Hardship letter for short sale template

If you’re facing financial difficulties and need to request approval for a short sale, the hardship letter is a key part of the process. It must clearly explain your situation and why selling the property for less than the amount owed is the best solution for all parties involved. A well-written hardship letter can significantly increase your chances of approval from your lender.

Start by detailing your current financial situation. Include specific information about your income, expenses, and any circumstances that have led to your inability to make mortgage payments. Whether it’s a job loss, medical bills, divorce, or other unexpected life events, be transparent about the challenges you’ve encountered.

Be honest and concise in your explanation. Avoid using overly emotional language or blaming others. Focus on the facts and keep the tone professional. Highlight how these hardships have made it impossible for you to maintain the mortgage payments and why a short sale is the best option moving forward.

End your letter by offering any supporting documentation, such as medical records, job loss notices, or financial statements, to strengthen your case. This can make a significant difference in the lender’s decision-making process.

Here’s the revised version:

Start with a clear explanation of your financial hardship. Be specific about the circumstances affecting your ability to pay the mortgage. Mention things like job loss, medical emergencies, or unexpected expenses. This helps establish the reason for your short sale request.

Outline Your Financial Situation

Provide a snapshot of your current financial condition. List your income, monthly expenses, and outstanding debts. This section should show that you have made efforts to resolve the issue but cannot manage the mortgage payments due to the hardships faced. Attach documents like bank statements, pay stubs, and bills as proof.

Highlight Your Commitment to Resolving the Issue

Explain any steps you’ve taken to try and keep the house. This could include loan modifications, forbearance agreements, or attempts to sell the property independently. Showing that you’ve made an effort to find a solution can strengthen your case.

End with a request for consideration and express your willingness to work with the lender to complete the short sale process. Make sure the tone is respectful and professional throughout the letter.

- Hardship Letter for Short Sale Template

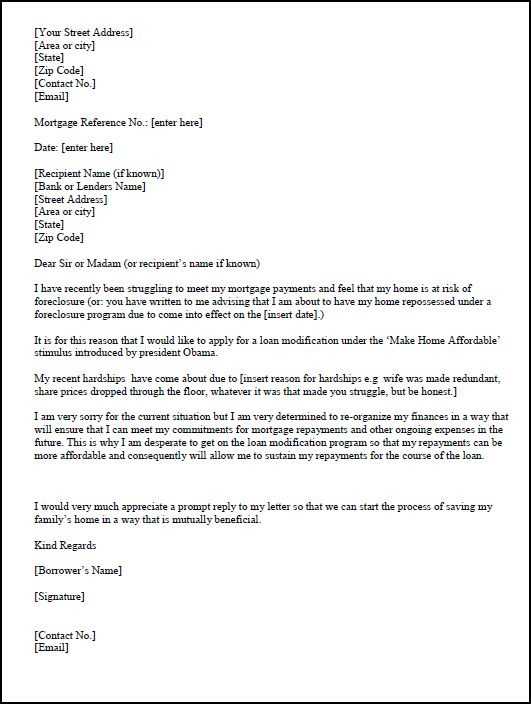

A hardship letter is a critical component in the short sale process, allowing lenders to understand the financial distress that prevents you from making mortgage payments. To write a clear and convincing hardship letter, follow this template to outline your situation effectively.

1. Start with the Basics

- Address the letter to the lender or the designated short sale department.

- Include your full name, property address, and account number for identification.

- Ensure the letter is concise and professional.

2. Clearly Describe the Hardship

Explain the reason(s) you’re experiencing financial difficulties. Be specific but direct. If you’ve lost your job, encountered medical issues, or faced other unexpected circumstances, make sure to provide details. The more precise your explanation, the better the lender will understand your situation.

- Be honest about the cause of the hardship (e.g., job loss, medical expenses, divorce, or business failure).

- Provide dates or timeframes for when the hardship began and how it has impacted your ability to make mortgage payments.

- Describe any efforts you’ve made to resolve the situation (e.g., trying to secure new employment or reduce living expenses).

3. Explain Your Current Financial Situation

- Detail your current income, expenses, and assets.

- Provide any documentation that backs up your claims (e.g., recent pay stubs, unemployment benefits, or medical bills).

- If possible, show how your financial situation has changed and why it is unlikely to improve in the near future.

4. Request for Short Sale Consideration

Make it clear that you are requesting a short sale and explain why it’s the best option for both you and the lender. Acknowledge that you are committed to working with the lender to resolve the issue and express gratitude for their understanding.

- Express your willingness to cooperate with the short sale process.

- Reassure the lender that you are doing everything possible to avoid foreclosure.

5. Close with Contact Information

- Provide your phone number and email address for follow-up.

