Request to close bank account letter template

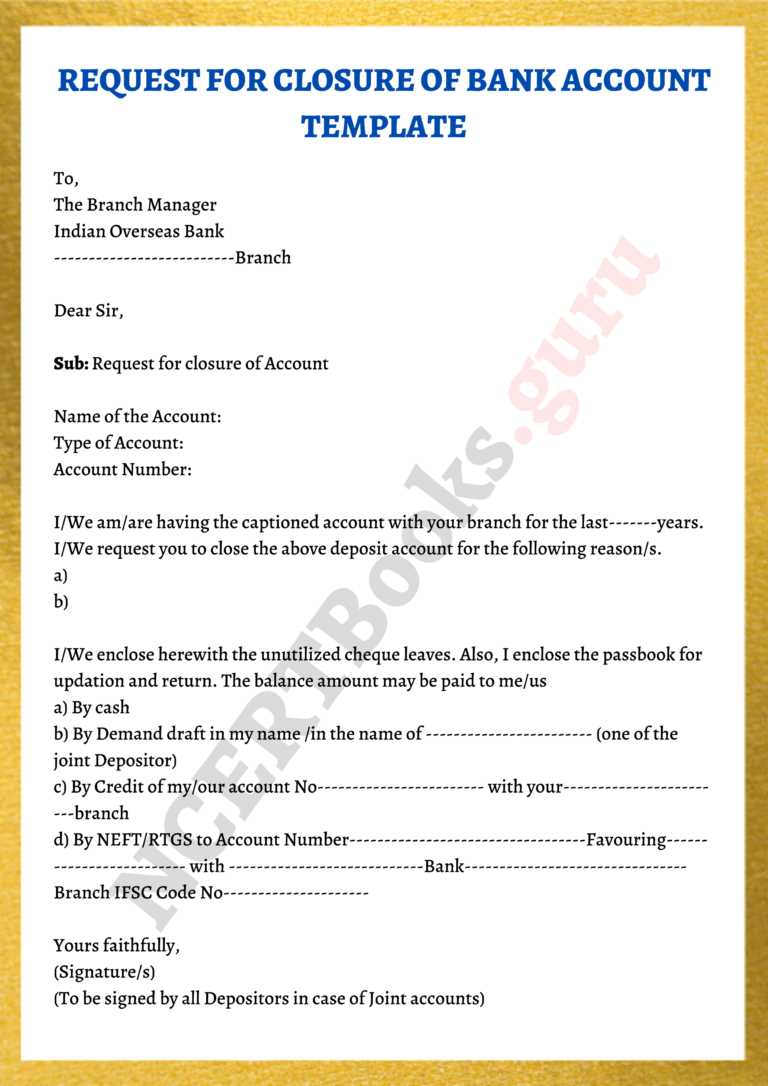

To close your bank account, start with a clear and polite letter that includes all necessary details. Begin by addressing the bank directly and stating your request to close your account. Include your account number and any additional identification information to make it easier for the bank to locate your records. If there are outstanding transactions or pending payments, mention your plan to settle them before closure.

