Gift of equity letter template pdf

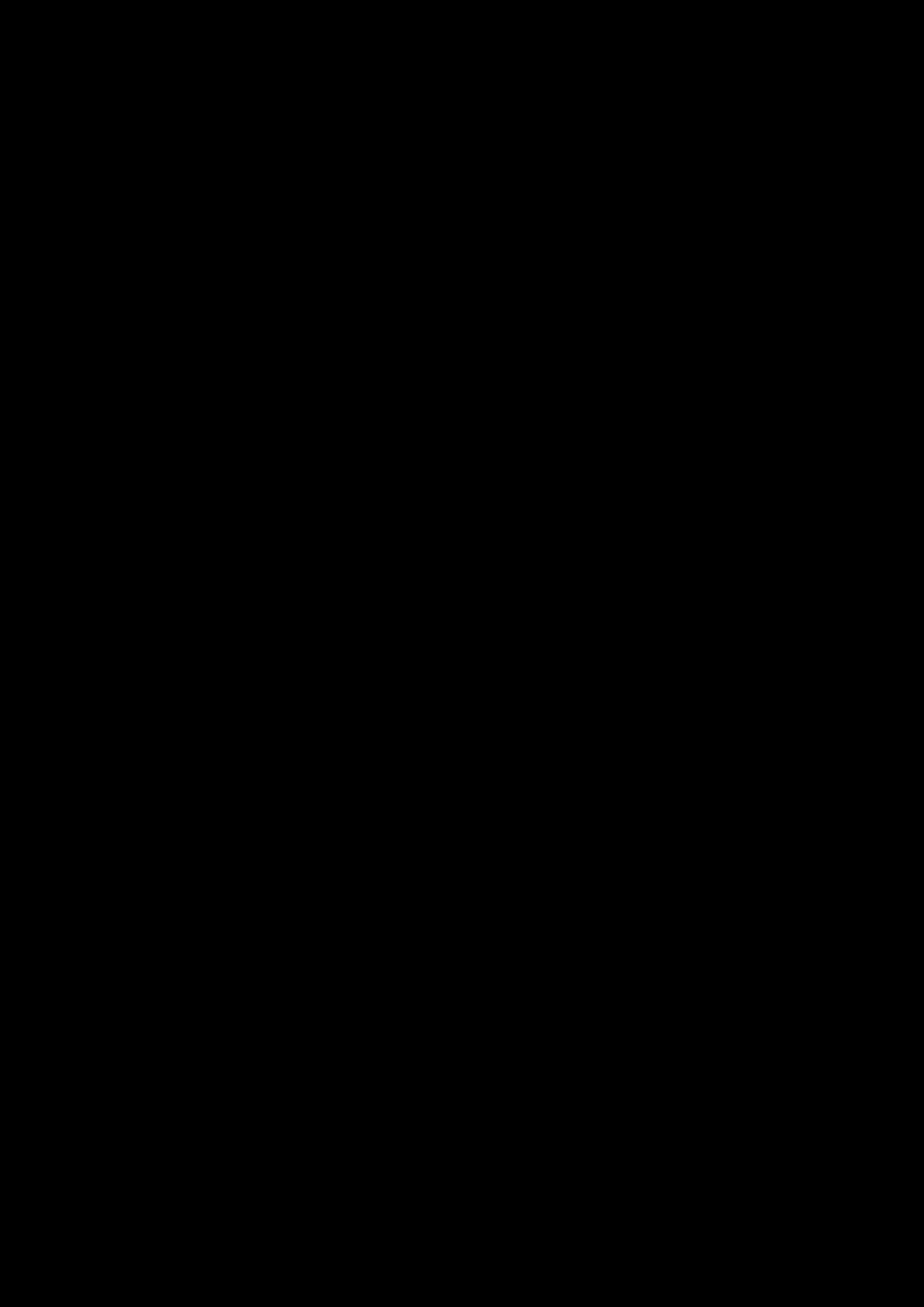

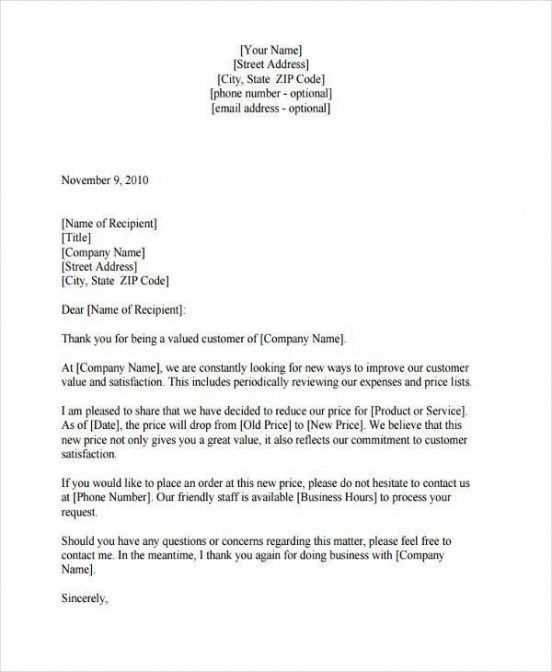

A Gift of Equity Letter serves as an important document in real estate transactions, where a seller provides a gift of equity to the buyer, often within family transactions. This letter outlines the terms of the gift and should be clear, concise, and legally sound to avoid confusion. Below is a simple template that can be adapted to various situations.

