Printable Mortgage Gift Letter Template for Easy Use

When someone helps a borrower with financial support, it’s important to formally acknowledge the assistance through an official document. This serves to verify the nature of the contribution, ensuring that it complies with all necessary regulations. A well-prepared document can make the process smoother, both for the person offering the help and for the individual receiving it.

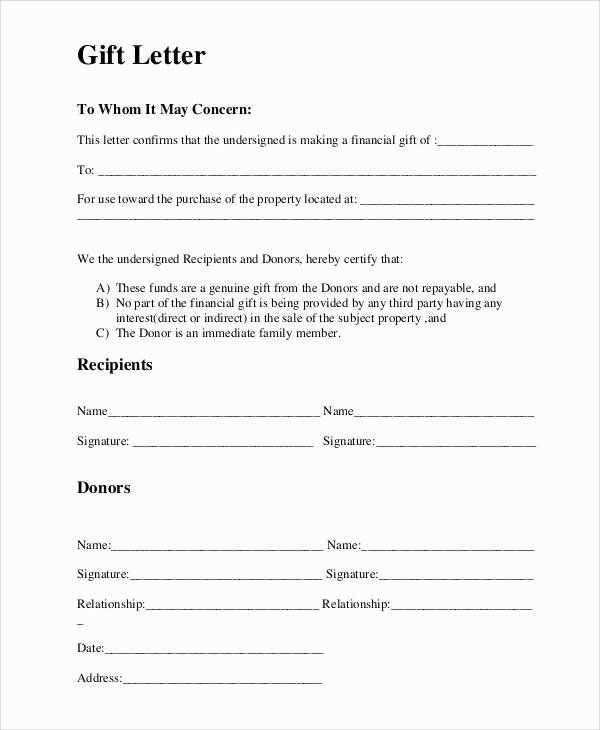

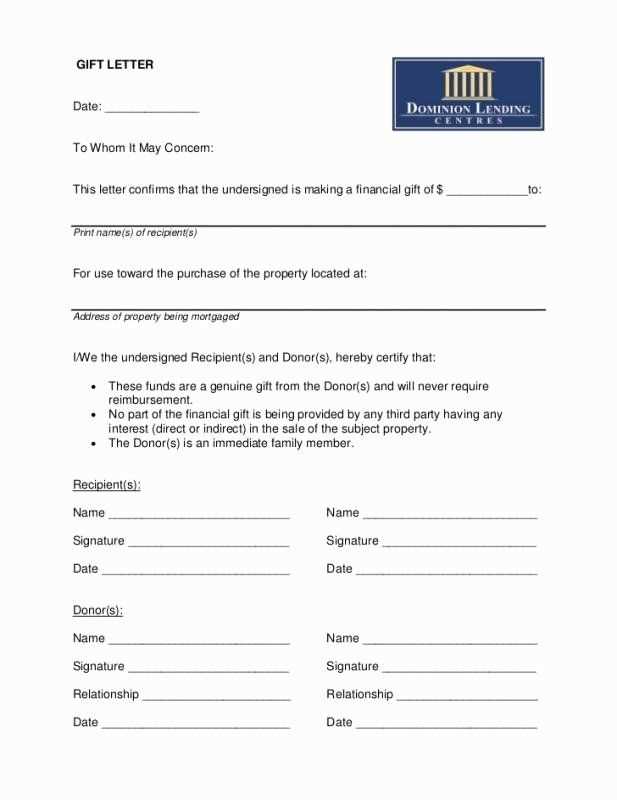

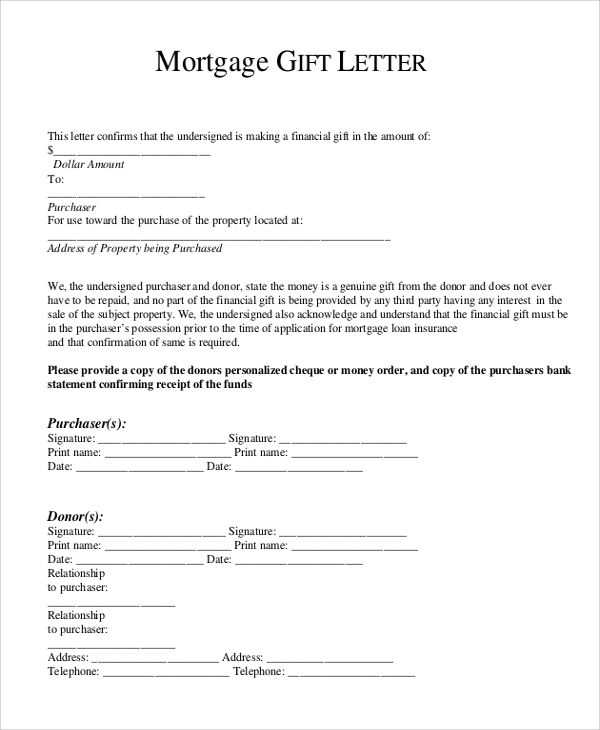

Key Components to Include

For clarity and accuracy, certain details are essential in such a document. These elements will ensure that both parties are clear on the terms of the assistance, preventing any misunderstandings in the future.

