Collection letter template free

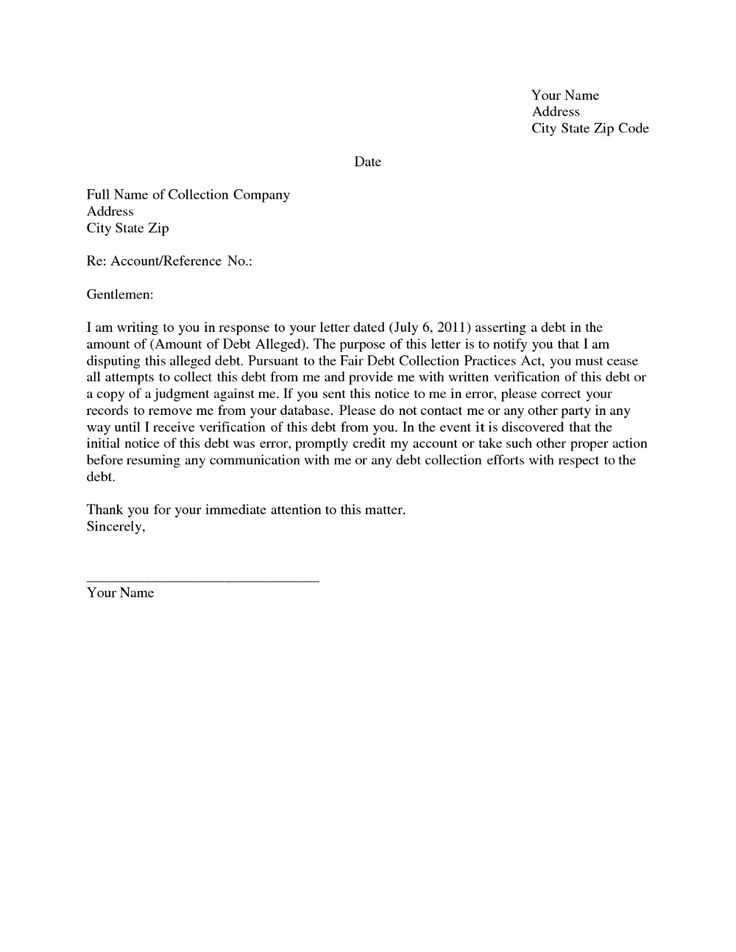

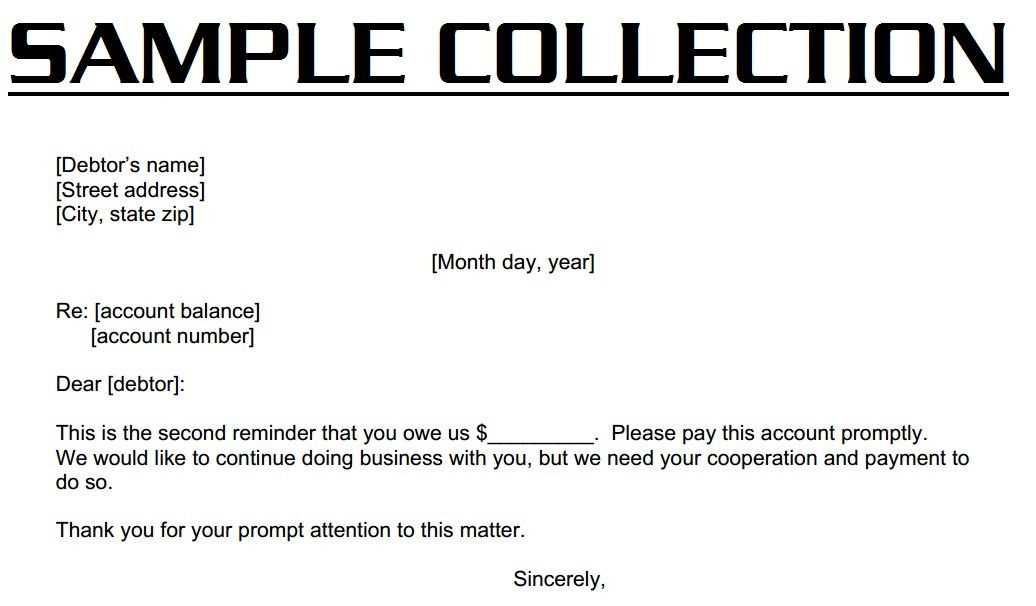

Creating a collection letter doesn’t have to be complicated. Start with a clear and direct approach. State the outstanding balance and request immediate payment. Keep the tone polite, yet firm, to encourage the recipient to take action.

