Free Credit Repair Letter Template PDF Download

In the world of personal finance, maintaining a strong record is crucial for accessing loans, mortgages, and other financial services. A negative mark on your history can significantly impact your ability to secure favorable terms. Fortunately, there are steps you can take to address and remove these blemishes, improving your financial reputation.

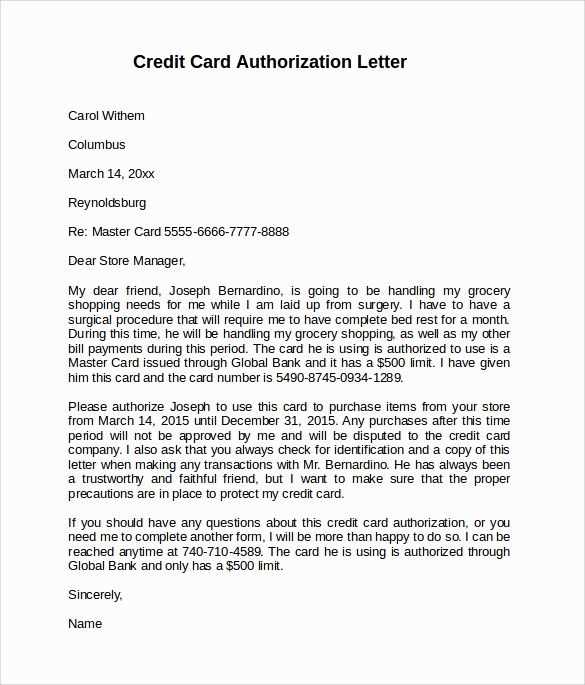

One of the most effective approaches is through formal communication with the institutions reporting incorrect or outdated information. By sending a well-structured request, you can initiate a process to rectify inaccuracies. This method allows you to take control of your financial standing and work toward a cleaner profile.

To make this process as smooth as possible, using a professionally crafted document can help ensure that all necessary points are addressed clearly. Such documents serve as formal requests, making your intentions known in a structured and effective manner, increasing the likelihood of a positive response.

When dealing with inaccurate or outdated financial records, having a clear and professional communication approach can help resolve issues effectively. Crafting a well-structured document for contacting relevant institutions or agencies is essential. This section provides guidance on how to create a formal request that can increase the chances of successfully addressing discrepancies in your financial history.

Key Components of an Effective Request

To ensure your appeal is taken seriously, it’s important to include certain details in your message. A structured approach can make all the difference. Consider the following points when composing your communication:

- Personal Information: Clearly state your full name, address, and any other identification details to ensure your request is linked to the correct account.

- Specific Issue: Describe the exact problem, including the date of the error, the affected transaction, and why you believe it is incorrect.

- Request for Action: Politely ask for the correction or review of the issue, stating the desired outcome.

- Supporting Documentation: Attach any relevant documents that support your claim, such as bank statements or receipts.

- Contact Information: Provide clear details on how the recipient can reach you for follow-up or additional information.

Best Practices for Sending Your Request

Once your document is ready, following the correct process for submission can improve the likelihood of a swift resolution. Here are some tips to keep in mind:

- Check for Accuracy: Ensure all the details in your message are correct, as inaccuracies can delay the process.

- Choose the Right Method: Send your communication via a reliable channel such as registered mail or secure online forms.

- Follow Up: If you don’t receive a response within a reasonable timeframe, don’t hesitate to reach out again to confirm receipt and check on the status of your request.

