Credit dispute letter template experian

Disputing inaccurate information on your Experian credit report can help improve your credit score. Start by using a well-structured credit dispute letter to ensure your request is processed smoothly. A clear and concise letter will increase the chances of having errors corrected quickly.

Your letter should include key information, such as the account number in question, a detailed description of the error, and any supporting documents that back up your claim. Focus on providing specific facts that can help Experian verify your dispute. Be direct in your language and avoid unnecessary details that could complicate your case.

Remember, Experian must investigate your claim within 30 days of receiving your dispute. If you do not hear back or the results are unsatisfactory, follow up with a second letter or escalate the matter. Keep all correspondence for your records in case further action is needed.

Here are the corrected sentences with removed repetitions, maintaining meaning and correctness:

When disputing an entry on your credit report, clarity and accuracy are crucial. Below are examples of corrected credit dispute letters that eliminate redundancy while ensuring the message is clear and concise:

Example 1: Addressing Incorrect Information

Original: “I am writing to dispute an error on my credit report, which is incorrect and has a mistake. The information is wrong and should be updated as soon as possible.”

Corrected: “I am writing to dispute incorrect information on my credit report. Please update it promptly.”

Example 2: Incorrect Reporting of Payment History

Original: “The payment history listed for my account is incorrect, as it shows late payments which were made on time, and I would like to correct this mistake on my credit report.”

Corrected: “The payment history for my account is incorrect, showing late payments that were made on time. I request that this be corrected.”

Example 3: Incorrect Balance Reported

Original: “The balance shown for my account is inaccurate and does not reflect the actual amount owed, as I paid off the balance in full and would like the information updated accordingly.”

Corrected: “The reported balance for my account is inaccurate. I paid off the balance in full and request that it be updated.”

Example 4: Account Ownership Discrepancy

Original: “I believe there is an error in the account ownership listed on my report, as I am not the owner of the account that is incorrectly associated with my name.”

Corrected: “There is an error in the account ownership listed on my report. I am not the owner of the account associated with my name.”

Example 5: Request for Timely Resolution

Original: “Please resolve this matter promptly, and I expect the issue to be corrected quickly on my credit report.”

Corrected: “Please resolve this issue promptly by updating my credit report.”

By simplifying these sentences and removing unnecessary repetitions, your message will come across as more professional and clear. Make sure your credit dispute letter remains focused on the key issue to ensure a quicker and more efficient resolution.

| Original Text | Corrected Text |

|---|---|

| “I am writing to dispute an error on my credit report, which is incorrect and has a mistake.” | “I am writing to dispute incorrect information on my credit report.” |

| “The payment history listed for my account is incorrect, as it shows late payments which were made on time.” | “The payment history for my account is incorrect, showing late payments that were made on time.” |

| “The balance shown for my account is inaccurate and does not reflect the actual amount owed.” | “The reported balance for my account is inaccurate.” |

| “I believe there is an error in the account ownership listed on my report, as I am not the owner of the account.” | “There is an error in the account ownership listed on my report.” |

| “Please resolve this matter promptly, and I expect the issue to be corrected quickly.” | “Please resolve this issue promptly by updating my credit report.” |