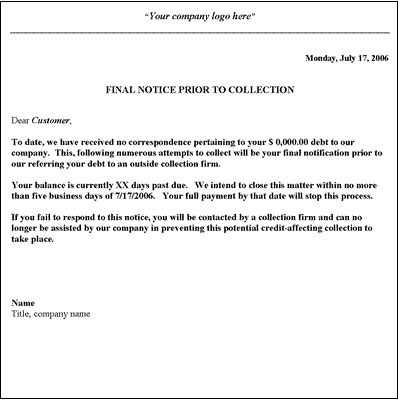

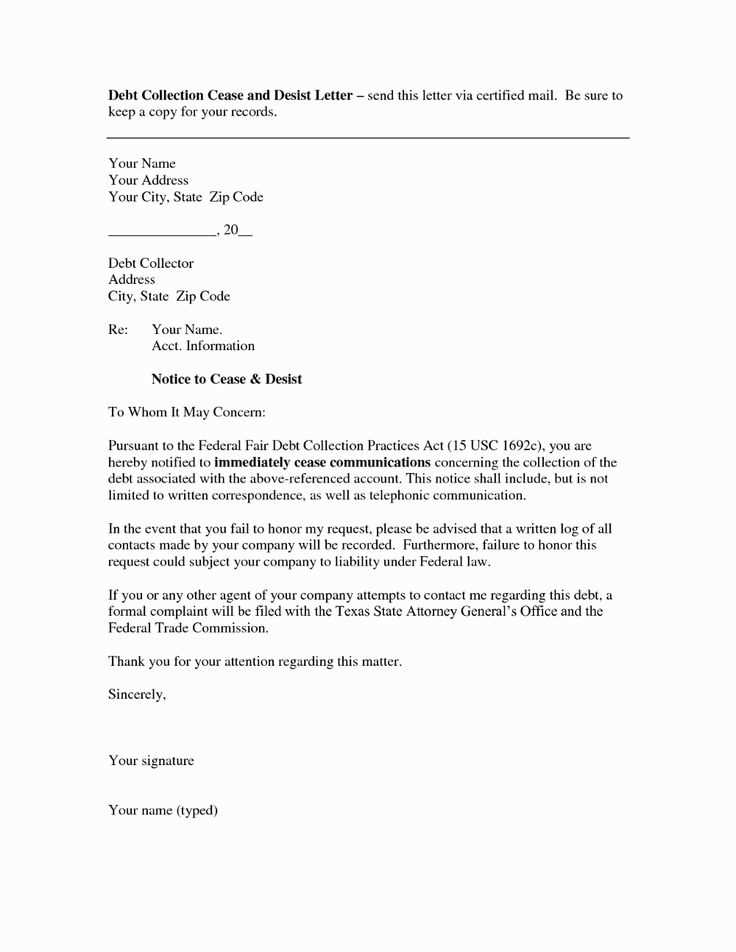

Use a straightforward subject line, like “Outstanding Payment Due.” This ensures the recipient understands the purpose of the letter from the start. In the body, briefly explain the nature of the debt and reference any previous communications or agreements. Mention the date by which payment is expected and include any penalties for late payment, if applicable.

Make it easy for the recipient to pay by providing clear payment instructions, including payment methods and contact information. A simple, well-organized letter can often prompt quicker resolution, so avoid unnecessary details or lengthy explanations. Keep the letter professional and free of emotional language to maintain a neutral tone throughout.

Here’s a revised version where the same word appears no more than 2-3 times:

Begin by clearly stating the purpose of the letter. Ensure the tone remains firm yet respectful, avoiding overly harsh language. Provide specific details about the outstanding amount, including dates and reference numbers, to help the recipient identify the issue. Acknowledge any previous communication, if applicable, and remind the recipient of their obligation to settle the debt. Offer a concise summary of the payment terms and deadline.

