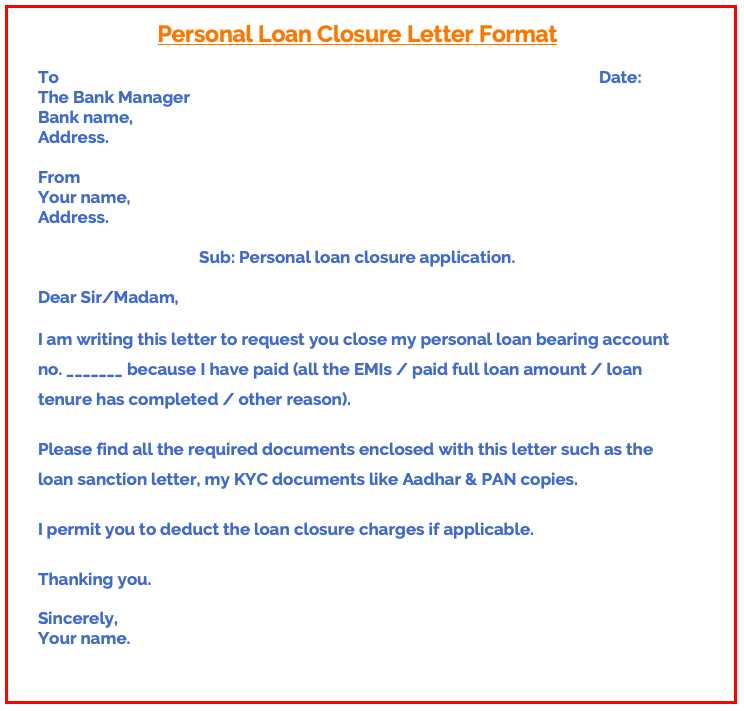

Personal loan letter template

If you need to request a personal loan, writing a clear and concise letter is crucial. A well-structured loan letter not only conveys your need for financial assistance but also highlights your credibility as a borrower. Follow this template to craft an effective letter that addresses all the necessary details and makes a positive impression on the lender.

Start by clearly stating your request. Mention the loan amount you seek, the purpose for which it will be used, and the terms you are hoping for. Lenders appreciate straightforwardness, so avoid unnecessary details that don’t directly relate to your request.

Next, demonstrate your ability to repay the loan. Include relevant financial information such as your income, employment status, or any assets that might strengthen your case. It’s important to convey confidence in your repayment plan without overstating your financial position.

Finally, wrap up by thanking the lender for considering your request. Be polite and professional, and offer to provide any additional documentation or clarification if needed. A respectful tone goes a long way in establishing trust with the lender.

Here’s the revised version:

Begin your personal loan request letter by clearly stating your need for the loan. Specify the exact amount you require, the purpose for which you will use the funds, and how you plan to repay the loan. This shows that you have thought through your request carefully.

Loan Details

Include the amount requested and the proposed repayment schedule. Be realistic about the repayment plan and show that you have the means to manage the payments. A clear breakdown of the loan amount and interest, if applicable, will help establish your credibility.

Repayment Assurance

Provide details about your income or assets that ensure you can meet the repayment terms. This reassures the lender that you will be able to fulfill your financial obligations. Be honest about your financial situation, as transparency fosters trust.

Conclude with a courteous statement expressing gratitude for considering your request. A professional tone throughout the letter, along with precise details, will strengthen your case for loan approval.