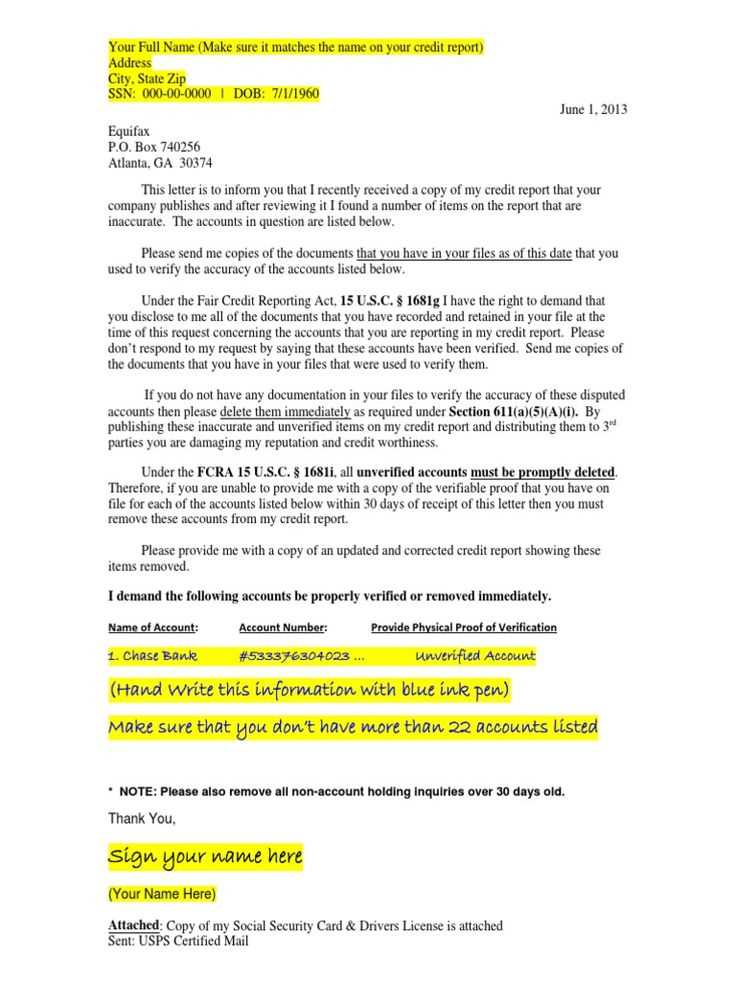

Understanding the Importance of Disputes

When dealing with inaccurate financial records, taking proactive steps to challenge these inaccuracies is crucial. Disputing errors allows individuals to address discrepancies that could impact their financial standing and overall reputation. This process empowers individuals to maintain control over their financial future and ensures that they are not unfairly penalized for mistakes beyond their control.

Disputes are an essential tool for maintaining a fair financial environment. By formally addressing inaccuracies, individuals give themselves a chance to correct any misleading information that may have been mistakenly reported. This can lead to more accurate assessments by lenders and institutions, helping people access better opportunities in the future.

In addition to improving personal financial profiles, disputes also help ensure that institutions maintain accurate records. By raising concerns and requesting corrections, individuals contribute to the overall integrity of the system, which benefits everyone involved.

