Word collection letter template

If you need to send a letter that collects information or updates from others, using a well-structured template will save time and ensure clarity. A well-crafted letter should be direct, organized, and professional. Use clear sections for the purpose of the letter, the information you’re requesting, and any deadlines for responses.

Start with a polite greeting and introduce the main goal of the letter right away. Avoid unnecessary details and get straight to the point. Include bullet points or numbered lists for easy reading, and ensure your message is concise. The tone should be friendly yet formal, encouraging recipients to respond promptly without feeling rushed.

For example, if you’re collecting feedback or updates, ask for specific details to avoid vague responses. Provide enough context to make your request clear but without over-explaining. Offering a specific time frame for responses shows you value the recipient’s time and helps keep the process moving efficiently.

Keep your closing positive and open, inviting questions if needed. A strong closing reassures the reader that you are available for further clarification, creating an approachable atmosphere. Finally, remember to double-check your template before sending it out, ensuring it’s easy to follow and free of errors.

Sure! Here’s a detailed plan for an informational article on the topic “Word Collection Letter Template” with 6 practical and narrow subheadings. The content is in HTML format using

1. Purpose of a Word Collection Letter

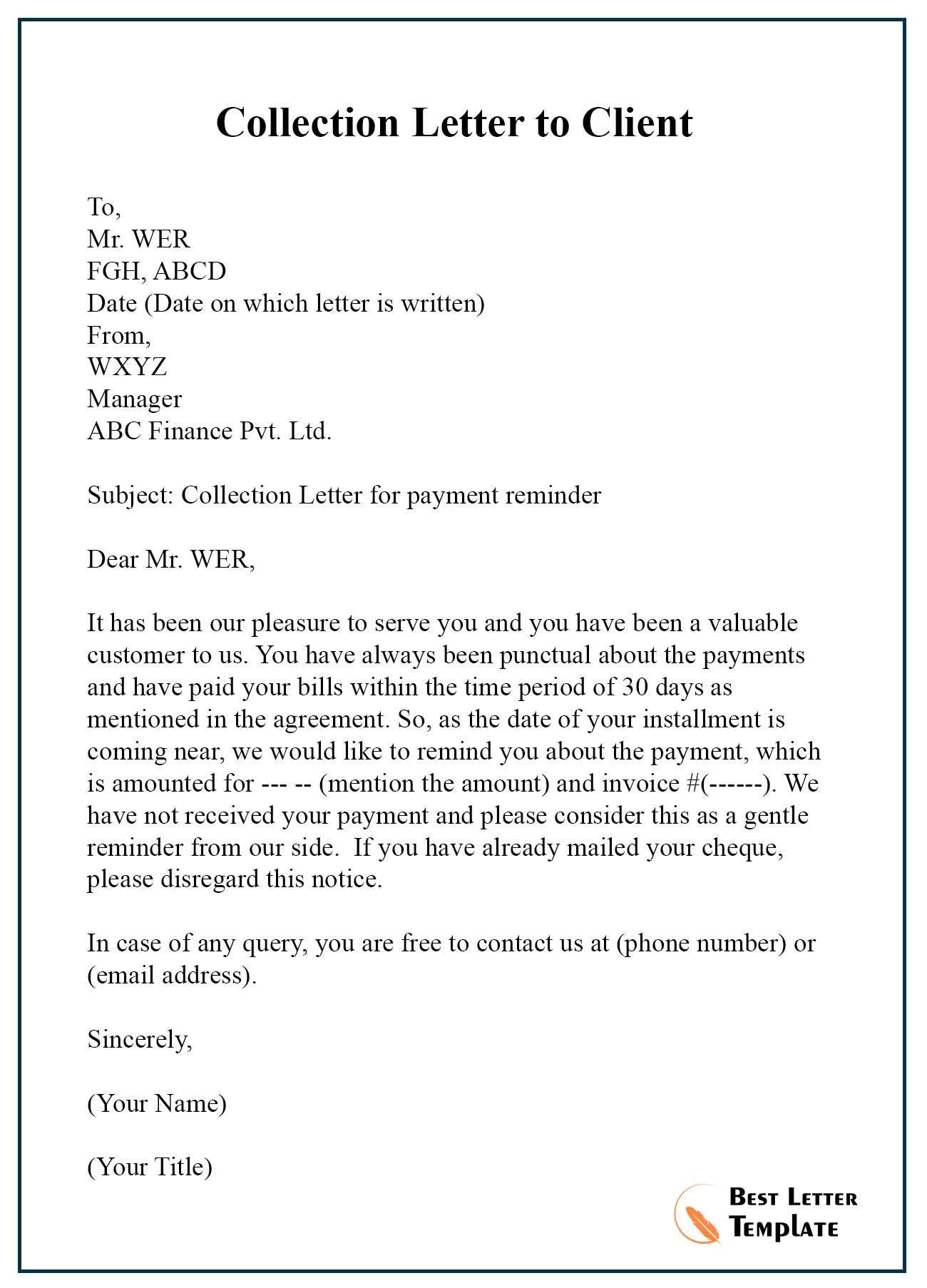

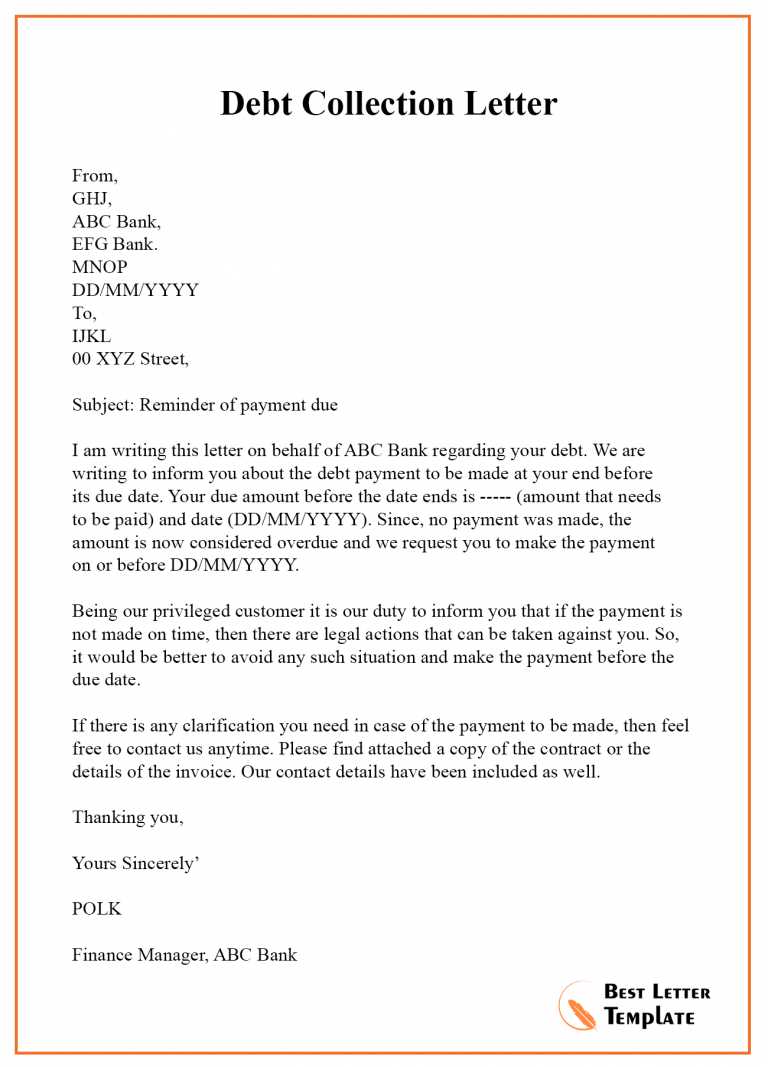

A Word Collection Letter serves as a formal request to recover outstanding payments or debts. It’s typically used in business environments to ensure that payments are made on time. A well-crafted letter clearly communicates the amount owed, the due date, and any consequences of non-payment.

2. Key Elements to Include

Each collection letter should have certain components, such as a clear subject line, recipient’s details, and the exact amount owed. Be concise but professional, outlining the payment terms and providing options for settlement. Avoid any ambiguity to prevent misunderstandings.

3. Tone and Language

The tone should be firm but respectful. A balanced approach helps maintain a professional relationship, even in cases of overdue payments. Refrain from being overly harsh or too lenient, as both extremes can harm your business reputation.

4. Timing of Sending the Letter

Sending a collection letter too soon may be unnecessary, while waiting too long could delay the payment further. It’s best to send the first reminder as soon as the payment is overdue, followed by periodic reminders if the situation persists.

