Credit dispute sample letter template

To resolve discrepancies on your credit report, take a direct approach with a clear letter outlining the issue. Start by clearly identifying the error and referencing any relevant details, such as account numbers or transaction dates. It’s crucial to state why you believe the information is incorrect, citing any supporting evidence, such as bank statements or payment receipts, to back up your claim.

Focus on being concise and specific in your letter. Avoid unnecessary details that do not pertain to the disputed item. Keep your language professional and polite, even when expressing frustration. A respectful tone can encourage a more positive response from the creditor or credit bureau.

Remember to request a specific resolution. Clearly state what you expect to happen, whether it’s the removal of incorrect information or an update to your credit record. Include your contact information and request confirmation once the dispute has been resolved. A well-crafted dispute letter can help you address credit report inaccuracies effectively and efficiently.

Here’s the revised version with the repetitions reduced:

To resolve a credit dispute, focus on providing clear and accurate information. Start by identifying the exact error and reference specific details in your credit report. Keep your letter concise, including your name, address, and account number. Ensure the disputed item is clearly marked, with a brief explanation of why it’s incorrect. Attach supporting documents, such as receipts or bank statements, to back your claim. This approach will help streamline the process and increase the chances of a successful resolution.

- Credit Dispute Sample Letter Template

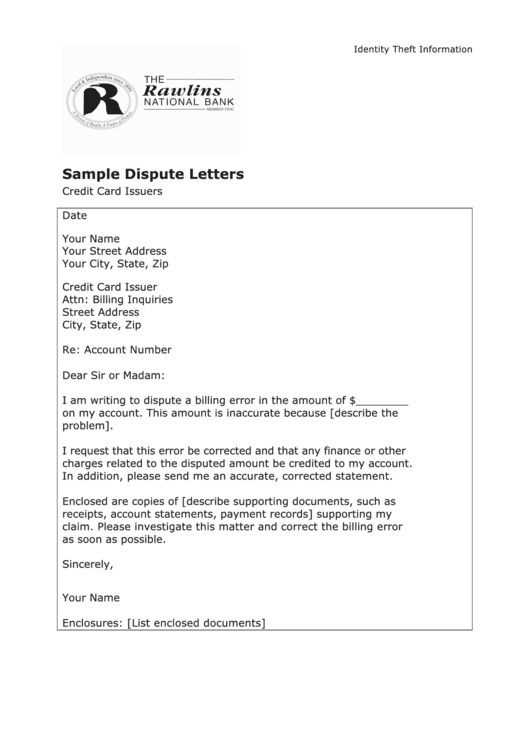

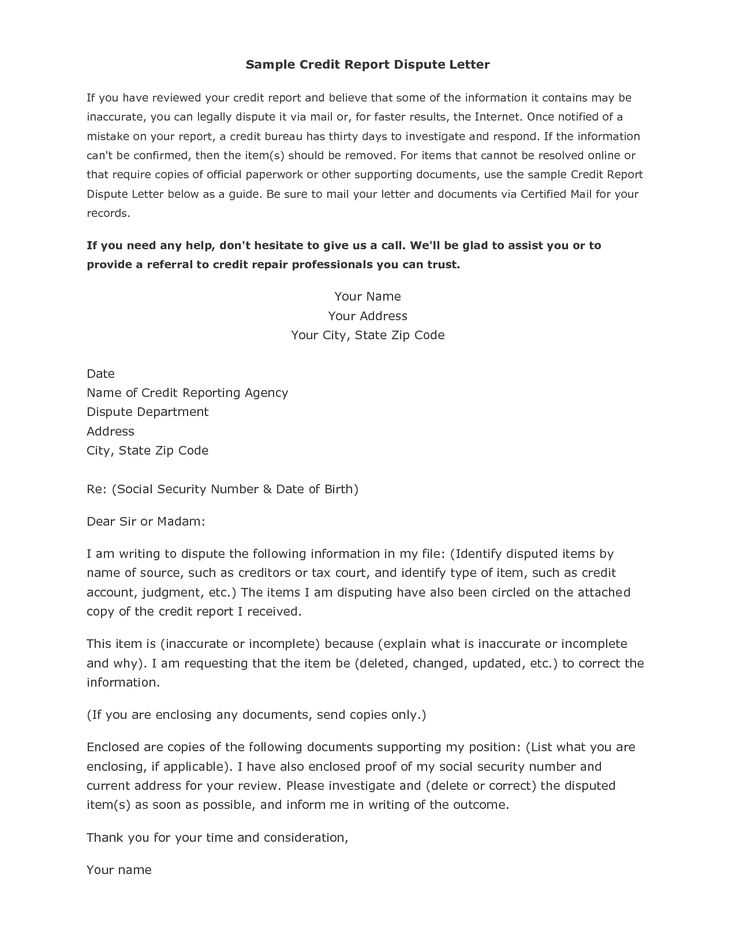

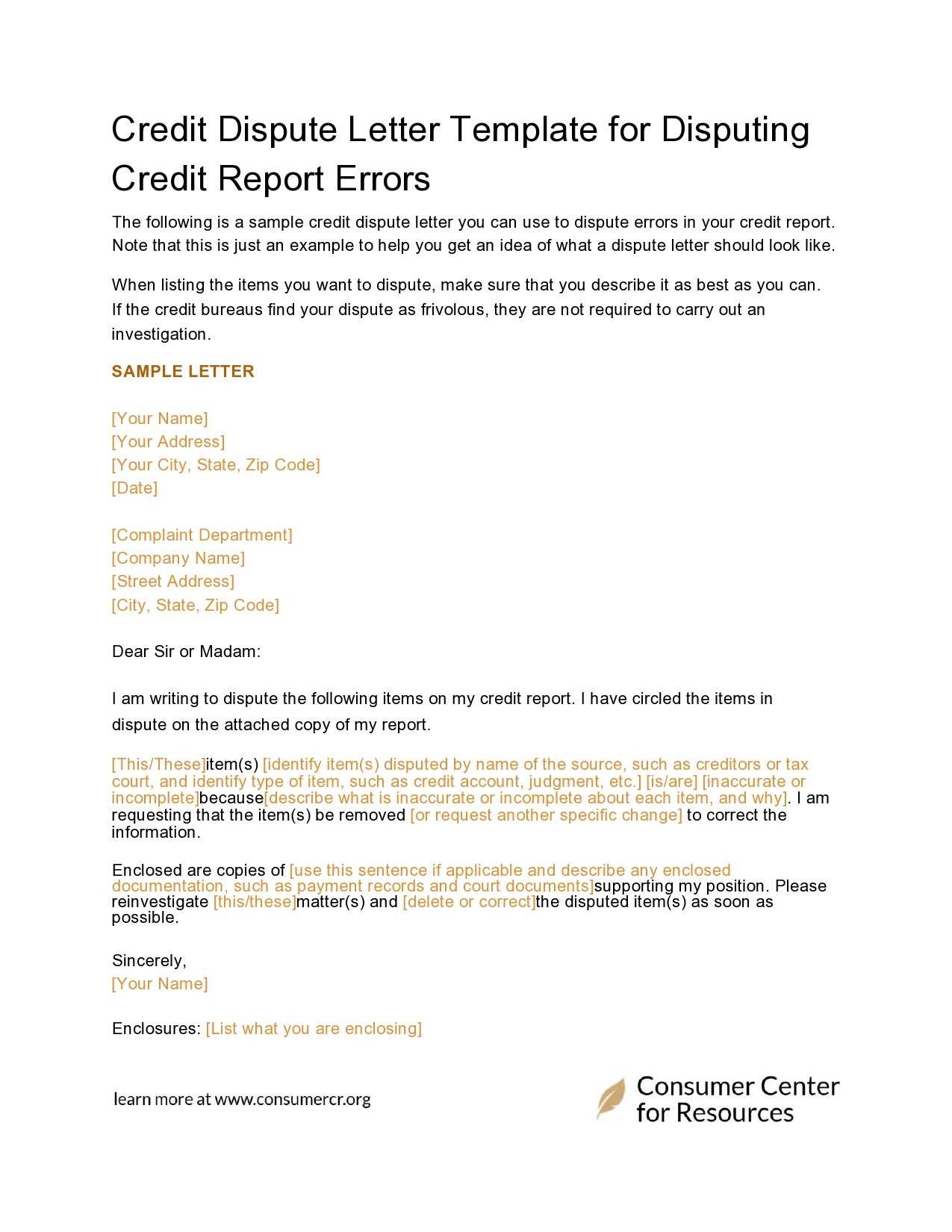

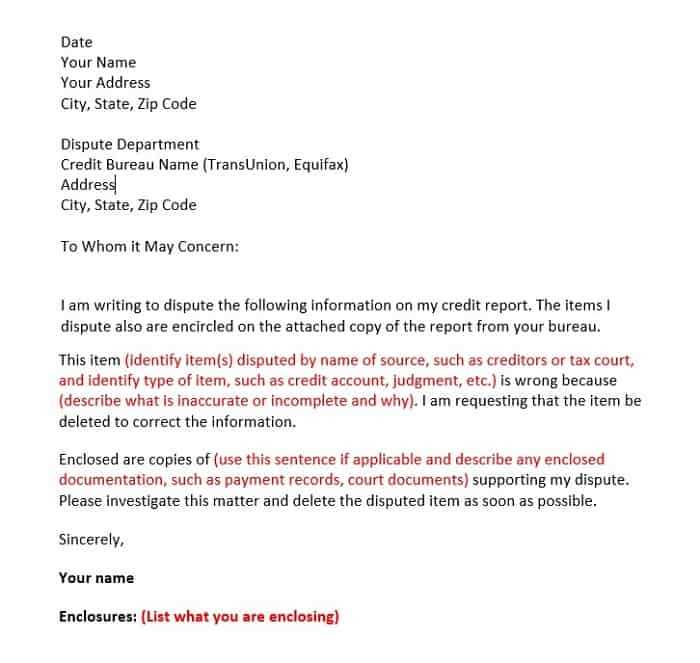

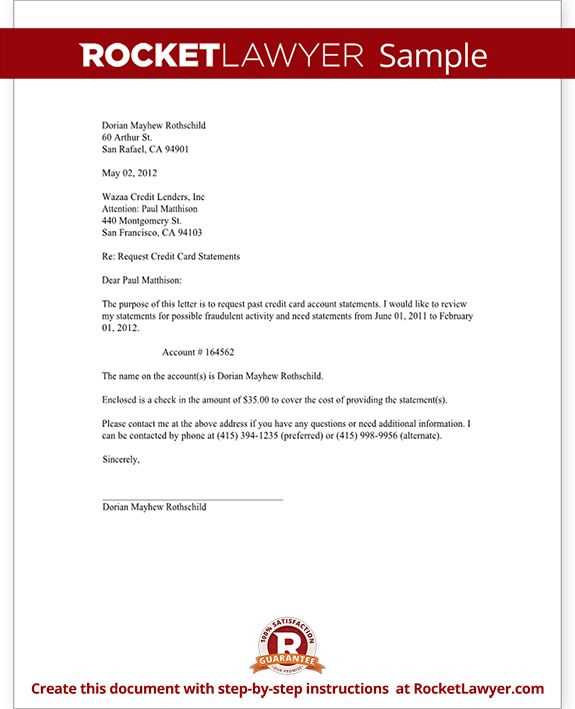

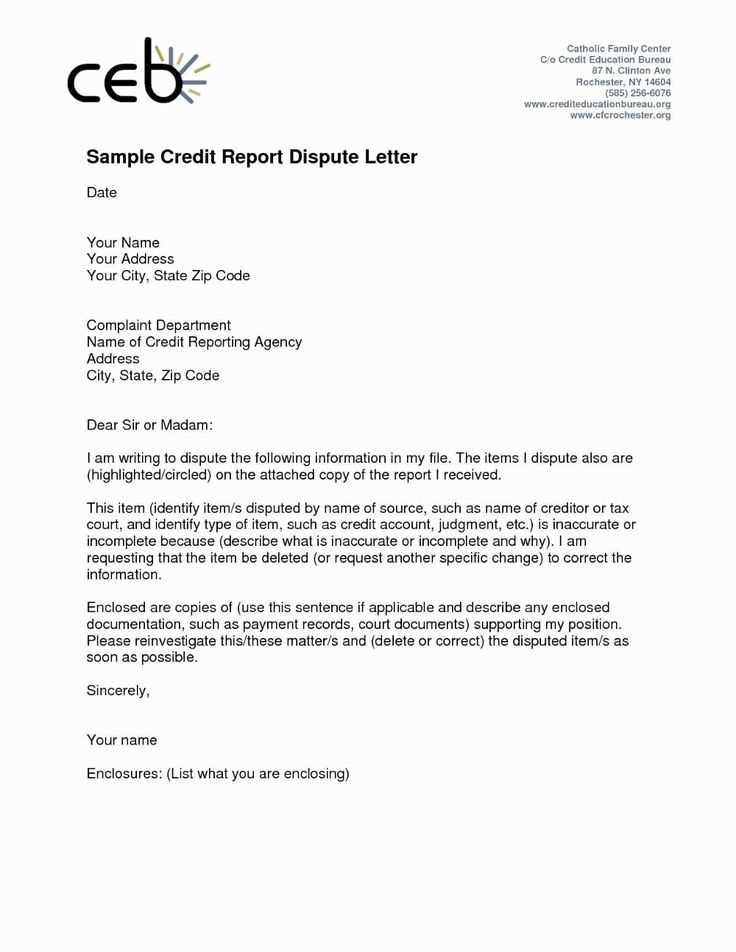

To dispute an error on your credit report, use this template to draft a clear and formal letter. Be sure to include specific details about the dispute and any supporting documentation. Always send the letter via certified mail for tracking purposes.

Dear [Credit Bureau Name],

I am writing to dispute the following information in my credit report. The item I am disputing is [describe the error in detail]. According to my records, this information is inaccurate because [explain why it’s wrong].

Attached are the supporting documents to substantiate my claim, including [list documents, such as bank statements, receipts, or a copy of your credit report]. Please investigate this matter and update my credit report accordingly. I would appreciate a response within [state the timeframe, typically 30 days] as required by law.

