Private Mortgage Payoff Letter Template for Word

When it comes to completing the final step in clearing a debt, crafting a formal document to confirm the closure is essential. Such a document ensures both parties acknowledge the settlement, outlining important details such as the remaining balance and agreement terms. Knowing how to format this document correctly is crucial for both accuracy and legal clarity.

Essential Components of a Debt Settlement Statement

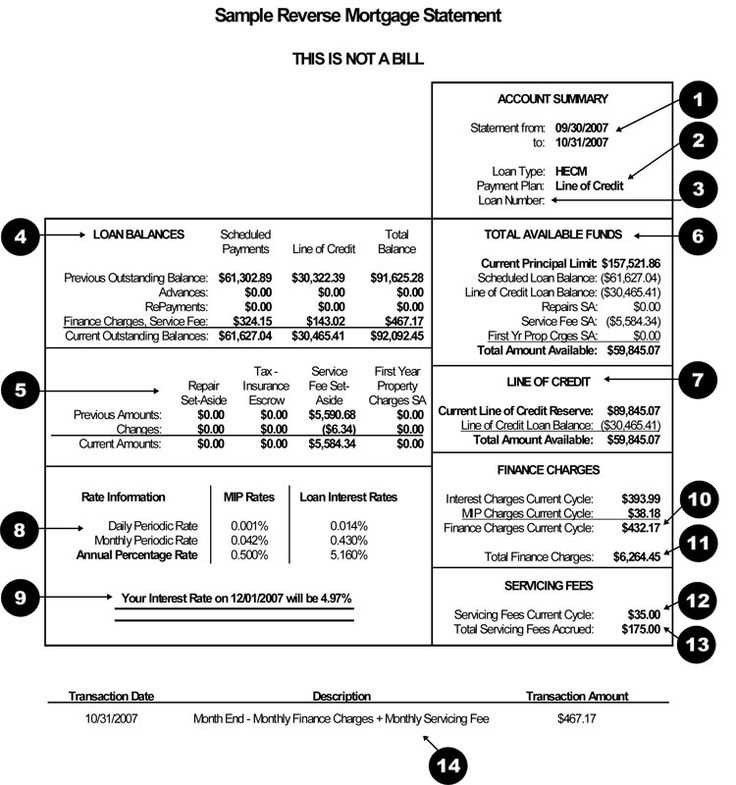

To ensure the document is comprehensive and effective, it should include several key pieces of information:

- Personal details of both the lender and borrower

- Final amount that has been settled

- Date of full settlement

- Confirmation that the debt is fully cleared

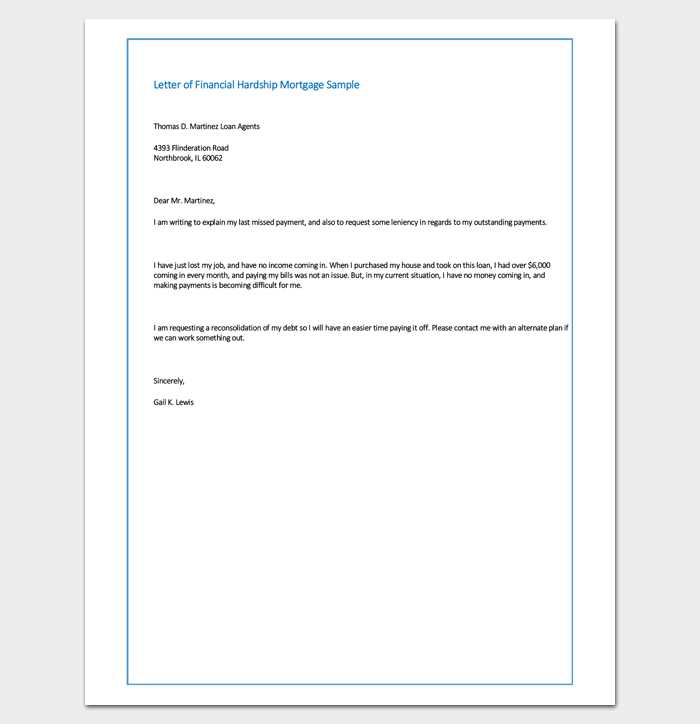

Why You Should Customize Your Document

Using a general document format can sometimes lead to important information being overlooked. Customizing the content ensures that all specific conditions related to the settlement are included. This can protect both parties from future misunderstandings or disputes.

Common Mistakes to Avoid

While drafting the document, be mindful of these common errors:

- Failure to double-check the final amount for accuracy

- Not including the proper signatures from both parties

- Leaving out important dates or details

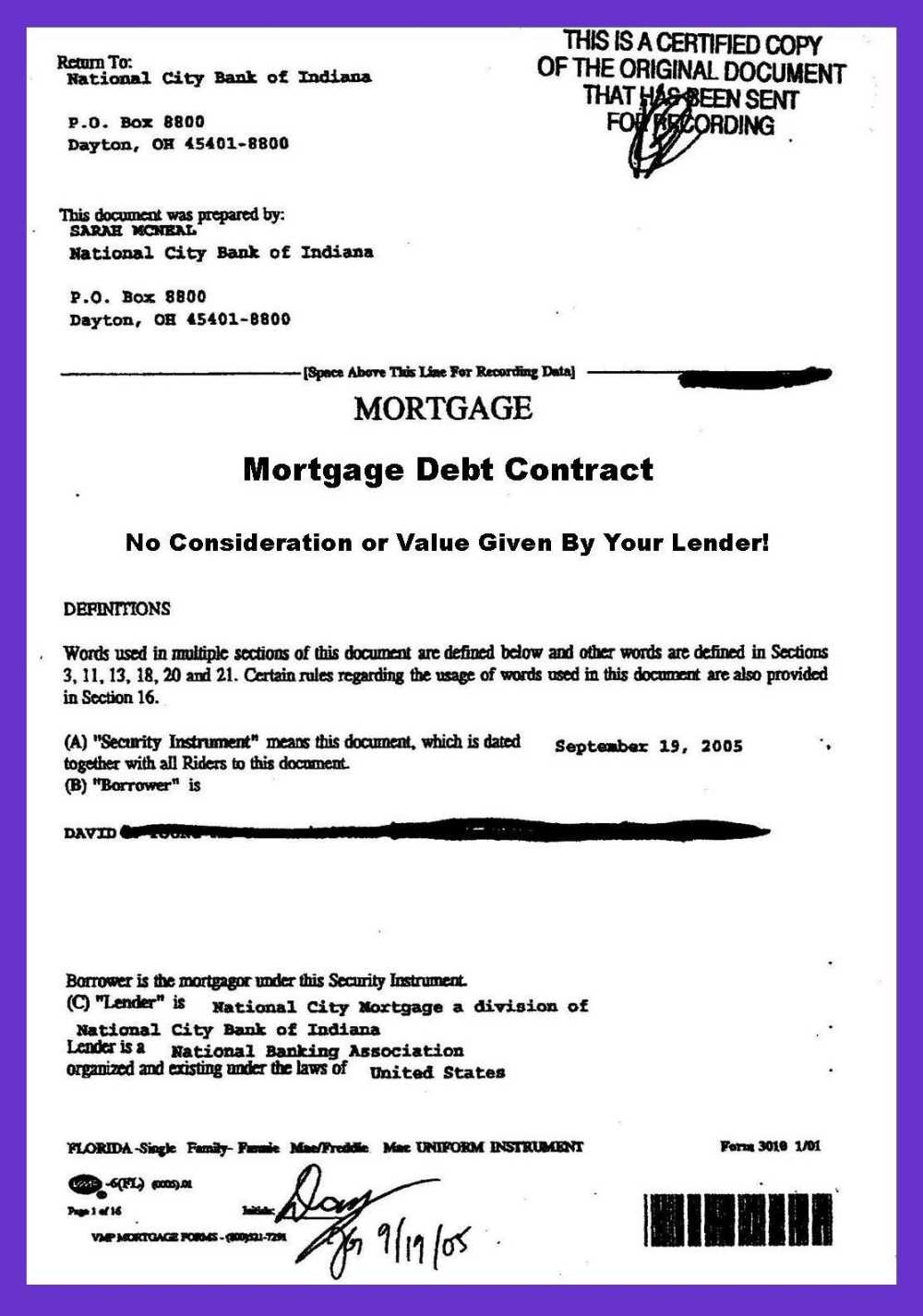

Finalizing and Using the Document

Once completed, the document should be signed by both the borrower and lender. It can then be stored for future reference or submitted as proof of debt resolution. Having a clear record of settlement can be beneficial for both credit history and legal purposes.

Creating a Document for Loan Settlement

Completing a financial agreement is an important step in resolving a debt. When the borrower has fulfilled their obligation, it’s essential to create a formal record that confirms the debt has been fully paid. This document should include specific details to ensure both parties acknowledge the settlement and its terms clearly.

Key Information Found in a Debt Settlement Document

A well-structured settlement document must contain the following details:

- Identifying details of both the borrower and lender

- Amount of the loan cleared

- Effective date of the settlement

- Confirmation that no further payments are due

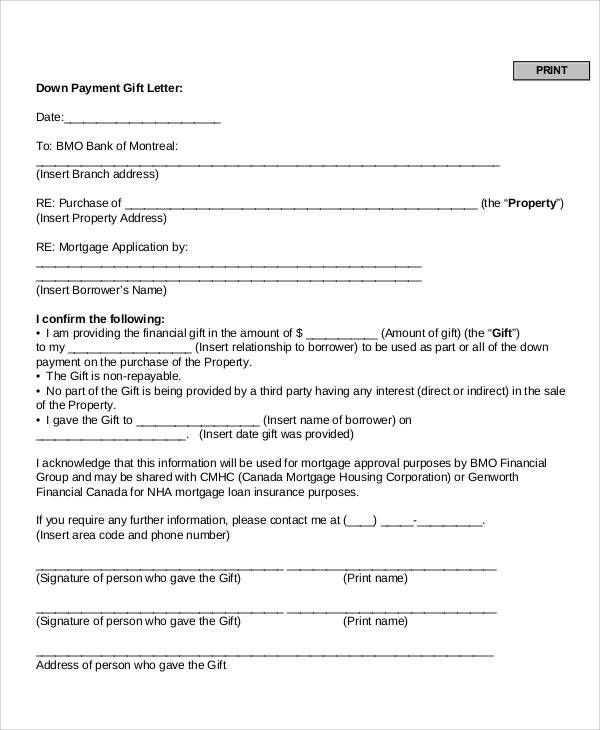

Benefits of Using a Structured Format for Documentation

Utilizing a structured format for drafting the document ensures consistency and avoids errors. A standardized framework makes the process quicker, more accurate, and legally sound. This is particularly useful in maintaining records or when dealing with financial institutions.

Customizing the document allows you to reflect specific details pertinent to your case. It helps to highlight any special conditions that might apply, such as payment deadlines or the inclusion of extra fees.

Important Considerations When Submitting the Document

Once the document is completed, ensure that all relevant parties sign it. This provides legal acknowledgment of the agreement. It’s also critical to keep a copy for personal records, as it might be necessary for future financial dealings or disputes.