- Personal Loan Letter Template

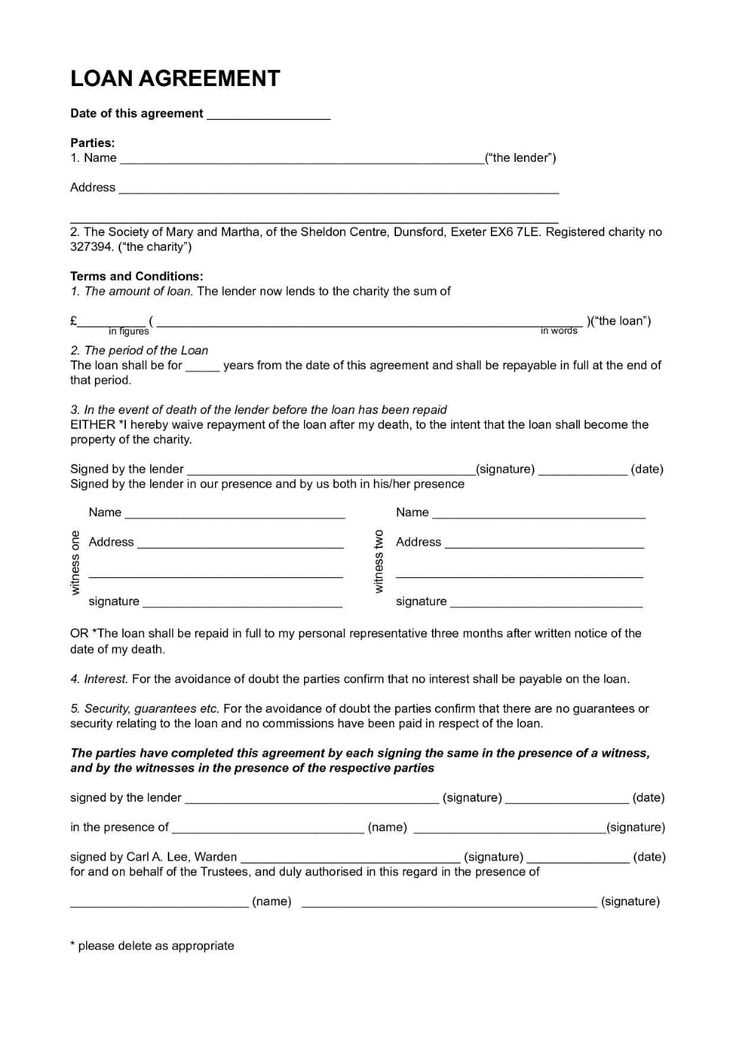

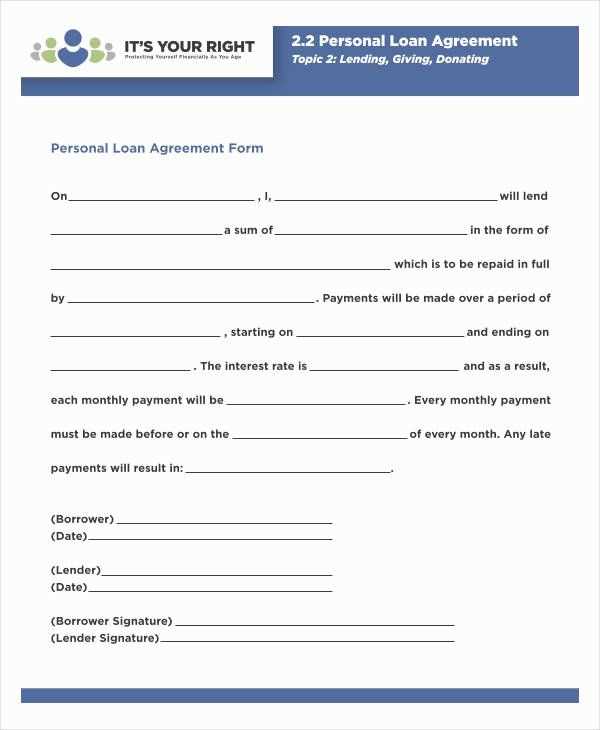

To write a personal loan letter, clearly outline the loan terms, the purpose of the loan, and your repayment plan. Include all necessary details for transparency and ease of understanding for the lender.

Basic Information to Include:

| Section | Details |

|---|---|

| Borrower Details | Full name, address, and contact information. |

| Lender Details | Name, address, and contact information of the lender. |

| Loan Amount | Exact sum requested, with currency specified. |

| Purpose of Loan | Brief explanation of why the loan is needed. |

| Interest Rate | State the agreed-upon interest rate (if applicable). |

| Repayment Terms | Outline the schedule and method of repayment (e.g., monthly payments, lump sum, etc.). |

Make sure to keep the language formal but straightforward. It helps to mention any collateral or co-signers, if applicable, and provide a signature line for both parties.

To write a clear and convincing personal loan request, focus on the essentials: the purpose of the loan, the amount you need, and your repayment plan. Be concise and straightforward while providing enough detail for the lender to understand your situation and evaluate the loan terms properly.