- Names of the Parties Involved: Full names of both the giver and the receiver must be included.

- Amount of Support: Clearly state the financial amount being provided.

- Purpose of the Contribution: Mention the reason for the support, such as helping with a home purchase.

- Statement of Non-Repayment: Specify that the funds do not need to be paid back.

- Relationship Between Parties: Briefly describe the relationship to clarify that the support is legitimate.

Writing the Document

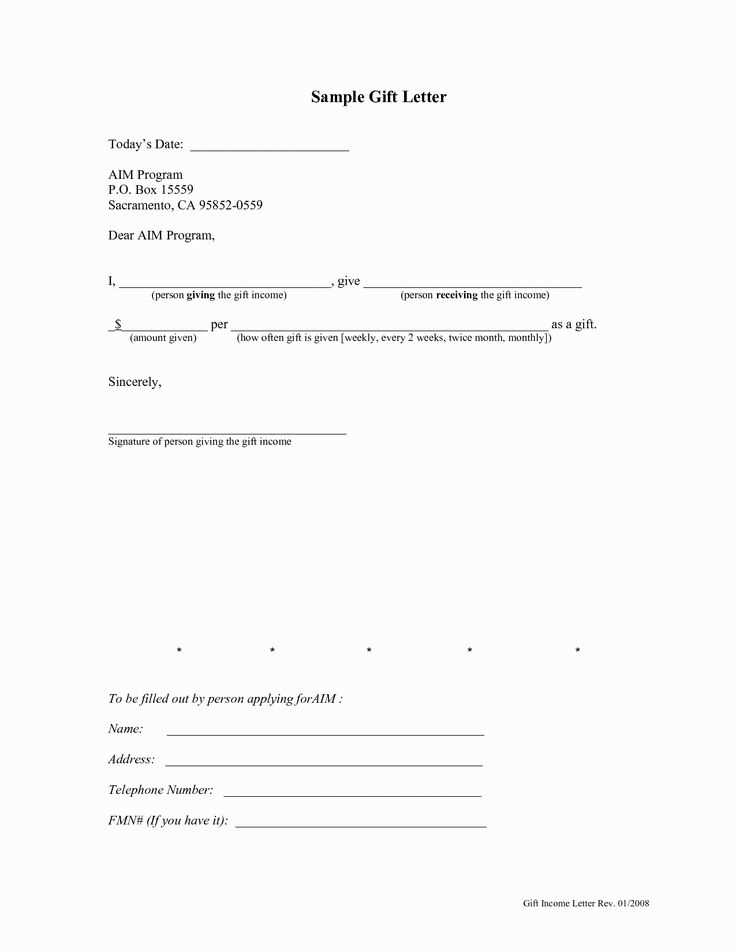

When creating this official form, it’s important to follow a structured approach. Begin by listing the date of the document creation. Then, make sure that both parties provide clear and concise details regarding the transfer of funds, including the amount and any relevant terms.

