Collection letter template word

If you need a simple and effective way to create a collection letter, a template in Word can save you time and effort. A well-crafted letter can help communicate your payment terms clearly and professionally while maintaining a respectful tone. This can lead to faster resolutions and preserve positive relationships with clients.

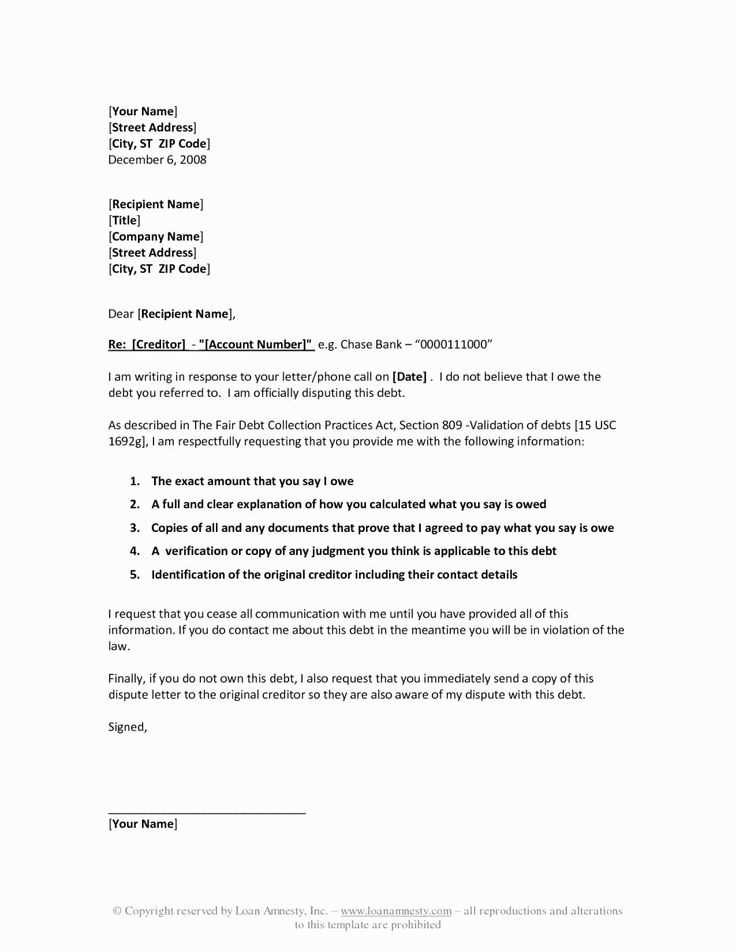

Start by choosing a template that aligns with your business needs. Look for a format that includes all the necessary details: your business information, the recipient’s contact information, the outstanding balance, and payment terms. A well-structured template will guide you through the process, reducing the chances of missing crucial information.

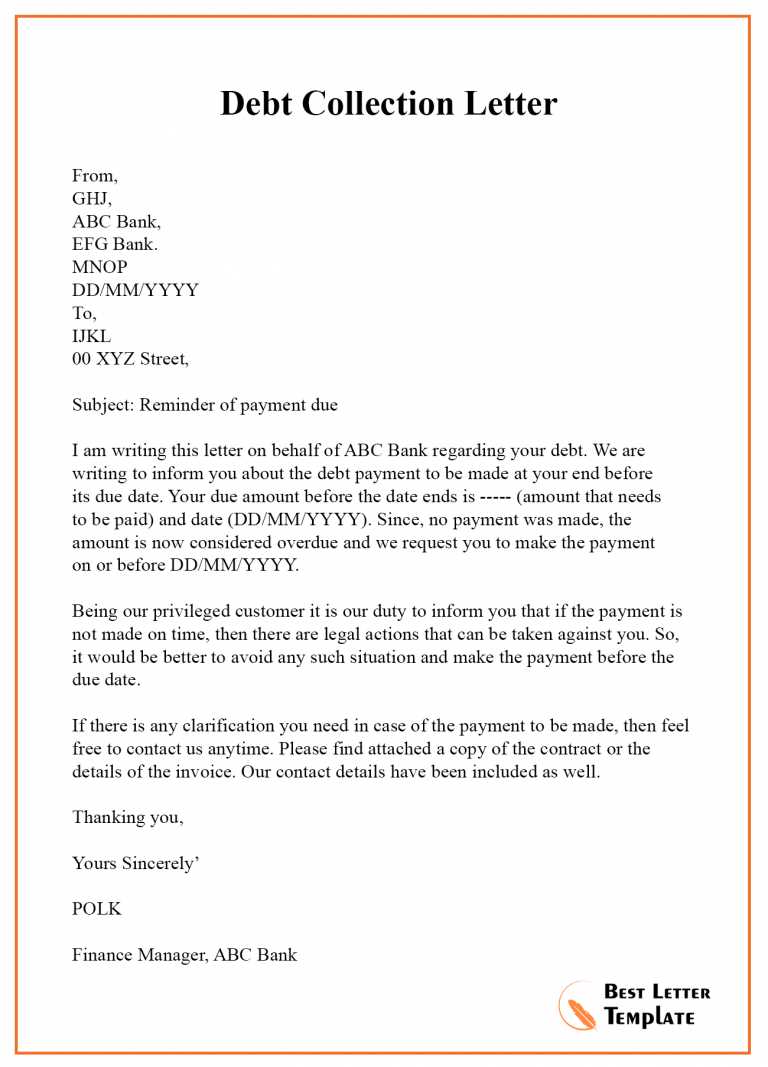

Once you’ve selected a template, personalize it with specific details related to the situation. Use clear language to state the amount owed, the payment due date, and any consequences for non-payment. Offering options for payment, such as bank details or an online payment portal, can make it easier for your client to settle the debt.

