Personal Guarantee Letter Template for Simple Use

In various situations, individuals and businesses may need to provide an assurance to secure a transaction or financial responsibility. This type of commitment is often required when a party needs to ensure their reliability or meet certain obligations. The written document serves as a formal way of expressing one’s willingness to take on responsibility in the event of non-fulfillment by another party.

The document that outlines these terms can be straightforward but must include essential details to be legally binding. By carefully structuring the agreement, both parties involved can have peace of mind, knowing their rights and duties are clearly defined. These agreements are frequently used in loan agreements, leases, and other contracts where trust plays a crucial role.

Understanding how to craft such a document is key to making sure that it holds up in legal situations. It’s important to include the correct language and ensure the terms are understandable and enforceable. A well-written document can prevent misunderstandings and disputes in the future.

Understanding the Purpose of Commitment Agreements

In many financial and business transactions, a party may be required to provide a form of security, ensuring their ability to meet specific obligations. This assurance is often necessary when one party needs to take on risk for another, providing a sense of confidence in the fulfillment of an agreement. The main purpose of such a document is to establish accountability in case of a default, where one party may be held responsible for another’s failure to meet their responsibilities.

The role of this kind of written assurance is to mitigate risk for businesses, lenders, and other parties involved in high-stakes transactions. By formalizing the commitment, it clarifies the expectations and potential consequences for both sides. This helps ensure that if the primary party does not fulfill their part of the deal, there is a secondary party willing to step in and take responsibility.

Additionally, these agreements serve as a legal safeguard. They provide clear terms and conditions that outline what is expected, protecting both sides and offering a path for legal recourse in case of breach. For the party offering the assurance, it signifies their confidence and willingness to uphold the terms in question.

Key Components of a Commitment Agreement

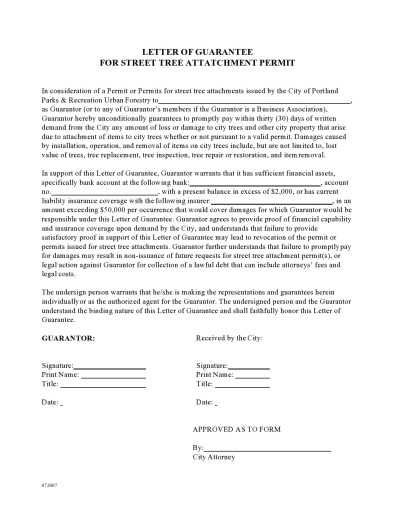

When drafting a formal agreement to ensure one party’s responsibilities, it’s crucial to include specific elements that make the document legally valid and enforceable. These components establish clarity and protect the interests of both parties involved. Understanding the core parts of this kind of document helps ensure that it fulfills its intended purpose and avoids potential legal issues.