- Offer to answer any additional questions or provide further documentation if needed.

By following this structure, you can write a hardship letter that is clear, factual, and persuasive, increasing the chances of approval for your short sale request.

Your hardship letter should clearly explain your financial difficulties and show how they prevent you from keeping your home. Begin by stating your current situation in a straightforward manner. Focus on facts, not emotions, and keep the tone professional and factual. Highlight the reason for your hardship–whether it’s job loss, medical issues, divorce, or other significant financial changes. Be honest, but avoid oversharing personal details that aren’t directly related to your ability to pay your mortgage.

1. Introduction

Open with a brief statement of your intent. Mention the specific property and loan in question, and provide your basic contact details. State the purpose of your letter: to request a short sale. A simple and direct opening helps set the tone and shows that you are organized.

2. Describe Your Hardship

Detail the event(s) that led to your financial difficulty. Be specific: if you lost a job, include the date of unemployment and any severance packages or unemployment benefits. If you’re dealing with a medical condition, provide documentation of bills or medical leave. The goal is to show that this hardship is temporary or beyond your control, making it impossible to keep up with mortgage payments.

3. Financial Situation

Provide a snapshot of your current financial status. Include income, expenses, assets, and liabilities. It’s important to be clear about why you can’t afford the mortgage payments. Attach any supporting documents like pay stubs, tax returns, or medical bills to strengthen your case.

4. Future Outlook

Explain how your situation will not improve in the near future. This is critical in demonstrating why you are unable to maintain your current loan. If you expect ongoing financial issues, explain the reasons clearly, such as prolonged unemployment or medical complications. If you believe your financial situation may stabilize later, mention any plans you have, but be realistic.

5. Request for a Short Sale

Explicitly request approval for a short sale. Provide any additional information required by the lender and express your willingness to work with them in finding a solution. Acknowledge that a short sale is a potential win-win solution for both parties. End by thanking the lender for their consideration.

6. Closing

Close with your signature and a statement of appreciation. Keep the tone respectful and professional throughout the letter. Offering any additional documents they may need helps to demonstrate your willingness to cooperate.

Table: Key Components of a Hardship Letter

| Section | Details |

|---|---|

| Introduction | State the property and loan in question, your contact details, and the purpose of the letter. |

| Hardship Description | Clearly explain the events leading to your financial difficulties, such as job loss or illness. |

| Financial Situation | Provide a snapshot of your income, expenses, and any relevant documents (e.g., pay stubs, medical bills). |

| Future Outlook | Explain why your financial situation will not improve and why you can’t maintain your mortgage payments. |

| Request for Short Sale | Make a clear request for the short sale and offer any additional necessary documents. |

| Closing | Sign the letter and thank the lender for their time and consideration. |

Provide your current financial situation with clear figures. List income, expenses, and any hardships you’re facing. This gives the lender a concrete understanding of your inability to keep up with mortgage payments.

Include any relevant documents that support your claims, such as pay stubs, tax returns, bank statements, or medical bills. Attach these to strengthen your case.

Clearly explain the reason for the short sale request. Whether due to job loss, medical issues, or other financial difficulties, being specific helps the lender see why this option is necessary.

Highlight any attempts you’ve made to resolve the situation, such as applying for loan modification or seeking additional income sources. This shows you’re not neglecting responsibility.