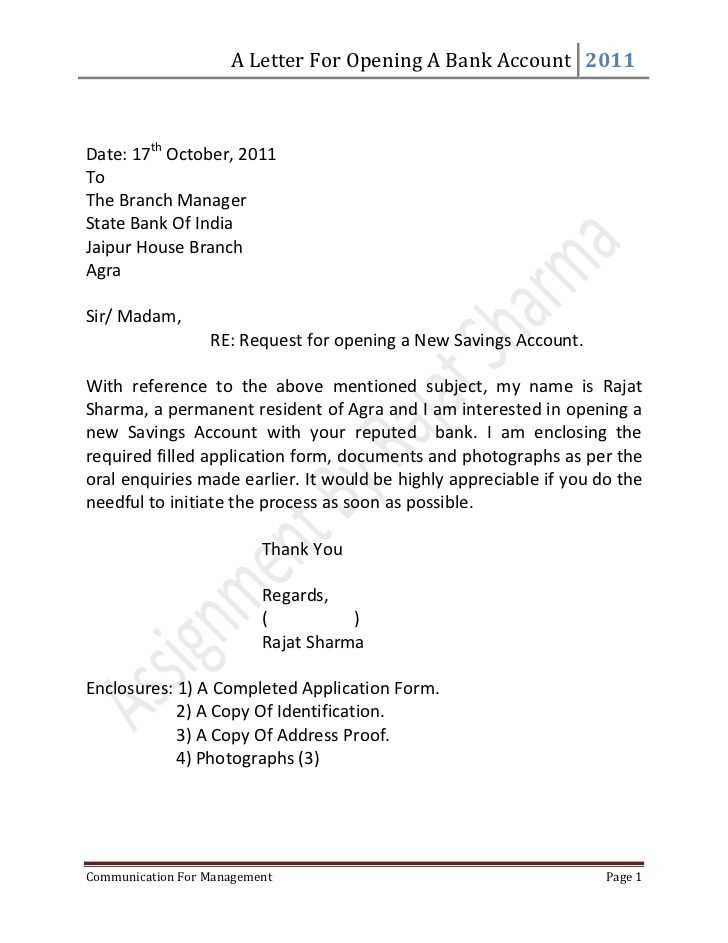

Example template:

Dear [Bank Name],

I am writing to formally request the closure of my account with your bank. The account details are as follows:

Account Number: [Account Number]

Account Holder’s Name: [Your Full Name]

Branch Name: [Branch Name]

Kindly ensure that all pending transactions are cleared before the closure. Please confirm in writing when the account has been successfully closed, and if there are any additional steps I need to complete. I would appreciate it if you could send me any remaining balance via check or transfer to [Your New Bank Account Information].

Thank you for your attention to this matter. I look forward to your confirmation.

Sincerely,

[Your Name]

This template is simple and covers all necessary elements for a bank account closure request. Adjust the details as needed to match your specific situation.

Here’s the corrected version:

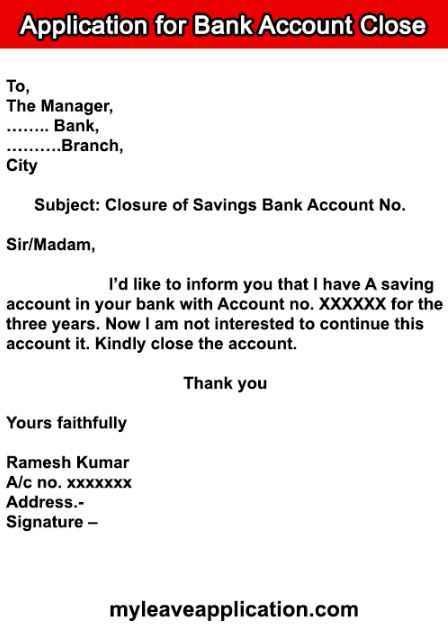

If you want to close your bank account, it’s crucial to send a clear and concise letter to your bank. Ensure that you include your account number, the request to close the account, and your personal details for identification. This will help the bank process your request swiftly.

Key elements to include in your letter:

- Your full name and address

- The account number you wish to close

- A clear request to close the account

- Your contact details for any follow-up communication

- A request for written confirmation of account closure

Be polite and professional, and keep the tone neutral. Once you’ve written the letter, send it via registered mail to ensure it’s received. If you can, visit your branch in person for added clarity. Make sure to clear any pending transactions and withdraw any remaining balance before submitting your request.

