Letter Template to Bank for Different Purposes

Communicating with financial institutions often requires formal written correspondence. Whether you need assistance, wish to inquire about services, or resolve an issue, understanding the structure and tone of your communication is crucial. Clear and respectful writing can help achieve a prompt and effective response from the institution.

It is important to include all relevant details in your message without overwhelming the recipient with unnecessary information. The right format and wording can ensure your request is understood and handled efficiently. In this section, you will find guidelines for crafting a professional request that meets the expectations of your correspondent.

Understanding the purpose of your communication and choosing appropriate language can make a significant difference in the outcome. Whether you are reaching out for personal or business-related reasons, following a proven structure enhances clarity and professionalism. These simple yet effective strategies will help you make the most out of your written interactions.

The Role of Written Communication in Financial Matters

Effective written communication is a key part of maintaining smooth and professional relations with financial institutions. Whether you’re addressing a request, seeking clarification, or resolving an issue, formal correspondence allows you to present your case clearly and ensure that your intentions are understood. It helps establish a record of communication, which can be crucial in case of disputes or follow-ups.

Clarity and Precision in Requests

When you need to inquire about a product, initiate a service, or address an issue, written communication provides an opportunity to state your needs precisely. By outlining the matter in detail, you reduce the chances of miscommunication and increase the likelihood of a prompt, accurate response. This clear approach ensures that the recipient can understand your expectations and act accordingly.

Professionalism and Trust Building

Using the correct format and tone in your correspondence conveys professionalism. This, in turn, fosters trust between you and the institution, which can be beneficial for ongoing interactions. Establishing this level of professionalism also ensures that your requests are taken seriously and handled in a timely manner.

Common Reasons to Contact Your Bank

There are several situations when individuals and businesses need to reach out to financial institutions. Whether it’s for personal matters, professional needs, or administrative concerns, initiating communication is often necessary to resolve issues or request assistance. Below are some common reasons for making such contact:

Requests for Information or Assistance

Many individuals contact their financial institution to inquire about various services or products. Common examples include:

- Clarifying account details or transaction history

- Understanding loan options or interest rates

- Seeking guidance on account management or financial products

Addressing Issues or Concerns

There are times when account holders may face problems that need to be addressed promptly. These can include:

- Reporting unauthorized transactions or fraud

- Requesting corrections to account information

- Inquiring about fees or charges

How to Organize Your Letter Effectively

When crafting a formal message to a financial institution, organization is key to ensuring your request is clear and actionable. A well-structured document allows the recipient to quickly understand the issue or request and respond accordingly. The following steps outline how to organize your message for maximum impact.

| Section | Purpose |

|---|---|

| Introduction | State the purpose of your communication clearly and concisely, allowing the recipient to understand the reason for your message right away. |

| Body | Provide all relevant details regarding the issue or request, including specific facts, dates, and any necessary context. Make sure to keep the information organized and easy to follow. |

| Closing | Summarize your request, express appreciation for the recipient’s time, and indicate any follow-up actions or expectations. |

By following this structure, you ensure your communication is clear, professional, and likely to receive a timely response.

Key Details to Add in Your Correspondence

When reaching out to a financial institution, it is essential to include specific information that will help the recipient address your needs efficiently. Including the right details ensures your communication is clear and actionable, reducing the chances of delays or misunderstandings. Below are the critical elements that should be part of any formal communication.

Personal Information

Including accurate personal details helps the recipient identify your account or case easily. Some key information to include is:

- Your full name

- Account number or relevant reference number

- Contact details such as phone number or email address

Specific Request or Issue

It is important to clearly state the purpose of your communication. Whether you are making an inquiry, submitting a request, or reporting an issue, providing precise details will help the institution address your needs more effectively. Examples include:

- Details about the issue (e.g., transaction problems, account errors)

- Specific requests (e.g., account statement, loan inquiry)

- Preferred method of resolution or next steps

Maintaining a Professional Tone and Style

In any formal communication with a financial institution, the tone and style of your writing play a crucial role in how your message is received. A respectful and professional tone ensures that the recipient takes your request seriously and is more likely to respond promptly. The right language can also convey your intentions clearly, reducing the chances of misunderstandings.

