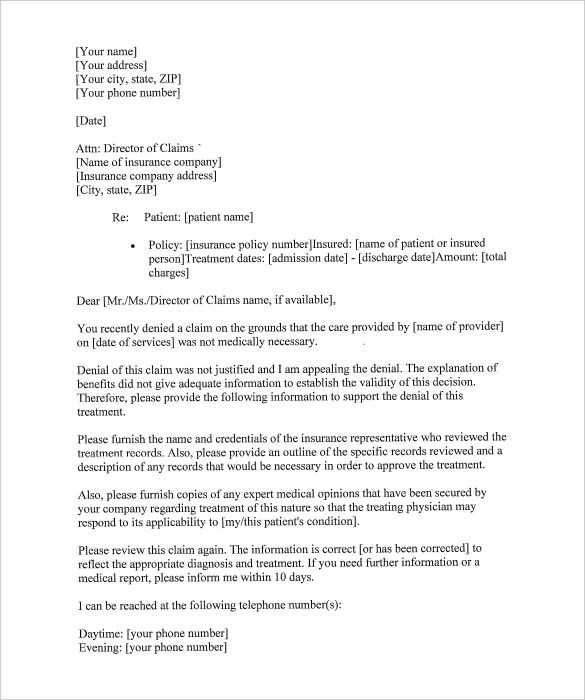

Health insurance appeal letter template

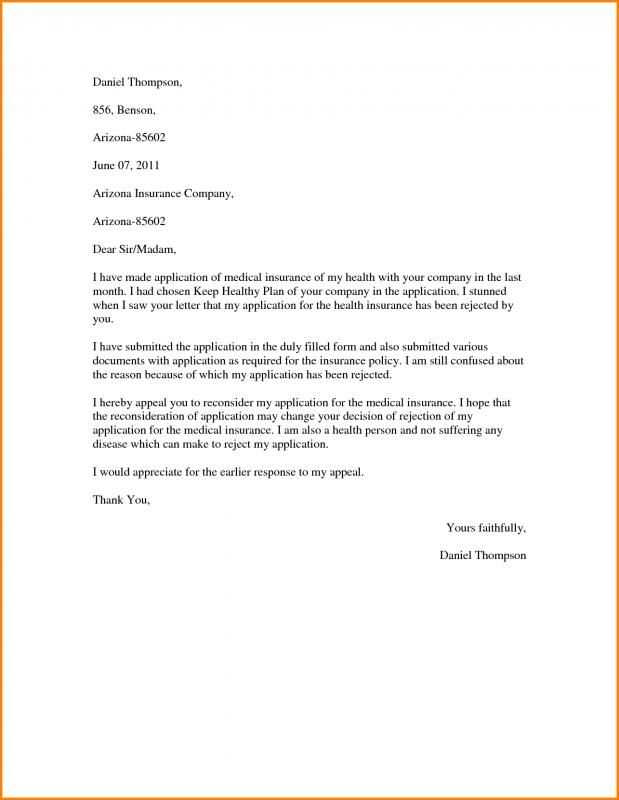

Writing an appeal letter for health insurance can significantly increase your chances of getting a denied claim reconsidered. The key to a successful appeal is clarity and directness. Start by addressing the letter to the specific department or individual handling appeals at your insurance company. Ensure that all necessary details are included, such as your policy number and the claim in question.

Be concise and provide evidence. Describe the issue with your claim, referencing the denial letter and any relevant policy terms. Attach supporting documents like medical records or a doctor’s note that can strengthen your case. Clearly explain why the treatment or procedure should be covered according to your plan’s benefits.

Stay professional and polite throughout the letter. Even though it’s important to be assertive, maintaining a courteous tone will help foster a constructive relationship with the insurance company. Keep your letter organized and straightforward to make it easy for the reader to follow your argument.

