Letter of Credit Sample Template for Secure Transactions

htmlEdit

In business transactions, certain agreements require formal assurances to ensure that payments will be made as per the stipulated terms. This document serves as a promise to fulfill financial obligations, providing both security and trust to all parties involved. It is widely used in international trade to mitigate risks associated with payment delays or disputes.

Typically, such a guarantee involves specific instructions regarding the conditions under which payments should be made. Its structure and content are crafted to address potential risks, outlining how and when the financial duties will be met. Parties can rely on this instrument to ensure that their transactions proceed smoothly and according to the agreed-upon terms.

Understanding how this guarantee works is crucial for anyone engaged in cross-border trade or financial dealings. It is a document that not only provides legal protection but also helps in building strong business relationships by ensuring that both sides honor their commitments.

htmlEdit

Financial Guarantee Document Overview

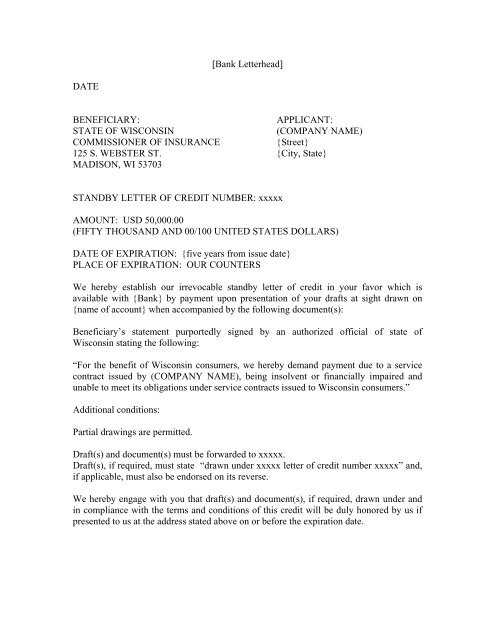

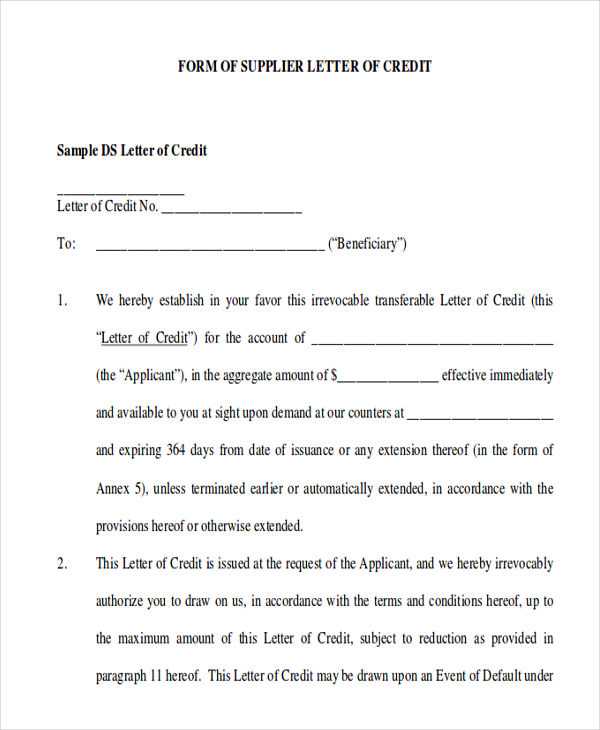

In global transactions, a written agreement issued by a financial institution plays a vital role in ensuring security for all parties involved. This document serves as a commitment to fulfill payment obligations under specified conditions. It is designed to provide both buyers and sellers with confidence, especially in unfamiliar or high-risk markets.

Such agreements are carefully structured to outline key details, including payment terms, delivery requirements, and the conditions under which payment will be made. Each agreement is customized to meet the needs of the transaction, offering flexibility while maintaining essential protections for all parties.

