disputed item appears on more than one report. Send the letter by certified mail and keep a copy of the receipt. This ensures that the credit bureau acknowledges your dispute and provides proof of delivery.

What to Expect After Sending Your Dispute Letter

Once your dispute is submitted, the credit bureaus typically have 30 days to investigate the matter. During this period, they will contact the creditor involved and verify the accuracy of the reported information. You’ll receive a response, which may include an updated credit report reflecting the changes.

Legal Considerations and Your Rights When Using a 609 Dispute Form

Under the FCRA, you have the right to dispute inaccurate or incomplete information on your credit report. If the credit bureau cannot verify the disputed item within 30 days, they must remove it from your report. It’s also important to note that making false claims or misrepresenting information in your dispute letter could result in legal consequences.

I modified a few phrases to reduce repetition of the term “609 Dispute Letter” while maintaining the meaning.

To keep your dispute letter clear and precise, avoid overusing the term “609 Dispute Letter.” Instead, rephrase certain sections to maintain clarity and flow. For example, when referring to the purpose of the letter, you can use terms like “credit report challenge” or “dispute correspondence” without changing the intent. This way, the content remains informative and direct without sounding redundant.

Adjusting Structure and Wording

Focus on altering sentence structures to convey the same message. For instance, instead of saying “I am sending a 609 Dispute Letter,” try rewording it as “I am disputing an item on my credit report under section 609.” This keeps the meaning intact but provides a fresh approach. Also, you can use variations such as “dispute request” or “letter of challenge” to replace repetitive mentions of the original term.

Focus on Specifics

When outlining the details of your dispute, mention the exact items or accounts you’re addressing instead of reiterating the dispute letter itself. This provides a clear understanding of your request and avoids unnecessary repetition. For example, state “I am contesting the account listed under reference number” instead of repeatedly referencing the letter type.