Credit repair dispute letter templates

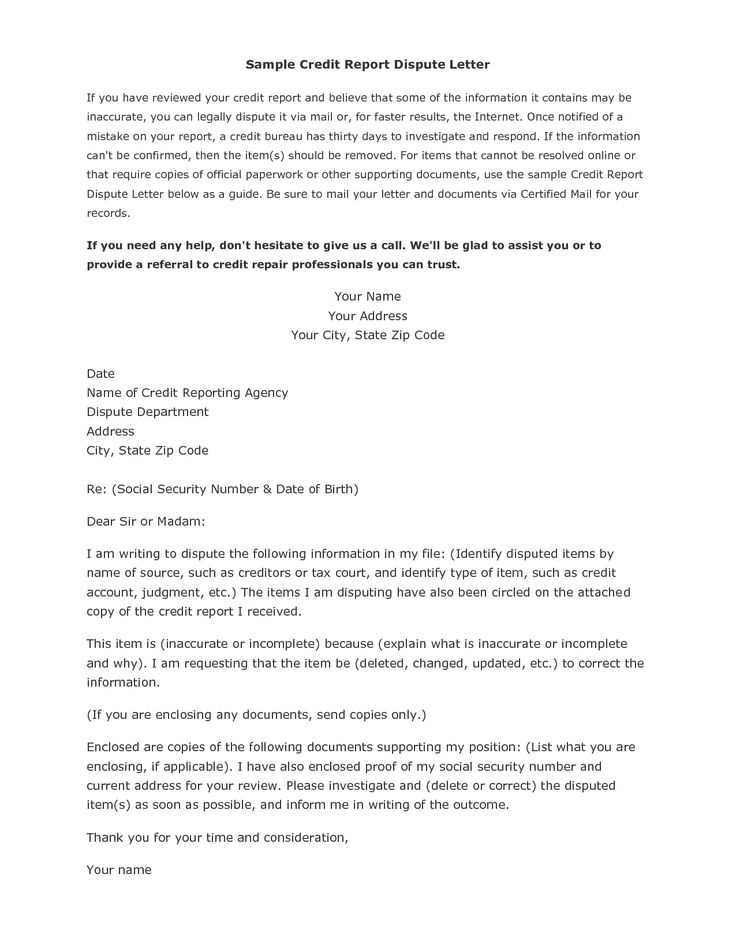

If you believe there are errors on your credit report, disputing them with a well-crafted letter can make a significant difference. Begin by addressing the credit reporting agency with a clear request for an investigation into the inaccuracies. Your letter should focus on the specific items in question, detailing why they are incorrect and supporting your claim with relevant documents.

Include clear identification details such as your full name, address, and the specific account information associated with the error. This helps the agency locate your information quickly. Don’t forget to provide copies of any supporting documents, like receipts or bank statements, that back up your dispute.