The document format is widely recognized for its role in reducing risks and preventing misunderstandings. It can be issued in various forms, but the underlying principles remain the same: ensuring that the agreed-upon terms are met before the transaction is completed. By adhering to these standards, businesses can engage in international trade with a higher level of security and reliability.

htmlEdit

How to Create a Guarantee Document

Creating a financial assurance document involves several critical steps to ensure that all parties involved are protected and obligations are clearly defined. This document acts as a formal agreement between the buyer and the seller, facilitated by a financial institution. The process requires careful attention to detail and adherence to legal and contractual standards to make sure it effectively serves its purpose.

The first step is to clearly outline the terms and conditions that must be met for payment to be released. This includes specifying the goods or services being exchanged, the amount to be paid, and the deadline for fulfillment. Additionally, any documents required to trigger the payment, such as shipping invoices or inspection certificates, must be listed.

Once the terms are established, the financial institution issues the agreement based on these conditions. It is essential to ensure that all parties agree to the details before the document is finalized, as any discrepancies could lead to misunderstandings or disputes later on. With the proper steps followed, a reliable and secure transaction can be guaranteed for all parties involved.

htmlEdit

Key Components of a Financial Guarantee Agreement

To create a comprehensive financial guarantee document, it is essential to include several core elements that define the terms, responsibilities, and obligations of all parties involved. These components ensure that the agreement is clear, enforceable, and provides the necessary protection in case of non-performance.

- Issuing Institution: The financial entity responsible for issuing the agreement and guaranteeing payment, typically a bank or another recognized financial institution.

- Beneficiary: The party entitled to receive payment under the agreement, often the seller or service provider.

- Applicant: The individual or entity that requests the agreement, typically the buyer or importer who is seeking assurance for payment.

- Amount and Currency: The specified amount of money that will be paid under the agreement, usually tied to the value of the goods or services provided.

- Payment Terms: The conditions under which the payment will be made, including required documents, such as invoices or shipping receipts.

- Expiration Date: The deadline by which the payment must be completed or the agreement will no longer be valid.

Including these elements ensures that the financial guarantee document effectively protects the interests of both parties, outlining all necessary terms for a secure transaction.

htmlEdit

Common Mistakes to Avoid in Financial Agreements

When preparing financial assurance documents, it’s crucial to ensure accuracy and completeness. Small errors or omissions can lead to misunderstandings, delays, or even financial loss. To avoid complications, it’s important to be aware of the common mistakes that can arise during the drafting process.

- Incorrect Payment Terms: Failing to clearly define when and how payment will be made can create confusion. Be specific about deadlines, payment methods, and the necessary supporting documents.

- Ambiguous Conditions: Vague language or unclear conditions can lead to disputes. All terms, such as delivery requirements or inspection procedures, should be explicitly stated.

- Incomplete Documentation: Missing or incomplete documents, like invoices, shipping records, or certificates, can cause delays or even invalidate the agreement. Ensure that all required documents are listed and provided when necessary.

- Overlooking Expiration Dates: Failing to include a clear expiration date can result in an agreement that becomes void without proper notice. Always specify a deadline for the agreement’s validity.

- Inaccurate Information: Double-check all details, such as amounts, parties’ names, and currency, to avoid errors. Even minor inaccuracies can lead to complications in fulfilling the agreement.

By being mindful of these potential pitfalls, you can help ensure that the financial document remains effective, secure, and legally binding for all parties involved.

htmlEdit

Benefits of Using a Standardized Format

Using a predefined structure for financial agreements offers numerous advantages. It provides a clear framework that ensures all essential elements are included and correctly formatted. This consistency not only saves time but also minimizes errors and misunderstandings that may arise from creating agreements from scratch.

Improved Efficiency

By utilizing a standardized format, you can streamline the document creation process. The framework ensures that each agreement follows the same structure, making it quicker to fill in the relevant details and finalize the agreement. This helps to meet deadlines and reduces administrative overhead.

Reduced Risk of Errors

A standardized approach minimizes the risk of overlooking important details or making mistakes. Since the structure is already set, there is less chance of omitting vital information like payment terms, deadlines, or required documents. This helps create more reliable and secure agreements.

