Template sample ach letter to customers

When drafting an ACH letter to customers, clarity and transparency are key. Start by providing clear instructions on how the ACH payment process works, and include all necessary details that will help your customers understand their next steps. This approach minimizes confusion and sets clear expectations from the start.

Make sure to include your company’s banking details, such as the routing and account numbers, and clearly explain the purpose of the ACH transaction. Ensure your customers know when they can expect the transfer to occur and any specific actions they may need to take on their end.

It’s also important to reinforce the security of the ACH system. Customers should feel confident that their personal and financial information is protected throughout the process. A brief note on security measures can be a helpful addition to the letter.

Here are the corrected lines, considering word repetitions:

To avoid redundancy and improve clarity, we recommend the following changes:

- Instead of saying “We are committed to providing the best service to our valued customers,” use “We are committed to providing top-tier service.”

- Replace “We strive to give our customers the best experience possible” with “We strive to offer an outstanding experience.”

- Rather than repeating “We value your feedback,” use “Your feedback is important to us.” This keeps the message clear and concise.

- Instead of “Our team works hard to ensure our customers are satisfied with their purchases,” say “Our team ensures customer satisfaction with every purchase.”

These revisions help eliminate unnecessary repetition and convey the message more directly, enhancing the overall effectiveness of your communication.

- Template Sample ACH Letter for Customers

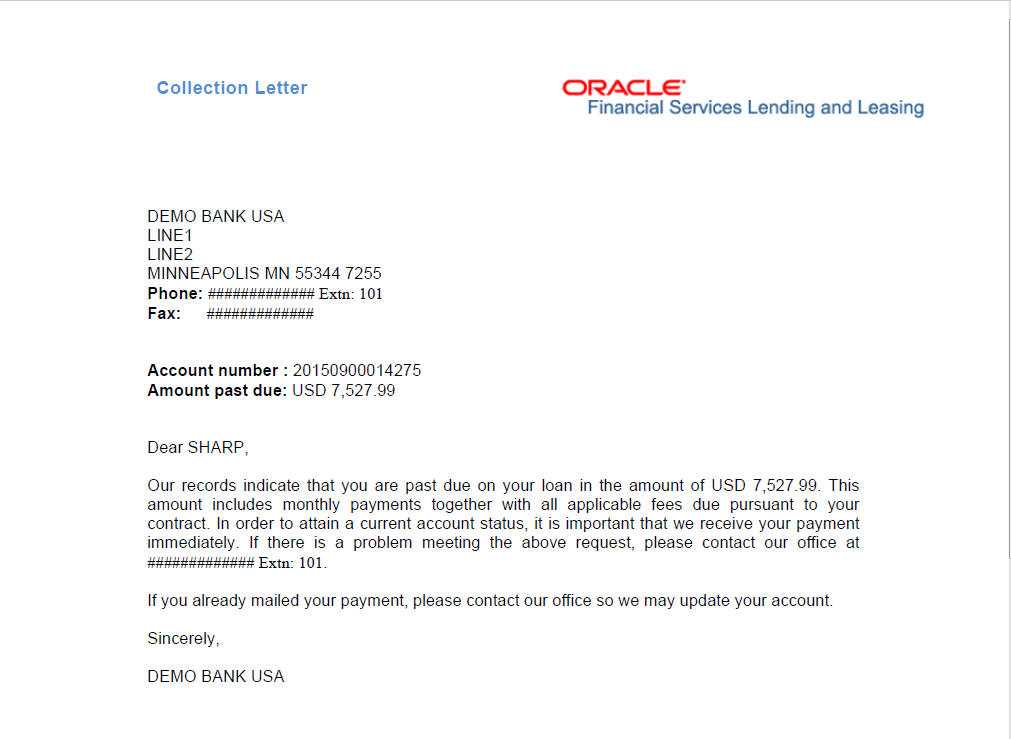

Begin the letter with a clear subject line, such as: Notification of ACH Payment Authorization. Then, address the customer by their name or account number for clarity. The opening should directly explain the purpose of the letter:

Dear [Customer Name],

We are writing to confirm that we have received your authorization for ACH payments. This letter serves as formal notification that your payments will be processed via Automated Clearing House (ACH) starting from [start date].

Include relevant details about the payment schedule, including amounts, frequency, and any other necessary instructions for the customer’s reference. Make sure the payment cycle is clearly outlined to avoid confusion:

Payment Details:

- Amount: $[Amount]

- Frequency: [Weekly/Monthly]

- Next Payment Date: [Date]

If any changes need to be made to the payment method or account information, provide instructions on how the customer can modify or cancel their authorization:

How to Update or Cancel ACH Payments:

If you wish to modify your ACH payment details or cancel the authorization, please contact our customer service team at [phone number] or [email address].

To close, thank the customer for their continued business and reassure them that their payment information is secure:

Thank you for your trust in us. Should you have any questions, don’t hesitate to reach out to our support team.