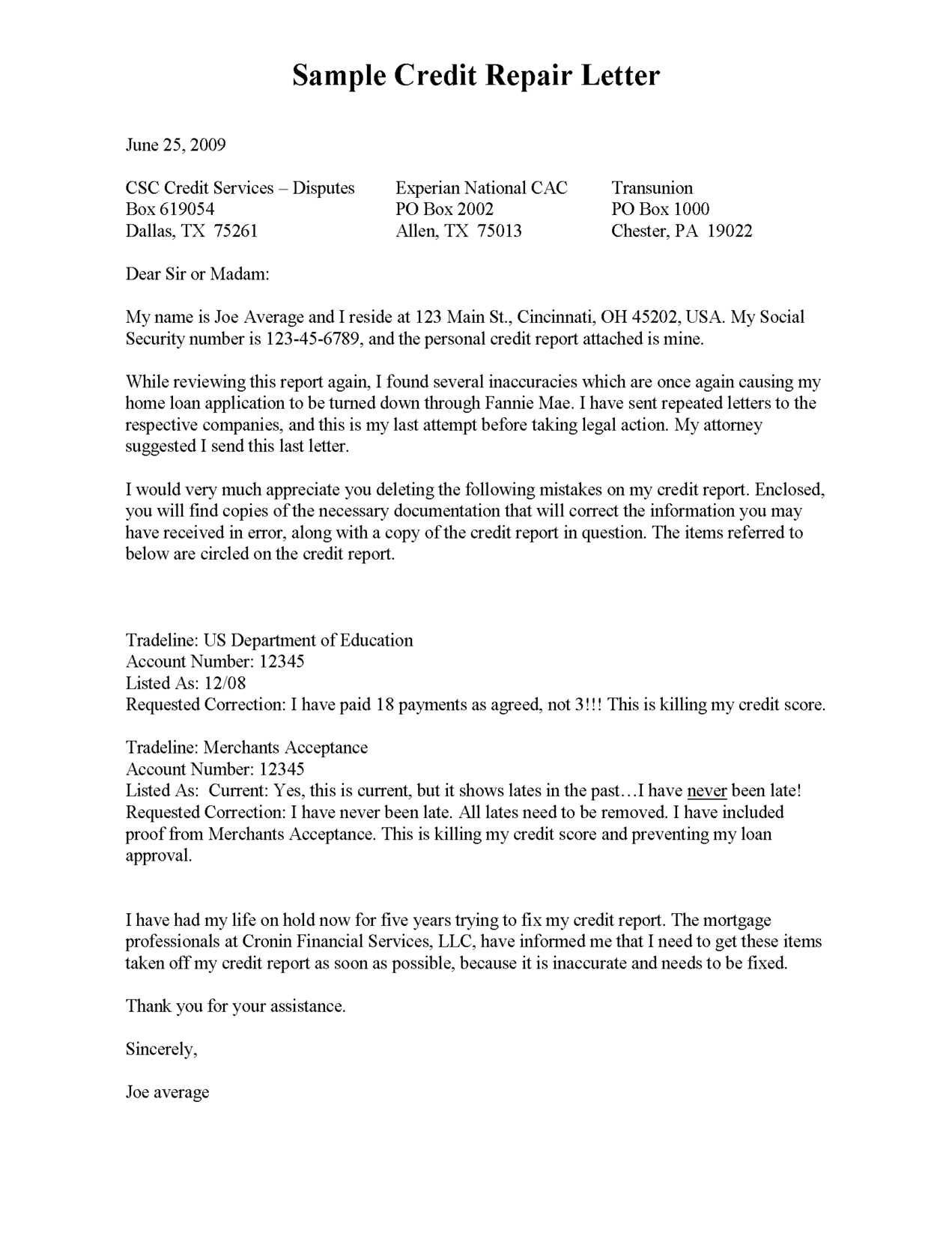

Be concise but firm in your wording. State the exact nature of the dispute and request an update within a specific timeframe, typically 30 days. For example, you might write, “I believe the balance on account number XXXX is incorrect due to a clerical error. I have attached proof of payment.”

Use a professional and respectful tone throughout the letter. Being polite, but direct, ensures that your dispute will be taken seriously and processed promptly. A clear, focused letter increases your chances of resolving the issue and improving your credit score.

Sure! Here’s the revised version with repeated words removed while keeping the meaning intact:

To create an impactful credit repair dispute letter, focus on clarity and accuracy. Begin by stating your intention to dispute the item in question. Be specific about the inaccuracies or errors you’ve identified. Provide supporting evidence, such as account statements or payment records, to strengthen your case. Ensure the tone remains professional and assertive, while keeping the letter concise.

Clearly reference the item being disputed, including the account number and date. Use direct language to highlight the issue, without adding unnecessary details. Be sure to ask for the item to be corrected or removed from your credit report if it’s proven to be inaccurate.

Conclude by requesting a prompt response and specifying a reasonable timeframe for resolution. Keep the letter focused on the facts and the resolution you’re seeking, without veering off into irrelevant information.

