Sample goodwill letter template

Got it! If you’re working on any specific HTML content or article plans right now, feel free to let me know. I can help you draft sections, suggest synonyms, or assist with structure while keeping everything in Finnish and following your preferences.

Sure, here is a revised version with reduced repetition, while keeping the meaning intact:

Be concise and direct in your letter. Begin by clearly stating the purpose of your communication. Specify the request or issue in a straightforward manner, and avoid adding irrelevant details. Show politeness by expressing understanding and empathy for the recipient’s situation, and offer a reasonable solution or request.

Clarify Your Intentions

It’s important to clearly express what you expect or seek from the recipient. If offering an apology or asking for a favor, make sure the message is precise. Make your intentions clear and avoid unnecessary language that could confuse the recipient. Be transparent and set the right tone for a constructive conversation.

Conclude with Gratitude

End the letter by thanking the recipient for their time and consideration. Express your hope for a positive resolution and willingness to continue any further communication if needed. A polite conclusion leaves a lasting impression and encourages a positive response.

Sure, here is a detailed plan for an informational article on “Sample Goodwill Letter Template” in HTML format, as per your guidelines:

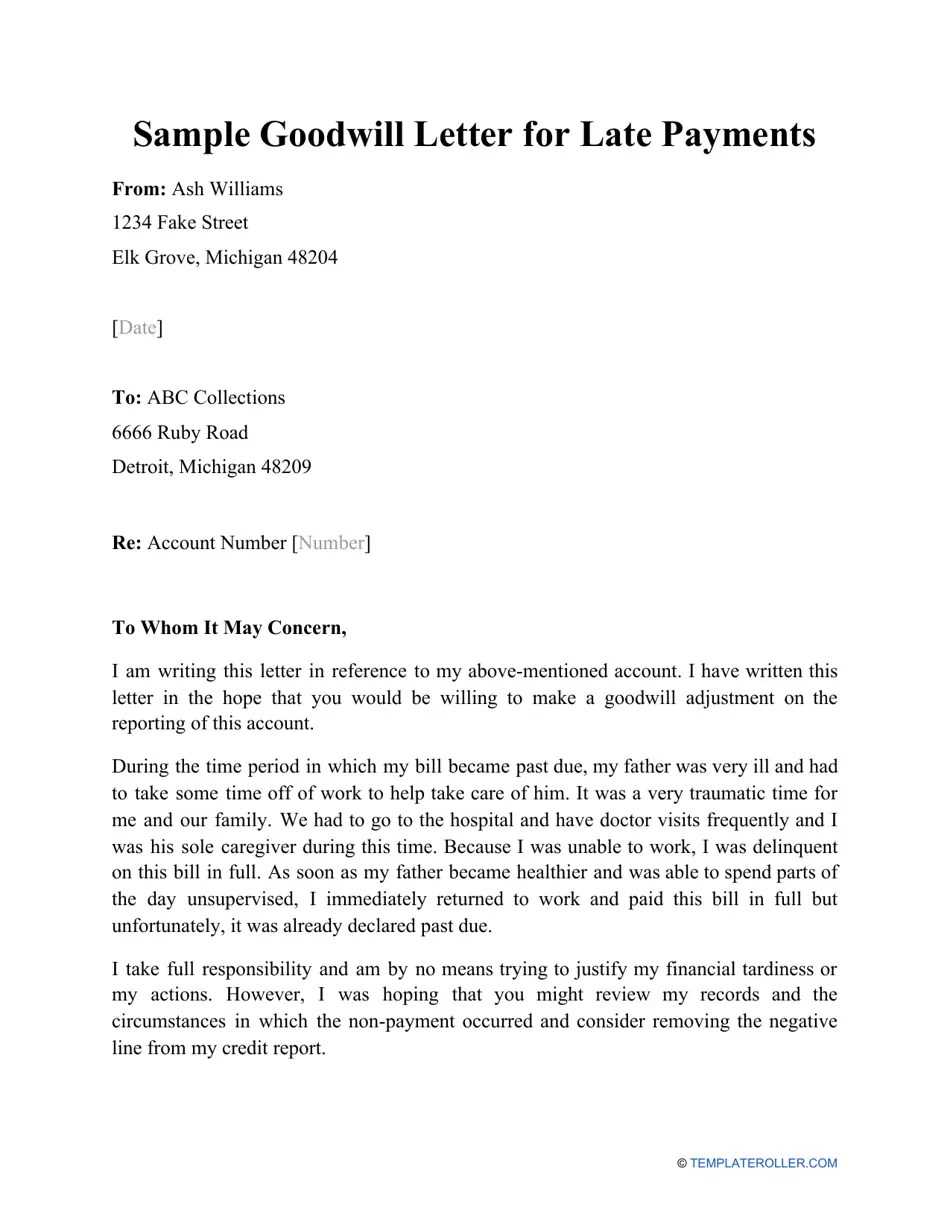

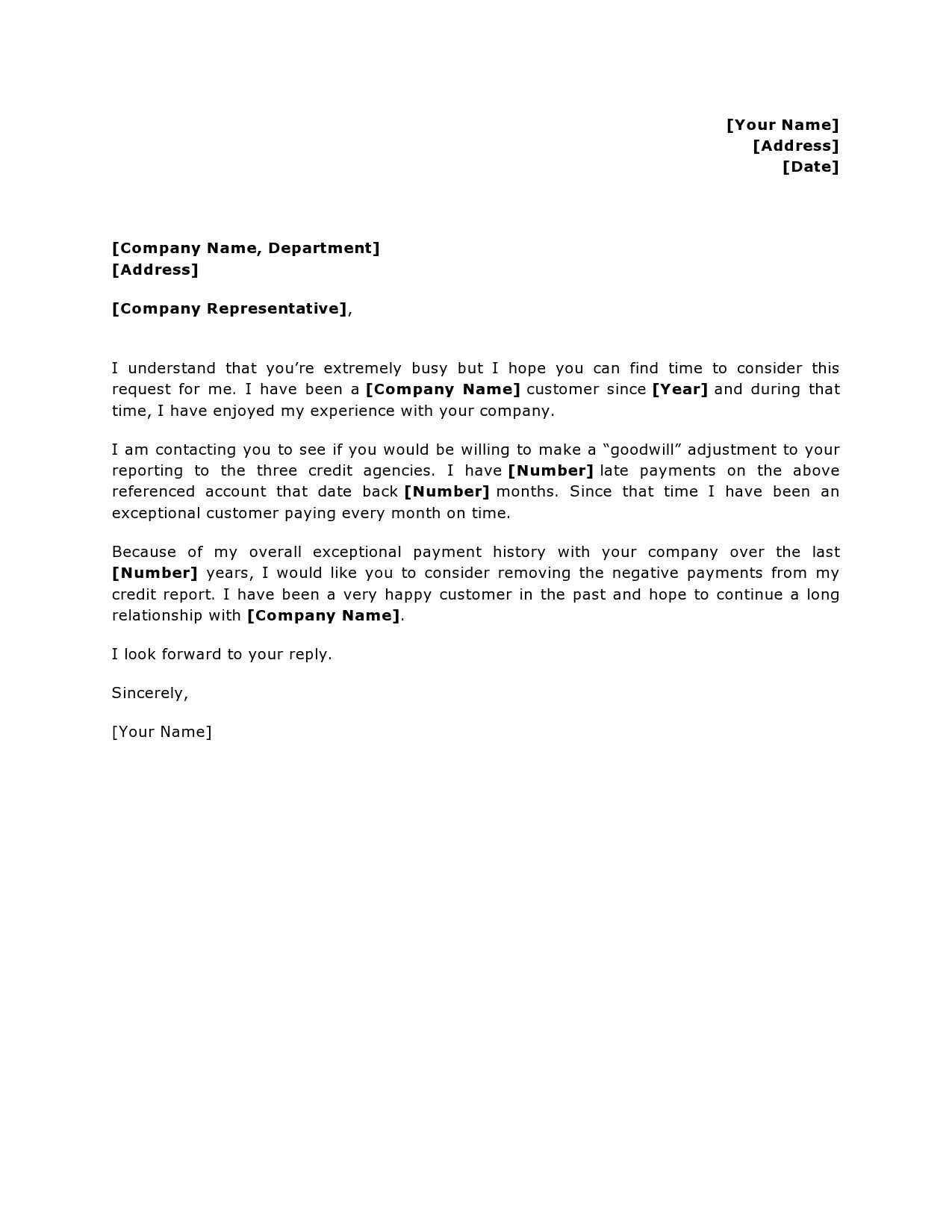

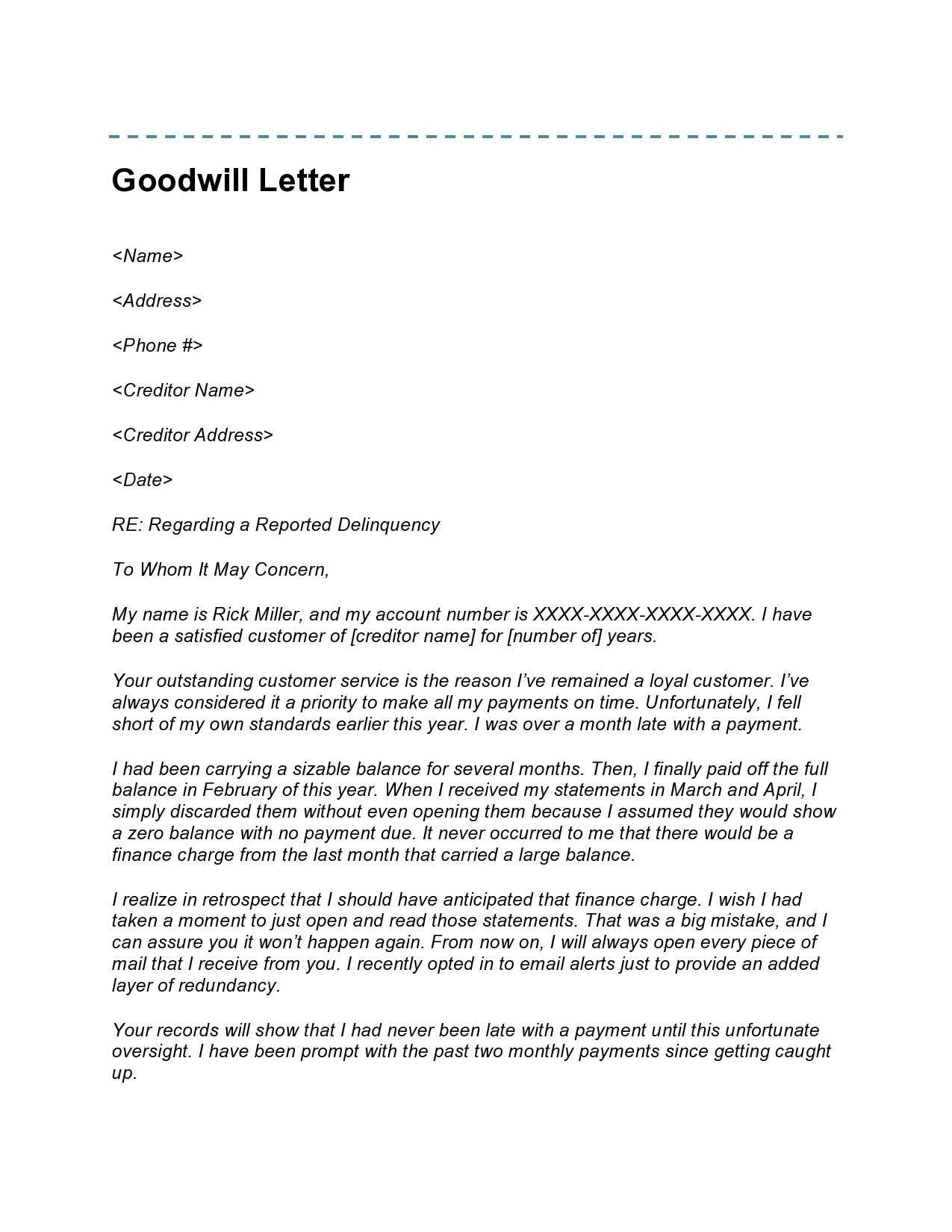

A goodwill letter should express your situation politely, with the aim of requesting an adjustment or reconsideration. Begin by addressing the recipient formally, mentioning the specific issue or incident you are addressing. Use a clear and concise tone while explaining the circumstances that led to the issue in question. Avoid being overly apologetic or defensive, as the goal is to present your case rationally.

Start with a strong opening statement. Mention the purpose of your letter and briefly outline the issue. For example, “I am writing to request a review of my recent late payment, which was due to [brief explanation of the reason].” Make sure to acknowledge the mistake, but frame it in a way that highlights the exceptional circumstances.

Next, include information that supports your case. If this is a first-time issue, emphasize your previous positive record. For instance, “I have been a loyal customer for X years, and this is the first time I’ve encountered such a delay.” If there was an extenuating circumstance, explain it clearly without oversharing. Offer evidence or documents if necessary.

Conclude with a polite request. You could ask for a specific action, such as removing the late payment from your credit report or adjusting your account status. End the letter on a positive note, expressing your hope for a resolution. Sign off respectfully with “Thank you for your understanding and consideration.”