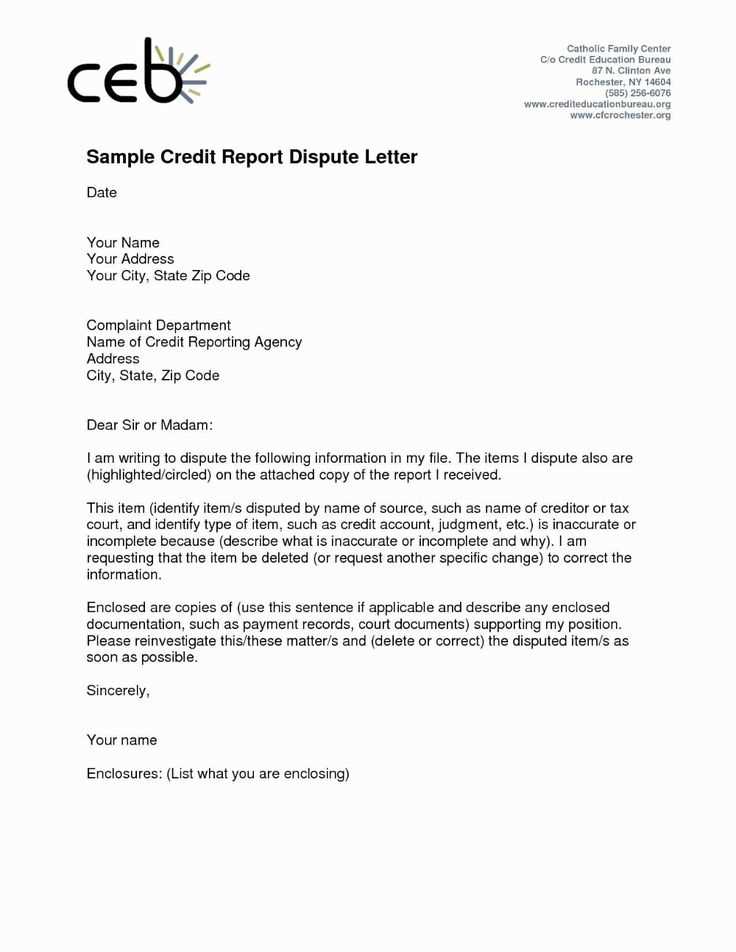

How to Write an Effective Repair Letter

When seeking to resolve discrepancies in financial records, crafting a clear and precise communication is key. The purpose of such a document is to inform the concerned parties about the inaccuracies and request corrective action. A well-constructed message helps convey your concerns in a professional manner and increases the chances of a successful resolution.

Clarity and detail are essential when drafting your message. Be sure to clearly state the issue, providing specific examples, dates, and other relevant details. This will make it easier for the recipient to understand the problem and assess the situation properly.

Additionally, the tone of your message should be polite yet firm. While it’s important to express your concerns, maintaining professionalism is crucial. Here are some tips for writing a compelling and effective request:

- Be Direct: Clearly state the issue in the first paragraph to avoid any confusion.

- Provide Evidence: Attach any supporting documents that substantiate your claim.

- Stay Professional: Use respectful language, even when expressing frustration or disappointment.

- Make a Specific Request: Indicate what action you want the recipient to take, whether it’s correcting the mistake or providing further clarification.

Essential Details to Include in Your Letter

When addressing discrepancies in your financial records, it’s important to provide all necessary information to ensure a prompt and accurate resolution. Including the right details not only helps clarify the issue but also increases the chances of a positive outcome. A well-structured communication will facilitate a smoother process for both you and the recipient.

There are several key elements that should be present in your request. These details are crucial for identifying the specific issue, demonstrating your claim, and guiding the recipient toward the correct action. Here’s a breakdown of what to include:

- Personal Information: Clearly state your full name, address, and any relevant identification numbers such as account or reference numbers. This ensures your request is linked to the correct records.

- Issue Description: Provide a brief but detailed explanation of the problem. Specify what is incorrect, such as a date, transaction, or amount, and why you believe it is wrong.

- Supporting Documents: Attach any evidence that supports your claim, such as bank statements, receipts, or official correspondence.

- Desired Outcome: Clearly state what you want to be corrected or clarified, whether it’s a correction to the record, further investigation, or removal of an incorrect entry.

- Contact Information: Provide multiple ways to be reached for follow-up, including phone numbers or email addresses.

Common Mistakes to Avoid in Writing

While drafting a formal request to address discrepancies in your financial records, it’s important to avoid common pitfalls that could undermine the effectiveness of your message. Mistakes in your communication can lead to misunderstandings, delays, or even rejection of your request. By being aware of these errors, you can increase the chances of your appeal being taken seriously and resolved swiftly.