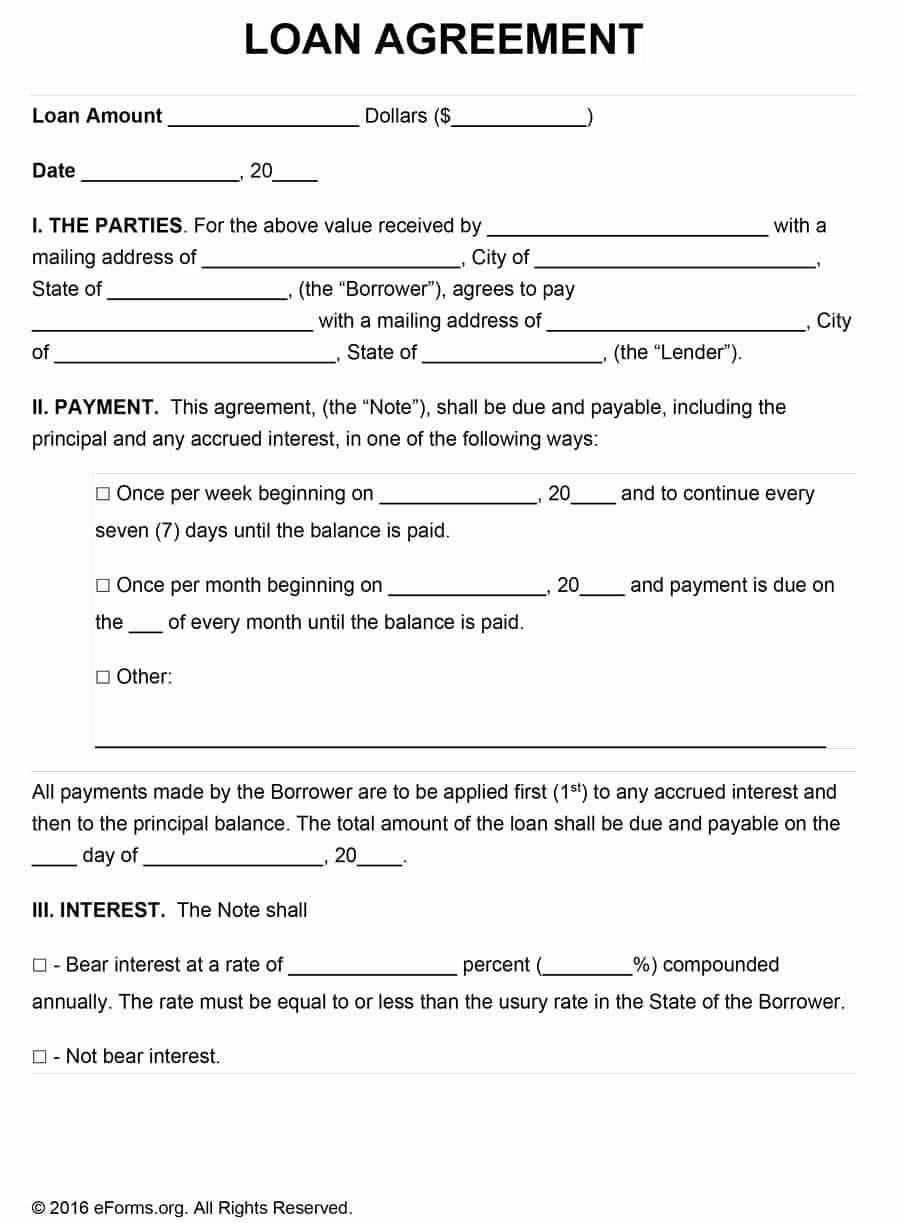

Step 1: State the Loan Amount and Purpose

Start by specifying the exact loan amount you’re requesting. Be clear about why you need the loan, whether it’s for medical expenses, home improvements, or another purpose. Giving a direct reason helps establish trust and transparency with the lender.

Step 2: Explain How You Plan to Repay

Outline a realistic repayment plan. Include your monthly income and expenses to show that you can handle the loan repayment. If possible, mention any collateral or assets you can offer as security. Lenders want to see that you are capable of managing the loan responsibly.

Clearly state the loan amount you are requesting. Specify the exact sum you need and ensure it aligns with your intended purpose for borrowing. Providing a clear and reasonable figure can help the lender assess your request more efficiently.

