Debt recovery debt collection letter template

If you need to recover unpaid debts, a well-crafted debt collection letter is a powerful tool to prompt action from your debtor. The letter should be clear, firm, and professional, outlining the amount due and a clear deadline for payment. Using a standard template ensures consistency and reduces the risk of overlooking critical details.

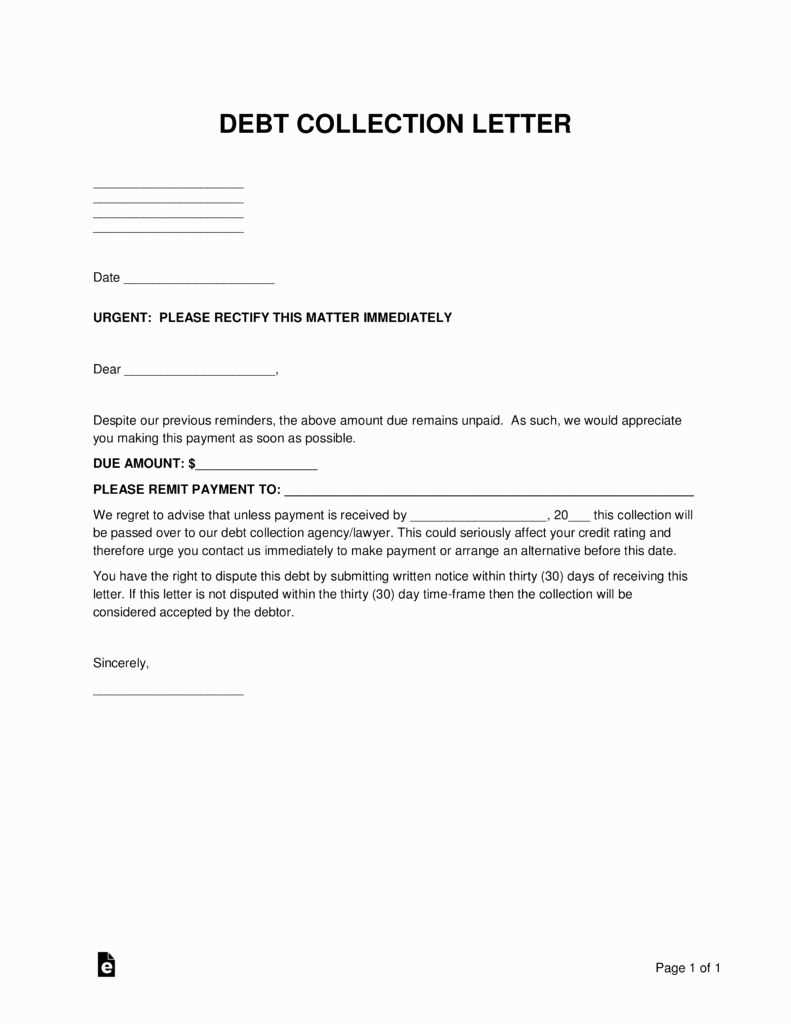

The template should begin with a polite but firm introduction. Specify the debt amount, the date it was due, and any previous communication regarding the payment. Be sure to mention the consequences of non-payment, including potential legal actions or collection efforts. Use direct language, avoiding ambiguity, to ensure the message is understood without any room for misinterpretation.

Make it clear that you expect the debt to be settled within a reasonable time frame, typically within 7-14 days. Offering a payment plan or a way to resolve the issue amicably might help in some cases, but the tone should remain assertive to avoid seeming too lenient. By maintaining professionalism and structure, you increase the likelihood of receiving payment promptly.

Here’s the Revised Version:

Begin by clearly addressing the recipient of the letter. Avoid ambiguity by using their full name and any relevant reference numbers. This sets the tone and shows you’re serious about the issue.

Subject: Outstanding Payment – Urgent Action Required

In the first paragraph, state the amount due, the date the payment was due, and any prior communications regarding the issue. Keep it brief and to the point. Make sure to mention any agreements or contracts, if applicable.

Next, explain the consequences of not settling the debt. You should outline what will happen if the debt remains unpaid, such as reporting it to credit agencies or seeking legal action. Be firm but avoid being threatening–clarify the seriousness of the matter without crossing the line.

Payment Instructions

- Provide clear payment details, such as the bank account number or payment platform.

- Include a deadline for the payment–preferably within a short, reasonable time frame.

- Offer multiple payment methods to accommodate the debtor.