Respectful language is key when addressing representatives. Always use polite phrases and avoid using overly casual or emotional language. Being direct and to the point is important, but it’s equally essential to maintain courtesy throughout your message.

Consistency in tone helps create a professional impression. Keep your sentences clear and structured, avoid slang, and ensure that your message is free from errors. Using formal language and appropriate greetings or sign-offs further strengthens your communication.

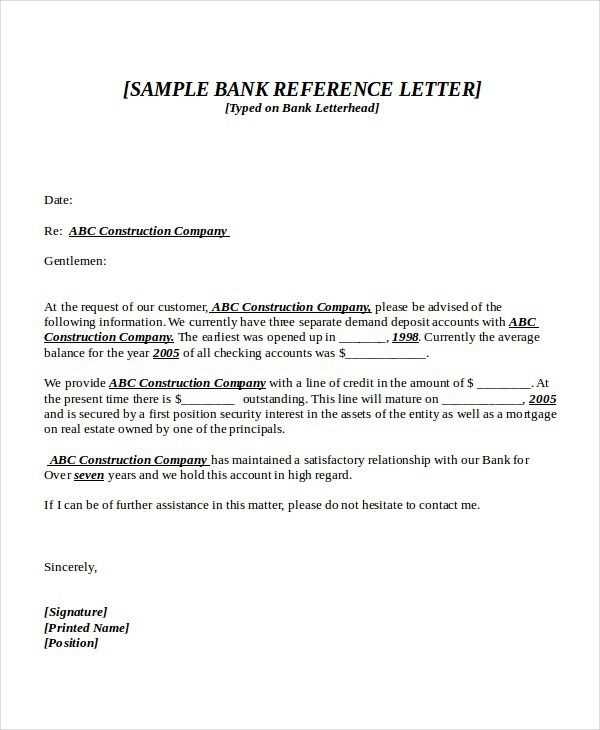

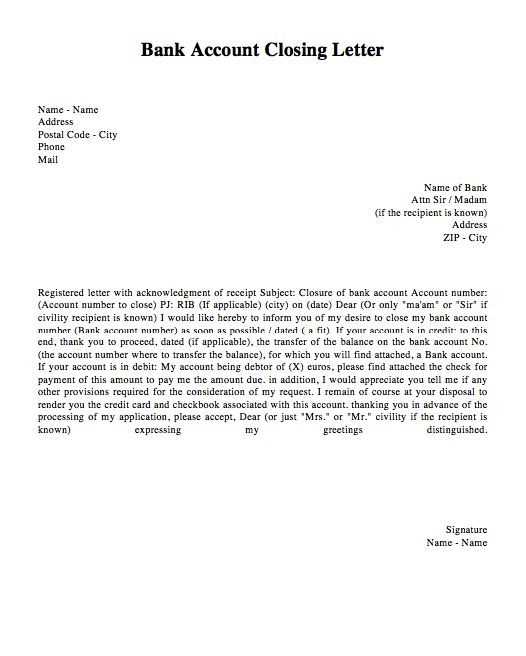

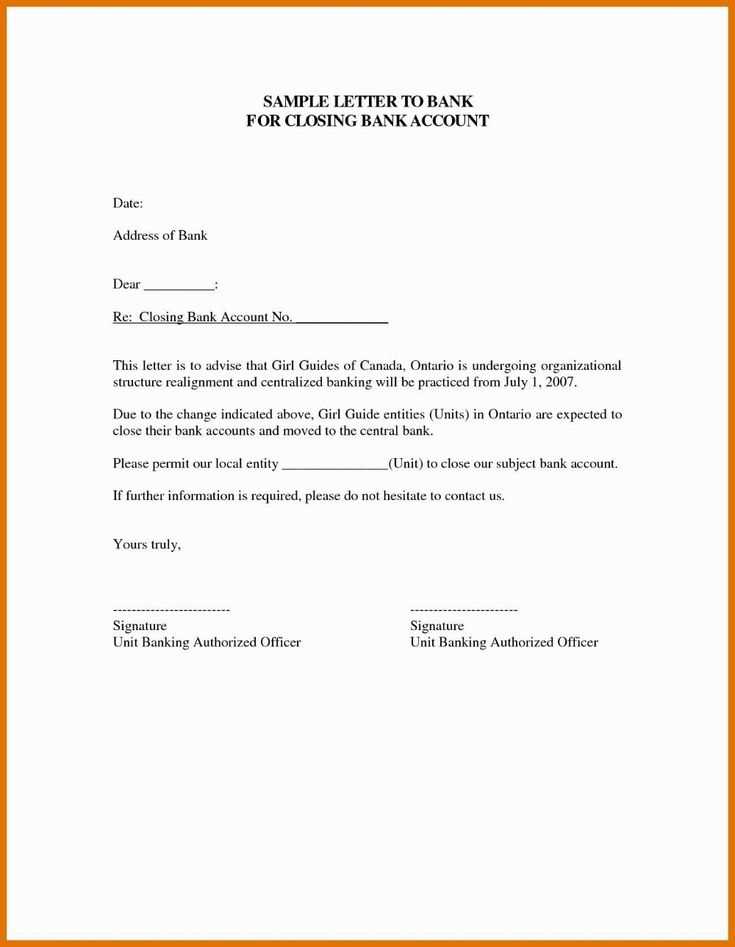

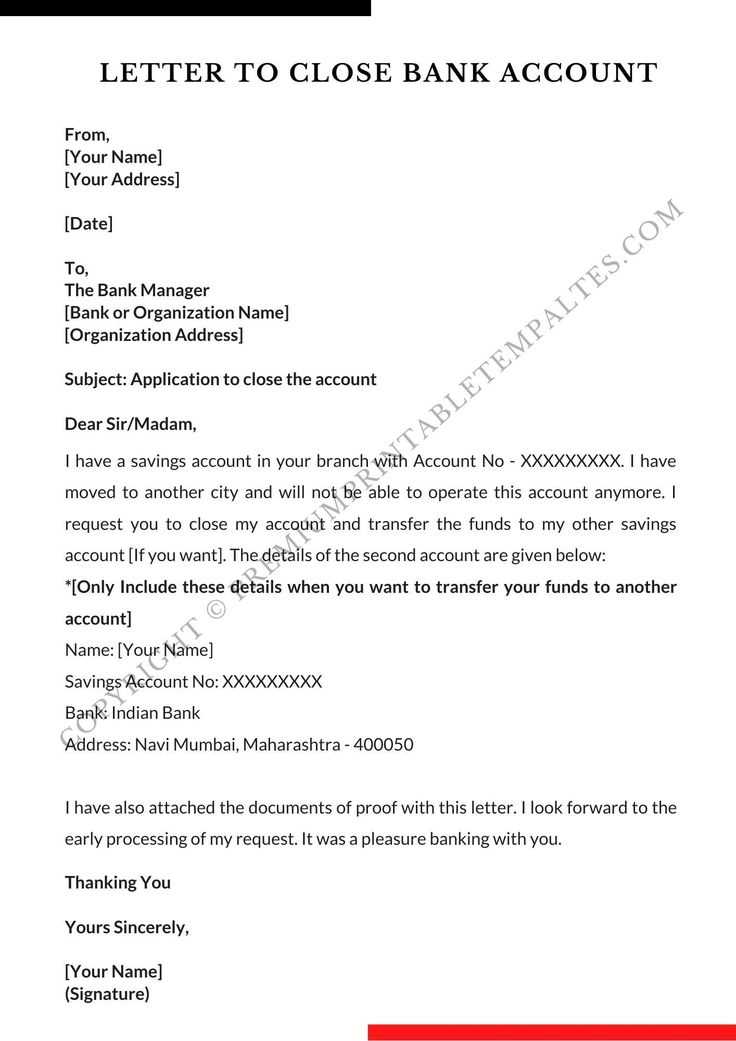

Sample Templates for Bank Letters

When communicating with a financial institution, having a structured and well-crafted example to follow can save time and ensure your message is clear. Below are some common situations that require written communication, along with sample structures to guide your approach. These examples can help you create professional correspondence tailored to your needs.

For example, if you are requesting information about your account, your message should start by clearly stating the purpose, followed by relevant details such as account number, and a polite closing expressing your appreciation for the assistance.

Similarly, if you are addressing an issue, such as an error in your statement, your message should include a description of the problem, any supporting evidence (if applicable), and a request for resolution. Being precise and concise is essential in ensuring your issue is handled efficiently.