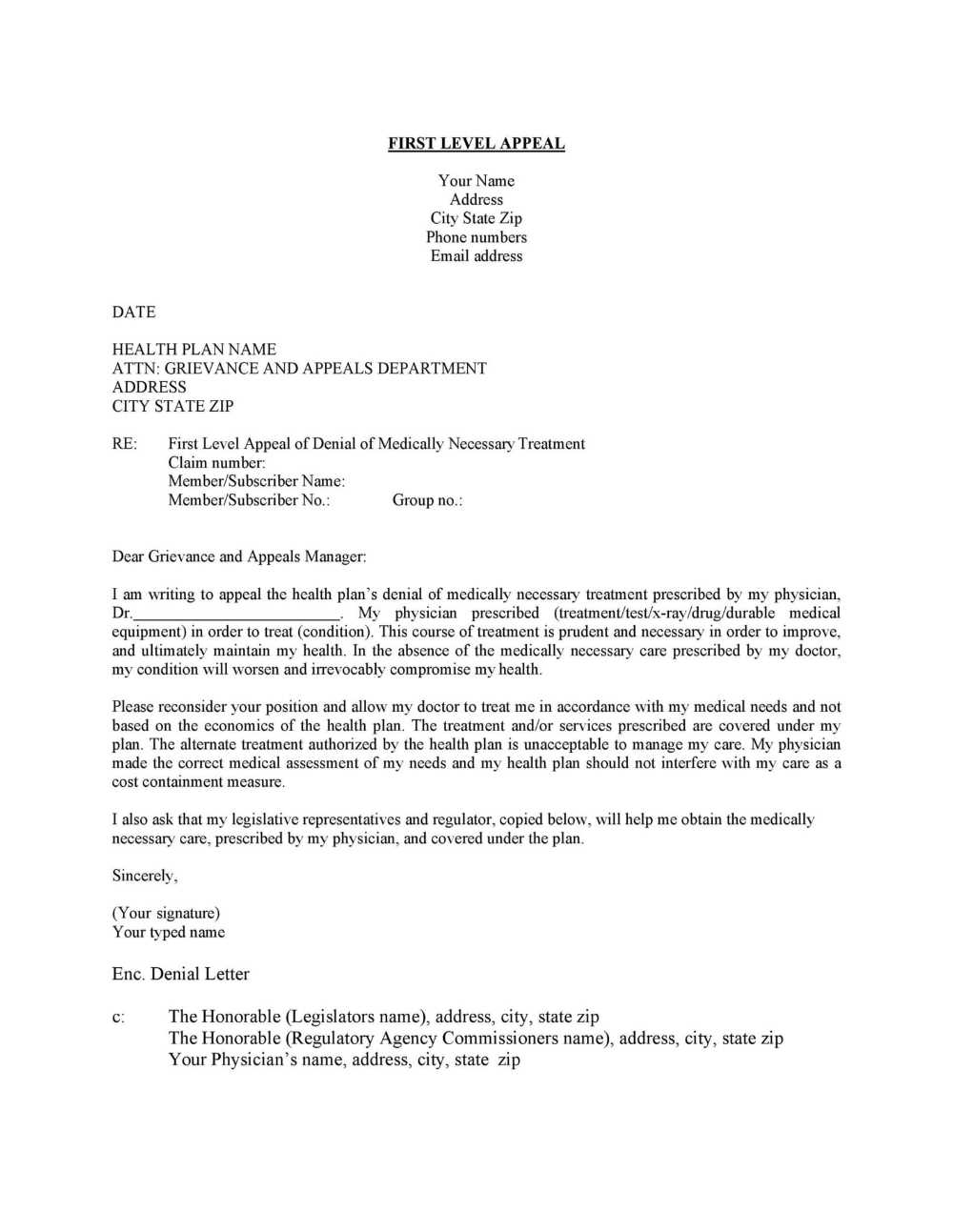

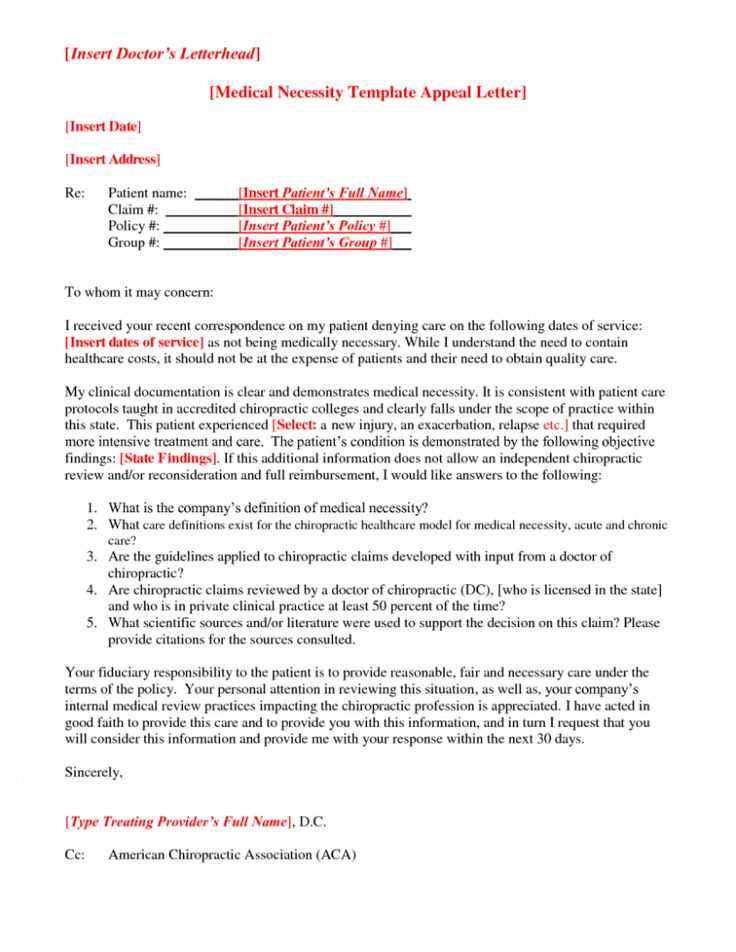

Health Insurance Appeal Letter Template

Begin your letter by addressing the claim denial directly. Make sure to include the necessary information such as your full name, policy number, claim reference, and the date the denial was issued. This will help the insurance company locate your case quickly.

Structure of the Letter

Follow this format to ensure all necessary points are covered:

| Section | Details |

|---|---|

| Claim Information | State your full name, policy number, and claim number. Include the date you received the denial to make referencing easy. |

| Reason for Denial | Clearly explain why you believe the denial is incorrect. Address any inaccuracies in the decision or explain the medical necessity of the treatment or procedure. |

| Supporting Documentation | Provide any relevant documentation, such as medical records, a doctor’s statement, or additional evidence that supports your claim. |

| Request for Action | Clearly request a review of the decision or reconsideration of the claim based on the information provided. |

| Conclusion | Politely express your hope for a prompt resolution. Include your contact details for any necessary follow-up. |

Example Closing Statement

Conclude your letter with a polite but firm closing statement, such as: “I look forward to your prompt response and resolution of this matter. Please feel free to contact me if any additional information is needed.”

Understanding the Basics of an Appeal

Begin by reviewing the reason your claim was denied. Focus on any specific terms or conditions mentioned in the rejection letter that explain why your coverage was denied. This will guide you in building your case for why the decision should be reconsidered.

Gather Supporting Documentation

Collect all relevant documents, including medical records, test results, and a letter from your healthcare provider if needed. These documents can demonstrate the necessity of the treatment and strengthen your argument for appeal. Make sure to provide clear copies of everything–avoid sending originals unless required.

Write a Clear and Concise Appeal Letter

Your appeal letter should directly address the reason for denial. Be concise, but provide enough detail to support your case. Refer to the specific sections of your policy or medical guidelines that apply to your situation. Avoid emotional language and stick to factual points that highlight why your claim should be reconsidered.

Key Elements to Include in Your Letter

Clearly state your policy number and personal information at the beginning of your letter. This helps the insurance company quickly locate your records. Include the date of the denial and any relevant claim or reference numbers to avoid confusion.

Describe the Reason for Appeal

Outline the specific reason for your appeal. Be precise about what was denied and why you believe the decision should be reconsidered. Reference any medical documentation or expert opinions that support your case.

Provide Supporting Documentation

Attach copies of medical records, letters from healthcare providers, or other documents that strengthen your appeal. Make sure the documents are clearly labeled and easy to follow, with explanations where necessary.

Be polite and professional in your tone. Avoid emotional language and stay focused on the facts. Ensure that your letter is concise and free of unnecessary details that might detract from your main points.

