Loan Pre Approval Letter Template for Easy Application

When seeking financial assistance, securing an initial confirmation of eligibility is often an essential step in the process. This document serves as a vital tool to confirm your potential for securing funding, simplifying the next stages of your application. It provides reassurance to lenders while giving applicants clarity on the path ahead. Understanding how to properly craft this document can significantly improve the chances of success in obtaining financial support.

Why This Document Matters

Having a well-prepared confirmation document can make a significant difference when approaching lenders. It sets the foundation for your financial journey, showing your preparedness and commitment. Additionally, it allows potential funders to assess your qualifications before diving deeper into the application process.

Key Advantages

- Faster Process: A properly structured document expedites the assessment and approval process, enabling quicker decisions.

- Increased Confidence: It assures financial institutions of your seriousness and preparedness.

- Improved Negotiations: This early confirmation often strengthens your position, helping secure better terms.

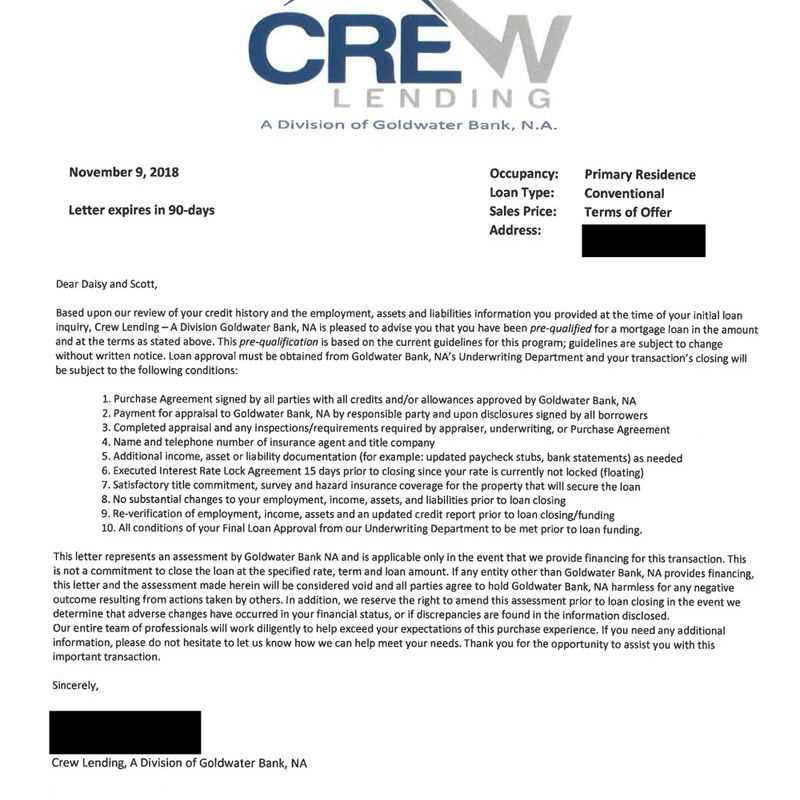

How to Customize Your Document

Each situation is unique, and tailoring your document to reflect your specific needs and circumstances will make it more effective. Start by including essential personal details, the amount requested, and the proposed repayment terms. It is crucial to keep the tone formal but clear, outlining your financial stability and ability to manage the requested funds.

Common Mistakes to Avoid

- Incomplete Information: Ensure that all necessary details are included and accurate.

- Over-Inflating Expectations: Be realistic in your expectations and do not overstate your financial position.

- Using Generic Phrases: Avoid using vague language that might confuse or mislead potential lenders.

Next Steps After Submission

Once your document is submitted, the next phase involves waiting for the lender’s decision. If approved, you can proceed with the full application process. If further information is required, be ready to provide it promptly to avoid delays.