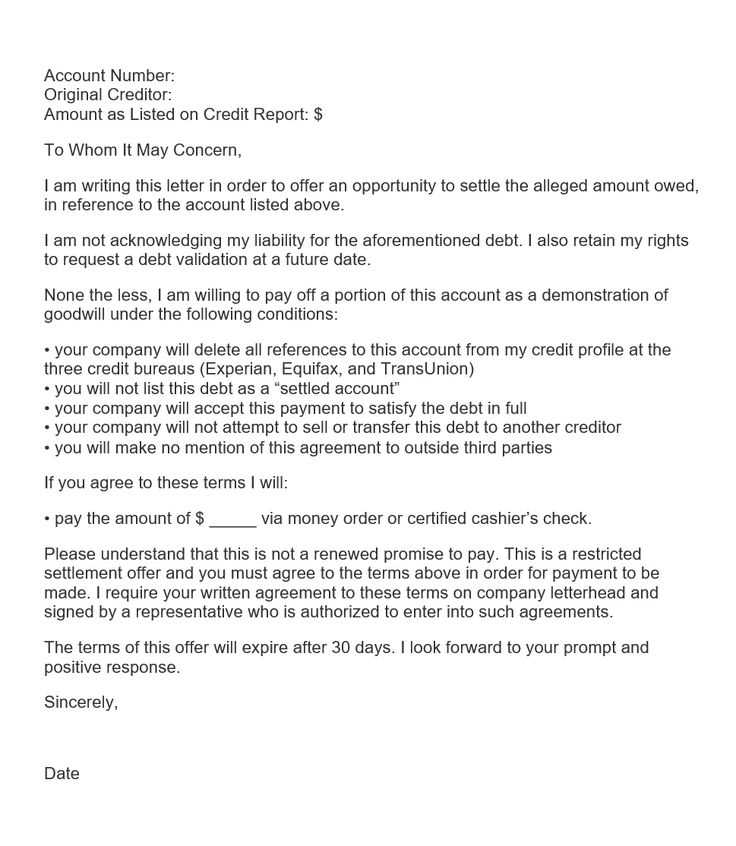

- Credit Dispute Letter Template for Experian

To file a credit dispute with Experian, use the following template to ensure clarity and accuracy in your communication.

- Your Name: Include your full legal name, as it appears on your credit report.

- Your Address: Provide your current residential address.

- City, State, ZIP Code: Complete your address details for proper identification.

- Phone Number: Include a reliable phone number where you can be reached.

- Email Address: Include a contact email address for any follow-up communication.

- Experian Address: Address your dispute letter to Experian’s correct contact address:

- Experian Consumer Services

- P.O. Box 4500

- Allen, TX 75013

- Subject Line: Clearly state the subject of your dispute. For example, “Credit Dispute for [Your Name] – [Disputed Item]”.

- Disputed Item(s): List each item on your credit report that you are disputing. Provide detailed information such as account numbers, dates, and descriptions of the errors.

- Explanation: Provide a brief explanation of why the item is incorrect. Attach supporting documentation if necessary.

- Request for Correction: Clearly request that the disputed item(s) be corrected or removed from your credit report if the error is confirmed.

- Signature: Sign your letter and date it at the end to confirm its authenticity.

Ensure you keep a copy of the letter for your records before sending it. You can submit your dispute through Experian’s online portal or by mail, depending on your preference.