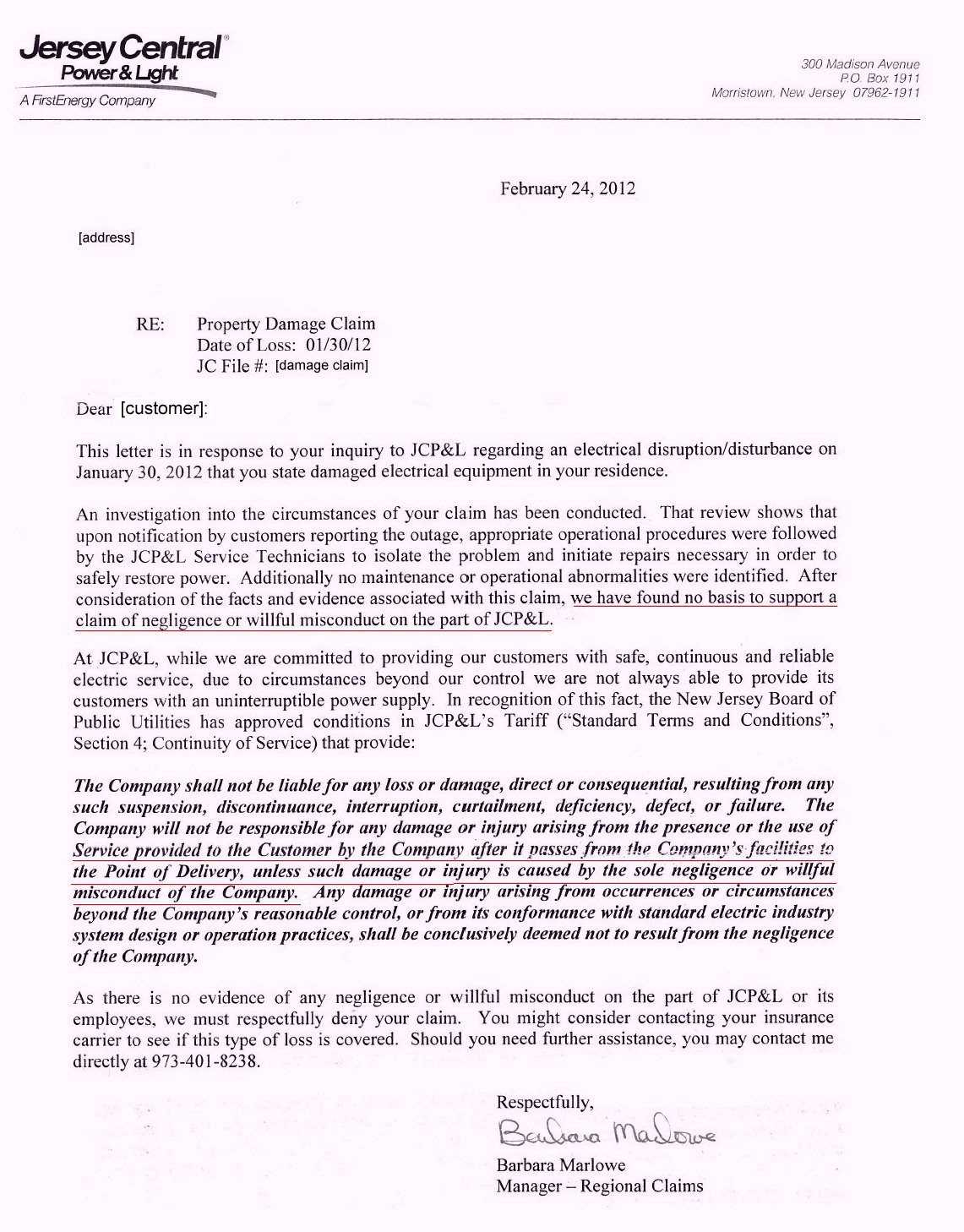

How to Address Specific Denials from Your Insurance Provider

Begin by reviewing the exact reason for the denial. Insurance companies are required to provide specific explanations for rejected claims. Understanding the exact terms of your policy can help you identify any discrepancies or misunderstandings in the denial. Double-check if the treatment or service in question is covered under your plan. If there’s confusion about the service’s eligibility, ask for a clear breakdown of the reasons.

If the denial stems from insufficient documentation, gather the necessary medical records, doctor’s notes, or receipts that can support your case. Include any missing information, and resubmit it with a detailed explanation of why this documentation is relevant. This can help clarify the situation and prompt a review.