Overall, using a standardized format ensures consistency, reduces errors, and increases the efficiency of the agreement creation process, benefiting all parties involved.

htmlEdit

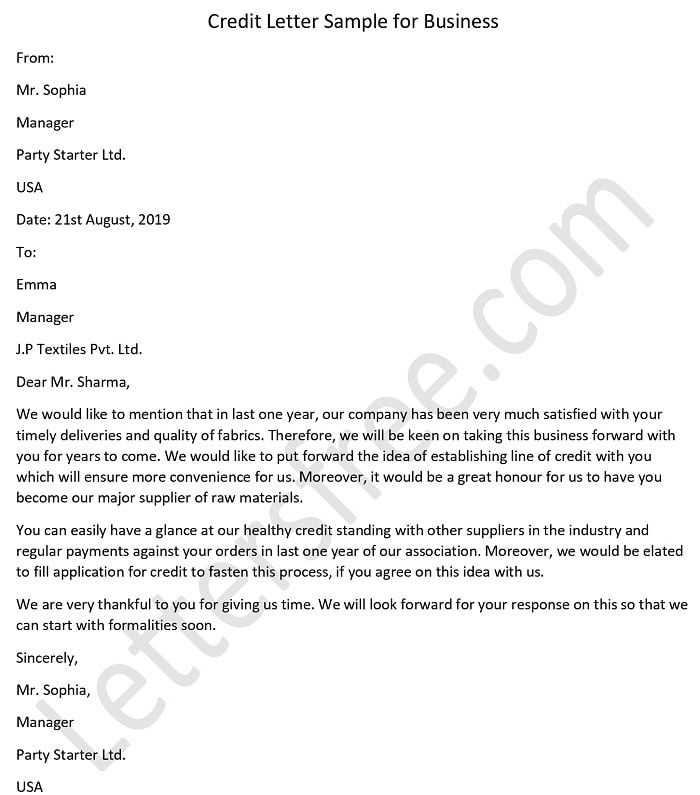

How to Personalize Your Financial Agreement

Customizing a financial agreement to suit the specific needs of your transaction is essential for ensuring that both parties are protected and the terms are clear. Personalization helps align the agreement with the unique aspects of your deal, making it more relevant and secure for all involved.

Start by adjusting the payment terms to match the specific conditions of your trade. Define the amount, currency, and method of payment according to your agreement. It’s also important to tailor the timeline and conditions for performance, ensuring that deadlines and responsibilities are explicitly outlined.

Additionally, including relevant supporting documents and clear instructions on what is required for payment can make the agreement more efficient. Whether it’s shipping invoices or inspection certificates, ensuring these are accurately referenced will help prevent any potential delays or disputes.

By personalizing these elements, you ensure that the document reflects the exact terms of your transaction, fostering better communication and a smoother process for everyone involved.

htmlEdit

Best Practices for Secure Transactions

Ensuring the security of financial exchanges is crucial in today’s fast-paced business environment. Implementing effective strategies can minimize risks and prevent fraud. When establishing secure methods for transactions, it is essential to follow a series of guidelines that protect both parties involved and foster trust. These practices are designed to create a seamless and safe process for all participants.

One of the most important steps is verifying the legitimacy of all parties. Before initiating any financial exchange, it is advisable to conduct thorough due diligence. This includes confirming the identity and financial standing of the other party, ensuring that they are reputable and capable of fulfilling their obligations.

Another key practice is to utilize secure communication channels. Ensuring that all correspondence is encrypted and transmitted through trusted platforms reduces the risk of interception by malicious entities. Additionally, using reliable payment methods that offer fraud protection provides another layer of security during the transaction process.

| Best Practice | Importance |

|---|---|

| Verification of Parties | Prevents fraud by confirming the identity and legitimacy of all participants. |

| Secure Communication | Protects sensitive information from being intercepted during transmission. |

| Reliable Payment Methods | Offers additional protection against fraud through trusted payment solutions. |

Adopting these secure practices provides confidence in the transaction process, safeguarding both financial interests and relationships.