Payment Information

| Invoice Number | Amount Due | Due Date |

|---|---|---|

| #12345 | $500 | 30th January 2025 |

Encourage the recipient to reach out if they have any questions or need clarification. Provide contact details, ensuring they have everything they need to resolve the matter quickly. End by reiterating the importance of resolving the issue before the due date to avoid further action.

- Collection Letter Template Free

To get started with a collection letter, ensure it is concise, clear, and polite. Begin by stating the purpose of the letter upfront and include specific details about the overdue payment. Specify the amount owed, the due date, and any previous communication about the debt. Using a direct approach without being confrontational helps maintain a professional tone.

Key Elements to Include

Include the following sections in your letter:

- Subject Line: Clearly state that the letter is about overdue payment.

- Introduction: A friendly reminder about the unpaid amount and previous agreements.

- Details of Debt: Amount owed, due date, and any relevant reference numbers.

- Action Requested: A polite request for the payment to be made by a specific date.

- Closing: A thank you note for their attention and cooperation.

Tips for a Successful Letter

Keep the tone friendly but firm. Avoid using harsh language that could damage the relationship. Offer payment options or discuss potential arrangements for those who may be struggling to pay in full. Make sure to include your contact information and be responsive if they reach out for clarification.

Begin with a clear structure that suits the purpose of your letter. Start by defining the header, body, and closing sections. The header typically includes the recipient’s name, address, and date. Ensure the header is aligned properly and use a professional font.

1. Choose the Right Format

Pick a layout that fits the tone and purpose of your letter. For formal letters, block format is common, where all elements are aligned to the left. For more personalized letters, you can use modified block format, where the return address and signature are aligned to the right.

2. Write a Clear and Direct Opening

Start your letter with a salutation. Address the recipient formally, such as “Dear [Name],” or use “To Whom It May Concern” if the specific person is unknown. Keep the tone polite and professional.

- Formal: “Dear Mr. Smith,”

- Neutral: “Dear Sir/Madam,”

- Informal: “Hello [First Name],” (for casual situations)

3. Develop the Main Body

The body of your letter should be clear and concise. Break it into paragraphs for better readability. Use short, direct sentences. If the letter involves asking for something, make the request straightforward and polite. Be specific about the action you need from the recipient.

4. Add a Professional Closing

End the letter with a courteous closing. “Sincerely” or “Best regards” are widely accepted in professional contexts. Ensure the closing matches the tone of the letter.

- Formal: “Sincerely,”

- Neutral: “Best regards,”

- Informal: “Kind regards,”

Once you have these sections in place, save the template in a document format that allows for easy editing. Each time you need to send a letter, simply adjust the details without rewriting the entire content. This saves time and ensures consistency in your communication.