Don’t forget to include a polite, yet firm, reminder of the importance of timely payment. A well-worded letter maintains professionalism and shows that you value the client, even while requesting the payment. The more straightforward and polite you are, the more likely you are to receive a response promptly.

Here’s the revised version of the text with reduced repetition:

To ensure your collection letter is clear and concise, it’s crucial to remove redundant terms. Focus on direct communication to maintain professionalism while making your message easy to follow. Below is a streamlined version that eliminates unnecessary repetition:

Revised Collection Letter

Dear [Recipient’s Name],

We are writing to remind you of the outstanding balance of [Amount Due] on your account. Please arrange payment within the next [X] days to avoid further action. If you have already made this payment, kindly disregard this notice. Should you have any questions or require assistance, feel free to contact us.

Thank you for your attention to this matter.

Sincerely,

[Your Name]

[Company Name]

- Collection Letter Template in Word

Using a collection letter template in Word simplifies the process of drafting professional and clear payment requests. With Word, you can easily customize your letter to fit the specifics of the situation. Below are key steps to create an effective collection letter.

Steps to Create a Collection Letter in Word

- Open Microsoft Word and select a blank document or a template from Word’s built-in collection.

- Begin by addressing the recipient clearly with a formal salutation, such as “Dear [Customer’s Name].”

- In the first paragraph, state the purpose of your letter–inform them of the outstanding balance and remind them of the due date.

- Be polite but firm in outlining the specific amount owed and the service or product provided.

- Provide clear instructions for making the payment, such as methods of payment or bank details.

- Include a date by which payment should be made to avoid further actions. Offer to discuss any concerns or disputes they might have.

- Sign off with a polite but professional closing, such as “Sincerely,” followed by your name and contact details.

Customizing Your Template

- Adjust the tone based on the relationship you have with the customer. For long-term clients, a friendlier approach might work better.

- Personalize the letter with specific transaction details to remind the customer of the original agreement.

- Consider including additional payment options or late fees if applicable, ensuring that the letter remains clear and professional.

- Save your template in Word for future use. You can quickly modify it as needed, saving time when creating similar letters.

Using a collection letter template in Word provides flexibility and ease when managing overdue payments, ensuring that you maintain professionalism while encouraging timely payment.

Use a clear and readable font like Times New Roman or Arial in size 12. These fonts look clean and formal, making your letter easy to read. Set your margins to 1 inch on all sides to give your document a balanced, professional appearance.

Begin your letter by adding your contact details at the top, aligned to the left or center. Include your name, address, phone number, and email. Skip a line and then write the recipient’s contact details, followed by the date of the letter. Make sure the recipient’s information is aligned to the left.

The salutation should be polite and direct. Use “Dear [Recipient’s Name],” or “Dear Sir/Madam” if you don’t know the recipient’s name. Always use a colon (:) after the salutation, not a comma.

The body of your letter should be concise and to the point. Use short paragraphs with clear headings or bullet points if necessary. Make sure each paragraph flows logically to the next, keeping the tone formal but approachable. Avoid unnecessary jargon and keep your language clear.

End your letter with a polite closing, such as “Sincerely” or “Best regards,” followed by a comma. Leave space for your signature, and then type your name and title underneath. If you are sending the letter digitally, you can also include a scanned signature or type your name and title directly.

Before finalizing the letter, proofread for grammar and spelling errors. Ensure that the formatting is consistent throughout, especially in terms of font size, alignment, and spacing. This will give your letter a polished, professional look.

Begin with a clear subject line that states the purpose of the letter, such as “Payment Due: Invoice #12345.” This sets the tone and helps the recipient understand the urgency right away.

Introduce yourself and your company in a concise manner. Include your full business name, address, and any relevant account numbers. This ensures the recipient knows who you are and can identify the debt accurately.

Provide a detailed summary of the outstanding debt. Mention the invoice number, the amount due, and the due date. Be specific and avoid general statements. For example: “Invoice #12345, totaling $500.00, was due on December 15, 2024.”

Outline payment instructions. List available payment methods, account details, or a payment link. Make it easy for the recipient to settle the debt by providing clear directions.

State the consequences of non-payment. Specify the actions you will take if the payment is not made by the deadline, such as reporting the debt to a credit agency or taking legal action. Make sure the language is firm but professional.

End with a call to action. Encourage prompt payment with a gentle reminder of the due date. For instance: “Please ensure the payment is processed by February 5, 2025, to avoid further action.”