Thank you for your attention to this matter.

Sincerely,

[Your Name]

[Your Address]

[Your Contact Information]

Begin by clearly stating the purpose of your letter. Identify the specific item or account that is being disputed, including relevant dates and amounts. Be concise and direct with your statement.

Follow this with a brief summary of the issue. Focus on the facts: explain the error or discrepancy you believe exists. Use clear and precise language, avoiding unnecessary details. Refer to any supporting documents you may have, like receipts, statements, or contracts.

Next, explain why you believe the dispute is valid. Provide any evidence that supports your claim, such as account records, transaction histories, or third-party verification. This helps reinforce your case without overwhelming the reader with excessive information.

Conclude the letter by stating what action you want the recipient to take. Be specific about your expectations–whether you seek a correction, removal, or another form of resolution. Include your contact information for follow-up and request confirmation of receipt.

Make sure to clearly outline the following key points in your letter to make your dispute effective:

- Your personal information: Include your full name, address, and contact details. Also, provide your account number or reference number for the disputed item.

- Details of the dispute: Describe the specific charge or issue you are disputing, including the date, amount, and any other relevant information. Be concise and to the point.

- Evidence of your dispute: Attach copies of any supporting documents, such as receipts, bank statements, or correspondence, to back up your claim.

- Clear statement of what you expect: Clearly state what action you want the recipient to take, whether it’s correcting the information, providing an explanation, or removing the charge.

- Timeframe for response: Set a reasonable deadline for the response to your dispute, typically 30 days, to ensure prompt action.

- Contact information for follow-up: Provide details of how they can reach you if they need more information or clarification on your dispute.

By including these details, you ensure that your dispute is presented professionally and that the recipient has all the necessary information to resolve the issue efficiently.

Clearly stating the issue is key to a strong dispute letter. Avoid vague language that leaves room for confusion. Be specific about the dispute and reference relevant dates, amounts, or account numbers. Never assume the recipient understands the details of your case without providing necessary information.