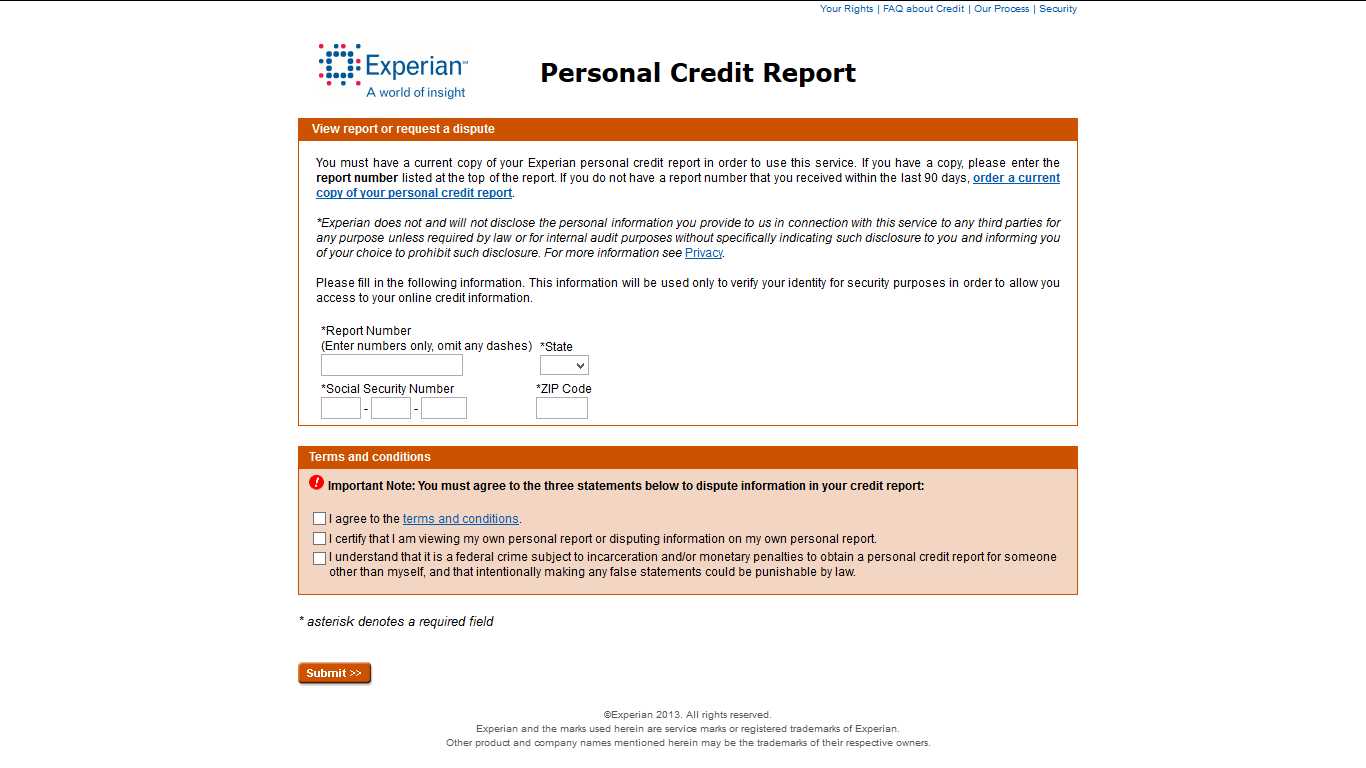

To initiate your dispute with Experian, you need to gather and provide specific information that will help them process your claim swiftly and accurately. Here’s what you need to have ready:

- Personal Identification: Ensure your full name, address, date of birth, and Social Security Number (or the last four digits) are correct in your file. Experian needs this to verify your identity before handling the dispute.

- Details of the Disputed Item: Identify which account, transaction, or credit entry is in question. Be as specific as possible, including account numbers, the name of the creditor, and any relevant dates.

- Supporting Documentation: Gather evidence that supports your claim. This could include receipts, letters from creditors, bank statements, or any other documents that demonstrate the error.

- Your Explanation: Clearly explain the issue with the entry. Whether it’s a mistake, fraud, or any other error, your explanation should be straightforward and concise.

Steps to Submit Your Dispute

- Visit the Experian website or use their mobile app to access the dispute portal.

- Choose the item you want to dispute and provide the necessary details.

- Upload any supporting documents to back up your claim.

- Submit the dispute and wait for confirmation.

Expected Timeline for Resolution

- Experian typically takes up to 30 days to resolve a dispute.

- You’ll be notified once the dispute is resolved, or if more information is required.

Focus on clarity. One of the biggest errors is failing to clearly state the issue. A vague explanation won’t help the credit reporting agency understand your dispute. Be specific about what is wrong with the information on your credit report and include all necessary details, such as account numbers, dates, and amounts in question.

1. Not Providing Supporting Documentation

Always include supporting evidence for your dispute. If you claim a debt is inaccurate, include copies of relevant documents such as receipts, contracts, or payment histories. Without this evidence, the credit bureau may dismiss your claim.

2. Using Unprofessional Language

Remain professional and respectful in your letter. Avoid using aggressive or accusatory language. Phrases like “this is outrageous” or “I demand you fix this immediately” can weaken your case. A polite tone shows you’re serious and helps maintain credibility.

Be concise. Credit bureaus have limited time to review disputes. Make sure your letter is straightforward and to the point. Avoid lengthy explanations that may confuse or divert attention from the main issue.

3. Forgetting to Include Your Personal Information

Failing to include personal details such as your full name, address, and date of birth can delay the process. This information helps the credit reporting agency verify your identity and locate your credit file.

4. Not Following Up

Don’t assume that submitting your dispute will immediately resolve the issue. If you don’t receive a timely response, follow up. Keep a record of your correspondence and any confirmation numbers provided by the credit agency.

By avoiding these common mistakes, you increase the likelihood of resolving the dispute quickly and effectively.