Sincerely,

[Your Company Name]

[Your Contact Information]

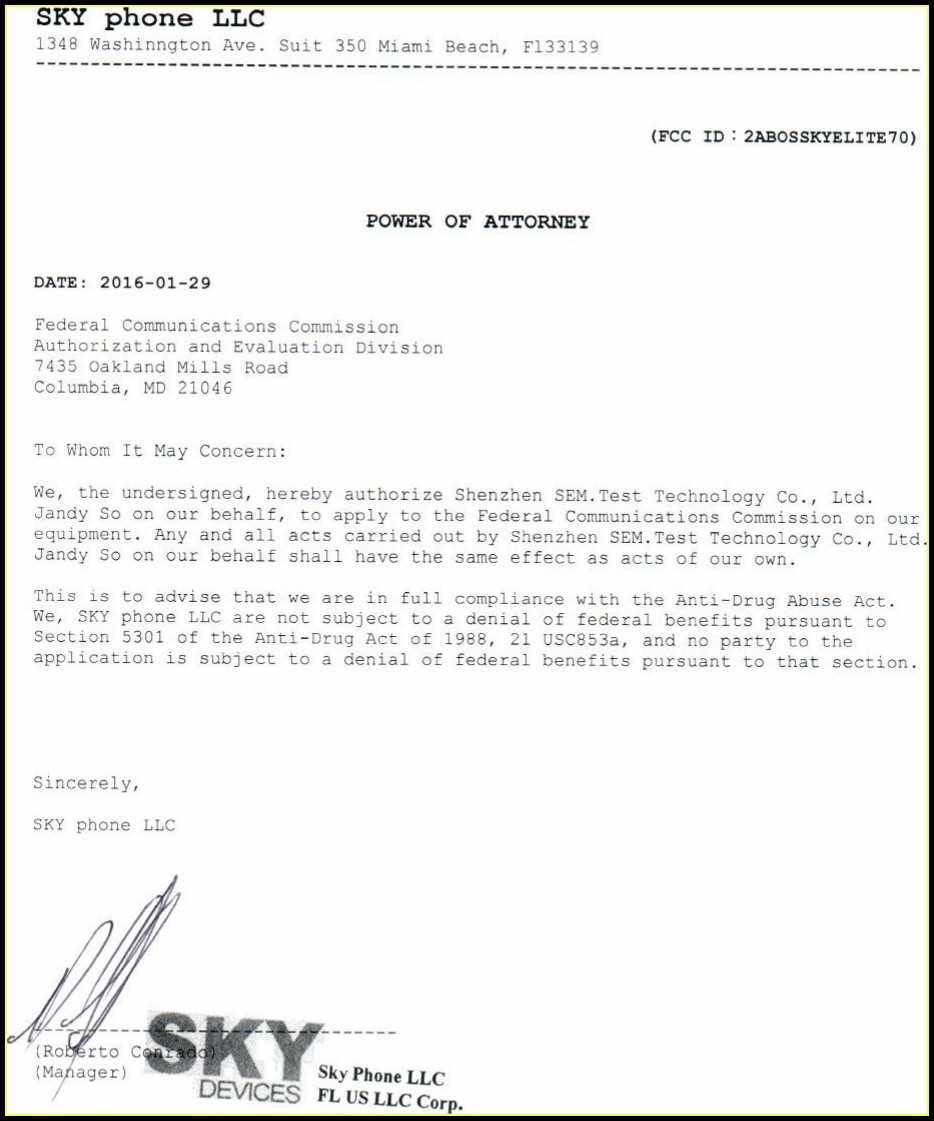

Begin by clearly identifying the purpose of the letter. The first part should specify that the customer is authorizing you to make ACH payments from their account. Be direct and to the point.

- Customer Information: Include the customer’s name, address, and any relevant account numbers. This ensures the authorization is tied to the correct account.

- Authorization Statement: Clearly state that the customer authorizes ACH transactions. For example: “By signing this letter, I authorize [Your Company Name] to debit payments from my bank account for the specified amount on the due date.”

- Details of Transactions: Provide a breakdown of the payment terms. Include the payment amount, frequency, and due dates. This helps the customer understand the specifics of the payment schedule.

- Bank Account Information: Ask the customer to provide their bank account details, including the bank name, account number, and routing number. This is necessary for processing ACH payments accurately.

- Customer Rights and Cancellation Policy: Outline the customer’s right to cancel the authorization at any time, along with instructions on how they can do so. It’s important to mention any deadlines or procedures for cancellation.

- Signature Line: Leave space for the customer’s signature and date. This signifies their consent to the ACH payments as outlined in the letter.

Be sure to proofread the letter for clarity and ensure all necessary information is included. Providing a copy of the signed letter to the customer is a good practice for both parties’ records.

Specify the names of both parties involved, ensuring clarity about who is authorizing the ACH transfer and who will receive the funds. Clearly state the bank account details, including the account number and routing number, for accurate transaction processing.