Incorrect Tone or Language

Keep the tone respectful and professional. Using aggressive or overly emotional language can hinder your chances of a resolution. Stick to factual statements and avoid personal attacks. This increases the likelihood of a positive response.

Failure to Include Supporting Documents

Ensure you attach all necessary documents to support your claim. This could include bank statements, receipts, or correspondence related to the dispute. Failing to provide these items can cause delays or a rejection of your dispute.

Being clear, concise, and courteous can significantly improve the effectiveness of your dispute letter. Double-check for these common errors before sending your letter to avoid unnecessary setbacks.

After sending your credit dispute letter, it’s critical to stay proactive. Track the receipt of your letter to ensure it’s been received by the creditor or credit bureau. You can request confirmation through a return receipt or follow up with a call or email. Knowing that your dispute has been received sets the stage for timely updates.

Follow Up and Monitor Your Credit Report

Give the creditor or bureau time to investigate your claim. Typically, they have 30 to 45 days to respond. During this period, keep an eye on your credit report for any changes or updates related to the dispute. Ensure that the disputed item is marked as “in dispute” if it’s still being reviewed.

Prepare for a Response

Be ready for any outcome. If the creditor agrees with your dispute, the item will be removed or corrected. If they disagree, request a detailed explanation of their findings. Should the dispute remain unresolved, you may want to escalate the issue, either through further negotiation, filing a complaint with the Consumer Financial Protection Bureau, or seeking legal advice.

| Action | Details |

|---|---|

| Track Dispute Status | Monitor the status of your dispute and ensure timely updates. |

| Review Credit Report | Check your report for any changes or updates on the disputed item. |

| Follow Up | Contact the creditor or credit bureau if you don’t receive a response. |

| Escalate if Necessary | If the dispute remains unresolved, consider further actions such as legal advice. |

Contact the credit bureau or lender regularly to check the status of your dispute. Set a clear timeframe for follow-ups to ensure you’re staying informed throughout the process.

Steps for Checking Your Dispute Status

- Review the dispute acknowledgment you received, noting the reference number and timeline given.

- Call or email the appropriate department to inquire about the current status.

- Keep a record of all communication, including dates and responses received.

What to Ask During Follow-Ups

- Request updates on the investigation’s progress.

- Ask if any additional documentation is needed on your end.

- Confirm the expected resolution date or next steps in the process.

Stay proactive and avoid letting too much time pass without checking. If you don’t get a response in the expected timeframe, don’t hesitate to escalate your case to a supervisor.

Begin your letter by clearly stating the error in your credit report. Include specific details like the date the report was accessed, the credit bureau, and the account or item in question. Attach supporting documents such as bank statements, transaction records, or any other evidence that proves the inaccuracy.

For example, if a payment was marked as late but you have proof that it was made on time, provide that information clearly. Specify that you are requesting the credit bureau to correct this error. Be concise and direct about the impact this error may have on your credit score.

Always include your contact information, such as your full name, address, and phone number, to ensure they can reach you if further clarification is needed. It’s important to remain polite, yet firm, in your request for the error to be fixed as soon as possible.

Finish by expressing appreciation for their attention to the matter, and state that you expect to receive confirmation once the correction is made.

When writing a credit dispute letter, make sure to be clear and concise about the issue you’re addressing. Provide all relevant details, including the account number, specific charge in question, and any supporting documentation to strengthen your claim. Stay focused on facts, and avoid emotional language or accusations. Keep the tone professional and assertive, stating exactly what resolution you’re seeking.

Detail the Discrepancy

Start by highlighting the particular transaction or account entry that’s in dispute. Include dates, amounts, and any information that proves the mistake, such as receipts or bank statements. This establishes clarity and shows you’re informed about your credit report.

Request for Resolution

State clearly what action you expect the creditor or credit bureau to take. Whether it’s a correction, removal of an incorrect entry, or re-investigation, be specific about the outcome you are requesting. Provide a deadline if necessary, and be firm in your expectations while remaining polite.