Insurance letter of experience template

Providing a clear and structured letter of experience is a key step in securing future opportunities in the insurance industry. A well-written letter outlines the specifics of the professional experience, ensuring clarity for both parties involved. It serves as proof of previous roles, responsibilities, and skills gained over time.

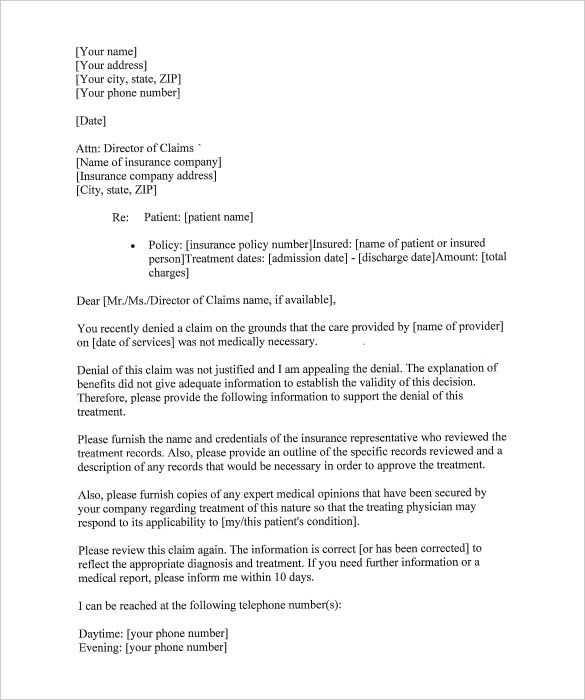

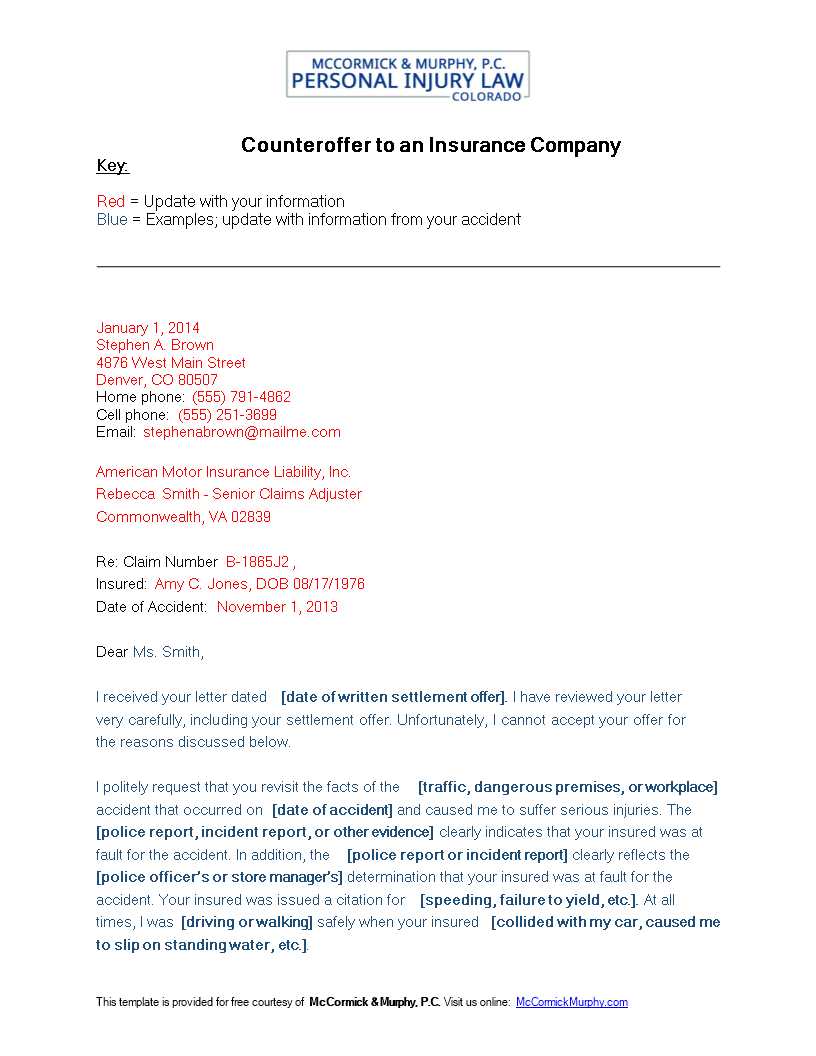

