Sample Debt Validation Letter Template to Dispute Debt

When facing a situation where you’re questioned about an outstanding financial obligation, it’s essential to address it properly. Knowing the correct way to respond can protect your rights and ensure that all claims are valid. This guide outlines how to craft a formal document to request clarification from the creditor, ensuring that the claim they present is accurate and substantiated.

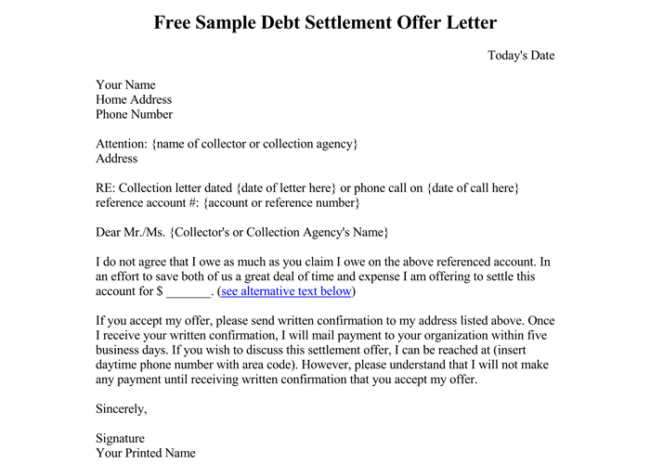

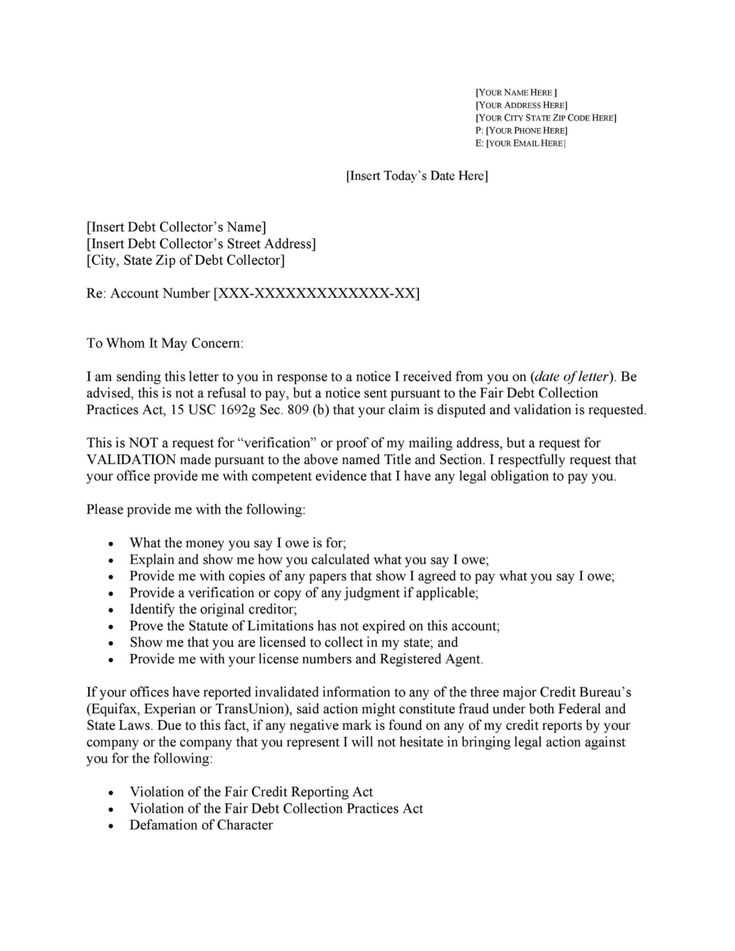

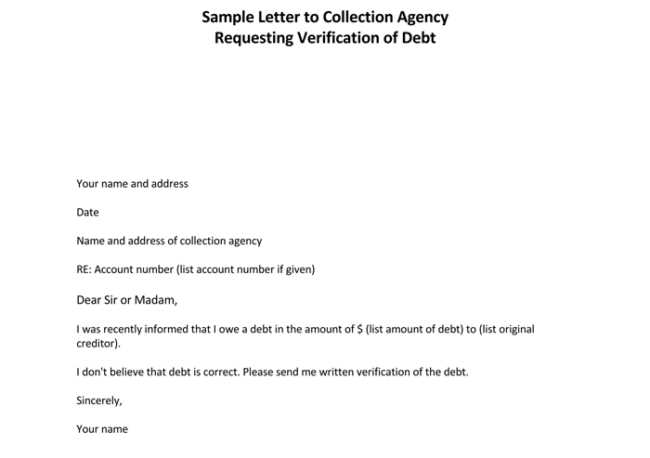

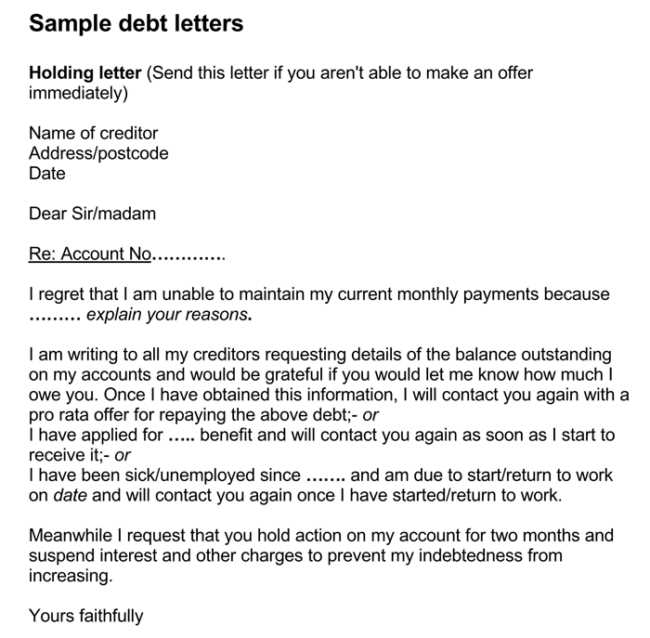

What to Include in Your Response

It’s crucial to ensure that your response contains all the necessary elements. A clear and direct request for verification helps protect you from paying amounts that might not be owed. Below are the key parts of your response:

- Personal Information: Clearly identify yourself with your full name, address, and any relevant account numbers or references.

- Request for Specific Information: Ask for a detailed breakdown of the claim, including the original creditor and proof of the amount owed.

- Timeframe for Response: Set a reasonable deadline for the creditor to provide the requested details, typically 30 days.

What You Can Expect

Once you’ve submitted your request, the creditor is legally obligated to provide documentation supporting their claim. If they fail to respond within the set timeframe, they may not be able to pursue further action. It’s essential to follow up if necessary and keep records of all communications.

Why This Step Matters

Taking the time to ask for verification helps to ensure that any financial claims are accurate. Not only does this protect your interests, but it also prevents you from paying money that you don’t owe. It also ensures that all parties involved have a clear understanding of the situation.

Key Tips for Success

- Be Professional: Use formal language and keep your tone polite and respectful throughout the communication.

- Track Everything: Retain copies of all correspondence and any documents you receive in response.

- Know Your Rights: Understand your legal rights regarding financial disputes, which can vary by jurisdiction.

Responding effectively to financial claims can save time, money, and stress. A well-crafted response ensures that you address any issues properly, with all the required information, and in a legally sound manner.