Include the repayment terms. Detail how and when you plan to repay the loan. Whether it’s a fixed schedule or flexible payments, define the frequency (e.g., monthly, quarterly) and the duration. This helps the lender evaluate your repayment capability.

Explain the purpose of the loan. Specify why you need the funds, whether for personal reasons, a project, or emergency expenses. This can provide context and demonstrate responsibility in handling the loan.

Offer a brief background on your financial situation. Mention your income, assets, and any existing debts. This information helps the lender understand your financial position and assess risk.

Provide contact information for follow-up. Include a phone number or email address for the lender to reach you for further questions or to discuss the loan request.

Ensure a formal and professional tone throughout the letter. While being clear and direct, avoid overly casual language. This enhances the credibility of your request.

End with a polite closing statement, expressing your appreciation for the lender’s time and consideration. This creates a positive tone and invites further communication.

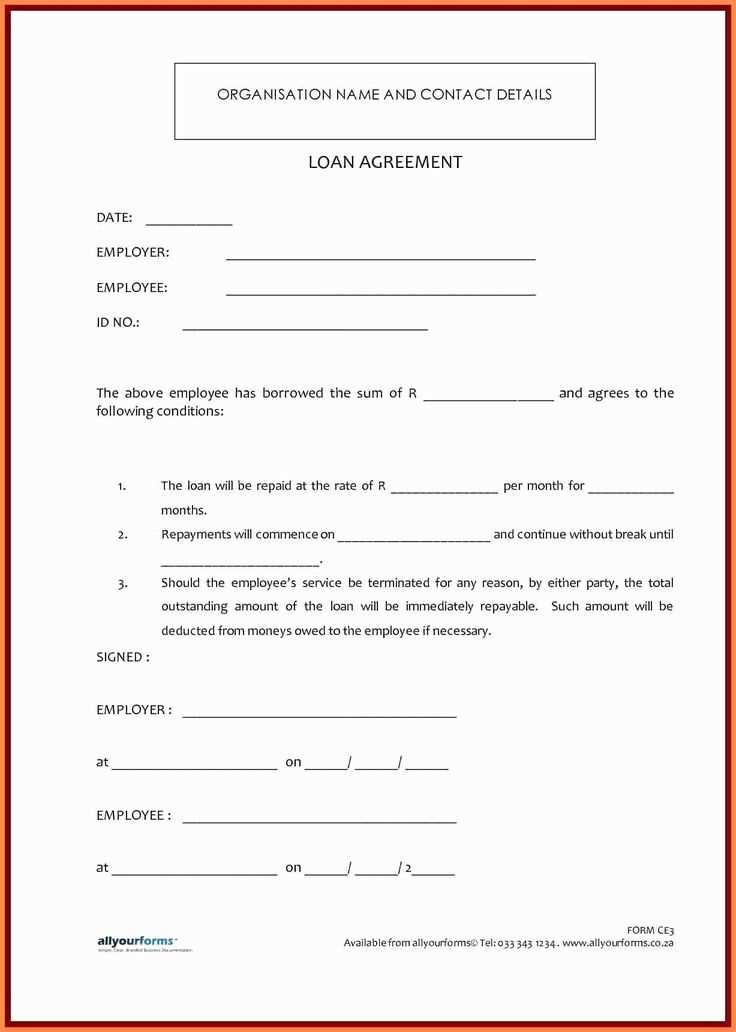

What Information to Provide About Loan Terms

Clearly outline all the details that define the loan agreement. Here’s a breakdown of the essential elements to include:

- Loan Amount: State the exact amount being borrowed, as well as any potential adjustments or limits to this sum.

- Interest Rate: Specify the annual interest rate, whether it’s fixed or variable, and how it will be applied over the course of the loan.

- Loan Term: Indicate the total duration of the loan. Specify both the start and end dates, and include any grace periods or deferred payments if applicable.

- Repayment Schedule: Detail when payments are due, the frequency (monthly, bi-weekly, etc.), and the amounts for each installment.

- Fees and Charges: Identify any fees tied to the loan, including origination fees, late payment fees, and prepayment penalties.

- Collateral (if applicable): If the loan requires collateral, describe the assets that will be pledged as security for the loan.

- Loan Purpose: Clarify the purpose of the loan, particularly if the loan is intended for specific uses such as home improvement, debt consolidation, or education.

- Repayment Method: Explain the accepted methods for making payments, such as bank transfers, checks, or automatic deductions.

