Credit Inquiry Removal Letter Template PDF Download

When it comes to maintaining a healthy financial profile, one key factor is ensuring your report remains free of unnecessary marks that may harm your score. These entries can appear due to various reasons, but you have the ability to challenge them and seek their removal. Addressing these issues effectively is crucial in protecting your financial reputation and enhancing your creditworthiness.

Understanding the process of disputing these marks involves clearly articulating your request to the relevant institutions. By submitting a formal communication, you can initiate the process of having incorrect or outdated information reviewed and potentially erased from your record. Properly phrased communication is vital for increasing your chances of success, as it ensures that the responsible parties understand the situation and take appropriate action.

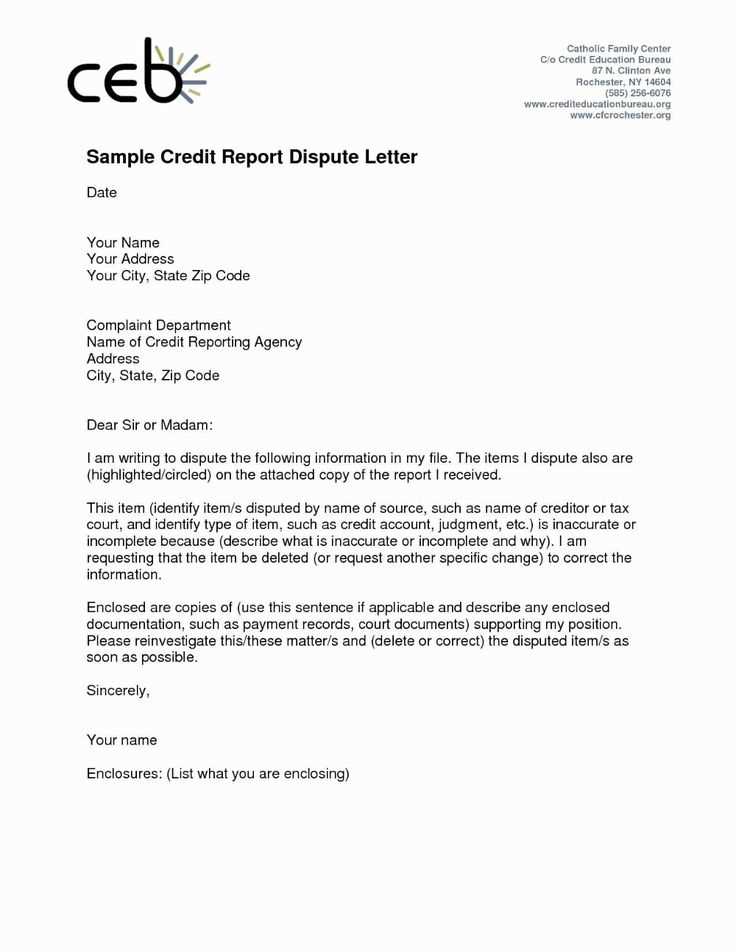

How to Write a Credit Inquiry Removal Letter

When disputing unnecessary marks on your financial report, it’s essential to create a clear and formal request that conveys your intention to have specific entries removed. This communication should be professional and concise, ensuring that it includes all necessary details to facilitate the review process. The tone and structure of your message play a significant role in how effectively the issue is addressed.

Start by providing accurate details in your message. Include your full name, account number, and any reference information related to the disputed marks. Make sure to reference the specific entry that you wish to challenge, as this will help the recipient locate the issue quickly and accurately.

Keep your message polite and factual. Clearly explain why you believe the information is incorrect or outdated, and provide any supporting documentation that can back up your claim. A well-documented case increases the chances of a favorable response and helps streamline the resolution process.

Understanding the Impact of Credit Inquiries

When your financial record is accessed by lenders, it can lead to a temporary entry that may influence your overall standing. These records serve as markers that indicate how often your financial profile is reviewed. While not always harmful, frequent access can potentially lower your score, affecting your ability to secure favorable lending terms in the future.

Short-Term Effects on Your Financial Score

Each time a third party checks your report, a small drop in your score can occur, typically lasting for a brief period. However, if multiple checks happen in a short time frame, the combined effect could be more significant. It’s important to monitor these entries to understand how they might influence your financial decisions.

Long-Term Consequences of Excessive Checks

While a single review may not have a lasting impact, a history of numerous checks may indicate higher risk to lenders. This can result in higher interest rates or difficulty securing loans in the future. Understanding the effect these records have on your profile can help you make informed decisions when managing your finances.