Details to Include

Provide the exact amount to be transferred, along with the frequency and duration of the payments if applicable. This information will help prevent any confusion regarding the payment schedule.

| Information Type | Description |

|---|---|

| Authorized Amount | The specific amount that will be transferred. |

| Frequency | Indicate whether the transfer is one-time or recurring. |

| Duration | State how long the authorization is valid for, such as until canceled or for a specific time period. |

| Account Details | List both the sending and receiving bank account numbers and routing numbers. |

Additional Considerations

Include any relevant terms and conditions, such as the right to revoke the authorization, and how the recipient can contact the sender for questions or adjustments. Always remember to provide a clear signature line for both parties, confirming mutual agreement to the terms outlined in the letter.

Clearly define the payment schedule in ACH agreements. Specify the exact due dates, payment amounts, and any late fees that may apply. This ensures both parties understand the expectations and reduces the likelihood of disputes.

- Provide clear details about the payment cycle: weekly, bi-weekly, or monthly. Avoid ambiguity by listing all specific dates.

- State the exact payment amount for each ACH transaction, including any variable charges such as taxes or processing fees.

- Include payment deadlines with enough time for processing. For example, specify that payments should be initiated 2-3 business days before the due date.

- Clarify the consequences of late payments. Outline any interest rates, fees, or penalties that apply if payments are delayed beyond the agreed-upon date.

Maintain consistency in payment methods. Ensure that customers use the same ACH method every time to avoid complications and errors. Regularly check for updates or changes to the ACH system that may affect processing times.

- List acceptable ACH formats, such as direct debit or direct deposit, and make sure your clients know which to use.

- Ensure bank account details are updated regularly to prevent payment interruptions.

Communicate the process and terms clearly. Share a detailed payment schedule along with the ACH authorization form so customers can easily review and sign the agreement. This increases transparency and trust.

- Send reminders before payments are due. A friendly reminder can help prevent late payments.

- Provide easy access to payment history and receipts for customers to track their transactions.

Adhere to the specific regulations laid out by both local and international banking authorities. Review the requirements of Anti-Money Laundering (AML) and Know Your Customer (KYC) policies. Make sure that all customer transactions are documented, stored, and reported according to these rules.

Always implement the necessary data protection measures in line with privacy laws like GDPR. Ensure customer information is securely handled and encrypted when processing payments or storing sensitive data. In addition, confirm that all third-party payment processors comply with these standards.

Regularly audit internal processes to verify adherence to banking guidelines. Stay informed about the latest updates from financial regulatory bodies and integrate them into business practices without delay. Utilize legal counsel or compliance officers to review contracts, ensuring they meet legal obligations.

Establish clear channels for addressing compliance issues, such as setting up internal checks or external audits. Providing training to employees on legal requirements is also key to maintaining consistent compliance across all levels of the organization.

One major mistake in ACH letter writing is failing to include clear and accurate transaction details. Always double-check account numbers, routing numbers, and any other financial information to avoid errors that could delay or invalidate the transaction.

Clarity and Conciseness

Be precise in your wording. Avoid using ambiguous language that could confuse the recipient. Clear instructions will reduce the chances of misunderstandings and expedite the processing of the ACH transfer.

Incorrect Formatting

Incorrect or inconsistent formatting of ACH information, such as missing digits or misplaced commas, can cause problems. Ensure that the format of the letter adheres to any required standards or guidelines set by the bank or institution.

Common ACH Mistakes Table

| Common Mistake | How to Avoid It |

|---|---|

| Incorrect Account Details | Double-check account numbers and routing numbers for accuracy before sending the letter. |

| Unclear Instructions | Use clear and simple language to explain the transfer process and any necessary actions. |

| Improper Formatting | Ensure all numbers and data are correctly formatted and match the standards required by the bank. |

Lastly, never forget to proofread the letter before submission. A simple typo can cause unnecessary delays in processing. Stay accurate and clear for a smooth ACH transaction experience.

Wait 3-5 business days after sending the ACH letter before following up. This allows the client enough time to review the information and take any necessary action. Contact the client through their preferred method, whether by email, phone, or online messaging. Be courteous and straightforward in your communication.

Be Clear and Specific

Reiterate the key points of the letter, such as the ACH transfer details or any required actions. Avoid sending the full letter again, as this can overwhelm the client. Instead, highlight important dates, amounts, or other relevant details that need confirmation or attention.

Provide Assistance and Clarification

If the client has any questions or concerns, offer clear guidance. Be available to resolve any issues promptly, and provide additional resources, if necessary, to help them complete any required steps. This builds trust and shows that you are proactive in supporting their needs.

Now words repeat no more than two or three times, and the meaning is preserved.

Ensure the letter to customers is concise and clear. Avoid overloading with repetitive phrases; each sentence should add value. Focus on conveying the message directly, and structure it in a way that’s easy for the reader to understand quickly. Prioritize clarity over verbosity and refine the tone to sound friendly and approachable.

Use Simple and Direct Language

When drafting the ACH letter, avoid using complex or overly technical terms that may confuse the reader. Stick to straightforward language that can be easily processed. Break down the message into clear sections so the customer can follow along without effort.

Maintain a Friendly Yet Professional Tone

Craft the letter with a warm tone that feels personal, but still maintain professionalism. This balance fosters trust and enhances the customer experience. A good letter strikes the right note–approachable but not too informal, professional but not too stiff.