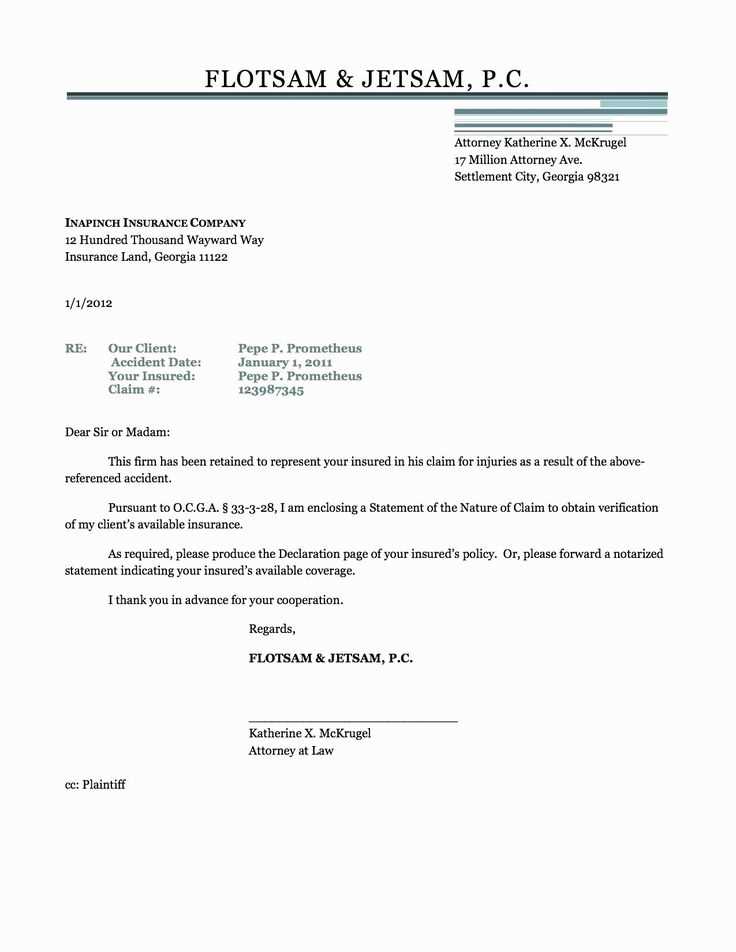

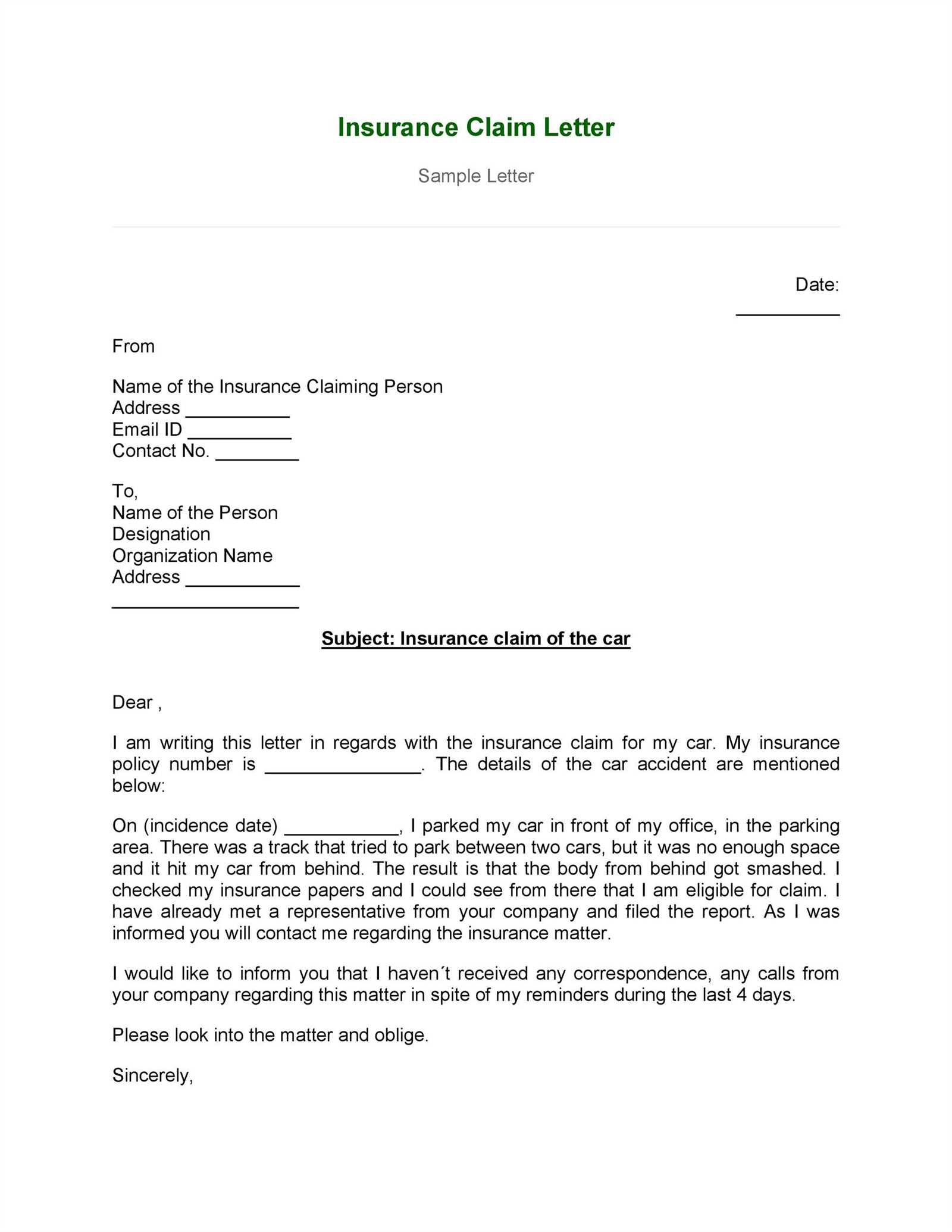

Start with a formal heading that includes the recipient’s name and position. Address them directly to maintain professionalism. Follow with a brief introduction, clearly stating the purpose of the letter and its relevance. The body should detail the scope of the experience, focusing on key tasks performed, results achieved, and relevant skills. Highlight any certifications or achievements that set the individual apart in their field.

Conclude with a short closing statement that reaffirms the value of the experience and offers further contact information if needed. The tone should be confident yet approachable, with a focus on transparency. This type of letter allows both parties to understand the level of competence and reliability, making it an invaluable document in the insurance sector.