Essential Information to Include

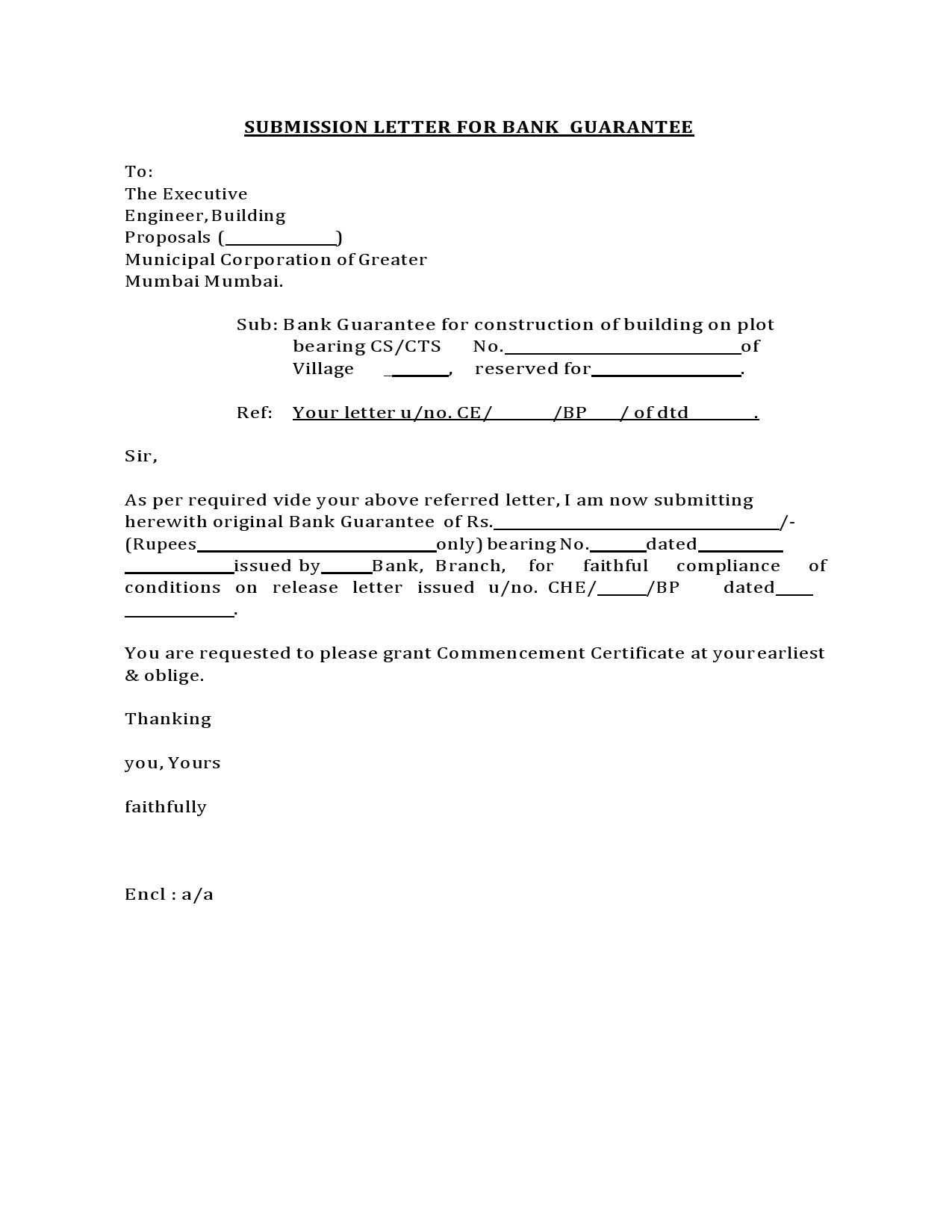

The document should start with basic information, such as the names and addresses of both parties involved, the date of the agreement, and a clear description of the obligations being secured. Detailing the nature of the responsibility and what is expected from the second party in case of default is also essential. This section serves as the foundation of the agreement, outlining the terms and establishing accountability.

Terms of Enforcement and Consequences

Next, the agreement must outline the enforcement conditions and potential consequences if the commitment is not met. This section ensures that the party providing the assurance understands the risks they are assuming. It should specify the actions that will be taken if obligations are not fulfilled, offering a clear path for legal recourse.

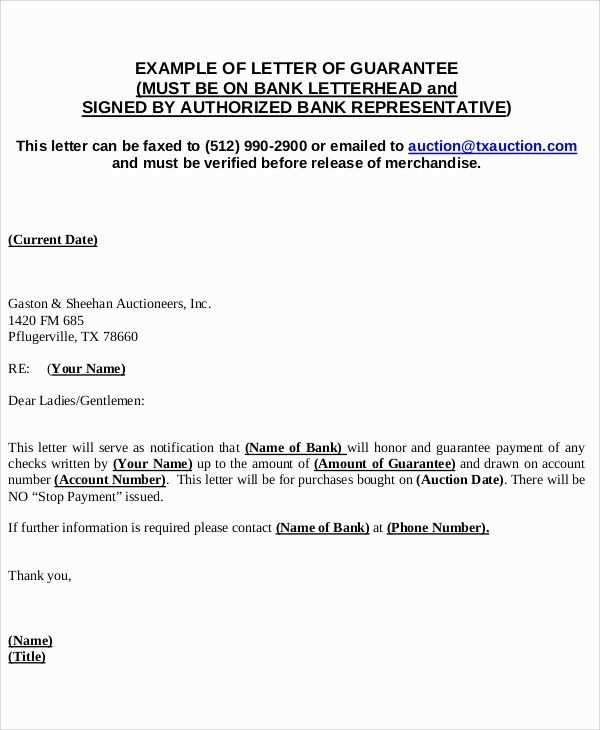

How to Draft an Effective Commitment

Creating an effective agreement to ensure fulfillment of obligations requires careful attention to detail. The document must be clear, concise, and legally sound to ensure both parties understand their responsibilities. A well-constructed commitment can prevent misunderstandings and protect the interests of all parties involved.

Start by clearly identifying the parties involved and specifying the exact terms of the commitment. The document should outline what is expected from both sides, including any timelines or conditions attached to the agreement. Be sure to use precise language to avoid any ambiguity, and ensure that all relevant information, such as the scope of the responsibility and the duration of the commitment, is included.

Additionally, it’s crucial to state the consequences for non-fulfillment in clear terms. This ensures that both parties understand the potential legal and financial risks if the terms are not met. Including dispute resolution mechanisms can also be beneficial, providing a clear process for handling any disagreements that may arise.