Request to Close Bank Account Letter Template

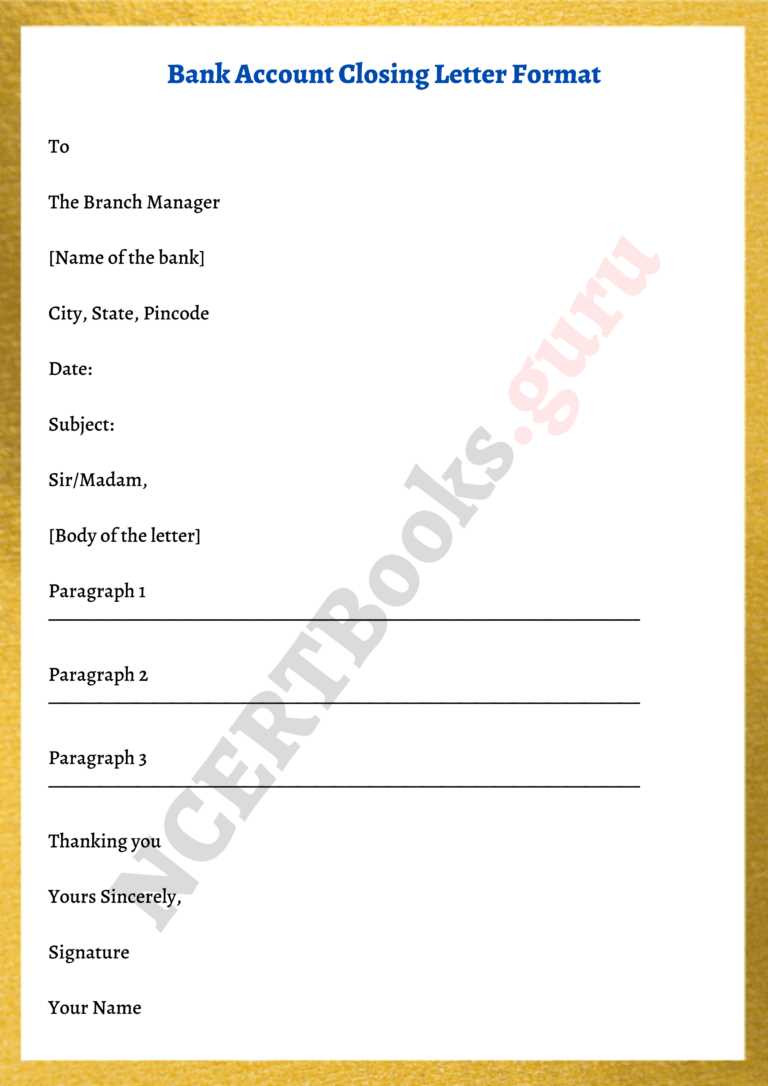

How to Begin Your Account Closure Request

Key Information to Include in the Letter

Important Considerations Before Closing Your Account

How to Submit the Request: Email, Mail, or In-Person?

What to Do After Sending the Request

Resolving Issues: What to Do if Your Request Gets Denied

Start your letter with a clear subject line or heading like “Request to Close Bank Account.” Address it to the correct bank department or branch, and include your account details: your name, account number, and type of account (checking, savings, etc.). Mention the reason for closing the account, but it’s not required to give specifics.

Include these key elements:

– Your full name and address

– Your account number

– Type of account

– A statement requesting closure

– Confirmation that all pending transactions have been completed

– Instructions on how to handle the remaining balance (either by check or transfer)

– Your contact details for follow-up.

Before closing the account, verify that all pending transactions, checks, and automatic payments have cleared. Also, ensure any direct deposits are redirected to a new account. Some accounts may have fees or require a notice period before closure.

You can submit your closure request via email, traditional mail, or by visiting the bank in person. For mail, ensure you send it via certified mail or with a tracking option. If submitting in person, request a receipt for your records.

Once the request is sent, monitor for confirmation. This could come as a letter, email, or phone call. If you do not receive confirmation, follow up promptly to ensure the request is processed.

If the bank denies your closure request, ask for clarification. The reason could be related to outstanding fees, unresolved transactions, or not meeting certain account terms. Resolve any issues and resubmit your request if necessary.