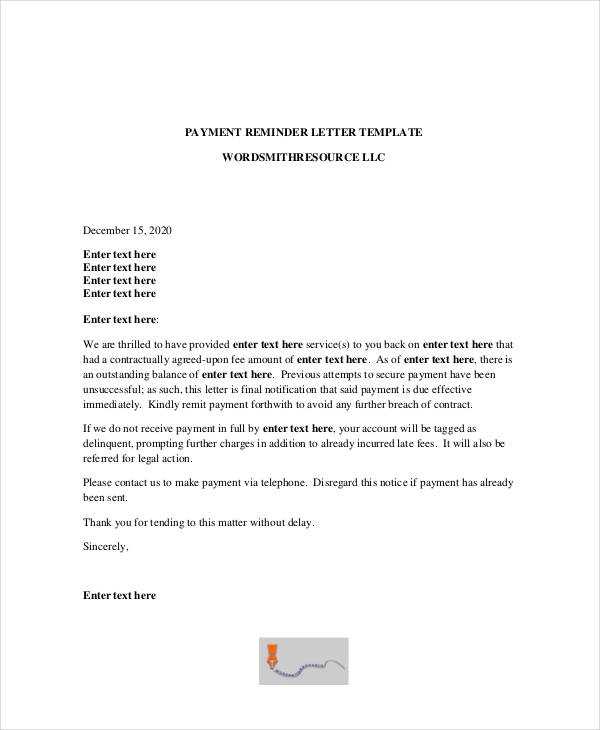

Payment Request Template Letter for Effective Communication

Securing payments for goods or services provided is crucial for maintaining business operations. When funds are overdue, clear communication is essential to prompt action from the client or customer. A professional message requesting payment can help resolve these situations efficiently while maintaining positive relationships.

Key Elements of a Successful Payment Reminder

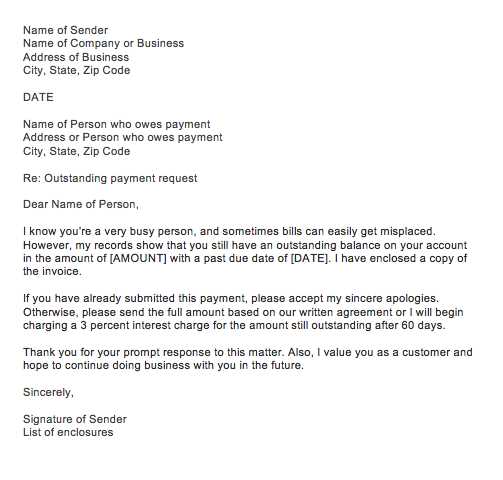

To ensure your message is effective, include the necessary details. Start by stating the reason for the communication, the amount due, and the due date. It’s important to remind the recipient of their outstanding balance without sounding confrontational.

Essential Information to Include:

- Amount Due: Be clear and precise with the figure.

- Due Date: Mention the original payment deadline.

- Payment Instructions: Provide clear guidance on how to make the payment.

- Consequences of Delay: Briefly explain any penalties or fees for late payments.

Best Practices for Effective Communication

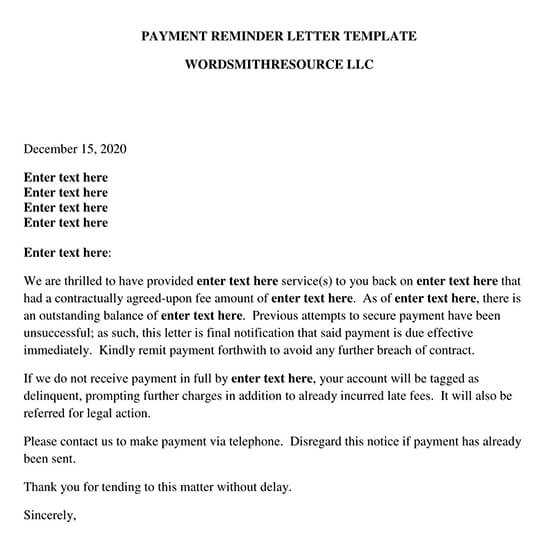

When crafting your request, be polite yet firm. Ensure the tone is professional, and avoid language that might create conflict. You want to encourage prompt payment while preserving the relationship.