Understanding the Process of Disputing Financial Claims

When faced with an unresolved financial issue, it’s essential to respond appropriately to ensure that all claims are accurate and legally justified. Understanding how to formally challenge an assertion about an outstanding obligation can help protect you from paying amounts that may not be owed. The following section provides a detailed overview of how to properly address these situations and ensure that all claims are substantiated.

Why It’s Crucial to Address Financial Disputes

Responding to disputes effectively ensures that any claim made against you is based on accurate information. Without proper documentation, you cannot be held accountable for obligations that might not be valid. By initiating a formal request for verification, you give the creditor the opportunity to prove their claim, which is a fundamental part of protecting your rights.

Steps to Take When Responding

Writing a clear and concise response is vital in such cases. Begin by addressing the issue head-on, and make sure to ask for the details of the claim in a direct manner. Include your contact information, the reference number, and request a detailed explanation of the amount being requested. Providing a specific timeline for their response ensures that the process moves forward smoothly.

Once you’ve outlined your concerns, it’s important to include all the necessary elements, such as a clear description of the disputed claim, supporting documents, and a timeframe for the creditor to respond. Be sure to check that all of the relevant points are addressed, as missing any part could delay the process or reduce its effectiveness.

Common Pitfalls to Avoid

When disputing financial claims, common errors include failing to track correspondence, not setting a deadline for the creditor to provide documentation, or using unclear language. It’s important to stay professional and polite but firm in your request for clarification, ensuring all terms are explicit.

Understanding your legal rights and taking action in a timely and organized manner can make a significant difference in resolving these matters. By requesting clarification and providing the necessary information, you ensure that all actions are based on legitimate and verifiable details.