5. Common Mistakes to Avoid

Avoid vague wording, as this can confuse the recipient. Don’t make threats or use an aggressive tone, as this can lead to disputes. Ensure that all facts are accurate to prevent legal complications. Also, always double-check contact information to avoid communication delays.

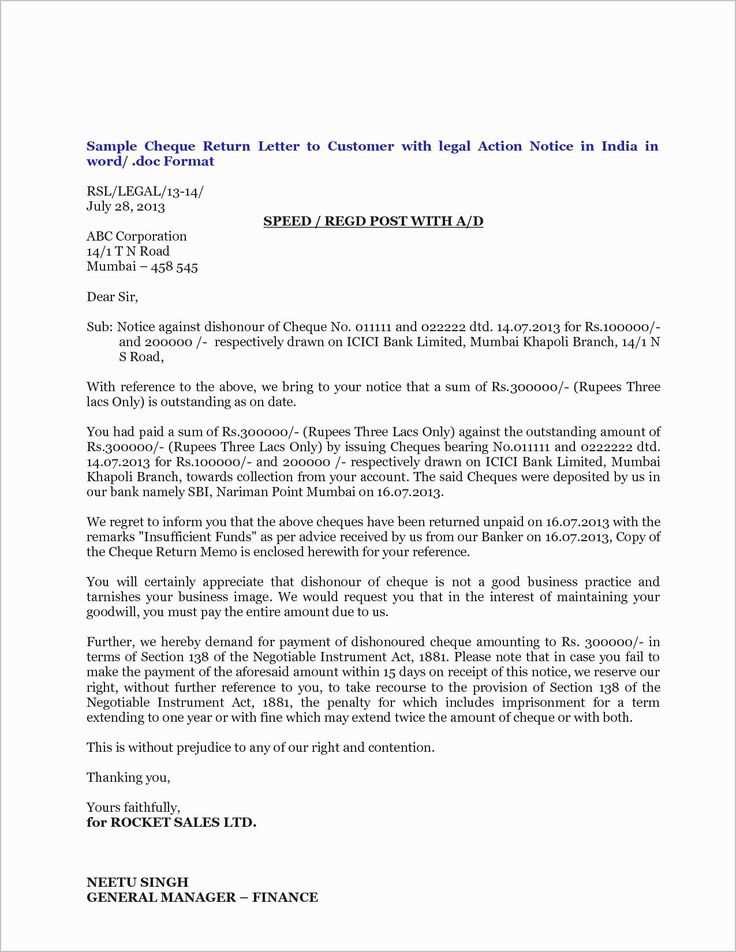

6. Legal Considerations

Be aware of the legalities of debt collection in your jurisdiction. Familiarize yourself with the relevant laws and make sure that your letter complies with those regulations. Avoid making false claims, as this could result in legal consequences.

How to Structure a Letter in Word

Begin by setting up your document with proper margins. Use the “Page Layout” tab to ensure your margins are set to 1 inch on all sides for a clean look.

1. Set Up the Header

Start with your contact information at the top, including your name, address, and phone number. If you’re writing on behalf of a company, include the company name and logo. Align this text to the left or center, depending on your preference.

2. Add the Date

Insert the current date below your contact information. It should be aligned to the left or right margin, just below your address block.

3. Recipient’s Information

Next, include the recipient’s name, title, company name, and address. This should be left-aligned, starting two lines below the date. Use proper titles and avoid abbreviations to maintain professionalism.

4. Salutation

Begin your letter with a greeting. Use formal salutations such as “Dear Mr. Smith,” or “Dear Hiring Manager,” followed by a colon or comma. Always ensure the tone matches the relationship with the recipient.

5. Body of the Letter

The body should be concise and focused. Start with a clear statement of purpose, then support your message with details and examples. Paragraphs should be short and to the point for easy readability.

6. Closing Remarks

End your letter with a polite closing statement, such as “Sincerely,” “Best regards,” or “Kind regards.” Leave four lines of space for your signature, and add your typed name below the space.

7. Signature

If you’re sending a printed letter, leave enough space to sign your name manually. For electronic letters, you can include a scanned image of your signature or simply type your name.