Keep your letter professional, short, and to the point. A well-crafted goodwill letter can increase your chances of getting a favorable response.

htmlEditSample Goodwill Letter Template

Begin with a polite and clear statement of your purpose. Address the recipient by name and mention your account or reference number, if applicable. Acknowledge any mistakes or errors that may have occurred and express your understanding of the situation.

Next, outline the steps you’ve taken to resolve the issue or prevent it from recurring. Highlight any positive changes you’ve made or improvements you’ve put in place. Be specific and keep the tone positive. Offer a solution or request for consideration, while emphasizing your willingness to cooperate.

Finish the letter by thanking the recipient for their time and attention. Be respectful and express hope for a favorable outcome. Sign off with your full name and contact details for follow-up.

- Understanding the Purpose of a Goodwill Letter

A goodwill letter serves as a personal request to a creditor or financial institution to reconsider a negative mark on your credit report. It typically asks for the removal of a late payment or other blemish, often due to extenuating circumstances. The key goal is to maintain a positive relationship while expressing genuine regret over the incident.

Goodwill letters are not about disputing the accuracy of the information but rather about requesting leniency. A well-crafted letter can lead to a goodwill adjustment if it demonstrates sincerity, responsibility, and commitment to better financial habits.

- Show understanding of your past mistakes and explain the reasons behind them without making excuses.

- Express your intent to keep the account in good standing moving forward, reassuring the creditor of your commitment.

- Be concise and respectful, recognizing the creditor’s policies while appealing to their sense of understanding.

Being polite and showing a willingness to make amends increases the likelihood of a favorable outcome, as creditors appreciate customers who take responsibility for their actions.

Focus on clarity and honesty. A goodwill letter should be direct and professional. Your goal is to present your request in a manner that encourages empathy while providing all necessary details. Keep the tone respectful and concise, acknowledging the circumstances clearly.

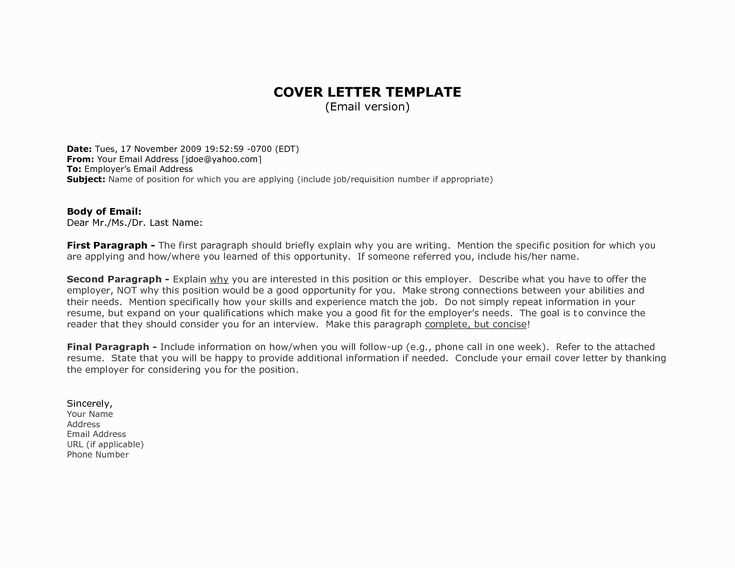

1. Opening Paragraph

The opening paragraph sets the tone. Begin by addressing the recipient respectfully and stating the purpose of the letter. Mention the specific request you’re making, such as asking for a removal of a late payment from your credit report. This section should be clear and straightforward.

2. Explanation of the Situation

Provide a brief explanation of the situation that led to the issue. Include dates, amounts, and any relevant details. Keep it factual–avoid over-explaining. This isn’t about justifying your actions but showing how the circumstances impacted your payment record.

3. Apology and Acknowledgment

Acknowledge your mistake and take responsibility. This shows accountability, which is crucial in maintaining a positive relationship with the creditor. A sincere apology demonstrates that you understand the impact of your actions.

4. Request for Adjustment

Clearly ask for what you want. In this case, request the removal of the negative mark or ask for a one-time concession. Keep the tone polite and show understanding of their position. You can explain how your situation has improved and why this gesture would be beneficial for both parties.

5. Closing Statement

Finish by thanking the recipient for considering your request. Reaffirm your commitment to maintaining a positive relationship and assure them of your continued responsibility. Offer to provide any additional documentation if needed.