- Consequences of Default: Outline the repercussions for missing payments or defaulting on the loan, including any legal actions or asset seizures that may occur.

By providing these details, you establish transparency and set clear expectations for both parties involved in the loan agreement.

Begin by clearly outlining the total loan amount and the agreed-upon interest rate. This sets the foundation for the repayment terms. Then, specify the repayment start date and the frequency of payments, whether it’s weekly, bi-weekly, or monthly. Indicate the exact amount to be paid in each installment, making sure it aligns with the loan amount and interest.

Breakdown of Payment Amounts

Provide a detailed breakdown of how each payment is applied. This could include the principal and the interest portions, so the borrower understands how their payments are split. Include the exact duration of the repayment period, whether it’s six months, one year, or longer, with clear monthly or periodic totals.

Late Payment Penalties

Clearly state any penalties for missed or late payments. Mention the exact fee, how it will be added to the total, and the period after which late fees apply. This ensures both parties are aware of potential additional costs. End with a clear statement about how any adjustments, such as early payments, will be treated–whether they reduce the principal or are applied to future installments.

How to Address the Lender’s Concerns

To build trust with a lender, be clear and transparent in your communication. Begin by addressing your financial stability, outlining your income sources, employment history, and current obligations. Include any assets that demonstrate your ability to repay the loan. Be specific about your repayment plan, showing that you have a solid strategy for managing the loan terms. For example, if you’re seeking a personal loan for an emergency, explain why this situation is temporary and how you plan to return to stable financial footing.

Demonstrate Your Creditworthiness

If you have a good credit score, make sure to highlight this as it is a direct indicator of your ability to repay loans. If your credit score is lower, provide context for this. Perhaps you faced a temporary hardship or had a medical emergency–be honest. Acknowledging past difficulties while showing how you’ve managed them can reassure the lender of your reliability. If possible, share any steps you’ve taken to improve your financial situation, such as debt repayment or budgeting practices.

Explain the Purpose of the Loan

Be clear on how you plan to use the loan funds. Lenders are more likely to approve loans when they see that the money will be used responsibly. Avoid vague explanations and instead, provide specific details. For instance, if you’re seeking the loan to consolidate debt, outline which debts you will pay off and how this will lower your monthly obligations.

Offer reassurances about your commitment to fulfilling the loan’s terms. If you’ve had any previous loans, mention how you handled them, emphasizing your timely repayments. This not only builds confidence in your character but also highlights your financial discipline.

One of the most frequent mistakes is failing to provide enough detail about the purpose of the loan. Be clear about why you need the funds and how you plan to use them. A vague or unclear explanation can raise doubts and may result in a rejection. Specify your needs and show that you’ve thought through your plan carefully.

Unclear Repayment Plan

Always outline a clear repayment schedule. Lenders want to know that you have a realistic plan for paying back the loan. Avoid presenting an unclear or overly optimistic repayment timeline. Include the amount you can afford to repay each month and ensure it fits your budget.

Incorrect or Missing Personal Information

Ensure all your personal and financial details are accurate. Double-check your contact information, employment status, and credit history. Incomplete or incorrect data can lead to delays or rejections. If something changes after submitting the request, inform the lender immediately.

Another mistake is failing to check the loan terms carefully. Always review the interest rates, fees, and repayment conditions. Misunderstanding these terms can lead to unexpected financial challenges later.

Finally, not proofreading your loan request is a critical error. A loan request with spelling and grammatical mistakes can create an impression of carelessness. Take the time to carefully revise your letter before submission.

To create a personal loan letter that stands out, ensure it clearly conveys your request, the purpose, and repayment terms. Keep the tone polite and formal but straightforward, highlighting the necessity of the loan and your plan for repayment.

Key Elements to Include

- Your details: Full name, address, and contact information.

- Lender’s details: Name, company (if applicable), and contact information.

- Loan amount: Clearly state the specific amount of money you are requesting.

- Purpose of the loan: Briefly explain why you need the loan.

- Repayment plan: Outline how and when you will repay the loan.

Formatting Tips

- Keep the letter concise and focused on the main points.

- Use clear, professional language and avoid unnecessary details.

- Ensure proper structure, with an introduction, body, and conclusion.

By following these steps, you’ll craft a clear and effective personal loan letter that meets your needs and presents you as a reliable borrower.