8. Proofread

Before sending, double-check for grammar and spelling errors. Ensure the letter flows logically and that it meets the intended tone and purpose.

| Section | Details |

|---|---|

| Header | Contact info, company name, logo |

| Date | Align left or right, use current date |

| Recipient’s Info | Include name, title, address |

| Salutation | Formal greeting with colon or comma |

| Body | Clear and concise paragraphs |

| Closing | Polite closing statement |

| Signature | Leave space for signature or typed name |

| Proofread | Check grammar and flow |

Learn the key elements for organizing your collection letter in Word.

Start with a clear header that includes your contact information and the recipient’s. Make sure your letter is visually clean by using consistent formatting, such as bold for the main points and clear sections for easy reading. Begin with a polite but direct introduction, stating the purpose of the letter. Keep paragraphs short, focusing on a single idea per paragraph for clarity.

In the body, list any outstanding amounts, along with due dates and any previously made attempts to contact the recipient. Be specific and concise with the information provided. Avoid jargon and keep the tone professional, but firm. Use bullet points if needed to make important details stand out.

Include a polite yet firm call to action, clearly indicating the next steps the recipient should take. Set a deadline for payment or response, and outline the consequences of not acting on time, ensuring that the message remains clear but respectful.

End with a courteous closing, offering assistance if needed, and always include your contact details in case the recipient has questions or needs to discuss the matter further.

Choosing the Right Tone for a Letter

Focus on the purpose of your letter when selecting the tone. For formal communication, use a professional tone with clear, respectful language. For casual letters, a friendly and conversational tone works best. Tailor the tone to your audience’s expectations and the message you want to convey.

Formal Tone

In professional settings, use a polite and respectful tone. Avoid contractions and slang. Be direct but considerate in your wording. Address the recipient with the appropriate title and ensure that the message remains clear and focused on the key points.

Informal Tone

When writing to friends or acquaintances, a more relaxed and personal tone is appropriate. Feel free to use contractions and colloquial language. The aim is to sound approachable while maintaining respect. Personal touches, like anecdotes, can add warmth to the message.

Remember, the tone shapes how your message is received. Always keep your audience in mind to avoid misunderstandings.

Find out how to select an appropriate tone to maintain professionalism.

Selecting the right tone is key to maintaining professionalism in written communication. Start by keeping your language polite, clear, and concise. Avoid using slang, casual expressions, or overly complex terminology. Focus on delivering your message with respect and neutrality, ensuring the recipient feels valued and respected.

Focus on Clarity

Be straightforward. Use simple words and short sentences to ensure your message is easily understood. Avoid long-winded explanations that could lead to confusion or misunderstandings. Be mindful of the recipient’s level of knowledge on the subject and adjust your tone accordingly, without sounding condescending.

Avoid Emotional Language

Stay neutral and objective in your language. Emotional language or subjective expressions can come across as unprofessional. If you need to express disagreement, do so respectfully, using facts and logic rather than emotional appeals.

| Tip | What to Avoid |

|---|---|

| Use clear, direct language | Avoid jargon or overly technical terms |

| Be concise | Avoid rambling or unnecessary details |

| Maintain a neutral tone | Avoid using emotional or biased language |

| Be respectful | Avoid condescending or patronizing language |

By following these practices, you’ll ensure your tone is professional and your message comes across as both respectful and clear.

Incorporating Payment Terms in Your Template

Clearly state your payment terms in the template to avoid any confusion and ensure smooth transactions. Specify the due dates, accepted payment methods, and any discounts or penalties for early or late payments. This section will set expectations for both parties and help manage finances more effectively.

Key Elements to Include

| Payment Method | Due Date | Discounts/Penalties |

|---|---|---|

| Bank Transfer, Credit Card, PayPal | Due 30 days after the invoice date | 2% discount for payment within 10 days; 5% late fee after 30 days |

| Check, Cash | Due 15 days after the invoice date | No discount; 3% late fee after 15 days |

Additional Considerations

Ensure your payment terms are visible at the beginning of the document to avoid ambiguity. If needed, add a brief explanation about your payment policy to clarify any points of confusion. Be consistent with your terms in all communications to maintain transparency.

Understand how to add clear payment terms for better clarity.

To ensure your payment terms are clear, specify the exact due date for payments and state any late fees that may apply. Clearly outline the accepted payment methods, such as bank transfers or credit cards. Avoid vague language and provide examples if necessary. Define the steps for disputing charges and the timeframe for resolution. This helps clients understand their responsibilities and minimizes confusion. Make sure to keep your language simple and direct, leaving no room for misinterpretation.

