Gift letter template pdf

If you’re planning to give a gift of money or property, a gift letter is a simple yet powerful tool to confirm the transaction. It outlines the nature of the gift, the donor’s details, and assures that no repayment is expected. This document is crucial for both the giver and the receiver, providing clarity and preventing any misunderstandings down the line.

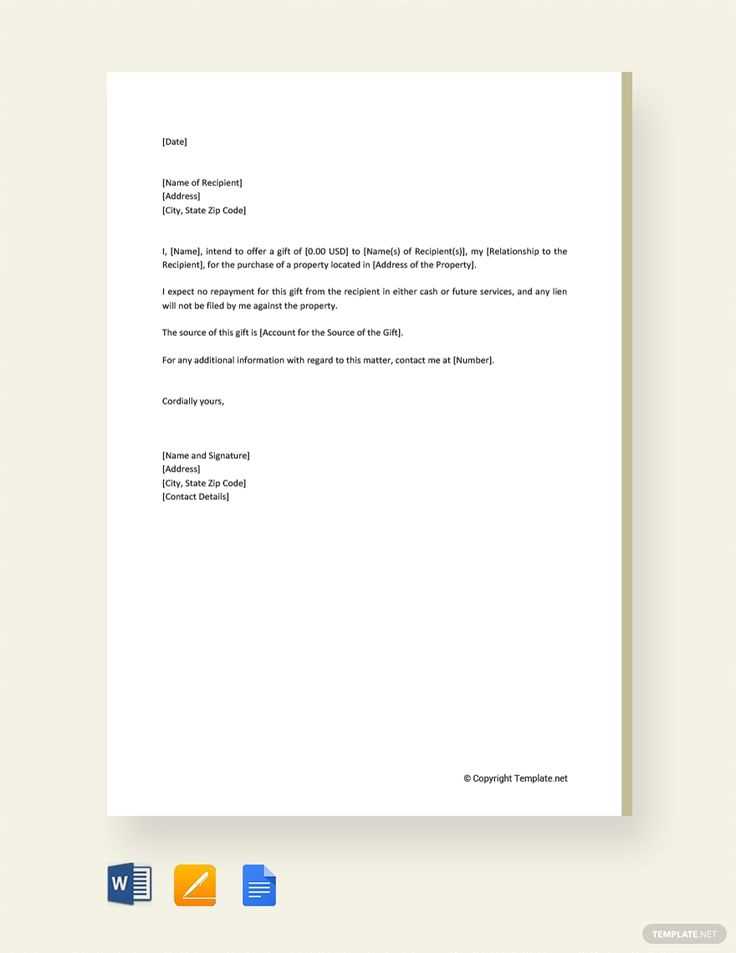

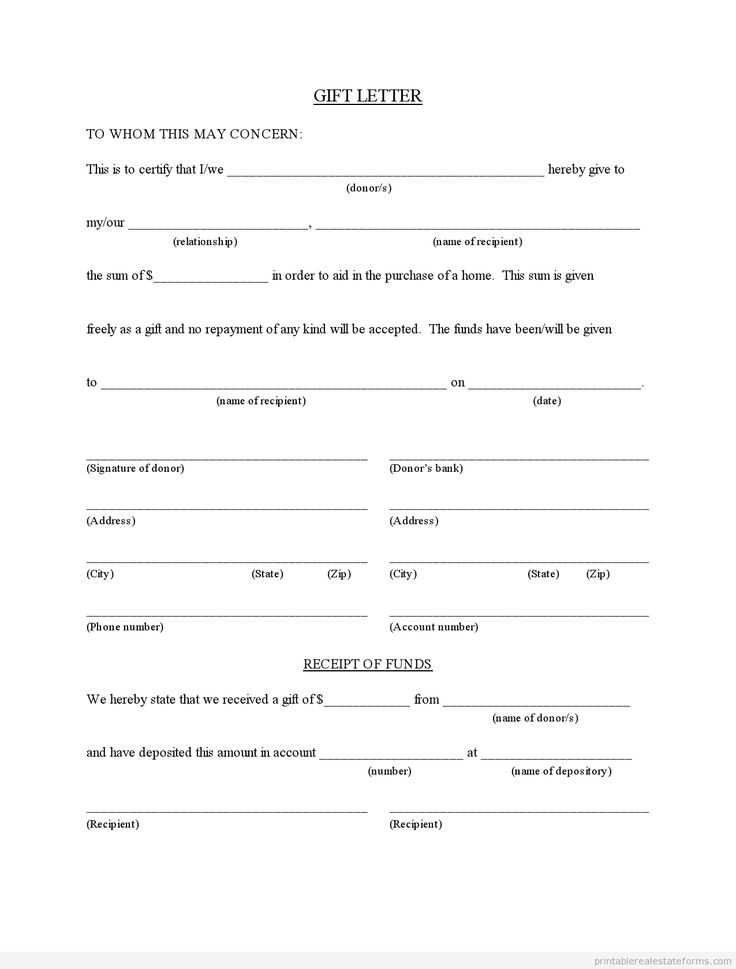

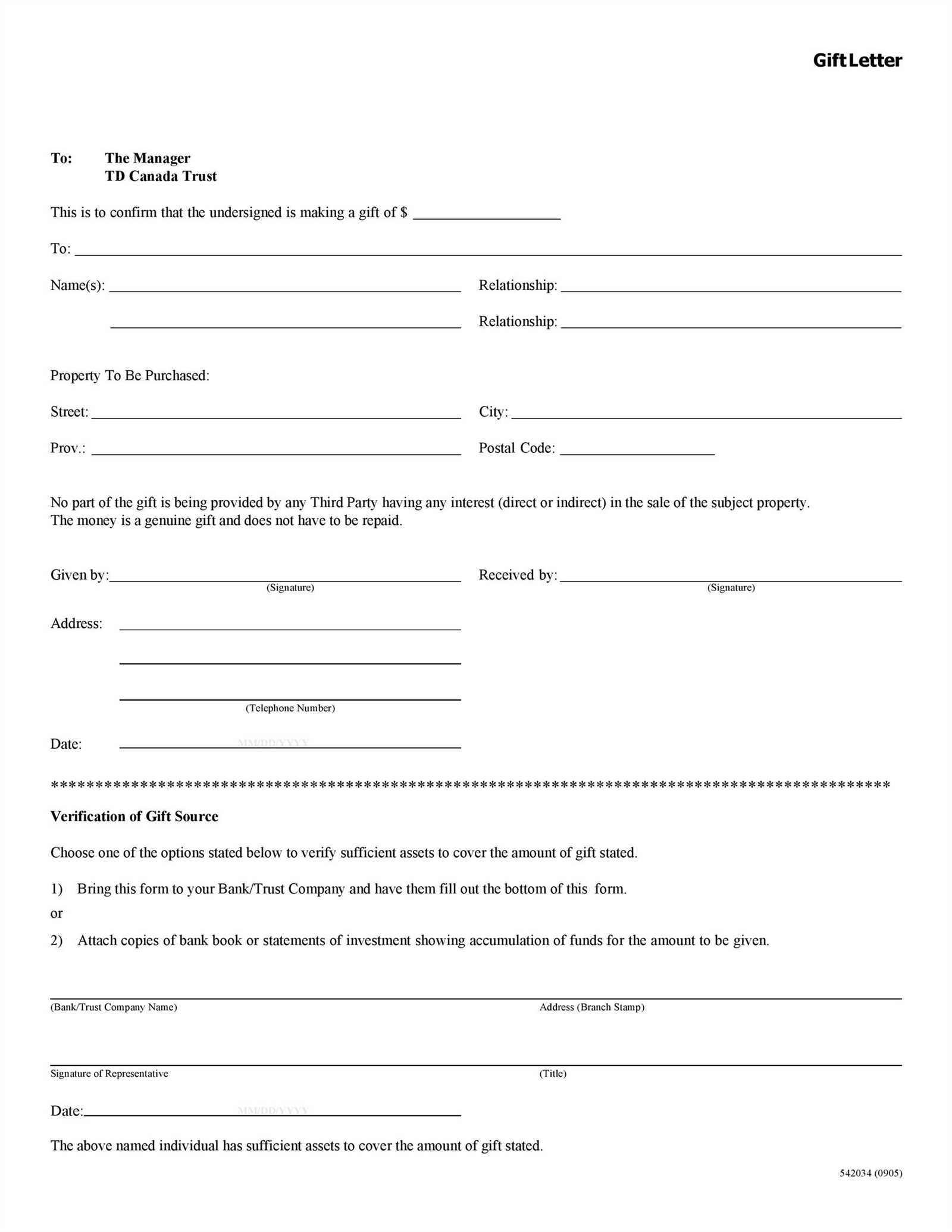

To make the process smoother, consider using a gift letter template PDF. This format is widely accepted by financial institutions and can save you time. It provides a clear structure to follow, making sure all necessary information is included, such as the donor’s full name, address, and relationship to the recipient. A well-written letter can help streamline processes like mortgage approvals or legal matters where proof of the gift is required.

When filling out the template, ensure you specify that the gift is non-repayable and that there is no expectation of reimbursement. This detail can be particularly important for situations where the gift impacts financial qualifications, such as loan applications. Once completed, simply save it as a PDF for easy sharing and printing.

Here’s the revised text:

Start by clearly stating the amount being gifted and the purpose of the gift. Mention the relationship between the giver and the recipient to make the context clearer. This section helps avoid any confusion regarding the nature of the transfer.

Ensure you include both parties’ full names and addresses. This will verify the identities involved, adding to the legitimacy of the letter. It’s also beneficial to have the date of the letter to clarify the timing of the gift transaction.