Close the letter by expressing willingness to discuss the matter further. Reassure the recipient that resolving the issue promptly is in both parties’ best interest. Remain professional and polite, even while emphasizing the importance of action.

Finally, make sure to provide your contact details for any questions or clarifications. Always include a signature at the end of the letter to add a personal touch.

- Debt Recovery and Collection Letter Template

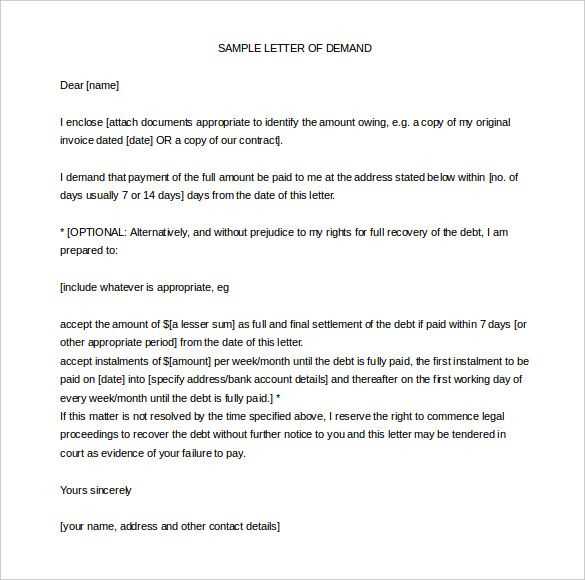

Begin with a clear and polite subject line that indicates the purpose of the letter. Make sure it is direct yet respectful.

- Subject Line: “Payment Reminder: Invoice #12345 Due for Payment”

- Introduction: Address the debtor by name and briefly explain the reason for writing. For example: “Dear [Debtor’s Name], We are reaching out regarding the overdue payment for invoice #12345, which was due on [Due Date].”

- Details of the Debt: Clearly state the amount due, the original due date, and any penalties or interest that may have accrued. Example: “As of today, the total outstanding balance is $[Amount], including a late fee of $[Amount].”

- Request for Payment: Politely but firmly request that payment be made immediately. Provide payment options and relevant details. For instance: “We kindly ask that you remit payment by [New Due Date] using [Payment Method]. Our payment details are as follows: [Insert Payment Information].”

- Consequences for Non-Payment: Include a clear statement of any consequences should the debt remain unpaid. For example: “If payment is not received by [Final Due Date], we may have to take further action, including legal steps or involving a collections agency.”

- Contact Information: Offer a way for the debtor to reach out in case of questions or issues. Example: “Please contact us at [Phone Number] or [Email Address] if you have any questions regarding this matter.”

- Closing: Close on a polite note, reiterating your expectation for payment and expressing hope for a swift resolution. Example: “We appreciate your prompt attention to this matter and look forward to resolving this promptly.”

Ensure that the tone remains professional and courteous, maintaining clarity throughout the letter. A structured letter like this helps facilitate a smoother recovery process.

Begin with clear identification. Address the letter to the debtor by name, making sure the recipient knows exactly who the communication is from. Include your company name, address, and contact details. A formal salutation such as “Dear [Debtor’s Name]” sets a professional tone.

Next, specify the purpose of the letter. Be direct and concise. State that the letter serves as a formal reminder of an outstanding debt. Clearly list the amount owed, the invoice or reference number, and the due date. Highlight any late fees or interest accrued if applicable.

Include a brief summary of previous communications regarding the debt. This could be phone calls, emails, or letters sent prior. Reassure the debtor that this letter is a final reminder before further action, if necessary.

Then, outline the payment options available. Offer clear instructions on how to make the payment, whether it’s through bank transfer, online payment, or other methods. Specify the payment deadline to avoid any ambiguity.

Include a statement of consequences if the debt is not settled. Be firm but polite. Mention potential actions like referral to a collections agency or legal proceedings. Keep the tone professional and not threatening, but firm in your intent.

End with a polite closing. Thank the debtor for their attention to the matter and express hope that they will resolve the debt promptly. Include your contact details again, inviting them to reach out for any questions or clarification.

Finally, sign the letter professionally. Include your name, title, and company name to provide credibility to the communication.

Be clear and specific when outlining the details in your debt recovery letter. Here are the key points to include:

- Creditor’s Information: Start by listing your name, company name, and contact details at the top of the letter. This helps identify the source of the communication right away.