Common Mistakes to Avoid

To ensure the validity of the document, steer clear of the following errors:

- Omitting Important Details: Be sure to include all necessary information, such as the exact amount and purpose of the funds.

- Using Unclear Language: Avoid vague terms that may lead to confusion or legal issues later on.

- Not Getting Signatures: Both parties must sign the document to make it legally binding.

Importance of Compliance

Ensuring that the document complies with local regulations is essential. The proper handling of financial support documents is not only a formality but a necessary step for both the giver and the recipient. A well-structured document prevents future disputes and protects all involved parties.

Understanding Financial Support Documents

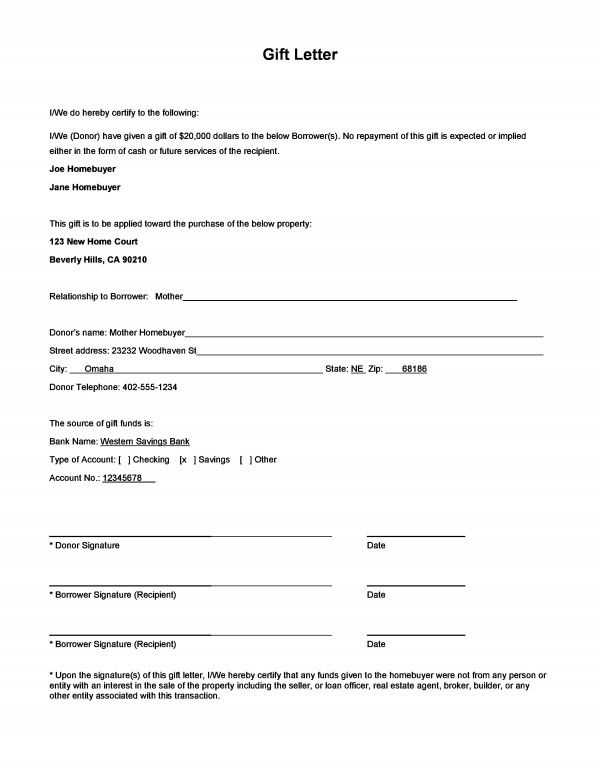

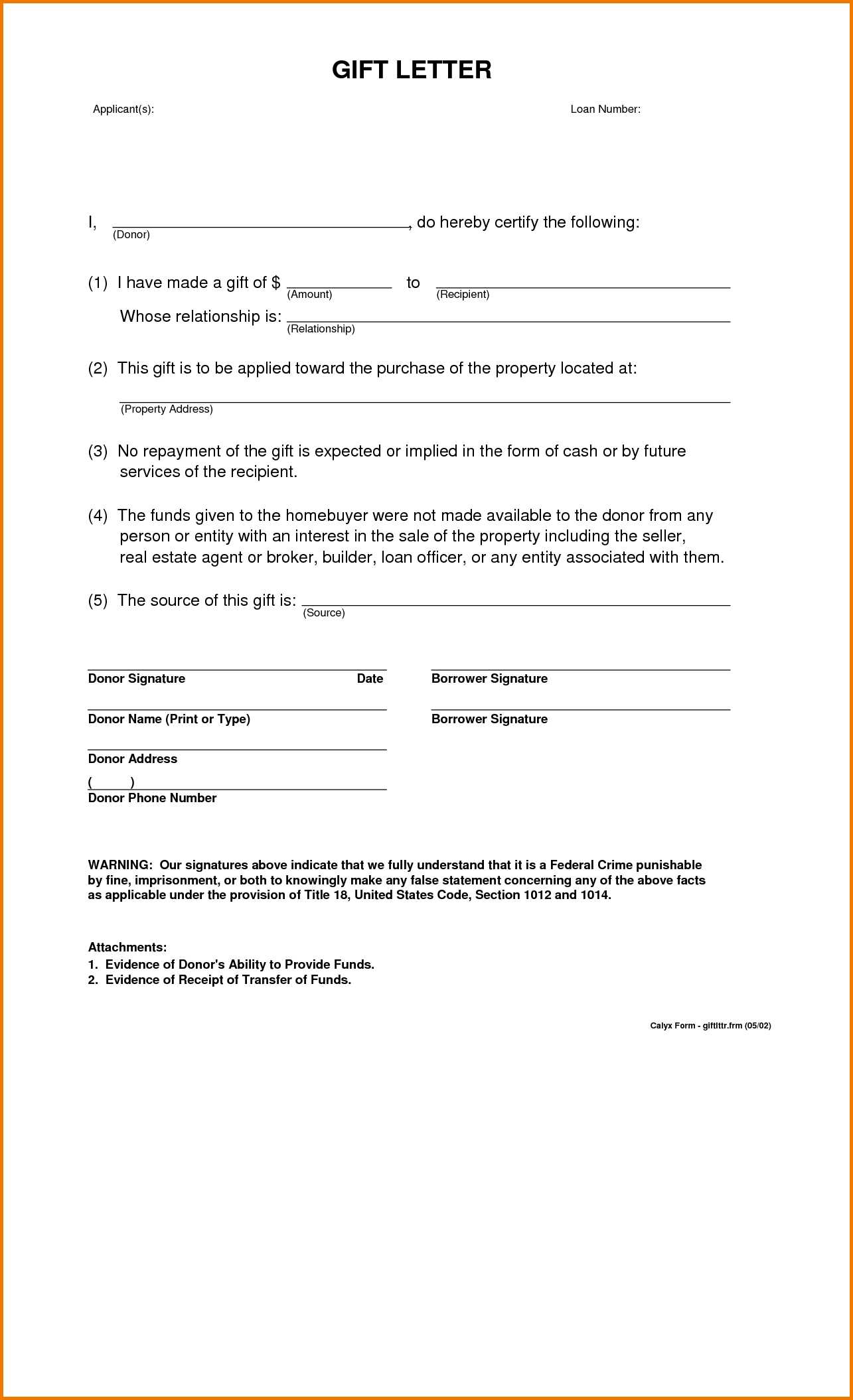

When one individual assists another with funds for a significant purpose, such as buying a home, formal documentation is required to ensure clarity and legal compliance. This paperwork verifies the transfer of money, specifying terms and ensuring both parties are in agreement. Properly drafted, this document is crucial for both the giver and the recipient, particularly in scenarios involving financial institutions.

Key Elements to Include

Several critical details must be present in the document to make it valid and clear:

- Parties Involved: Full names of both the person providing the funds and the one receiving them.

- Amount Transferred: Exact sum of the financial support being provided.

- Purpose of Support: Briefly outline why the funds are being provided, such as for a home purchase.

- Repayment Terms: Clarify that the support is a gift and does not require repayment.