Attach clear copies of documents that support your claim, such as billing statements, letters from creditors, payment receipts, or any relevant contracts. Ensure each document is legible and complete to avoid delays.

Document Quality

Provide high-resolution images or scanned copies of your documents. Avoid blurry or cropped files. If you submit paper documents, consider using a scanner to maintain the quality of the content.

Organization

Organize your documents logically, grouping related items together. For example, if disputing a late payment, include the statement showing the payment, proof of payment, and correspondence with the creditor.

Label each document with a brief description, such as “Billing Statement for [Month]” or “Receipt for Payment on [Date]”. This helps Experian understand the context of each item.

If Experian rejects your dispute, take the following actions to move forward effectively:

1. Review the Rejection Reason

First, examine the reason for the rejection. Experian will provide details on why your claim was not accepted, which can help you understand whether there was an error or missing documentation. Make sure you have all the necessary information and evidence to support your case.

2. Correct and Resubmit the Dispute

If the rejection was due to missing or incorrect information, correct the details and file the dispute again. Double-check all the supporting documents, such as bank statements or letters from creditors, to ensure they clearly back up your claim.

3. File a Complaint with the Consumer Financial Protection Bureau (CFPB)

If you believe Experian’s rejection is unfair or unjustified, file a complaint with the CFPB. The bureau can help mediate between you and Experian to resolve the issue and potentially prompt a re-evaluation of your claim.

4. Consider Hiring a Credit Repair Agency

If your dispute continues to be denied, or if you are unsure how to proceed, consider enlisting the help of a credit repair agency. They can offer professional assistance in handling your case and improving your credit report.

By staying persistent and addressing the rejection methodically, you increase the chances of successfully resolving the dispute and correcting your credit report.

Experian typically takes up to 30 days to investigate and resolve disputes. The process starts when they receive your dispute letter or claim, which they are required to acknowledge within five business days. This gives them the time to verify the details of your dispute with the creditors involved.

What Happens During the 30-Day Window

Once Experian receives your dispute, they will contact the creditor or data furnisher to validate the information in question. The creditor then has up to 30 days to respond to the inquiry. If they fail to respond within this timeframe, Experian is obligated to remove the disputed item from your credit report.

After the Investigation

After the investigation concludes, you will receive the results in writing, either via mail or electronically. If the dispute is resolved in your favor, the negative item will be corrected or removed. If the dispute isn’t successful, Experian will explain why and you can either appeal the decision or seek further steps, such as providing additional documentation.

Keep in mind that while 30 days is the standard, the process may be delayed if additional information is needed, or if Experian is handling a high volume of disputes at the time.

If you haven’t received a response to your credit dispute with Experian within the expected time frame, follow up to ensure the process is moving forward. The first step is to check the status of your claim through the Experian website or mobile app. You’ll typically find an update under the “Disputes” section of your account. If your claim is still being reviewed, it’s a good sign that Experian is actively working on it. However, if it’s marked as “closed” or “resolved” without a satisfactory outcome, take action.

Contact Experian Directly

If you don’t see any progress or need clarification, call Experian’s customer service. Be prepared to provide your claim number and other identifying information. Ask about the status of your dispute and whether any additional documentation is needed. If Experian has found discrepancies in your credit report, request confirmation that the corrections will be made and ask for a timeline for updates.

Use Certified Mail for Written Follow-Ups

If you prefer written communication, send a follow-up letter through certified mail. In your letter, reference your claim number, specify the date you initially filed the dispute, and request an update on the current status. Certified mail provides proof of delivery and establishes a formal record of your communication with Experian. Keep copies of all correspondence for your records.

Credit Dispute Letter Template for Experian

Start your credit dispute letter by clearly identifying the inaccurate information. Include the account number, the name of the creditor, and a brief description of the error. Be specific and avoid unnecessary details.

Request the Correction

After addressing the error, state your request for a correction. Mention that you expect the disputed item to be investigated and corrected promptly. Make sure to ask for a written confirmation once the dispute is resolved.

Provide Supporting Documentation

Attach any evidence that supports your claim. This could include bank statements, receipts, or communication with the creditor. Providing these documents strengthens your position and helps expedite the process.

Sign the letter and include your contact information. This ensures that Experian can easily reach you for follow-up or clarification if needed.