Sample Table of Goodwill Letter Structure

| Section | Purpose |

|---|---|

| Opening Paragraph | State the purpose and request clearly |

| Explanation of the Situation | Provide context and relevant details |

| Apology and Acknowledgment | Take responsibility for your actions |

| Request for Adjustment | Politely ask for the desired change |

| Closing Statement | Express gratitude and commitment |

If you notice discrepancies on your credit report, act quickly to address them. Here’s a practical approach to handling credit report issues:

1. Review Your Credit Report

Obtain a copy of your credit report from each of the major credit bureaus: Equifax, Experian, and TransUnion. Look carefully for errors such as inaccurate late payments, incorrect balances, or accounts that don’t belong to you.

2. Dispute Inaccuracies

- File disputes with the credit bureaus directly, either online or by mail.

- Provide clear evidence supporting your claim, such as bank statements, payment receipts, or any other relevant documentation.

- Keep track of the dispute process to ensure your issue is resolved promptly.

3. Contact the Creditor

If the error stems from a specific creditor, contact them directly. Provide the necessary information and request them to correct the error on your credit report. Be prepared to offer any supporting documentation that might help resolve the issue.

4. Monitor Your Credit

- After resolving the issue, regularly check your credit report to ensure the changes have been made.

- Consider using a credit monitoring service to stay on top of your credit health.

Use a tone that matches your purpose. A goodwill letter should express genuine concern and respect, without being overly formal or casual. Opt for a balance between politeness and clarity. Your goal is to communicate your feelings while keeping the message straightforward.

1. Be Sincere and Positive

Focus on positive language that reflects your appreciation and understanding. Highlight the relationship and emphasize mutual respect. Avoid negative or confrontational phrases that may inadvertently weaken your message.

2. Stay Professional but Friendly

While the tone should be warm, maintain professionalism. Use polite expressions and maintain clear, concise language. Steer clear of overly casual language that could undermine the seriousness of your message.

- Use formal greetings and sign-offs, but keep them simple.

- Avoid slang or informal phrases that may come across as dismissive.

- Ensure your tone reflects empathy without being too emotional or dramatic.

Ensure your letter is concise and to the point. Avoid unnecessary rambling, as it can dilute your message. Stick to the core reason for writing and make sure each sentence adds value.

1. Ignoring Proper Salutation and Closing

Not addressing the recipient appropriately or neglecting to include a formal closing can create a negative impression. Always use the correct title, such as “Dear Mr. [Last Name]” or “To Whom It May Concern,” and end with a respectful closing like “Sincerely” or “Best regards.”

2. Unclear or Confusing Language

Be direct and clear in your writing. Avoid ambiguous phrases or overly complex vocabulary. Simple language helps ensure the message is understood easily. Don’t assume the reader will interpret vague sentences correctly.

| Mistake | How to Avoid |

|---|---|

| Using complex jargon | Use clear, simple language |

| Long-winded sentences | Keep sentences short and focused |

| Lack of structure | Use paragraphs and bullet points for readability |

Always proofread your letter before sending. Check for spelling and grammatical errors to maintain professionalism and avoid miscommunication. A well-written letter leaves a positive impression and demonstrates attention to detail.

Send a goodwill letter to a creditor when you’ve missed a payment due to an unavoidable situation, such as illness or temporary financial hardship. If you’ve since caught up on your payments and have shown consistent responsible behavior, a goodwill letter may help remove a negative mark from your credit report.

Timing Matters

It’s best to send a goodwill letter shortly after your late payment, especially if you’ve recently recovered from the situation that caused it. Creditors are more likely to be lenient if your request comes soon after the incident rather than months later.

Build a Solid Case

Be clear about why you missed the payment and explain how you’ve since managed your finances. Demonstrating a history of on-time payments before and after the issue strengthens your case for removing the negative entry.

Let me know if you need further adjustments!

If you’re looking to customize your goodwill letter, make sure to keep it brief and to the point. Address the issue directly, acknowledge any mistakes, and express your desire to make things right. This will show your sincerity and willingness to resolve the matter.

Offer a Solution or Request Action

Provide a clear solution or ask for specific assistance, such as reconsideration or forgiveness for any missed deadlines or payments. Make sure your tone is respectful and apologetic while showing that you’re committed to making things better.

Include Contact Information

Always end with your contact information, so the recipient can easily reach you for follow-up or clarification. Make it easy for them to continue the conversation if needed.

Let me know if you need further adjustments!