- Relationship Between Individuals: Indicate the connection between the giver and the recipient, such as family or close friend.

How to Create a Valid Document

To ensure that the document is legally recognized, follow these steps:

- Start with Basic Information: Include the date, names, and a clear statement of the amount and purpose.

- Detail the Terms: Be specific about the fact that the contribution is a non-repayable gift.

- Get Signatures: Both parties must sign to confirm the accuracy of the information provided.

Avoiding Common Mistakes

It’s essential to avoid certain mistakes when drafting such a document:

- Omitting Key Information: Ensure all details about the amount, purpose, and terms are clearly outlined.

- Unclear Language: Use precise and formal language to prevent ambiguity.

- Failure to Sign: Both parties should sign to formalize the agreement.

The Impact on Loan Approval

Financial institutions often require such documentation to ensure that the funds do not count as a loan or increase debt obligations. A well-drafted document can aid in securing loan approval, as it shows that the financial assistance is genuine and non-repayable.

Legal Aspects of Financial Support Documentation

Legal compliance is crucial when drafting these documents. Different jurisdictions may have varying requirements, so it’s important to check local regulations to ensure everything is in order.

Effective Use of Financial Assistance Documents

Using this type of documentation correctly can streamline the financial process. By ensuring that all details are accurate and complete, both the giver and the recipient can avoid complications. Additionally, understanding the potential legal implications helps both parties maintain a smooth relationship throughout the process.