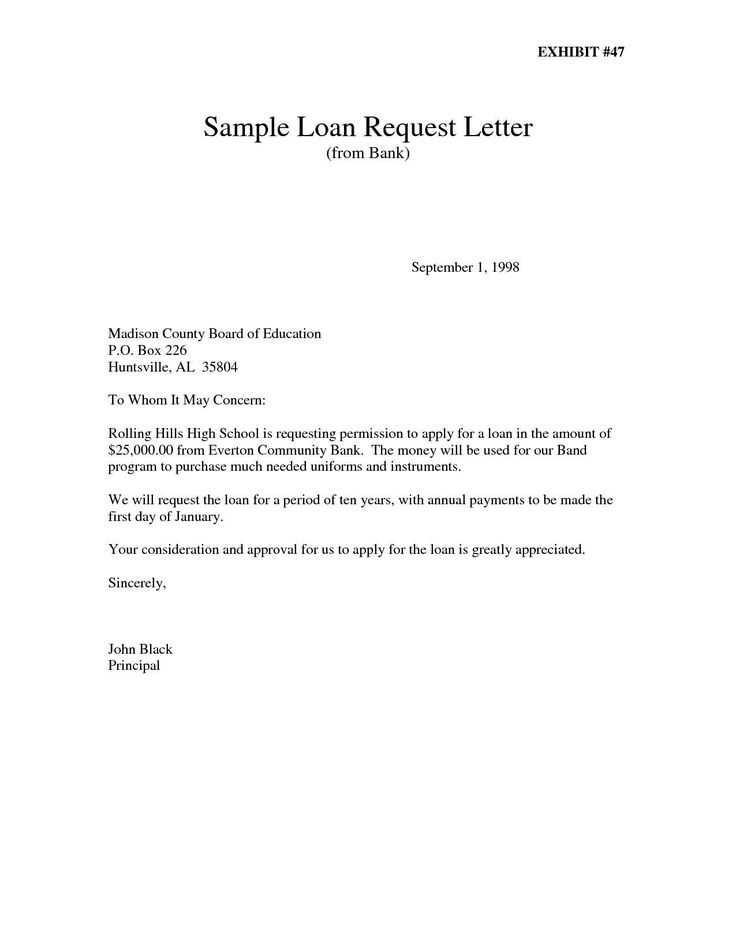

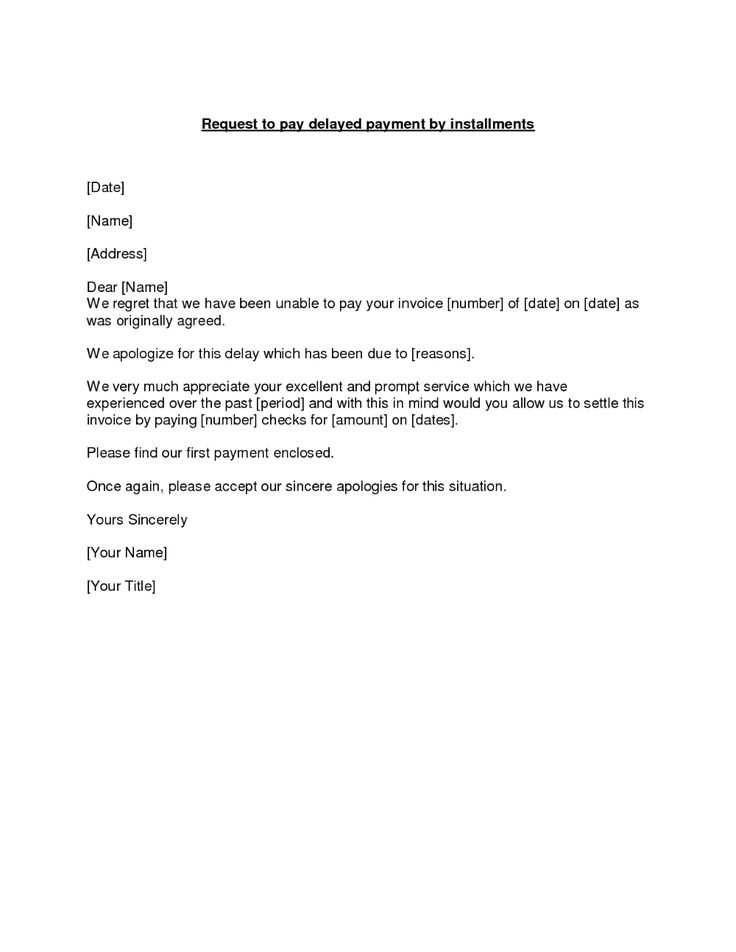

Sample Letter Requesting Payment Plan Template

When financial challenges arise, it’s often necessary to communicate with creditors to arrange a more manageable way to handle outstanding balances. Crafting a well-structured communication for this purpose can increase the chances of a positive response and ensure clarity in the agreement process. The following guide helps you formulate such correspondence effectively.

Key Components to Include

In your communication, make sure to cover these essential details to present a clear and respectful request:

- Reason for Request: Briefly explain the circumstances leading to the need for an alternative financial arrangement.

- Proposed Terms: Outline the amount and frequency of proposed installments to show your commitment to fulfilling obligations.

- Assurance of Good Faith: Express your intention to meet the terms and your recognition of the importance of resolving the matter responsibly.

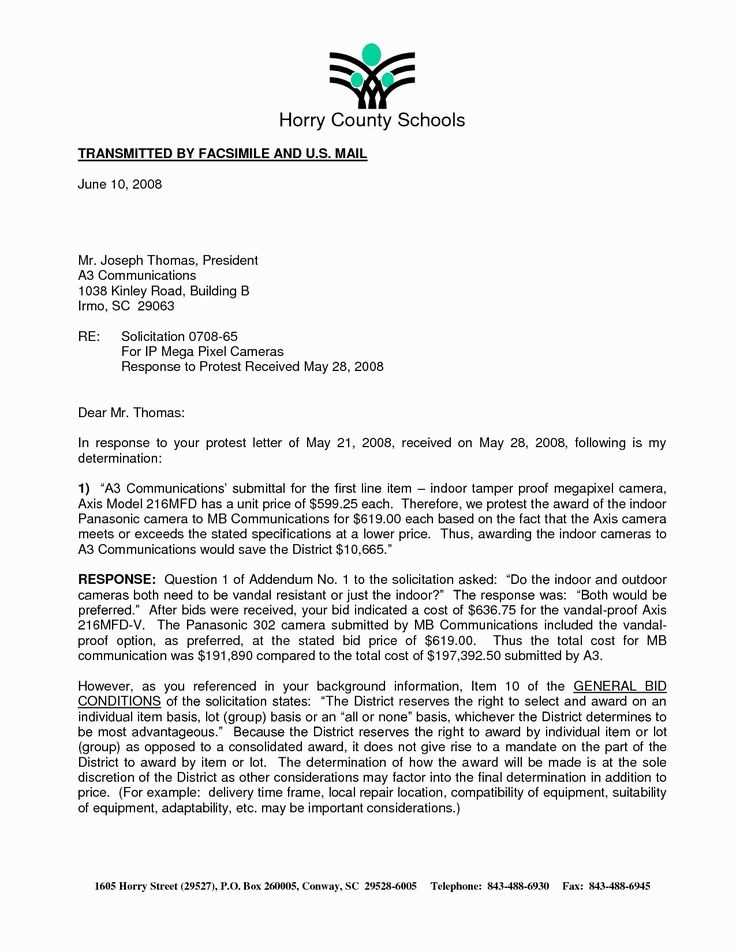

Effective Language to Use

Ensure that your tone remains polite, professional, and clear. The message should convey both respect for the recipient and an understanding of the responsibility you hold. Avoid using overly casual language or being too vague about your intentions.