Template for a Gift of Equity Letter

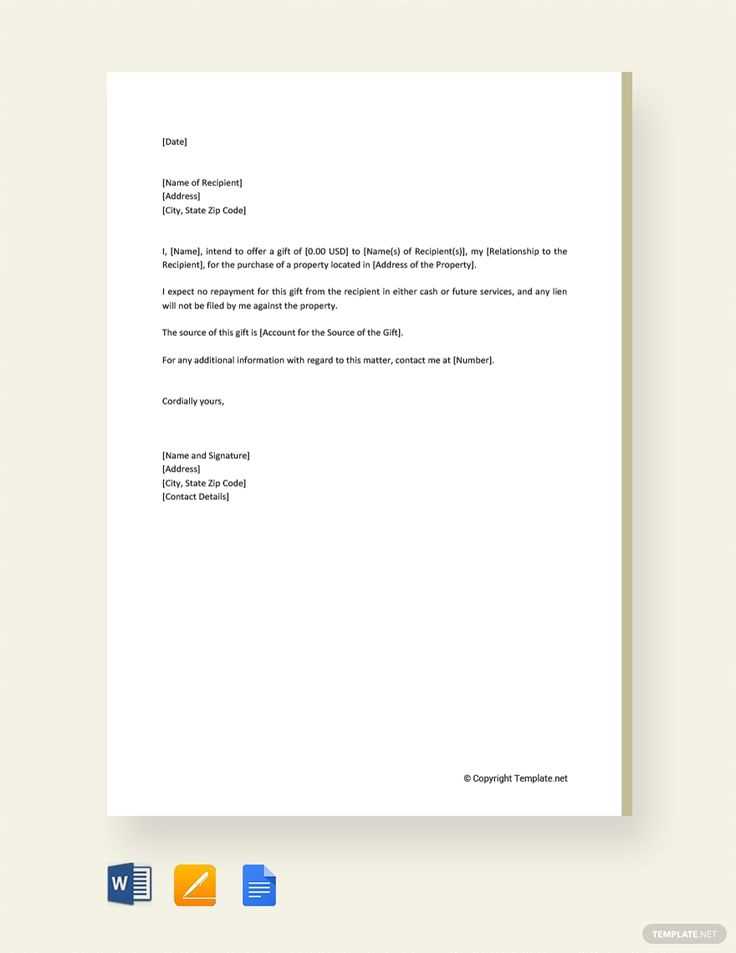

To whom it may concern,

I, [Seller’s Full Name], am the legal owner of the property located at [Property Address]. I hereby acknowledge and confirm that I am gifting an equity amount of [Dollar Amount or Percentage] of the property’s value to [Buyer’s Full Name], who is [Relationship to Seller]. This gift is given with no expectation of repayment.

This gift of equity will be applied towards the purchase price of the property during the transaction between [Seller’s Name] and [Buyer’s Name], which is being conducted on [Closing Date].

The value of the equity being gifted is based on the current appraised value of the property or the agreed-upon sale price of [Dollar Amount]. I confirm that no compensation is expected from the buyer for this gift, and it will be applied solely to the buyer’s purchase of the property.

Gift of Equity Terms

- Seller’s Full Name: [Seller’s Full Name]

- Buyer’s Full Name: [Buyer’s Full Name]

- Property Address: [Property Address]

- Gift Amount: [Dollar Amount or Percentage]

- Closing Date: [Closing Date]

This letter is provided for the purpose of documenting the gift for tax and legal purposes. Please contact me should you require any further documentation or clarification regarding this transaction.

Best regards,

[Seller’s Signature]

[Date]

Important Notes

- The recipient may be required to provide a copy of the gift letter to their lender or other involved parties.

- It is recommended that both the buyer and seller consult with a tax professional before completing the transaction to understand any potential tax implications of the gift.

This template serves as a general guide and should be customized to fit the specifics of each transaction. Make sure all parties involved are fully aware of the terms and conditions of the gift to avoid any future misunderstandings. A notarized copy of this letter might be required depending on the lender’s or state’s requirements.

Gift of Equity Letter Template PDF: A Practical Guide

Understanding the Concept of Equity Gifts

Key Elements to Include in the Gift Letter

How to Adapt the Template for Your Requirements

Legal and Tax Considerations for Equity Gifts

Step-by-Step Guide to Drafting the Letter

Common Errors to Avoid When Using the Template

When drafting a Gift of Equity Letter, it is critical to clearly define the value of the equity being transferred. Start by outlining the amount of equity gifted and the property’s market value at the time of transfer. This letter should explicitly state that the gift is non-repayable, specifying the gift’s purpose and the relationship between the donor and the recipient.

The key elements to include in your gift letter are: the donor’s name, recipient’s name, description of the gifted equity, a statement confirming the gift is not a loan, and a clear mention of the property’s value at the time of transfer. Ensure both parties sign the letter, affirming their understanding and agreement.

Adapting the template for your needs involves modifying the template to reflect specific details of the transaction. Customize the amount of equity, property description, and terms as needed. This customization ensures the letter matches the transaction accurately and fits your specific scenario.

Legal and tax considerations should not be overlooked. A gift of equity may have tax implications for both the donor and the recipient. Be sure to consult with a tax professional to understand gift tax limits, any necessary reporting, and exemptions. Certain states may require the filing of additional documents or paperwork for equity transfers, which must be accounted for in the letter.

Step-by-step guide to drafting the letter includes: first, gathering all necessary property details and verifying the equity value; second, drafting the letter with all required components; third, having both parties sign the letter; and finally, keeping a copy for personal records or submission to any relevant parties (such as a lender).

Common errors to avoid include failing to specify the relationship between the donor and recipient, leaving out the value of the property, or incorrectly worded terms that could cause confusion. Avoid these mistakes to ensure the letter is legally sound and effective.