State the payment schedule

Clarify whether the payment is due in full upfront, on delivery, or in installments. Specify the dates when each installment is due and the amount required for each. This ensures that both parties are aligned and expectations are clear from the start.

Detail payment terms for late payments

If payments are late, explain the penalties or interest that may apply. Mention how and when these penalties will be added, as well as the process for notifying the client about overdue payments. This helps prevent disputes and ensures timely payments.

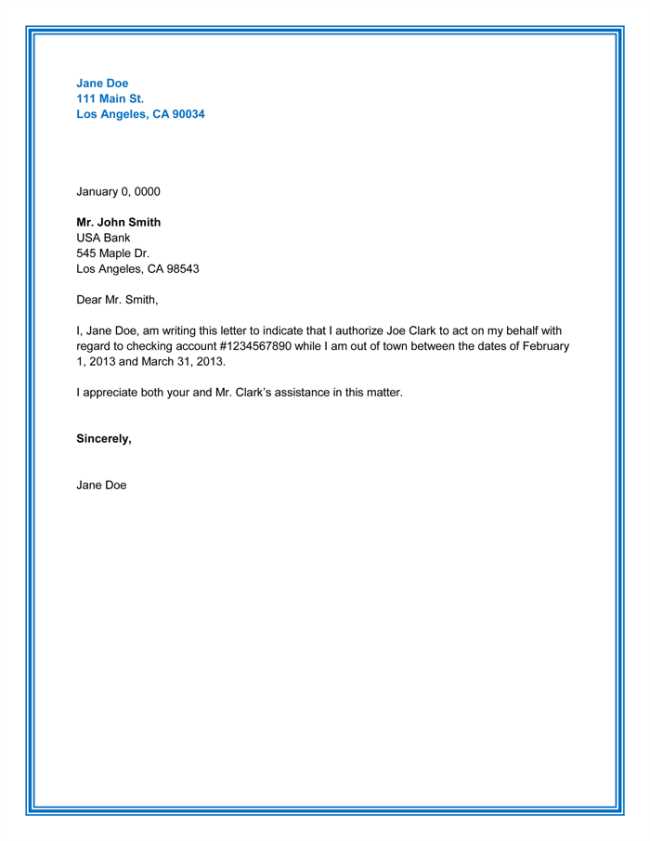

Customizing the Template for Various Clients

Adjust the template to reflect each client’s unique tone and requirements. This ensures that the letter feels personalized, while still maintaining professional standards. Start with simple changes like modifying the header to include the client’s name or logo.

Adjusting the Language

Adapt the language to match the client’s industry and communication style. For example, a tech company may prefer a more direct, formal approach, while a creative agency might appreciate a more conversational tone. Here are a few tips:

- Use industry-specific terminology when appropriate.

- Avoid generic phrases that may not resonate with the client’s target audience.

- Ensure the tone aligns with the client’s brand voice–be it formal, casual, or professional.

Incorporating Client-Specific Elements

Include details that make the letter more relevant. This might involve referencing a recent project, achievement, or partnership. Adjust the call-to-action to suit the client’s goals, whether it’s scheduling a meeting, initiating a follow-up, or requesting more information. Customize the footer with client-specific contact information or social media links.

Adapt your letter format to suit the needs of different clients.

Adjust the tone, style, and structure of your letters based on the recipient’s preferences and your relationship with them. For corporate clients, maintain a formal tone with clear, concise language. Focus on professionalism by including all relevant details in an organized format. For individual clients, consider a more personalized approach, perhaps using a conversational tone that reflects your familiarity and rapport with them.

Use proper formatting to guide the reader’s attention. For formal letters, stick to a standard layout with a header, introduction, body, and closing. For less formal correspondence, experiment with headings or bullet points to make the content more digestible. Keep your paragraphs short and break up large blocks of text to enhance readability.

Tailor the message to each client’s preferences. Some may appreciate brevity, while others may expect more detailed explanations. Always consider the client’s expectations and the context of the communication when deciding how much information to include or how direct your tone should be.

Avoid Common Mistakes in Collection Letters

Ensure your collection letters are direct, clear, and to the point. Avoid vague language and be specific about the amount due, due date, and payment instructions. This removes any potential confusion for the recipient.

