Insurance complaints letter template

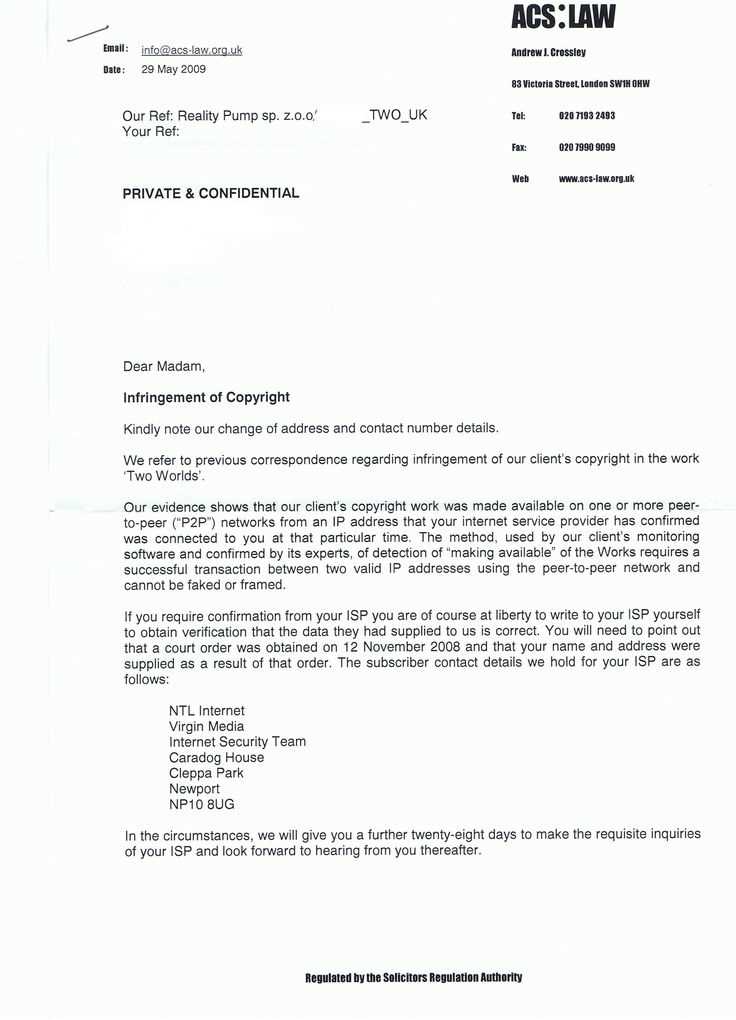

If you are dissatisfied with the service provided by your insurance company, it’s crucial to clearly state your concerns in writing. A well-structured complaint letter increases the likelihood of a prompt resolution. Be sure to include the policy number, specific issues you encountered, and any relevant dates. Use polite but firm language to express your dissatisfaction.

Start your letter by addressing the company’s customer service department or the relevant contact. Make sure to specify the exact nature of your complaint, whether it’s related to coverage, delays, or poor customer service. Clearly describe the events or actions that led to your frustration, and mention any previous communication or actions taken to resolve the matter.

In the closing paragraph, request a clear response and indicate your expectations for resolving the issue. It’s helpful to provide a timeframe for when you would like a reply. Always keep a copy of your complaint letter for future reference and follow up if you don’t receive a response within the specified time.

Insurance Complaints Letter Template

To address your concern, begin your letter with clear details about the incident or issue. Include the policy number, claim reference, and the date the incident occurred. State the nature of your complaint, whether it’s related to delays, unsatisfactory settlements, or any other issue you’ve faced. Be concise and avoid unnecessary descriptions.

Claim Details

Provide all relevant information, such as the type of coverage you have, the claim’s current status, and any communication you’ve had with the insurer so far. If possible, include supporting documentation, like emails or letters that back up your claim.

Your Desired Outcome

Explain what resolution you’re seeking. Whether it’s a review of the claim, a full settlement, or clarification on the decision made, make sure your request is clear. If applicable, mention a timeline for receiving a response.

End your letter with a polite but firm statement, encouraging the insurer to address your complaint within a reasonable period. Make sure to include your contact details for follow-up.

How to Start Your Complaint Letter

Begin by addressing the insurance company correctly. Make sure to include their full name, department (if applicable), and mailing address. If you are unsure of the specific department, check the company’s website or call their customer service for clarification.