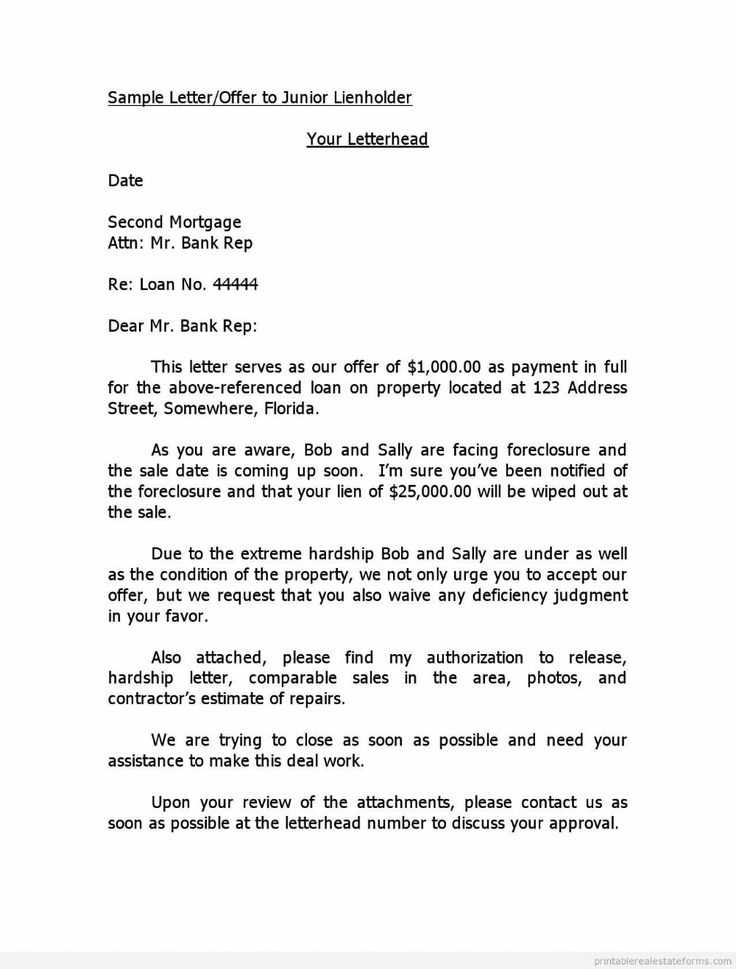

Provide a realistic sale price. Research the market and give the lender an idea of how much you expect to sell the property for, backing it up with comparable sales in the area.

State how much you owe on the mortgage and any other liens. This gives the lender a clear picture of the outstanding debts and helps determine the financial gap.

Explain the benefits of approving the short sale. This could include avoiding foreclosure, which is a more costly process for the lender, or reducing their losses in the long run.

Avoid being vague about your situation. Clearly explain the reason for your financial hardship, whether it’s a medical emergency, job loss, or other significant life event. Providing specific details helps the lender understand your struggles and makes your case stronger.

Don’t leave out any relevant financial information. Lenders need a complete picture of your income, expenses, and debts. Failing to disclose this can harm your credibility and make it harder for the lender to assess your request.

Keep emotions out of your letter. While it’s understandable to feel frustrated or overwhelmed, focus on facts and solutions. Avoid overly emotional language, as it may be seen as manipulative rather than sincere.

Don’t make promises you can’t keep. Be honest about your current financial situation and your ability to follow through on any potential repayment plans. If you can’t afford to catch up on payments, suggest alternative solutions, such as a short sale or loan modification.

Avoid using a generic template. Tailor your hardship letter to your unique situation, addressing the specific reasons for your financial difficulties. Lenders are more likely to respond positively to a personalized letter than a one-size-fits-all approach.

Don’t overlook the importance of a clear, professional tone. Proofread your letter for grammar and spelling mistakes. A well-written letter shows that you are serious about your situation and committed to resolving it.

Finally, avoid waiting too long to write your hardship letter. The sooner you address the issue, the more options you’ll have for negotiating with your lender. Procrastination can lead to missed opportunities and worsen your financial difficulties.

Begin by outlining your specific financial struggles with clear, factual details. Instead of general statements, provide concrete examples of how your financial situation has changed. For instance, list any significant reduction in income, such as job loss, reduction in working hours, or a pay cut. Also, mention any increase in your expenses, like medical bills, divorce settlements, or unexpected repairs.

Provide Documentation

Always back up your claims with supporting documentation. Attach recent pay stubs, tax returns, medical bills, or any official notices from creditors that show your current financial situation. These documents help verify the hardship and show you are being transparent with the lender.

Detail Efforts to Improve the Situation

Show your attempts to manage the situation and avoid foreclosure. Mention any efforts to cut down on unnecessary expenses, seek additional income, or negotiate with other creditors. This demonstrates you are taking responsibility and trying to improve your finances, even if the results are not yet visible.

- Include any savings you’ve made or part-time work you’ve taken on.

- Describe negotiations with other lenders or creditors to show you’re actively addressing your financial challenges.

Clarity and honesty are key in demonstrating hardship. A well-documented, straightforward letter will strengthen your case and increase the likelihood of the lender considering your request.