1. Be Clear About Payment Details

Provide precise instructions for how the payment should be made. Specify the payment methods you accept, the exact amount due, and any late fees if applicable. Giving multiple options for payment may make it easier for the recipient to settle the debt promptly.

2. Keep a Professional Tone

Avoid sounding overly aggressive or harsh. Use a respectful tone and focus on resolving the issue. The goal is to maintain a positive relationship, not create conflict. A professional tone can encourage cooperation and timely action from the recipient.

3. Stick to Facts

Only include relevant information that directly supports the claim. Avoid emotional language or accusations that may distract from the purpose of the letter. Provide clear evidence of the debt, such as invoices or contracts, to substantiate your request.

4. Avoid Delaying Action

Send your collection letter promptly after the payment deadline passes. Waiting too long can make it harder to collect the debt and could lead to further delays or disputes. Follow up regularly but not excessively.

5. Use Proper Formatting

- Ensure the letter is neatly formatted with clear sections, including an introduction, the body, and a conclusion.

- Use bullet points or numbered lists to make payment details easy to understand.

- Proofread for errors in grammar, spelling, and punctuation to maintain professionalism.

6. Avoid Overly Lengthy Letters

Keep the letter concise. Recipients may ignore or skim through long, convoluted letters. Make sure the purpose and instructions are quickly apparent to ensure the recipient takes immediate action.

Identify and prevent common errors when drafting collection letters.

Ensure your collection letter remains clear and direct. Avoid using confusing language that may lead to misunderstandings. Start by addressing the recipient politely but firmly. A vague tone can weaken the message, causing delays in payment. Clearly state the purpose of the letter from the start, mentioning the overdue amount, the due date, and any relevant reference numbers. This helps the recipient quickly grasp the key details.

1. Avoid being too aggressive or too soft

Finding a balance between firm and friendly is key. Being overly aggressive may alienate the recipient, while being too lenient can send the wrong signal. Maintain a professional yet respectful tone throughout. If you are asking for payment, ensure the language is clear, but not harsh. Use phrases such as “We kindly request” or “Please arrange payment by…” to make the tone respectful but firm.

2. Double-check for inaccuracies

Incorrect details such as wrong amounts, dates, or account numbers will reduce the credibility of your letter and may delay payment. Double-check every figure, reference, and date before sending the letter. A small mistake can cause unnecessary confusion and frustration, making it harder to recover the owed money.

3. Provide clear instructions for payment

- Include payment methods, deadlines, and relevant banking details.

- Offer an easy way for the recipient to contact you if they have questions.

This clarity ensures the recipient knows how to settle the balance. Avoid vague instructions such as “pay when you can.” Specify how the payment should be made (bank transfer, check, etc.) and any reference number to be used with the payment.

Saving and Reusing Letter Templates

To save time and maintain consistency, storing letter templates is key. After drafting a template, save it in a standard file format like .docx or .txt. This ensures compatibility across various word processing software. Use cloud storage or a document management system to keep them organized and easily accessible.

Organizing Templates for Quick Access

- Group templates by category (e.g., business, personal, formal, informal) for faster retrieval.

- Label templates clearly with descriptive names that reflect their purpose or audience.

- Consider using folders or subfolders in your cloud storage to keep everything tidy.

Reusing and Customizing Templates

- Before reusing a template, adjust the date, recipient information, and any other personalized details to fit the current situation.

- Modify the tone or content slightly to ensure the message feels fresh, even when reusing the same structure.

- Save any changes as a new version of the template, so you can track revisions over time.

Discover the benefits of saving templates for future use.

Saving templates allows for quick and easy access to pre-designed documents, significantly reducing the time spent on repetitive tasks. Once a template is created, you can reuse it without having to start from scratch, streamlining your workflow and minimizing errors. For instance, saving a letter template allows you to customize it with minimal effort each time you need to send correspondence, ensuring consistency in format and tone.

Time-saving advantage

By saving templates, you eliminate the need to recreate documents for every new task. This is especially useful for recurring tasks like invoicing, business proposals, or newsletters. The time saved can be redirected to other important activities, improving your overall productivity.

Consistency and professionalism

Templates help maintain a consistent style and format across all documents. This consistency is key when it comes to presenting a polished and professional image. Whether it’s a letter, report, or email, using the same template ensures uniformity, making your communications clear and well-structured.