Common Errors to Avoid in Agreements

When drafting a formal document that outlines a commitment, it’s easy to make mistakes that can affect the validity of the agreement. These errors can create confusion, lead to misunderstandings, or even result in legal complications. Avoiding common pitfalls ensures the agreement serves its intended purpose and protects the interests of all involved parties.

Typical Mistakes to Watch Out For

- Ambiguous Terms: Vague language can make the document difficult to enforce. It’s essential to define each party’s responsibilities clearly.

- Missing Information: Failing to include important details such as the obligations, deadlines, and consequences for non-fulfillment can make the agreement incomplete.

- Inconsistent Language: Using inconsistent terms for the same concept can lead to confusion. Stick to one terminology throughout the document.

Critical Legal Oversights

- Failure to Include Legal Recourse: Not specifying the consequences in case of breach can leave both parties unprotected. Ensure the terms include penalties or actions that will follow non-compliance.

- Incorrect Signatories: Make sure that all parties who need to sign the document do so, and that they have the authority to commit to the terms.

When to Utilize a Commitment

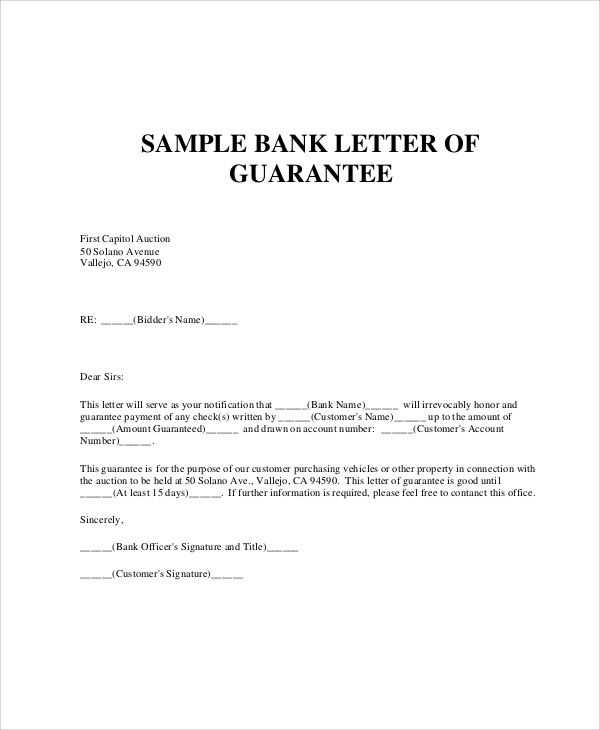

There are specific situations where an individual or business may need to step in and offer assurance for another party’s obligations. This action typically occurs when a lender, supplier, or business partner needs additional security before proceeding with a transaction. Offering such a commitment provides the necessary confidence that the obligations will be met, even if the primary party fails to fulfill their part of the deal.

One common scenario where this assurance is required is during loan agreements. If the borrower has insufficient credit or assets, the lender may request this form of commitment to reduce risk. Similarly, when entering into leases or contracts with new businesses, a supplier or landlord may ask for this additional assurance to ensure payment and compliance with the terms.

Understanding when and why to provide this type of commitment is crucial. It is often seen as a way to strengthen business relationships by demonstrating reliability and trustworthiness, especially in high-risk transactions or new partnerships.

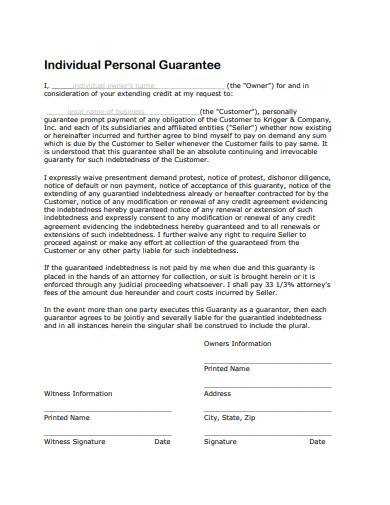

Legal Consequences of Signing a Commitment

Signing a document to assure the fulfillment of another party’s obligations carries significant legal implications. By providing this form of security, you are assuming responsibility for the other party’s actions in the event they fail to meet their commitments. This can result in both financial and legal consequences if the terms are breached.

It is essential to understand the risks involved before agreeing to such terms, as they can lead to personal or business liabilities. In the event of default by the primary party, you may be required to honor the obligations outlined in the agreement. Below is a table that outlines the potential consequences one may face when signing this kind of document.

| Scenario | Possible Legal Outcome |

|---|---|

| Failure to fulfill obligations | Financial liability for the debt or unpaid amount |

| Non-compliance with terms | Legal actions, including lawsuits or garnishment of wages |

| Refusal to honor commitment | Damage to credit score, potential bankruptcy |

Being fully aware of these potential consequences is crucial before signing any agreement, as they may have long-term financial and legal repercussions.