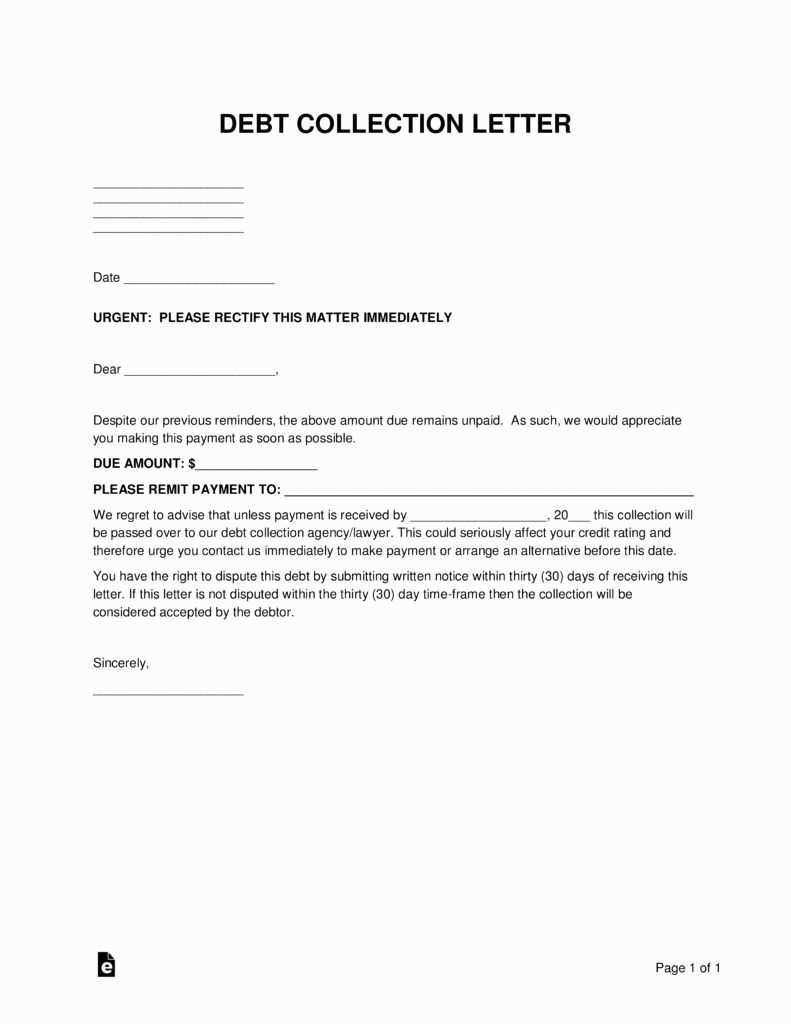

Clear identification of the debt is a must. Specify the exact amount owed, including any interest or late fees. Break down the total to make it easy for the recipient to understand what they’re being charged for.

Payment instructions should be straightforward. Outline how the debtor can pay, whether via bank transfer, online payment, or check. Provide clear payment details and deadlines.

Consequences of non-payment need to be outlined to encourage timely action. Clearly state what will happen if the payment is not made within the specified period–such as additional fees or legal action.

Polite yet firm tone is key. Use professional language that encourages the debtor to resolve the matter without sounding overly harsh or unfriendly.

Contact information should be easy to find. Include a phone number or email address for any questions or disputes, making it easy for the recipient to reach out if needed.

Due date is critical. Set a clear deadline for payment to avoid confusion. Be firm about when you expect the payment, but allow some flexibility if necessary.

Proof of debt might be required if the debtor disputes the claim. Be ready to attach any relevant documentation, such as contracts or invoices, to back up your request.

Canva offers a simple, drag-and-drop interface to create a polished, professional-looking letter. With customizable templates and intuitive design features, it’s a great option for those who need to make a quick, impactful impression. You can start with a template or create a design from scratch with easy-to-use tools for fonts, colors, and layouts.

Another tool worth considering is Google Docs. Its built-in templates for formal letters make it easy to start crafting your message, whether it’s a collection letter or any other type. It’s free, accessible, and collaborative, making it a great choice if you want to work with others on the same document in real-time.

If you prefer something more focused on the writing aspect, check out Zoho Writer. This online word processor offers several free templates, including those for formal letters. You can also enjoy seamless integration with other Zoho apps for smooth document management.

For those who need more specific guidance, FormSwift allows you to customize professional letter templates. It also offers a user-friendly interface, where you can input your details, and download your finished letter for free in multiple formats.

Adjust the tone of your letter to match the relationship with your recipient. If you’re addressing a long-time client, keep the language polite but friendly. For newer clients or those with outstanding payments, use a more formal tone to convey urgency.