Helpful Tips:

- Be Clear: Avoid ambiguity in the wording. Make your request straightforward.

- Be Professional: Use formal language to reflect your seriousness about the matter.

- Stay Polite: Maintain courtesy to ensure a positive outcome.

By adhering to these guidelines, you can increase the likelihood of timely payments while maintaining a respectful tone. Regular follow-ups, if necessary, will demonstrate your commitment to receiving compensation for your work or products.

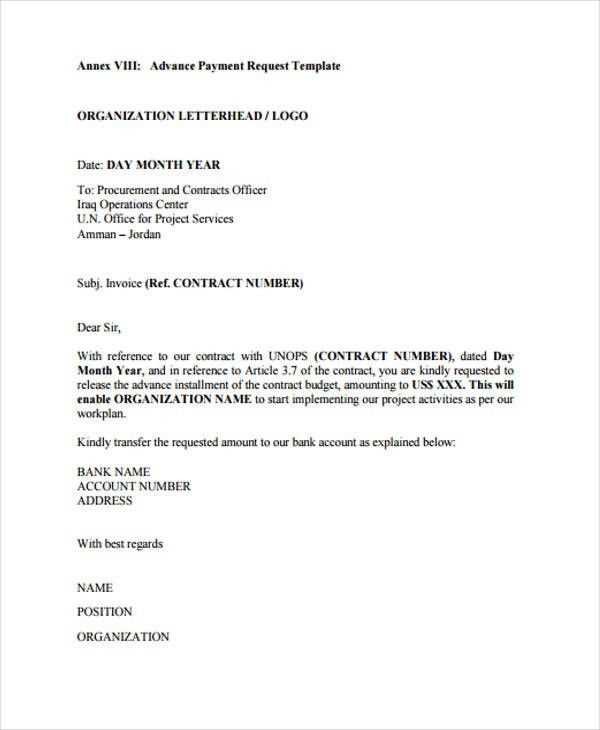

Understanding Financial Collection Documents

In business, addressing overdue funds requires clear communication. Creating a well-structured document that conveys the necessary information helps expedite the process and ensures that both parties understand their obligations. Such communication is essential for maintaining good relations while ensuring payments are made on time.