Insurance Letter of Experience Template

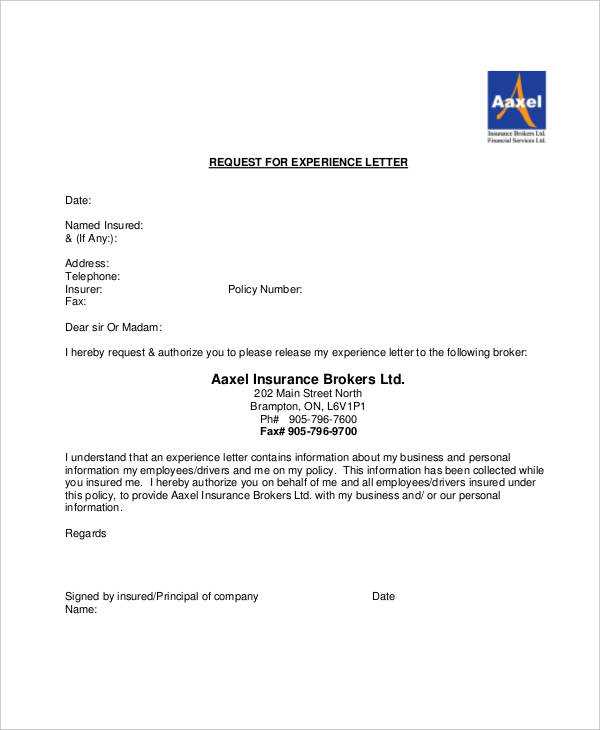

To craft an insurance letter of experience, begin by clearly identifying the insurer’s name and policy number at the top of the document. This provides immediate context for the reader. Below this, introduce the policyholder, detailing their full name and the duration of the policy. Make sure to specify the exact coverage provided and any claims history, if applicable. Include dates of policy issuance, renewals, and any significant changes made to the terms.

Ensure the tone remains factual and precise throughout. For example, you may write, “We have maintained a policy with [Insurer Name] since [start date], covering [specific coverage details]. During this period, [Policyholder Name] has demonstrated a strong commitment to risk management and consistently maintained premiums in good standing.” This structure reinforces the purpose and clarity of the letter.

Provide a brief summary of any claims filed and their outcomes. If no claims were made, highlight the absence of claims as a positive indicator of the policyholder’s low-risk profile. Close the letter by stating the purpose, whether it’s to confirm insurance history for another insurer or a request for a policy review. End with a professional sign-off, including the authorized representative’s name, title, and contact details.

Understanding the Purpose of Experience Letters

Experience letters provide clear documentation of an individual’s professional background, confirming their skills, responsibilities, and duration of employment. These letters are crucial for demonstrating practical expertise and can significantly influence future employment opportunities.

Employers use these documents to assess the relevance of past work experiences in relation to open positions. By detailing specific duties and accomplishments, the letter serves as proof of a candidate’s qualifications.

For employees, an experience letter is a record of their professional growth. It offers a tangible representation of their contributions, which can be valuable when applying for new roles or seeking promotions.

One of the key purposes is to maintain transparency between the former employer and the prospective employer, ensuring both parties understand the scope of the applicant’s previous roles.

In some cases, an experience letter may also be used for verifying professional qualifications when applying for insurance or regulatory certifications, as it reflects an applicant’s history of responsibility and trustworthiness.

Key Components to Include in the Template

Start with the recipient’s full name and position, followed by the name of the insurance company. This helps establish the credibility of the document. Provide the duration of the individual’s employment, specifying the start and end dates. Include a brief but clear description of the individual’s role and responsibilities during their tenure. This section demonstrates their experience and qualifications in the field. Don’t forget to mention any specific achievements or notable contributions that align with the insurance industry standards.

Detailed Work Experience

Clearly outline the employee’s work experience with respect to their duties and responsibilities. This section should reflect their hands-on skills and depth of knowledge in various insurance-related processes. Mention any positions of authority or significant responsibilities held by the employee. Use specific language to show how their work impacted the company’s success.

References to Training and Development

Highlight any formal training or professional development the individual underwent. This can include certifications, workshops, or courses relevant to the insurance field. Demonstrating continuous learning gives the letter added value and confirms the employee’s commitment to professional growth.

| Component | Description |

|---|---|

| Employment Dates | Indicate the start and end dates of employment to establish the duration of the individual’s experience. |

| Job Role and Responsibilities | Outline the key tasks and duties performed, showcasing the individual’s role within the company. |

| Achievements | Provide specific examples of accomplishments that demonstrate the individual’s impact and success. |

| Training and Certifications | List any relevant training, courses, or certifications completed during their time in the industry. |

Formatting Guidelines for Professional Appearance

Choose a clean, readable font, such as Arial or Times New Roman, with a size of 10 to 12 points. This ensures clarity while maintaining a professional look. Avoid decorative fonts or excessive use of bold and italics, as they can distract from the content.