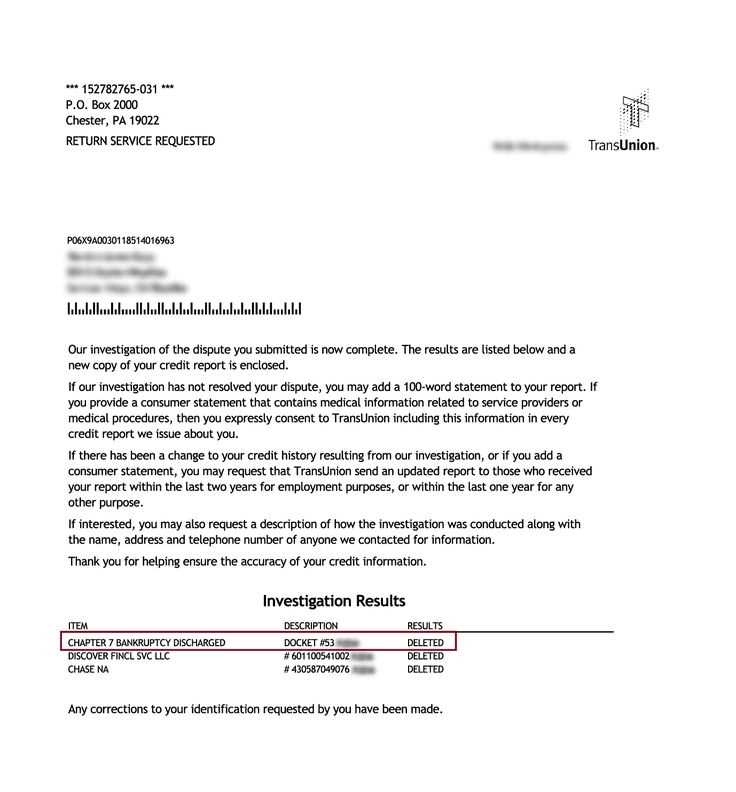

Step-by-Step Guide to Removing Inquiries

Eliminating unwanted marks from your financial record requires a methodical approach. By following a series of clear steps, you can effectively address any discrepancies and work towards improving your profile. This process ensures that unnecessary entries are properly disputed, leading to a cleaner financial history.

Step 1: Review Your Financial Report – Begin by carefully examining your record to identify any entries that appear incorrect or outdated. Make sure to cross-reference the details with your own financial activities to confirm if any errors have occurred.

Step 2: Gather Supporting Documentation – Collect any relevant documents that support your claim for removing the entry. This could include transaction records, communication with lenders, or any other information proving the inaccuracy of the mark.

Step 3: Submit Your Dispute – Once you have reviewed the information and gathered the necessary documents, submit your dispute to the relevant parties. Ensure your communication is clear and concise, providing all the details they need to assess the situation and resolve it efficiently.

Step 4: Follow Up – After submitting your dispute, make sure to track the progress and follow up if necessary. Timely communication helps ensure that the matter is resolved without unnecessary delays.

Why You Should Dispute Unnecessary Inquiries

Disputing irrelevant entries on your financial record is crucial for maintaining a healthy financial standing. These marks can impact your reputation with lenders, potentially leading to higher interest rates or difficulty securing loans. By challenging any inaccuracies or unnecessary checks, you can ensure that your profile accurately reflects your financial behavior, which is essential for favorable lending decisions.

Taking action to remove these unwanted marks can also help protect your financial future. Even minor discrepancies can accumulate over time, affecting your overall score and potentially limiting your access to credit. By addressing these issues promptly, you can avoid long-term negative effects and maintain a more accurate representation of your financial health.

Common Mistakes to Avoid in Your Letter

When submitting a request to remove unnecessary entries from your financial record, it’s important to approach the process with precision. Many individuals make mistakes that can delay the resolution or weaken their case. Understanding what to avoid is key to ensuring a successful outcome.

- Being Too Vague – Always be specific about the entry you wish to challenge, providing exact details and context to help the recipient understand the issue clearly.

- Using Aggressive or Impolite Language – Maintain a respectful and professional tone throughout your communication. Being too forceful or confrontational may harm your chances of a positive outcome.

- Omitting Supporting Evidence – Failing to provide relevant documentation can significantly reduce the chances of your request being taken seriously. Always include proof where necessary.

- Not Following the Correct Process – Make sure you are aware of the proper procedure for submitting your dispute. Missing steps or ignoring guidelines can lead to delays or rejection.

By avoiding these common pitfalls, you increase your chances of successfully resolving the issue and improving your financial record. A careful and thorough approach is the best way to ensure that your dispute is addressed efficiently and effectively.

How a PDF Template Can Save Time

Using a pre-designed format for your dispute requests can significantly reduce the amount of time spent crafting your message. With a standardized structure, you can ensure that all necessary details are included, and you won’t have to start from scratch each time you need to make a request. This streamlined process allows for quicker resolution of issues and a more efficient approach overall.

Instead of figuring out how to format your communication or remembering which information is required, a ready-made form ensures that you cover everything with minimal effort. Additionally, these formats can be easily customized for each situation, saving time on re-writing and enabling you to focus on the core details of your request.

| Step | Action | Time Saved |

|---|---|---|

| 1 | Fill in your personal and account details | Minutes saved on manual input |

| 2 | Provide supporting documentation | Less time gathering evidence |

| 3 | Send directly to relevant parties | Quicker submission process |

By using such a format, you not only make the process faster but also reduce the likelihood of overlooking key information, helping you get the best results in the least amount of time.