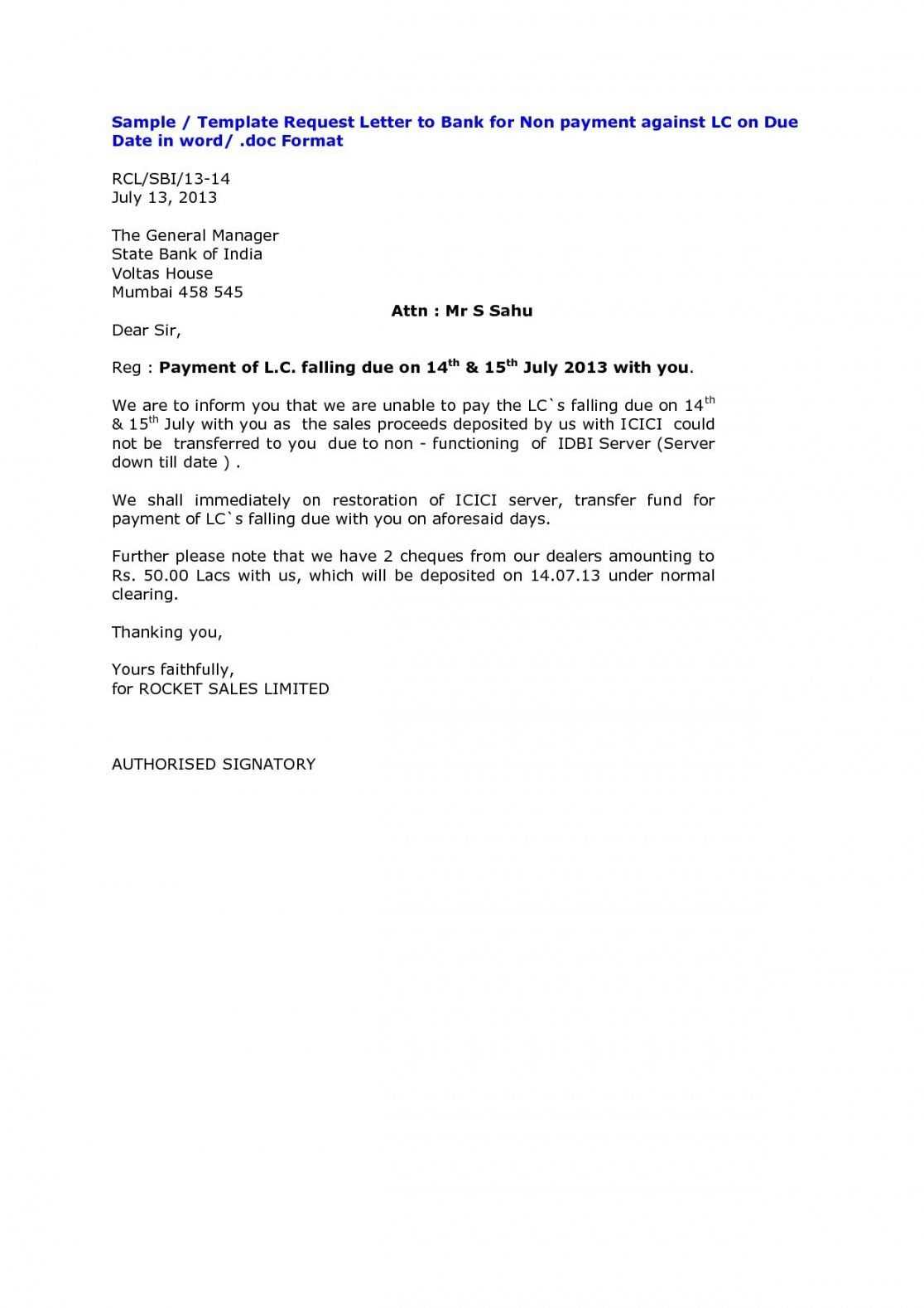

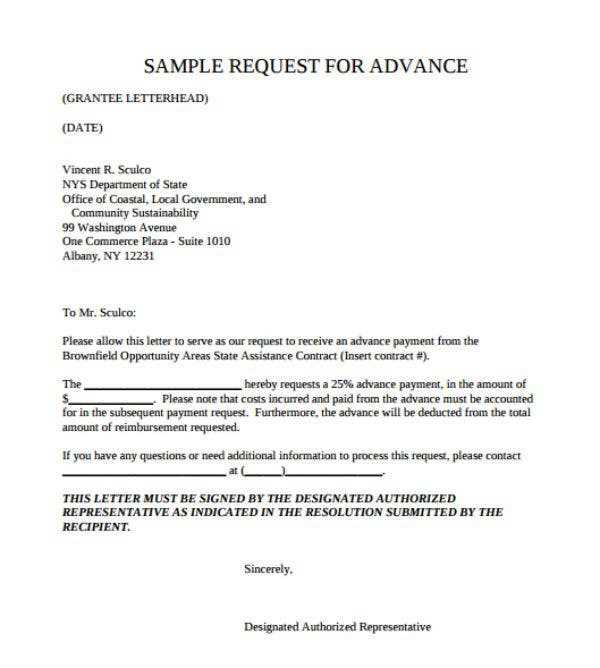

Creating an Effective Collection Document

An efficient document should be concise and direct. Begin by clearly stating the amount owed and the specific date it was due. Then, outline the preferred methods for settling the balance, providing all relevant details to avoid confusion. A polite yet firm tone is key to encouraging prompt payment.

Key Elements for Successful Communication

The core of an effective financial notice lies in including all relevant details. This should cover the amount due, the original due date, the payment methods available, and any penalties for delays. Clarity ensures the recipient fully understands their obligations, leading to a higher chance of prompt action.

Also, avoid common errors that can undermine the clarity of your communication, such as unclear instructions or an overly aggressive tone. Optimizing the document’s layout and language makes it easier for the recipient to process and respond to your request promptly. Finally, be aware of the legal requirements related to financial collections to ensure your document complies with applicable regulations and protects both parties’ interests.