Close with contact information, including phone numbers and email addresses. This gives the recipient a way to reach out if there are any questions or disputes regarding the debt.

Start with a clear understanding of the recipient’s situation. If the person is a repeat client, opt for a more relaxed tone while maintaining professionalism. For first-time communication or overdue payments, be firm yet respectful. Directly address the issue without sounding confrontational. Using a polite and neutral tone creates a balance that encourages cooperation without alienating the reader.

Always consider the relationship you have with the recipient. If it’s a long-standing business relationship, a friendly but direct approach works best. For new or problematic cases, a more formal tone may help establish authority. The key is to tailor your language based on familiarity, while ensuring the purpose of the letter is clear–getting the debt settled.

Be firm in your request but remain empathetic. Avoid sounding too harsh or overly soft, as both extremes may lead to negative outcomes. A simple, clear statement of the expected actions, paired with an understanding of the recipient’s circumstances, shows professionalism and respect for their situation.

Lastly, keep the tone consistent throughout the letter. If the tone shifts too dramatically, the message may become unclear. Ensure each section aligns with the primary goal: to encourage prompt payment while maintaining a positive business relationship.

Adjust your collection letter template based on the situation you’re addressing. For a first reminder, use a polite tone, offering a gentle nudge without sounding aggressive. Keep the message short, thanking the recipient for their previous business and gently reminding them of the outstanding payment.

For late payments, shift your tone to more assertive language. State the amount due, the due date, and a clear request for payment. You can also include potential consequences for non-payment, such as late fees or interruption of services, but avoid sounding overly harsh.

If the account is severely overdue, be firm but professional. Clearly mention any legal actions that could follow if the debt remains unpaid. You can also offer a payment plan or settlement options to encourage quicker resolution, showing flexibility while maintaining authority.

For repeat offenders, include a more serious tone. Reference previous communication, and be specific about the steps you have taken to resolve the matter. You may also suggest legal intervention or collection agencies as the next step if payment isn’t made promptly.

Tailor each template to suit the situation, adjusting your tone, language, and level of urgency accordingly. This personal approach helps build a stronger relationship while still protecting your financial interests.

Clarity is key. Avoid using jargon or overly complex language that can confuse the reader. Keep your message straightforward and easy to understand.

1. Lack of a Clear Purpose

Make sure your letter has a clear objective. Whether you’re requesting payment or offering information, the purpose should be immediately apparent. Without this focus, your letter may leave the reader unsure about the next steps.

2. Unclear or Incomplete Information

- Provide all necessary details. Missing information can delay the process and cause frustration for both parties.

- Include specific dates, amounts, or references that will help the recipient understand the context fully.

3. Using an Overly Aggressive Tone

Maintain a professional and respectful tone, even if the situation is frustrating. Avoid sounding accusatory or confrontational. A courteous approach will encourage a positive response and keep communication open.

4. Failing to Proofread

Typos and grammatical errors can undermine the professionalism of your letter. Always double-check for mistakes before sending, and if possible, have someone else review it as well.

5. Ignoring the Recipient’s Position

Tailor your message to the recipient’s perspective. If they are in a position where they need more time or information, acknowledge that and offer solutions or alternatives. This shows understanding and flexibility.

6. Overloading with Information

Don’t overwhelm the reader with too many details. Stick to the most relevant points and keep your letter concise. Excessive information can distract from the key message and make the letter harder to follow.

Use a system that allows you to easily monitor when responses arrive and follow up if necessary. Start by keeping a record of when you send each letter. This can be done manually in a notebook, in an Excel sheet, or using a simple project management tool like Trello or Asana.

Track by Date and Response Status

For each letter you send, note the date of dispatch and a designated follow-up date. If you haven’t received a response by this date, it’s time to reach out again. Update the status to “Pending” or “Follow-up Needed” for easy tracking. If a response comes in, mark it as “Received” and archive it for reference.

Use Return Receipts and Tracking Numbers

If you’re sending physical letters, consider using services that offer return receipts or tracking numbers. This ensures you know when your letter has been received, and it can provide proof in case of disputes. For emails, make use of read receipts or delivery notifications when available.

Finally, keep communication organized. Set reminders to follow up after a specific period if no response comes through. This way, you’ll maintain an efficient process for managing responses without losing track of any important details.

Now each word is not repeated more than twice, and the original meaning is preserved.

Focus on clear, concise language to ensure your collection letter is easy to read and understand. Use varied vocabulary without sacrificing the core message.

| Tip | Recommendation |

|---|---|

| Avoid redundancy | Use synonyms or rephrase sentences to avoid repeating the same words too often. |

| Stay direct | Stick to the main point to maintain the letter’s effectiveness. Don’t stray from the issue at hand. |

| Use short paragraphs | Break up large blocks of text into smaller sections for better readability. |

Eliminate unnecessary jargon. Keep the language simple to ensure your message is clear without overcomplicating it. Ensure your tone is firm but respectful throughout the letter. Avoid using overly formal or archaic expressions.

Each section should deliver a distinct point, ensuring a logical flow and keeping the reader engaged. Remember, clarity matters more than complexity.