- Debtor’s Information: Include the debtor’s full name, address, and contact information. Make sure these details are accurate to avoid any confusion.

- Debt Amount: Clearly state the exact amount owed, including any interest or fees that may have accumulated. Specify the original debt amount and how it has increased over time, if applicable.

- Due Date: Include the original due date of the debt and, if applicable, any grace periods or extensions. This shows the timeline and when the debt became overdue.

- Payment Instructions: Provide clear payment options, including bank account details, online payment options, or any other methods you accept. Make it as easy as possible for the debtor to pay.

- Consequences of Non-Payment: Politely but firmly mention any consequences if the debt remains unpaid, such as further legal action or additional fees. This motivates the debtor to respond quickly.

- Request for Immediate Action: Politely ask the debtor to settle the debt within a specified period, usually 7 to 14 days, to avoid further escalation.

- Documentation of the Debt: Mention that you have included any relevant documentation that supports the debt claim, such as invoices, contracts, or previous correspondence.

By covering these points, you can ensure your debt recovery letter is both professional and effective, leaving little room for misunderstandings or disputes.

Overloading with Legal Jargon: Keep the language simple and clear. Using too much legal terminology can confuse the recipient, making them feel alienated or intimidated. Aim for clarity over complexity in your message.

Being Too Aggressive: Striking the right tone is critical. Being overly harsh or threatening can escalate the situation and potentially lead to legal issues. A firm yet respectful approach is more likely to elicit a positive response.

Not Including Specific Payment Details: Always provide precise information, such as the outstanding amount, due dates, and payment options. Vague references like “pay what you owe” make it harder for the recipient to act promptly.

Forgetting to Include Contact Information: A recovery letter should always contain clear details on how the recipient can reach you. This includes a phone number, email address, and instructions for payment. Failing to provide this can delay resolution.

Not Following Up: A single letter is rarely enough. Make sure to follow up if the payment is not received within the expected time frame. A friendly reminder can keep the matter on the recipient’s radar without being pushy.

Ignoring the Recipient’s Circumstances: Consider offering flexibility if the recipient faces financial hardship. This can include setting up payment plans or negotiating lower amounts. A personalized approach can increase the chances of repayment.

Failure to Proofread: A letter full of mistakes or unclear language can undermine your credibility. Always double-check for spelling, grammar, and factual errors before sending it out.

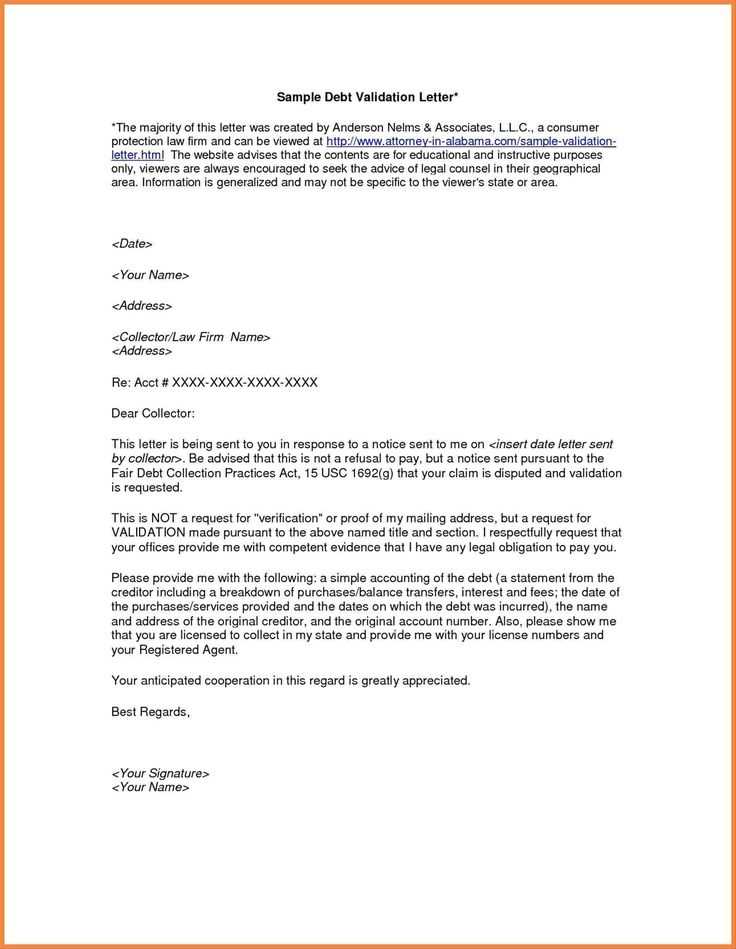

Before sending a debt collection letter, ensure that you comply with local, state, and federal regulations. Failing to follow the legal guidelines may lead to penalties, fines, or lawsuits. In the United States, the Fair Debt Collection Practices Act (FDCPA) sets strict rules on how debt collectors must interact with debtors. These rules apply to any third-party agency attempting to collect a debt, including collection letters.