Include Relevant Policy Information

Next, provide all necessary details related to your insurance policy. This includes your policy number, claim number (if applicable), and any other identifiers that may help the company locate your file quickly. This helps avoid unnecessary delays.

Clearly State the Reason for Your Complaint

State the problem directly. Avoid vague language. Be specific about what went wrong with your claim, service, or the actions of the company. A clear description will help the company understand your issue from the start.

- Explain the situation: Describe the incident or issue with clear dates and details.

- Highlight the actions taken: Mention any previous attempts to resolve the issue, including phone calls or emails.

- Be clear about your expectations: Let the company know what you expect as a resolution to your complaint.

Including Your Policy Information

Always provide your policy number in the complaint. This helps the insurance company identify your case quickly. Write the number clearly at the beginning of your letter. Include the full name of the policyholder as it appears on the policy to avoid any confusion.

If applicable, also reference any claim numbers or specific documents related to your case. If you have had previous correspondence, mention the dates of these communications, so the insurer can easily track the history of your issue.

Provide the details of the policy type, such as life, health, auto, or home insurance. This extra detail helps to pinpoint the exact coverage in question. If there are any riders or additional clauses, be sure to include those as well.

By being specific and clear about your policy, you make it easier for the insurance company to understand your situation and address your complaint swiftly.

Describing the Issue Clearly

Be specific about the problem you experienced with your insurance policy. Include key details such as the policy number, date of the incident, and the coverage in question. This helps the reader understand the context of your complaint immediately.

State the Facts

Provide a clear timeline of events, starting with the date you purchased the policy, followed by any incidents, communications with the insurance company, and the date when the issue first arose. Include specific references to documents or communications that support your claim.

Clarify Your Expectations

Clearly state what you expect as a resolution. Whether it’s a refund, claim payment, or clarification of coverage, being direct about your expectations avoids confusion. Be realistic but firm in what you believe is a fair outcome.

Providing Supporting Documents and Evidence

Attach clear and relevant documents to strengthen your claim. Include copies of your insurance policy, any communications with the insurer, and receipts for expenses incurred. If applicable, provide photographs or reports that detail the damage or loss, as well as police or medical records if they are related to the incident.

Ensure all documents are legible and well-organized. Use timestamps, case numbers, or claim references where possible to tie documents to specific events. If you submit digital copies, check that they are readable and in a common format, like PDF or JPEG.

Be accurate when describing the context or situation in your documents. Avoid submitting irrelevant or outdated records, as they may confuse the claims process. Include only the most recent and pertinent evidence.

Consider writing a brief summary alongside your documents, outlining the key points of each one. This helps the reviewer quickly identify the purpose of each piece of evidence and how it supports your case.

Keep a copy of everything you submit for your records, including emails and forms sent to the insurer. This will help you track your progress and follow up if necessary.

Setting a Resolution Request

Begin by clearly stating what resolution you are seeking. Specify whether you want a refund, claim adjustment, or other specific outcome. This helps the recipient understand your expectations right away.

Outline the steps you believe the insurance company should take to resolve the issue. Provide clear instructions on how you would like the matter to be handled, whether it’s reviewing the claim, offering compensation, or another action.

Keep the tone respectful and focused on your desired outcome. Avoid blaming or making generalized statements. Instead, focus on the facts and describe the steps you are asking them to take.

- State your preferred resolution (e.g., claim reassessment, compensation, policy adjustment).

- Explain the actions you expect the company to take, ensuring they align with your expectations.

- Provide any additional documentation that supports your resolution request.

End with a clear call to action. For instance, ask for confirmation within a specific time frame, or request a meeting if necessary to discuss the issue further.

Polite and Professional Closing

End your letter on a respectful and clear note. A professional closing reinforces your expectation for a timely and positive resolution while maintaining a cordial tone. Always thank the recipient for their time and attention to your issue. Here’s a guide on how to structure the closing of your letter:

| Closing Phrase | Example |

|---|---|

| Thank you for your prompt attention | Thank you for your prompt attention to this matter. I look forward to your response. |

| Kind regards | Kind regards, [Your Name] |

| Sincerely | Sincerely, [Your Name] |

After your closing phrase, include your contact information or any details that may help resolve the issue efficiently. Avoid long-winded sentences and keep the tone respectful and clear.