For denials based on pre-authorization issues, verify if you followed the correct steps and timelines for obtaining approval. If the process wasn’t followed, ensure that all forms or approvals are resubmitted according to the insurer’s guidelines. Clear communication can help resolve misunderstandings about pre-authorization requirements.

If your insurer has denied a claim due to a coding error or a mistake in the billing process, contact the provider to ensure the codes used for the service are correct. Ask your healthcare provider to resubmit the claim with the accurate information. This could lead to a prompt resolution without further complications.

In cases where the denial is based on medical necessity, seek further clarification from your healthcare provider. Request a detailed statement that explains why the treatment or service was necessary. With this, you can build a strong case to present to your insurer. If necessary, involve your healthcare provider to provide direct communication with the insurance company to address the concern.

Finally, don’t hesitate to appeal the decision if you believe the denial is unjust. Write a clear, concise appeal letter, outlining the reason for your disagreement, and include any supporting documentation. Keep a record of all communications and follow up regularly to ensure that your case is being reviewed thoroughly. Don’t be afraid to challenge decisions that seem incorrect, as this can lead to a positive resolution of your claim.

Steps to Gather Supporting Documentation

Begin by collecting all relevant medical records. Request copies of your doctor’s notes, treatment plans, and diagnostic tests from your healthcare provider. Make sure these documents are clear and up-to-date, including dates and the names of all healthcare professionals involved.

Next, obtain any hospital or clinic bills related to the treatment or procedure in question. These should show the costs and any charges for services rendered. Be sure to include any receipts or statements showing payments already made.

Contact your insurance provider for a copy of the original claim and any correspondence regarding the denial. This will help you understand their reasoning and tailor your appeal accordingly.

Gather supporting statements from healthcare professionals. A letter from your doctor explaining the medical necessity of the treatment or service can be a strong addition to your case. If applicable, include additional expert opinions that support your position.

Make sure to include any relevant prescriptions, lab results, or imaging reports. These can provide further evidence of the necessity of the treatment or procedure.

Lastly, double-check that all documents are legible and organized. Ensure all pages are present and properly formatted, as incomplete or difficult-to-read materials can delay the review process.

How to Maintain a Professional and Clear Tone

Stay focused on your message and avoid unnecessary language. Be concise and direct, using clear language to explain your position or request. Avoid jargon that might confuse the reader or detract from the point you’re making.

- Use polite, respectful language: Even if you’re frustrated with a claim denial, remain courteous. Avoid aggressive or confrontational language that could harm your case.

- Stick to the facts: Present your case logically. Include all relevant details, such as claim numbers, dates, and medical information, without emotional language or assumptions.

- Avoid making threats: Refrain from using statements that could sound like ultimatums. Instead, focus on how the issue can be resolved with a fair review of the facts.

- Keep sentences short and to the point: Eliminate unnecessary words that might dilute your message. Each sentence should add value to your case or provide clarification.

By following these guidelines, your letter will maintain a professional tone, making it easier for the reader to understand your concerns and respond appropriately.

What to Do if Your Appeal is Denied Again

If your appeal is denied, take a moment to review the denial letter carefully. Understand the specific reasons for the denial and identify any missing information or errors in the initial submission. If the denial is based on incorrect facts or misunderstood documents, gather the correct information and resubmit your appeal with a clear explanation.

If the reason for denial is related to coverage limitations or policy exclusions, check your health insurance policy for detailed terms. Sometimes, insurers are willing to reconsider their decision if they see a valid reason within the policy. If you’re unsure, consult with a healthcare advocate or attorney who specializes in insurance issues for advice.

File a second-level appeal with the insurance company, if available. This process typically involves a higher level of review and may result in a different outcome. Be sure to submit any new or additional documentation that supports your case, such as medical records or expert opinions.

If the second-level appeal is denied as well, consider requesting an external review by an independent third party. Many states offer this option, and it can provide a neutral perspective on the situation. A favorable outcome from an external review can lead to a reversal of the denial.

If all internal and external appeal options are exhausted, consider filing a complaint with your state’s insurance department or seeking legal assistance. Legal professionals with experience in health insurance disputes can help you understand your rights and explore further avenues for action.