Debt Verification

Make sure the debt you are trying to recover is valid. Send a debt verification notice to the debtor before initiating further communication. The debtor has the right to dispute the debt within 30 days. If they request verification, you must provide documentation showing the debt is legitimate. Without proper verification, attempting to collect the debt can result in legal consequences.

Prohibited Practices

Collection letters must avoid tactics prohibited by the FDCPA. This includes threatening legal action that you do not intend to pursue or harassing the debtor. Do not send letters that imply criminal consequences or make false statements. Stick to the facts and refrain from using inflammatory language or making false promises.

Also, respect the debtor’s privacy. Do not disclose the debt to third parties or contact them at inappropriate times, such as early in the morning or late at night. Ensure your collection letter is clear and professional, focusing solely on the debt and options for payment.

Adhering to these legal guidelines will help maintain a fair and lawful approach to debt recovery, reducing the risk of complications down the line.

If the recipient doesn’t respond to your debt letter, act quickly to maintain progress in recovering the debt. First, send a follow-up letter. This should be polite but firm, reminding them of the original debt and asking for immediate payment. Be sure to include the details of the previous correspondence and offer multiple ways for them to pay.

If the follow-up letter doesn’t prompt a response, consider using more formal methods, like sending a demand letter. This letter should clearly state the consequences of not responding, such as legal action or involving a collection agency. Include a deadline for payment to create urgency.

If there’s still no response after sending the demand letter, escalate the matter by consulting a professional debt collection agency or an attorney. At this stage, you may need to take legal action to recover the owed amount.

Throughout the process, keep detailed records of all communications. This will help you demonstrate your efforts to resolve the situation if legal proceedings become necessary.

If the debtor does not respond to your letter within the specified time frame, it’s time to move to the next step. A lack of communication or payment indicates the need for more direct action. Here’s what you can do next:

1. Follow Up with a Reminder

If the due date has passed and there’s been no response, send a polite but firm follow-up reminder. This should restate the terms and consequences for non-payment. Mention the previous communication and provide a clear deadline for resolution, usually within 7-10 days.

2. Offer a Payment Plan

If the debtor is facing financial difficulties, offering a structured payment plan can resolve the situation. Break down the total amount due into smaller, manageable payments. This could motivate them to act instead of avoiding the debt.

3. Engage a Collection Agency

If the debtor remains unresponsive or unable to settle the debt, it might be time to engage a collection agency. Choose an agency that specializes in your type of debt. They will have the experience to handle the situation, although they may charge a commission.

4. Legal Action

If all attempts at collection fail, you can consider pursuing legal action. Consult with an attorney to evaluate the feasibility of filing a lawsuit. You may also want to explore small claims court if the debt amount falls within the court’s limits.

| Action | Timeframe | Pros | Cons |

|---|---|---|---|

| Follow Up Reminder | 7-10 days after original letter | Friendly, direct approach | May not resolve the issue |

| Offer Payment Plan | Within a week of follow-up | Flexible, helpful for cash-strapped debtors | May not be accepted |

| Collection Agency | After a second reminder | Professional handling, more resources | Commission fees |

| Legal Action | After exhausting other methods | Potential to recover the full amount | Time-consuming, costly |

Escalation steps depend on the situation, but being proactive will help in resolving the debt efficiently.

Keep your debt collection letters clear and direct. Address the issue quickly, stating the amount owed, the due date, and the consequences of non-payment. A concise approach can prompt action faster.

Provide Clear Payment Instructions

Include exact payment details, such as the payment method, bank account information, or online payment portal. This minimizes confusion and encourages the debtor to act promptly.

Set a Firm Deadline

Give a specific date for payment. Without a deadline, the debtor may delay or ignore the request. Be firm but polite, reinforcing the need to resolve the issue before the deadline to avoid further consequences.

Lastly, include your contact information for any inquiries, ensuring a smooth communication process for both parties.