If applicable, note any terms or conditions attached to the gift. For example, whether it’s a one-time gift or if it has specific usage limitations. This provides transparency and prevents misunderstandings later on.

Conclude with a declaration confirming that the gift is given voluntarily and without any expectation of repayment or compensation. This is crucial for maintaining the legal standing of the gift.

Gift Letter Template PDF: Practical Guide

Understanding the Purpose of a Gift Letter

Key Elements to Include in Your Template

Formatting and Customizing a PDF Letter

Legal Considerations When Using a Gift Document

Common Mistakes to Avoid in Gift PDFs

How to Download and Edit a Template

A gift letter serves as a formal declaration that a financial gift has been given to an individual, often to help with purchases like a home. The purpose of the letter is to clarify that no repayment is expected, which is vital for tax purposes and other financial transactions.

Key Elements to Include in Your Template

Your gift letter should include the donor’s name, the recipient’s name, the date the gift was made, the amount of the gift, and a clear statement confirming that the gift is non-repayable. Additionally, specifying the purpose of the gift (e.g., for a home down payment) can help provide further context. Don’t forget to have both parties sign the letter to authenticate the gift.

Formatting and Customizing a PDF Letter

The template should be simple and professional. Use a clean layout with clearly defined sections for each key element. Customize it by adding any specific information relevant to the gift transaction. Once the content is complete, ensure the document is saved as a PDF for easy sharing and printing, preserving the formatting across devices.

Be mindful of the font and style used–choose a legible, neutral font like Arial or Times New Roman to maintain clarity. The document should not be too long or complicated; keep the text straightforward and focused on the necessary details.

Legal Considerations When Using a Gift Document

Before finalizing your gift letter, check local regulations to ensure that all required legal elements are included. Some jurisdictions may require additional documentation to verify the gift’s authenticity. Consult with a legal professional if you’re uncertain about what needs to be included, especially for large monetary gifts.

Also, be aware that large gifts may trigger tax implications, both for the donor and the recipient. It’s wise to consult a tax advisor to understand the potential tax burden or reporting requirements associated with the gift.

Common Mistakes to Avoid in Gift PDFs

Avoid vague language. Ensure the gift’s intent is clearly stated, and that there are no ambiguities about whether the gift is repayable. Be careful with the donor’s and recipient’s details–errors here could lead to confusion. Finally, make sure the letter is signed by both parties; without signatures, the gift letter may not hold up in financial or legal proceedings.

How to Download and Edit a Template

To get started, search for a downloadable gift letter template online. Once you have found a PDF version, you can use free editing tools like Adobe Acrobat Reader or other PDF editing software to fill in the required details. Always save a copy for your records before sending or submitting the document.