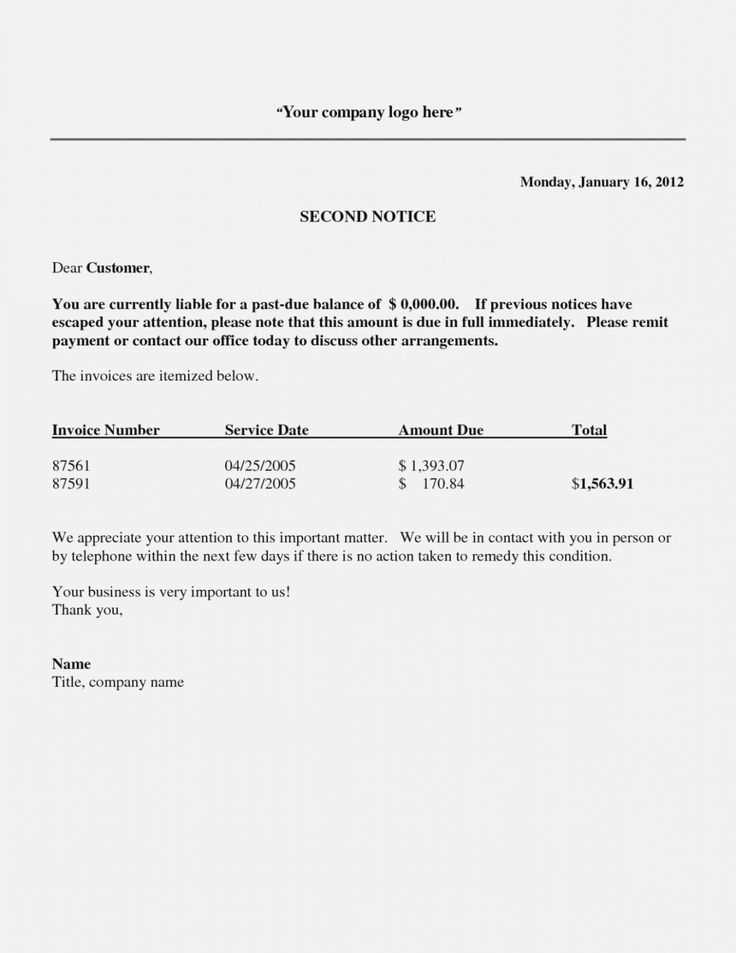

Always include specific payment details. Reference invoice numbers, due dates, and amounts due so the recipient has clear instructions on what is expected. This will help avoid any confusion or delays in payment.

Personalize the letter by adding the recipient’s name and other specific information relevant to them. Customizing each letter ensures it doesn’t feel generic and increases the likelihood of a positive response.

Keep the message brief but firm. Be direct about the overdue payment, while offering a simple way for the recipient to resolve the issue. Include payment methods, deadlines, and any potential consequences for non-payment, such as late fees.

Use professional but approachable language. Keep the letter polite, even if the recipient is late on payments. Clear communication without sounding confrontational can improve results.

Consider adding a “thank you” section at the end, acknowledging the recipient’s past business and expressing appreciation for their prompt attention to the matter. This can help maintain a positive relationship moving forward.

Be specific with your language. Avoid using vague phrases that could confuse the reader. Instead of saying “I need it soon,” specify a date or time frame, such as “I need it by February 15th.”

Avoid Excessive Formality

Don’t overcomplicate your language. Using unnecessary formal words can make your letter harder to understand. Stick to clear, simple sentences and focus on the point you’re trying to make.

Proofread Before Sending

Always review your letter for spelling or grammatical errors. A letter full of mistakes can give a bad impression. Take a moment to ensure everything is correct before hitting send.

Use a letter template to streamline communication and ensure clarity. A well-structured template saves time and avoids missing key details. Here’s how to make the most of it:

- Personalize the Template: Replace placeholders with specific details relevant to your situation. A template should be a starting point, not a rigid format.

- Keep It Clear: Follow the template’s layout for a coherent structure. Clear headings, concise language, and bullet points improve readability.

- Adapt for the Audience: Adjust the tone and formality based on who you are writing to. A template offers flexibility to customize for both formal and informal communication.

- Double-Check for Errors: After editing, carefully review the letter for spelling, grammar, and factual accuracy. Even templates require a personal touch to be flawless.

By following these steps, you can communicate more effectively with the help of a letter template, ensuring your message is received with clarity and professionalism.

Now the Phrases Avoid Redundant Word Repetition

Be clear and direct in your collection letters. Start by addressing the recipient’s name and include specific details of the outstanding amount. Use simple sentences to outline the payment expectations without overloading the letter with unnecessary language.

Keep it Professional but Friendly

Remain polite while being firm. A friendly tone helps maintain a positive relationship with the client while still requesting the payment. Reassure them that you value their business and look forward to resolving the matter quickly.

Provide Clear Instructions

Ensure that your letter provides clear payment instructions. Include the due date and accepted payment methods, making it easy for the recipient to complete the transaction. Avoid using vague terms like “soon” or “shortly”; instead, specify an exact date for clarity.