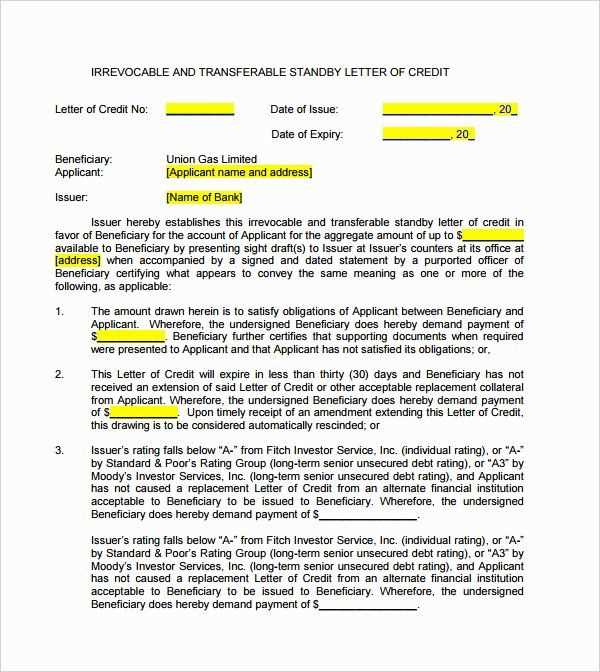

Credit Repair Dispute Letter Templates

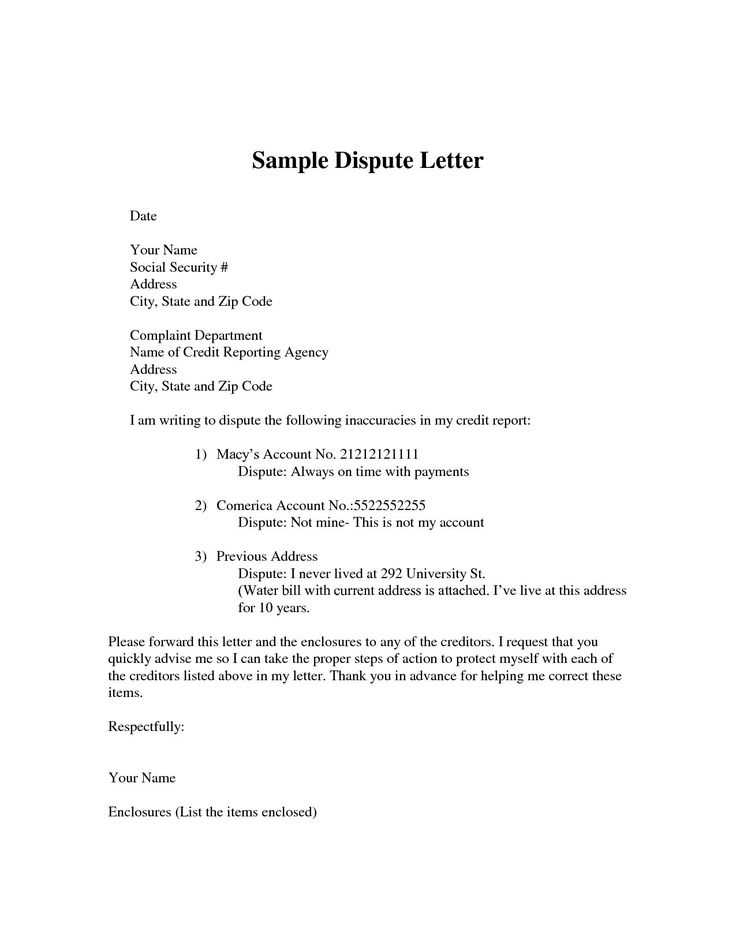

Begin your dispute letter by clearly stating the reason for the dispute. Identify the specific error, whether it’s a misreported account, incorrect balance, or outdated information. Provide as much detail as possible, including account numbers, dates, and any supporting documents to back up your claim.

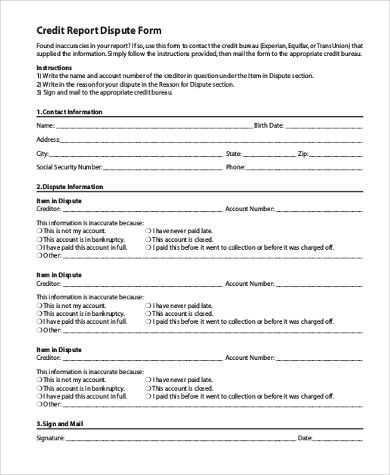

How to Structure a Dispute Letter

Keep the letter concise and to the point. Start with your name, address, and contact details at the top, followed by the creditor’s information. Mention the date of the letter and reference the specific entry on your credit report. Use simple language and avoid unnecessary jargon. Request a specific resolution, whether that’s correcting an entry or removing an item from your report.