Here are some of the most common mistakes to avoid when composing your request:

| Mistake | Explanation |

|---|---|

| Vague or Unclear Description | Failing to clearly explain the issue can lead to confusion and delays. Be specific about the error and provide concrete details. |

| Lack of Supporting Evidence | Without evidence to back up your claim, it’s harder for the recipient to understand your position. Always include relevant documentation. |

| Impolite Tone | Even if you’re frustrated, maintaining a professional tone is essential. An overly aggressive or rude message can result in a negative response. |

| Not Following Up | Failure to follow up after sending your communication can leave the issue unresolved. Always check in if you don’t receive a timely response. |

| Missing Contact Information | Make sure your contact details are easily accessible so the recipient can reach you for clarification or updates. |

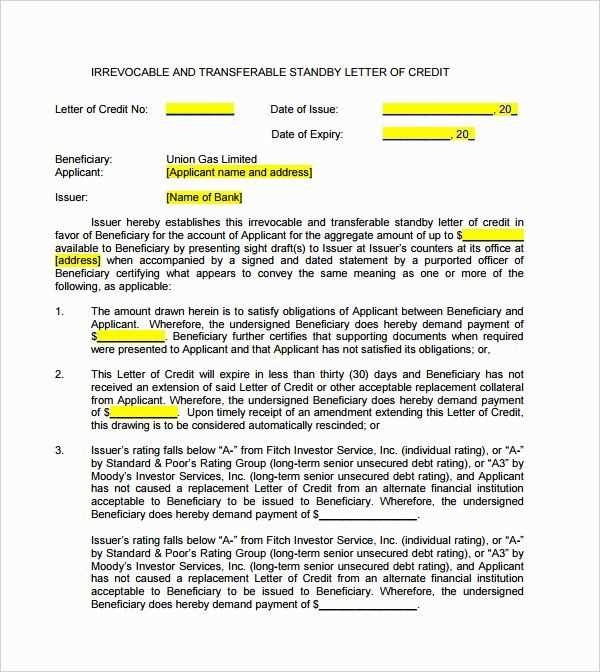

How to Send Your Repair Letter

After composing your formal request to address discrepancies in your financial records, the next step is ensuring it reaches the appropriate party. How you send your communication can have a significant impact on how quickly and efficiently the issue is handled. Choosing the right method not only guarantees that your message is delivered but also provides proof of receipt if needed.

There are various methods for sending your communication, each with its own benefits and considerations. Here’s a guide to help you choose the most effective way to send your message:

- Certified Mail: This method provides proof that your communication was sent and received, which can be crucial if there’s any dispute about whether the request was received. You’ll also receive a tracking number.

- Email: If the recipient accepts digital submissions, email is a fast and efficient option. Be sure to request a read receipt to confirm your message has been opened.

- Fax: For immediate delivery, faxing can be an effective option. Be sure to retain a fax confirmation page as proof of transmission.

- In Person: If possible, delivering your request in person ensures it’s received directly by the right person. Request a signed receipt to have a record of delivery.

Whichever method you choose, always retain proof of delivery for your records. This can be important if you need to follow up or take further action later on.

Where to Download Free PDF Templates

If you’re looking for professionally designed documents to help address discrepancies or disputes in your financial records, there are many resources available where you can find free, downloadable options. These tools can help ensure your communication is clear, well-structured, and effective, saving you time and effort in creating your own from scratch.

Here are some reliable sources where you can download free, ready-to-use formats:

- Online Document Libraries: Websites that specialize in providing free legal or financial document templates often offer a wide range of formats that can be customized according to your needs.

- Government and Nonprofit Websites: Many government agencies and nonprofit organizations provide free forms for individuals seeking to address financial issues. These resources are generally well-designed and legally sound.

- Online Marketplaces: Some websites offer free downloadable versions of documents as part of a promotional effort. Be sure to check the website’s legitimacy before downloading.

- Document Sharing Platforms: Websites like Google Docs or Microsoft Office Online sometimes offer free templates for individuals in need of professional-looking formats.

Always review any document before use to ensure it meets your specific requirements and contains all necessary details for your communication.