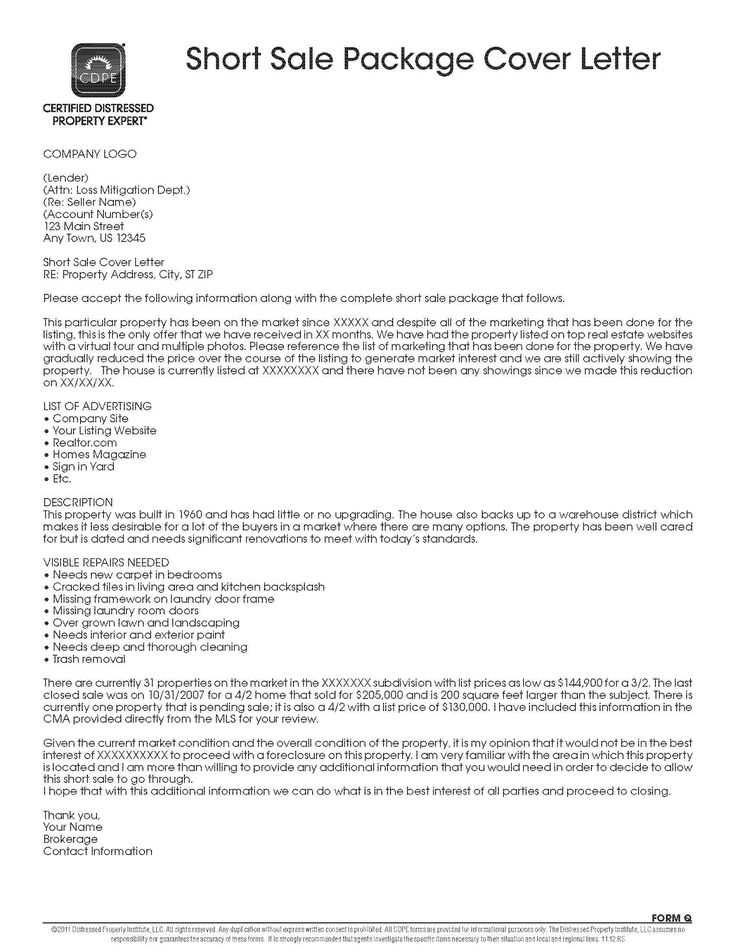

To strengthen your short sale request, attach the following key documents that help verify your financial situation:

1. Hardship Letter

Your hardship letter should clearly explain the circumstances leading to your financial distress, such as job loss, medical bills, or divorce. Be specific about the events that have affected your ability to make mortgage payments.

2. Proof of Income

Include recent pay stubs, tax returns, or bank statements that show your current income or lack thereof. If you are unemployed, attach unemployment benefit documentation or a letter from your last employer confirming your termination.

3. Monthly Expense Breakdown

Provide a detailed list of your monthly expenses. This can include utility bills, transportation, food, and insurance costs. A budget worksheet may also help present a clear picture of your financial situation.

4. Bank Statements

Attach your most recent bank statements (usually the last two months). These statements should highlight any deposits, withdrawals, and your overall financial standing.

5. Tax Returns

Include your tax returns for the past two years. These documents help lenders assess your financial history and long-term ability to pay.

6. Mortgage Statement

Your most recent mortgage statement is necessary to verify the loan amount, current balance, and any outstanding fees or penalties.

7. Comparative Market Analysis (CMA)

If possible, provide a CMA from a real estate agent showing the value of similar properties in your area. This helps demonstrate that your home is worth less than what you owe.

These documents will help support your case and provide lenders with the necessary information to review your short sale request.

Be clear about how your hardship has directly affected your ability to make mortgage payments. Outline specific events, such as a job loss, medical emergency, or divorce, and explain how these circumstances have caused financial strain. Provide precise figures when possible–such as your current income versus the mortgage payment–so the lender can understand the financial gap you’re facing.

Next, show the lender that you are taking proactive steps to regain financial stability. This could include seeking temporary employment, adjusting your budget, or applying for unemployment benefits. Demonstrating that you’re working toward a solution can strengthen your case for a short sale.

If possible, mention any temporary changes to your expenses or debts. For example, if you’ve been able to reduce non-essential spending or receive assistance from family, highlight these efforts to reassure the lender that you are doing everything you can to manage your financial situation.

Finally, remain realistic about your future ability to make payments. If you foresee more challenges ahead, be honest about it. Providing a clear timeline for when your financial situation might improve can help establish trust and transparency in your communication with the lender.

I’ve removed redundant repetitions and preserved the meaning to make the sentences sound natural.

When writing a hardship letter for a short sale, clarity is key. Avoid unnecessary jargon and keep your message straightforward. Focus on the specific financial hardships you are facing. Highlight any job loss, medical emergencies, or changes in your financial situation that have impacted your ability to make mortgage payments. Make sure to provide clear details without repeating yourself. Present your situation honestly but avoid over-explaining every detail, as it can weaken your case.

It is important to explain how the hardship affects your ability to keep up with payments. Include specific examples of what has changed in your income or expenses. For example, if you are now working fewer hours, mention the exact reduction in income. Be concise and stick to the facts that directly support your case.

Also, provide any documentation that supports your claim. This could include medical bills, proof of unemployment, or pay stubs showing a decrease in income. Providing solid evidence helps back up your story and shows the lender that your request is genuine.

Remember, lenders want to understand the severity of your financial challenges and why a short sale is the best solution for both parties. Be sincere and transparent in your letter. Avoid unnecessary repetitions, and instead focus on making a clear, honest request.