Understanding the Financial Confirmation Process

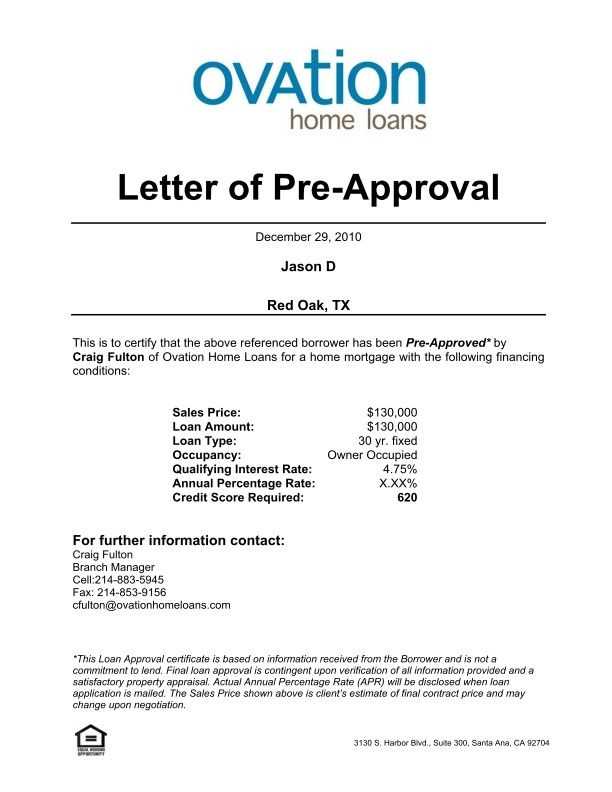

When seeking funding, having a structured document that outlines your financial eligibility can make the application process smoother. It helps verify your suitability for receiving support and serves as an essential step before moving forward. This document helps both parties–lender and borrower–establish a clear understanding of the terms and qualifications for funding.

Key Benefits of Having an Early Confirmation

Having an early confirmation of eligibility provides several advantages. First, it expedites the approval process, as the initial eligibility has already been verified. It also allows borrowers to focus on specific options that align with their needs, rather than wasting time on unsuitable offers. Financial institutions can quickly assess your preparedness, increasing the likelihood of receiving favorable terms.

Customizing Your Confirmation Document

Personalizing your document is essential to reflect your unique financial situation. Be sure to include accurate details about your income, financial history, and the amount you’re seeking. Tailoring the document to your specific case will help create a clearer picture for lenders, ensuring they understand your qualifications and financial goals.

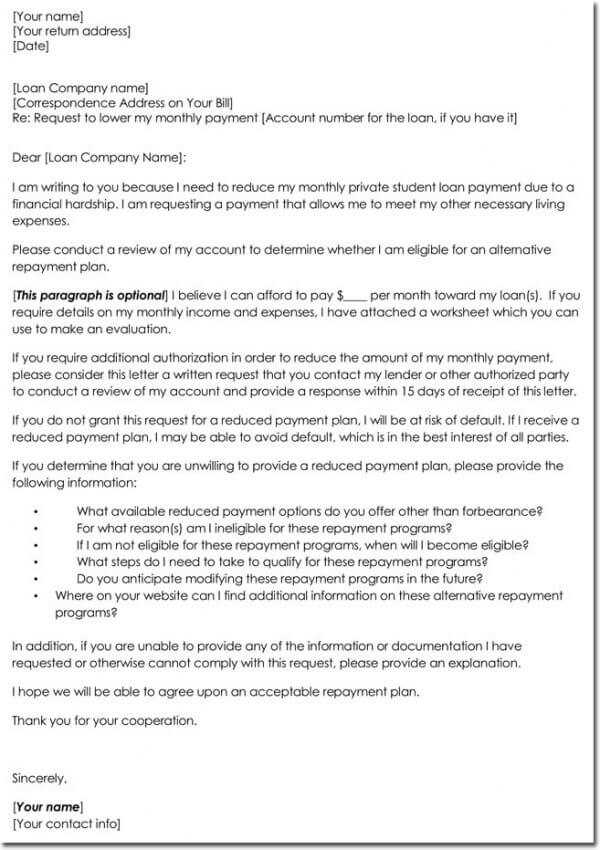

Avoiding Common Mistakes in Your Application

Errors in your application can lead to delays or even rejections. Common mistakes include submitting incomplete or incorrect information, failing to explain your financial needs clearly, or using language that is too vague. Double-check the document to ensure all the required details are present and clearly articulated.

Required Documents for Financial Eligibility

To complete your eligibility document, you will need to provide specific supporting papers. These typically include proof of income, bank statements, identification, and any other documentation that reflects your financial stability. Make sure you have these documents organized and up-to-date to avoid unnecessary delays.

Impact of Early Confirmation on Terms

The initial eligibility confirmation can significantly influence the terms of your funding. It helps define the amount you’re qualified to receive, as well as the interest rates and repayment plans available to you. A well-structured document often results in more favorable terms for the borrower.

Next Steps After Receiving Your Confirmation

Once you have received confirmation of your financial suitability, it’s time to take the next steps. This may include submitting additional documents or formally accepting the offered terms. Be prepared to move quickly if you receive an offer to ensure that the terms remain valid.