Key Elements to Include in Your Letter

Always include the following in your dispute letter: your full name, address, and date of birth. Clearly reference the disputed item and explain why it’s incorrect. Attach any relevant documentation, such as bank statements, receipts, or correspondence with creditors, to strengthen your case. Request that the creditor review the item and update the information accordingly.

Address the issue professionally but assertively. Use factual language without sounding confrontational. Keep a record of all communications, as this can be helpful in future disputes or follow-ups.

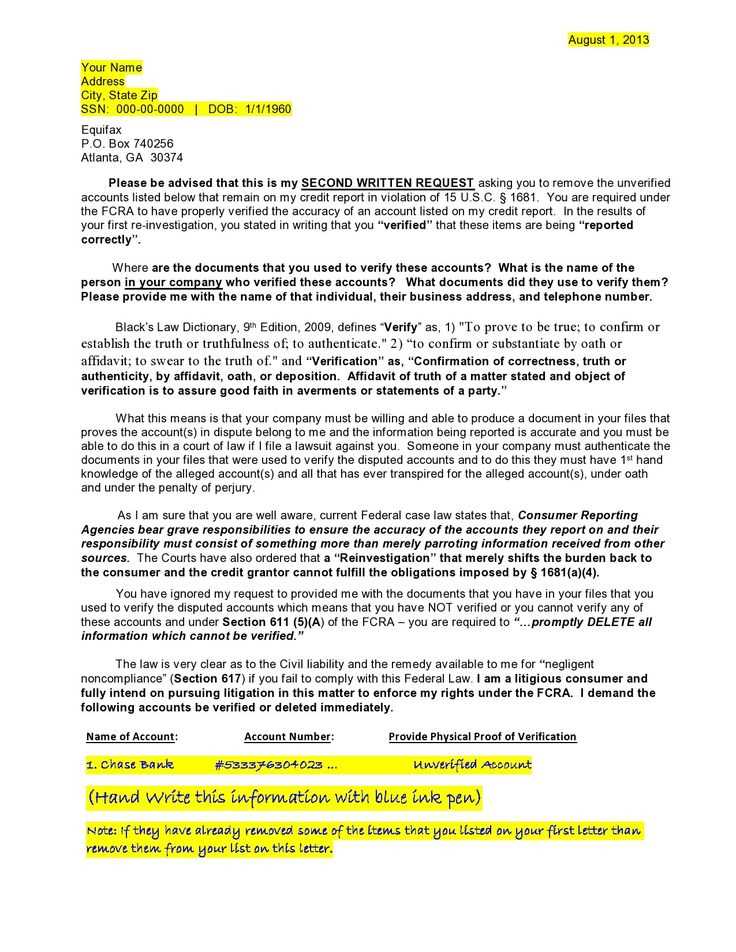

Common Mistakes to Avoid in Disputes

Avoid vague statements. Be specific about the error, why it’s wrong, and how it affects your credit. Do not make emotional claims or accusations, as these weaken your case. Never send incomplete or poorly organized documents. Ensure you include all supporting evidence and reference relevant dates and account numbers. Lastly, don’t neglect to sign the letter; this may invalidate your dispute.

How to Address Negative Items on Your Report

When disputing negative items, be clear on whether they are inaccurate or outdated. For items that are past the statute of limitations or should no longer appear on your report, request their removal. If the negative entry is incorrect, provide proof such as payment receipts, settlement documents, or account statements to show the inaccuracy.

Understanding Legal Rights in Credit Issues

Familiarize yourself with the Fair Credit Reporting Act (FCRA), which ensures that information on your credit report is accurate and up-to-date. You have the right to dispute incorrect entries, and creditors must investigate and respond within 30 days. If they fail to do so, the disputed item must be removed from your report.

When to Follow Up on a Letter

If you haven’t received a response within 30 days, follow up with another letter. Be polite but firm in requesting an update on the status of your dispute. Include any reference numbers from previous correspondence and reiterate your request for correction. Keep copies of all letters and responses for your records.