Business loan letter template

For a successful business loan request, the letter should clearly outline the reason for the loan, the amount requested, and how the funds will be utilized. Start by addressing the lender professionally and provide a concise summary of your business operations.

Make sure to include relevant financial information that supports your loan request. Highlight your business’s ability to repay the loan, backed by solid financial records and forecasts. Transparency is key to demonstrating your financial health and reliability.

A strong closing is just as important. Reaffirm your commitment to the lender’s terms and express your appreciation for their consideration. A well-written, straightforward letter can make a significant difference in the success of your loan application.

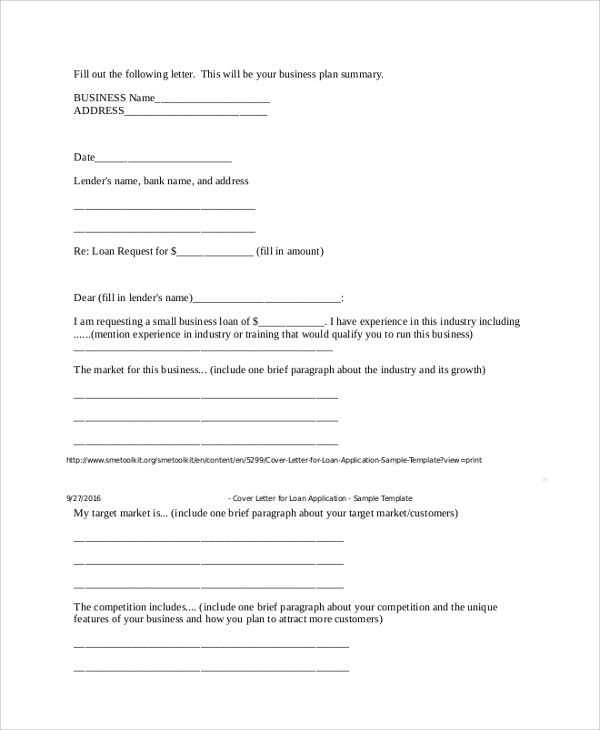

Here is the adjusted version with repetitions minimized:

Ensure the letter is clear, concise, and free from redundant information. Begin by addressing the lender with respect and specify the loan amount you are requesting. Avoid repeating the purpose of the loan; one mention is sufficient to convey the necessary details.

Structure and Clarity

Organize the letter logically: start with the introduction, followed by the purpose of the loan, and conclude with the request. Mention your financial history briefly to provide context without excessive elaboration. Keep sentences short to maintain a professional tone.

Specificity and Tone

Use precise language and numbers. Avoid using vague terms such as “some” or “a little.” Be direct about the amount you require and the terms you are seeking. A clear, friendly tone establishes professionalism without sounding overly formal or robotic.

Ending the letter with a call to action, like requesting a meeting or further discussion, can prompt the lender to act quickly without sounding too insistent.

Business Loan Letter Template

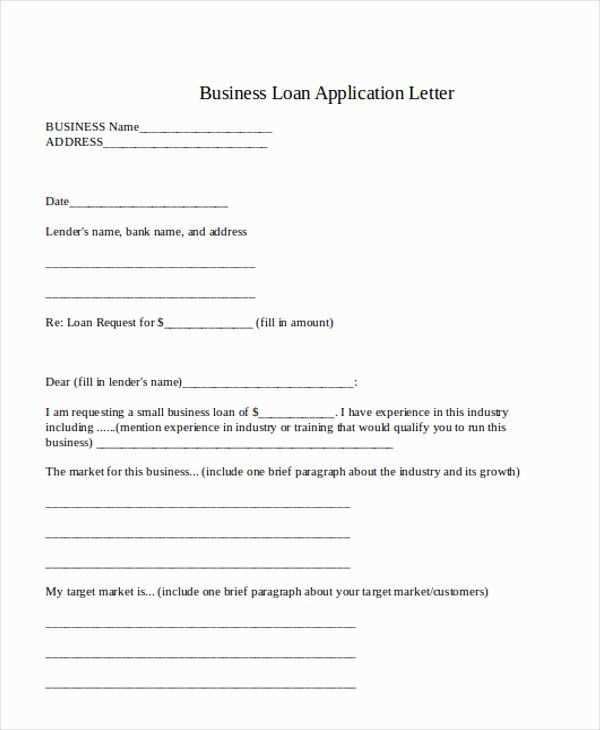

How to Begin Your Business Loan Request

Key Details to Include in a Loan Request

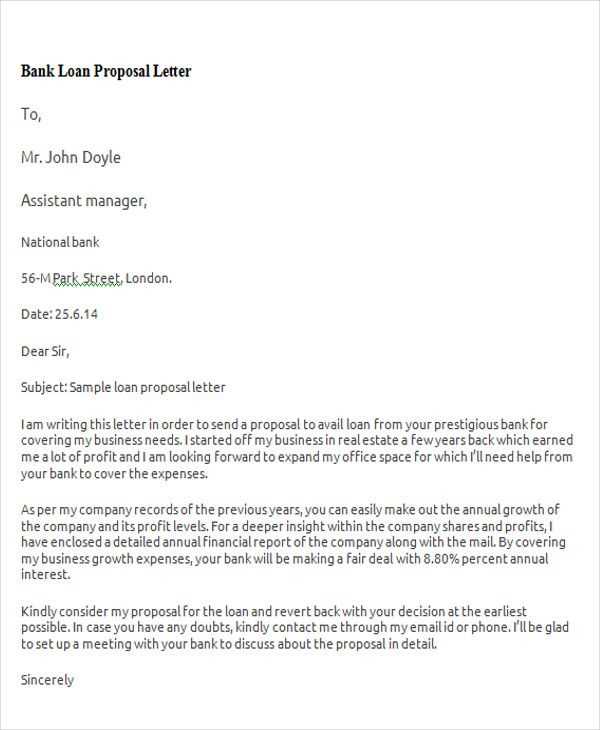

How to Address the Lender in Your Letter

Clarifying Your Business Needs and Loan Sum

Best Practices for Professional Loan Letter Tone

Final Steps for a Successful Loan Application

To make a clear, concise loan request, begin by stating the purpose of your letter directly. Identify your company’s needs and the specific loan amount requested. Focus on explaining why the loan is required and how it will benefit your business operations.

Include relevant financial details such as your business’s current financial standing, cash flow, and any projections that support the loan amount you are requesting. This will provide lenders with the context to understand your financial stability and loan repayment capacity.

Address the lender with professionalism, using formal language and their correct title. Clearly state your contact information so they can easily reach you if more details are needed. A respectful tone establishes credibility and trust with the lender.

Be transparent about how the loan will be utilized. Specify the exact use of the funds, whether for equipment purchase, expansion, or working capital. This shows you have a clear plan for the money and will be responsible with its use.

Maintain a professional tone throughout the letter. Avoid unnecessary embellishments or overly casual language. Clear, direct communication reflects well on your business and enhances your chances of securing the loan.

Conclude with a polite and concise closing. Express appreciation for the lender’s time and consideration. Provide any additional documents they may require for further review and state that you are available for any questions they might have.