Providing Supporting Information

Consider including any relevant documentation or details that support your situation, such as financial statements or evidence of changes in circumstances. This can demonstrate your sincerity and help the recipient understand your position better.

What to Avoid

To make the communication more effective, here are some common errors to avoid:

- Unclear or Vague Proposals: Being imprecise about what you are asking for may cause confusion and delay.

- Disrespectful Tone: Negative language or a confrontational approach may jeopardize your request.

- Excessive Information: While it’s important to be transparent, avoid overloading your message with irrelevant details.

Following Up

After sending your message, it’s important to follow up to ensure the recipient received your request and to check on the status of their decision. Be polite in your follow-up and allow ample time for them to review your proposal before reaching out.

How to Seek Financial Assistance Through a Structured Arrangement

When unforeseen financial burdens arise, it may become necessary to reach out to creditors for alternative solutions to meet outstanding obligations. Crafting an effective communication outlining your circumstances and proposed terms is essential for a smooth negotiation process. This section will provide guidance on how to approach such situations, focusing on clarity, professionalism, and key elements to consider.

Effective Ways to Communicate Your Request

Start by being transparent about your current situation, explaining the reasons that make it difficult to meet the original terms. Provide a realistic alternative that you can commit to, and show your willingness to resolve the matter responsibly. A well-structured message demonstrates your sincerity and helps build trust with the recipient.

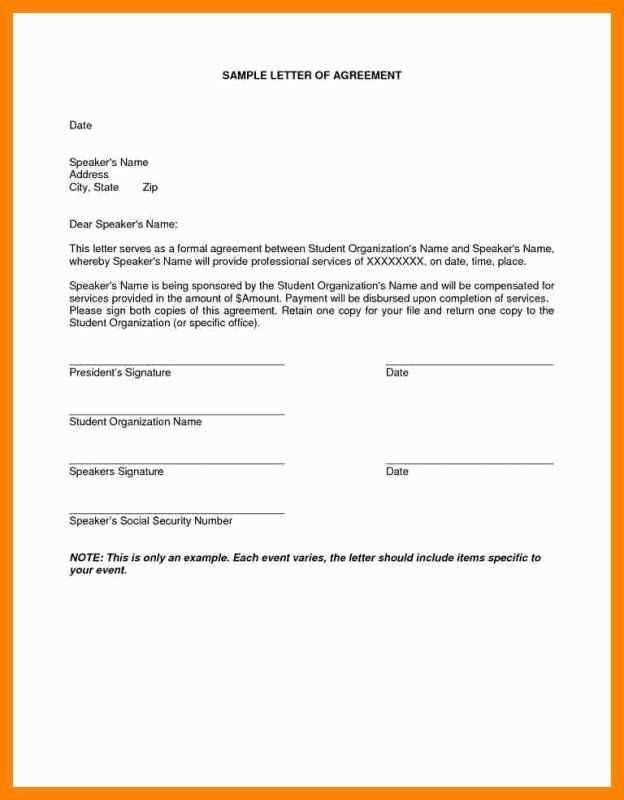

What to Include in Your Message

Incorporate important details to ensure your proposal is clear and actionable:

- Reason for Change: Briefly describe the circumstances that have led to your request.

- Suggested Terms: Outline your proposed modifications, such as the adjusted amount or schedule.

- Commitment: Reassure the recipient of your intention to honor the new arrangement and resolve the matter promptly.

Common Mistakes to Avoid

When making such requests, avoid vague language or being too general about your proposal. Clarity is key. Additionally, ensure your tone remains polite and respectful, as this will contribute to a more favorable response.

How to Follow Up on Your Request

After submitting your proposal, it’s important to follow up in a timely manner. Allow sufficient time for the recipient to consider your request, then reach out politely to inquire about their decision. A respectful follow-up can help keep the process moving forward without appearing too impatient.