Margins should be set to 1 inch on all sides. This standard margin size gives your letter a balanced and tidy appearance. Left-align the text for a consistent, formal structure.

Text Organization

Start the letter with a clear header containing the recipient’s name, title, and company. Use a formal salutation such as “Dear Mr. Smith” or “To Whom It May Concern” if the recipient’s name is unknown. Keep the tone courteous and direct throughout.

Break your letter into clear, concise paragraphs. Each paragraph should focus on one idea, making it easier for the reader to follow. Avoid large blocks of text, as they can overwhelm the reader.

Spacing and Alignment

Use single spacing within paragraphs, and add a space between each paragraph for easy readability. Align the text to the left for a clean, consistent layout. Keep the letter within one page, unless the content requires additional space.

Common Mistakes to Avoid When Writing

Focus on clarity. Avoid unnecessary jargon or overly complex sentences that may confuse the reader. Keep the language simple and direct, ensuring your message is easily understood.

1. Lack of Structure

Avoid writing without a clear outline. Structure your letter logically, starting with key details and moving to supporting information. Use paragraphs to separate ideas, and keep them concise.

2. Ignoring Tone

Pay attention to the tone. A formal letter should maintain professionalism while still sounding approachable. Avoid sounding too casual or overly stiff, which can make your letter seem less sincere.

3. Being Too Vague

Be specific about the experience. Don’t generalize or omit important details that provide context. Describe your experiences with concrete examples and clear timelines.

4. Neglecting Proofreading

Always proofread your letter before sending. Grammatical errors, typos, and inconsistencies make a poor impression. Take the time to review your text carefully to ensure its accuracy and coherence.

How to Customize the Template for Different Insurance Types

For each insurance type, adapt the template by emphasizing specific policy details and coverage options relevant to the particular insurance. Begin by adjusting sections such as “Policyholder Information” and “Coverage Summary” to reflect the type of insurance–whether health, auto, or property. Health insurance letters should focus on medical services, deductibles, and network providers, while auto insurance letters highlight vehicle specifics, claims, and accident history. Property insurance requires inclusion of property details, risk assessments, and claims history.

Tailor Sections to Insurance Categories

Each insurance type has unique fields that should be modified accordingly. For health insurance, adjust the “Coverage” section to mention specific treatments, medical services, and out-of-pocket costs. Auto insurance templates need clear details on vehicle make, model, and past accidents. Property insurance should prioritize property value, home structure, and previous damage claims.

Update Terms and Conditions

The terms and conditions in the template should align with the regulations and expectations specific to each insurance type. Health policies often have clauses about pre-existing conditions and emergency care, while auto insurance agreements may cover liability, collision, and comprehensive coverage terms. Property policies focus on loss assessment and reimbursement procedures. Customizing these sections ensures the letter stays relevant and clear for each situation.

Legal Considerations and Best Practices

Ensure the accuracy of the details provided in the experience letter. The information should be fact-checked and verified to avoid any legal repercussions from inaccuracies or misrepresentation. Maintain transparency about the nature of the job and the duration of the individual’s employment.

Adhere to data privacy regulations. Avoid including personal information that isn’t directly related to the job experience, such as medical or financial details, unless explicitly authorized by the individual. This is vital to stay in line with privacy laws and protect both parties.

Consider including a disclaimer to clarify that the letter reflects the applicant’s experience during their employment period, and not a guarantee of future performance. This helps manage expectations and reduces the possibility of legal disputes later.

Keep the tone professional, but avoid overly complex legal language. The letter should be clear, concise, and easily understood by all parties involved.

- Ensure proper authorization: Confirm that the employee has given consent to provide the letter.

- Use correct formatting: Maintain a professional layout and structure for clarity.

- Consult a legal expert: If in doubt, seek advice from a legal professional to avoid compliance issues.

By following these guidelines, you reduce the risk of legal conflicts and increase the letter’s reliability in fulfilling its intended purpose.